Original|Odaily Planet Daily (@OdailyChina)

Early this morning, the on-chain derivatives platform Hyperliquid once again topped the trending searches: a whale manipulated the pre-market price of XPL (Plasma token), leading to a large number of short positions being liquidated, resulting in losses exceeding tens of millions of dollars.

Hyperliquid has been favored by contract players and crypto whales for its convenient experience and good depth, with trading volumes hitting new highs repeatedly. However, its platform depth and liquidation mechanism have long been criticized. Previous incidents such as “Whale actively liquidates causing HLP to lose 4 million dollars” and “JELLYJELLY large short position leads to Hyperliquid's 'pulling the plug' handling” have once caused Hyperliquid to fall into a decentralization crisis. This time, the XPL price manipulation incident has once again sounded the alarm for Hyperliquid. Odaily Planet Daily will use the XPL whale manipulation of the market to liquidate short positions as a starting point to explore the development trends of on-chain contract platforms.

XPL Market Manipulation Incident: 4 Major Insider Addresses, Total Profit Exceeds 46 Million Dollars

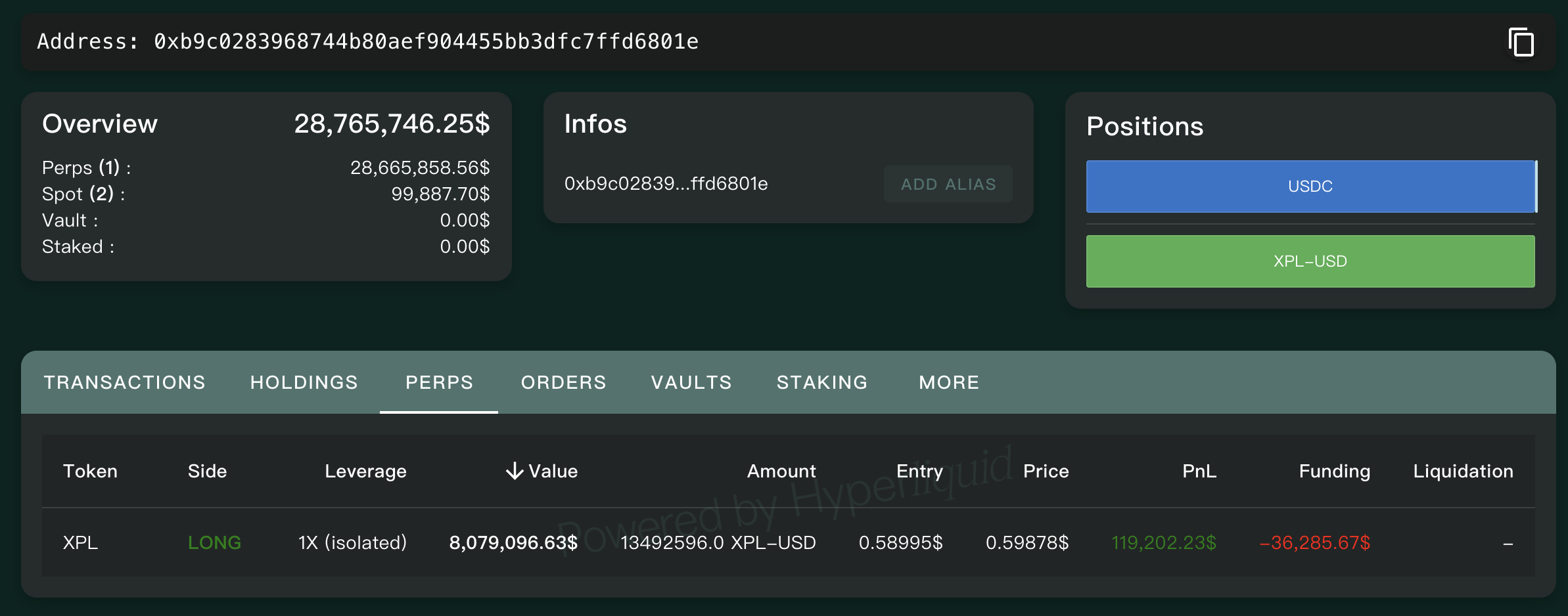

Around 6 AM today, MLM posted about a thrilling “whale long position harvesting event” on the Hyperliquid platform—address 0xb9c0283968744b80aef904455bb3dfc7ffd6801e opened long positions of up to several million XPL tokens and made a staggering 16 million dollars in just one minute; subsequently, the pre-market price of XPL surged to 1.8 dollars within 2 minutes, with a short-term increase of over 200%, leading to a series of short position liquidations. At that time, the address still held up to 15.2 million XPL long positions, worth 10.2 million dollars. As of the time of writing, the address still holds over 1x long positions, with the holding amount decreased to 13.5 million XPL, worth 8.08 million dollars, with an unrealized profit of about 120,000 dollars.

Due to the fact that this address transferred ETH to Sun Yuchen's address five years ago, the market speculates that this address may be related to Sun Yuchen.

Instigator Hyperliquid platform position information

XPL briefly surged over 200%

As time went on, more on-chain information gradually became public:

According to on-chain analyst Ai Yi statistics, there are suspected to be 4 main addresses involved in the XPL hedging attack, with a total profit of 46.1 million dollars. Among them:

- Address 0xb9c…6801e is the main driving address, which started to accumulate long positions in small amounts since August 24, and made a large purchase at 05:35 AM today to trigger the short positions;

- Addresses 0xe41…858c7, 0x006…2a78f, and 0x894…00779 are profit-taking addresses that cooperated in the liquidation, all of which completed long position accumulation between August 22 and 26, and closed their positions at the short-term peak of XPL.

The relationship between the addresses is as follows: the funding sources of addresses 0xe41…858c7 and 0x006…2a78f are the same, with the former's username on Debank being silentraven, who had an unrealized profit of over 10 million dollars from going long on HYPE in May this year; although address 0xb9c…6801e has no direct funding connection with the above two addresses, they share the commonality that their margin was obtained through debridge cross-chain, and their operational habits are similar; address 0x894…00779 is relatively independent, with margin sourced from Binance, possibly related to the above three addresses or just lucky to catch the XPL rise to take profit.

Thus, crypto whales successfully completed a “reverse harvesting” operation amounting to 46 million dollars by leveraging the “XPL pre-market.” The reason why whales could short-term raise prices to attack XPL hedging short positions is largely due to the relevant mechanisms of the Hyperliquid platform's pre-market. Consequently, the market's criticism is directed at Hyperliquid.

Hyperliquid Platform Mechanism Sparks Controversy Again: Pre-Market Market Single Oracle, Mark Price as the Only Indicator

According to Yunt Capital founder steven.hl commenting, “(The XPL liquidation incident) occurred in the pre-market phase due to a combination of various factors, including: 1) Only one oracle determines the market price (i.e., the pre-market perpetual contract itself); 2) The order volume is sparse, making it easy to temporarily manipulate the market; 3) Many people hedge risks through hedging, making it easy to guess where there are large liquidations (i.e., Hyperliquid platform).”

Additionally, user @nauhcner also explained: “In the isolated market, short position holders maintain their short positions, but when their account margin falls below the required 300% to avoid liquidation (because the XPL price rose about 3 times), it means that the rise in XPL price caused their short positions to incur losses greater than their margin, ultimately leading to liquidation.”

It is worth mentioning that the XPL price manipulation incident reflects similar issues as the previous incidents of “whale actively liquidating to transfer leverage losses to HLP” and “Hyperliquid forcibly liquidating JELLYJELLY”—the focus of the problem lies in:

- Unlike mixed oracle prices, on-site indicators, and aggregated platform index prices from multiple CEXs, Hyperliquid's pre-market contracts only have mark prices (i.e., dynamically displayed prices of single platform contracts);

- The Hyperliquid platform has not imposed order restrictions on large leveraged long or short positions, leaving a “loophole” for whales to manipulate market prices for profit, even for 1x hedged short positions, they still cannot escape the fate of liquidation under massive long buy orders.

Multiple incidents collectively reflect the issues of Hyperliquid platform's leverage settings and contract depth, while the cost bearers are the “victims” in these events—namely, those traders who chose to hedge and open shorts on the platform due to their trust in Hyperliquid.

According to trader Aoke Quant Captain Aoke (@aoke_quant), his partner's position on Hyperliquid was liquidated at a peak of 2 million dollars; trader Andy (@AndyJYGood 68) stated that he woke up to find his hedged short position liquidated for 200,000 dollars, with a group member losing 1.38 million dollars.

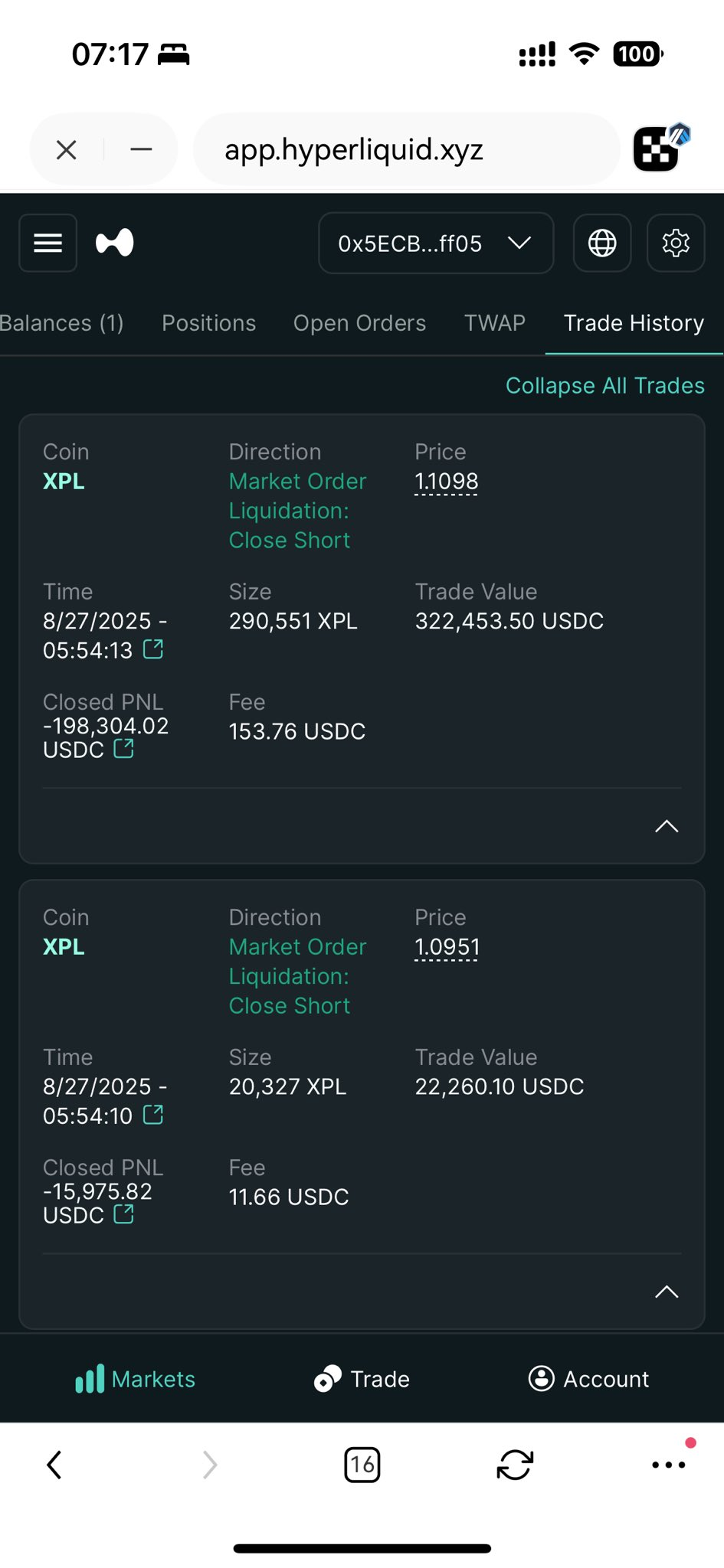

“Victim screenshot”

Trader CBB (@Cbb 0 fe), who previously initiated the “public whale hunting operation,” also posted, “I originally thought it was smart to hedge on @Hyperliquid, setting a 10% XPL position with 1x short and using a large margin to cope with liquidation risks; but ultimately lost 2.5 million dollars. I will never touch the pre-market isolated market again.”

According to LookonChain monitoring, the victim 0xC2Cb's XPL short position was also completely liquidated in this incident, with losses reaching 4.59 million dollars.

It is worth mentioning that perhaps WLFI and XPL are the two major “king-level projects” recently, and after the XPL price manipulation incident, possibly influenced by the chain reaction of XPL liquidations, WLFI briefly surged past 0.42 dollars, marking another magical event in the circle.

Looking back at Hyperliquid platform founder Jeff's previous “Explanation on the Decentralized Nature of Hyperliquid Platform's Margin Mechanism”, it can only be said to be lamentable, and whether Hyperliquid can make targeted improvements on price manipulation, margin liquidation, and contract pricing will be key to determining whether Hyperliquid can continue to dominate the on-chain contract market.

Finally, it appears that the XPL price manipulation incident has not affected the price of HYPE, which even briefly touched 50 dollars, setting a new historical high. Ironically, Arthur Hayes, co-founder of BitMEX, who previously stated during the “Hyperliquid JELLY liquidation incident” that “let's stop pretending Hyperliquid is decentralized” and “betting that HYPE will soon return to its starting point,” has now become a “loyal supporter” of HYPE, recently stating during a speech at the WebX conference that HYPE is expected to achieve a 126-fold increase.

It must be said that in the unpredictable crypto market, many things often come down to price representing everything.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。