Original author: Ryan Adams, Co-founder of Bankless

Original translation: Luffy, Foresight News

Editor's note: This article is a letter from Ryan Adams, co-founder of Bankless, to his son. In the letter, Ryan offers some wealth management advice, with the core message being "Don't keep your money in the bank." He argues that banks are actually a triple "scam." Ryan's alternative suggestion is to keep some dollars for daily expenses and then invest wealth in a portfolio of assets like Bitcoin, gold, and stocks that can store value over time. Below is the full translation:

Dear Son,

Don't keep your money in the bank; banks seem safe, but they are actually a triple "scam."

"Scam" One: They Steal Your Earnings

At any time, the dollar actually has a risk-free return, which is government bonds. In simple terms, government bonds are "dollars dressed in short-term government bond clothing," providing you with a fixed return of 4.2%.

With no extra risk, it's like free money, tailor-made for you.

But banks won't give you this money in your savings account; they pocket it for themselves. They don't tell you about this return, nor do they help you convert your dollars into government bonds, and they even actively lobby the U.S. government to prevent depositors from accessing this return.

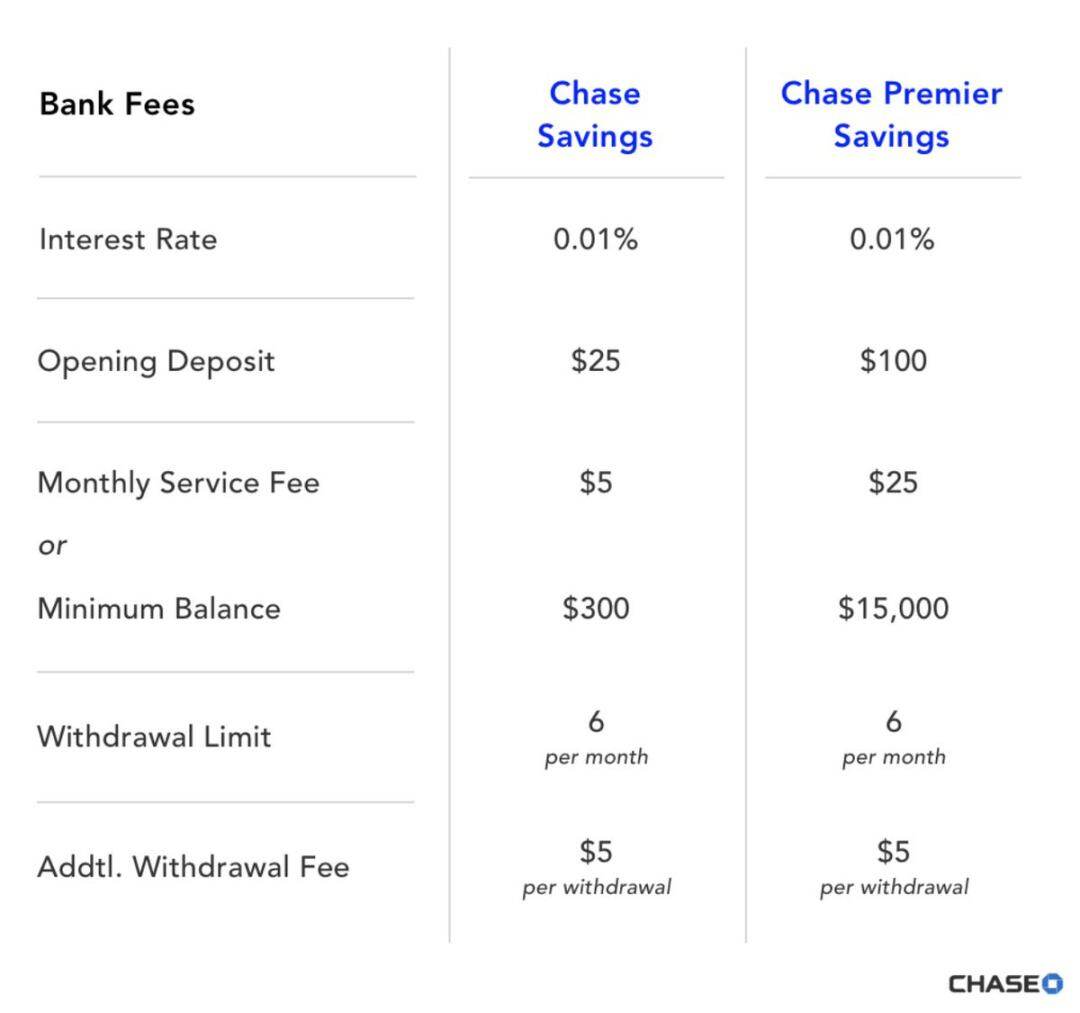

Banks take a 4.19% return but only give you 0.01%

Wealthy people don't keep their money in banks; they invest cash in government bonds instead of savings accounts. But the middle class and those lacking financial knowledge are daily robbed of their earnings by the "friendly" bank next door, completely unaware.

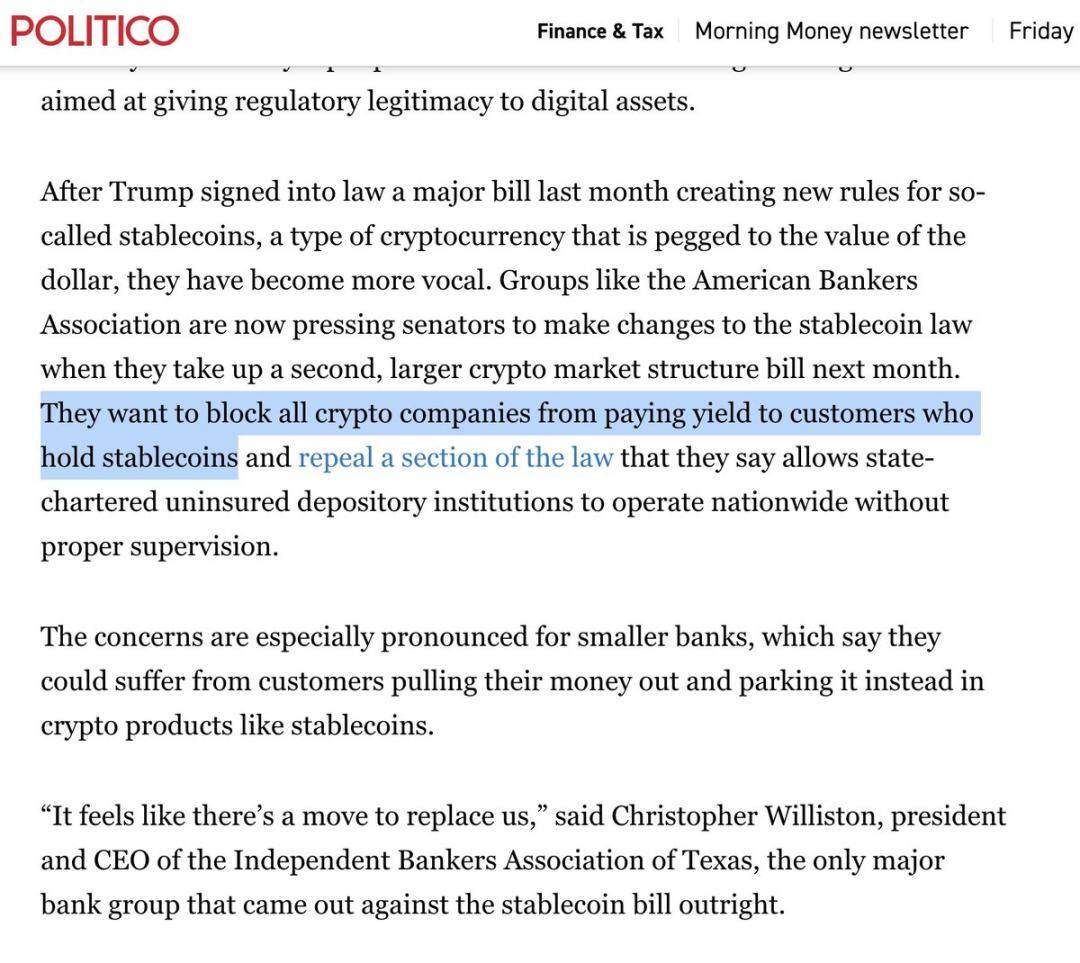

Bank lobbying groups are also eyeing the returns from cryptocurrency stablecoins, preventing you from accessing them. They spread panic, claiming that if the "bloodsucking" business of savings accounts disappears, the entire financial market will collapse!

Interest rates fluctuate, so you need to pay attention to the statements from the Federal Reserve Chair, but as long as the rates are positive, put your dollars into short-term government bonds and money markets, not in a bank account.

"Scam" Two: So-called Returns Are Not Real Returns

Now you should know the next secret: the returns are fake.

You think the 4.2% return you receive now can compensate for the loss of purchasing power? In fact, that's just the "nominal return." Because the purchasing power of the dollar shrinks every year, this is what we call inflation. Even in good times, inflation is to be expected; in bad times, it only gets worse.

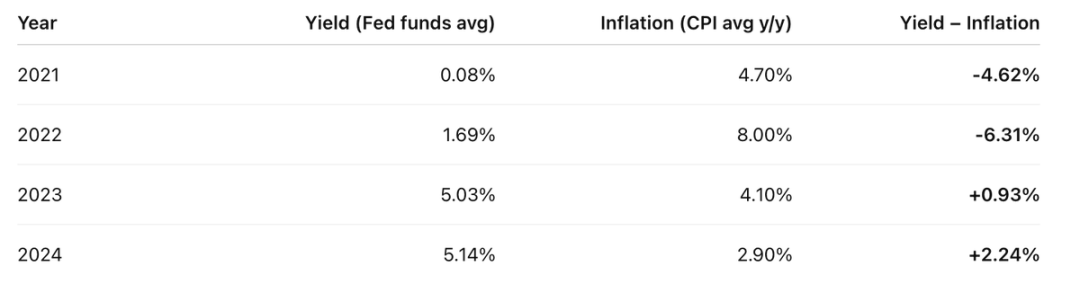

Over the past four years, your real returns have looked something like this:

The account's return minus the annual CPI results is not great

So over the past four years, there were two years where you lost much more than you earned.

But the reality is worse: those "fake returns" are also taxed as income.

Assuming your income tax rate is 20%, you first have to pay 20% tax on those "fake returns." So the actual return looks like this:

Before the inflation "tax," you first paid income tax, meaning the dollar is effectively double-taxed

Real return = Nominal return - Inflation.

They want you to think inflation is a natural force like gravity or physical laws, but it is not; it is a deliberate design of modern government and central banking systems.

Inflation is a tax, just like any other tax, only it is hidden from you.

I know you don't mind paying your fair share of taxes. Public services are important, and you agree with the common good. But what about this hidden tax? It specifically targets middle-class savers who want to save for the future; is that fair?

Learn from the wealthy: they evade the "savings tax" by holding a large amount of assets instead of dollars. This leads us to the third and most insidious layer of the nested "scam."

"Scam" Three: Money Itself Is Not "Real"

Okay, I may be exaggerating a bit. The dollar does exist, but it is just a "temporary thing." It is suitable for short-term payments, not for storing wealth over time, nor for leaving for the future. It is a medium of exchange, not a store of value.

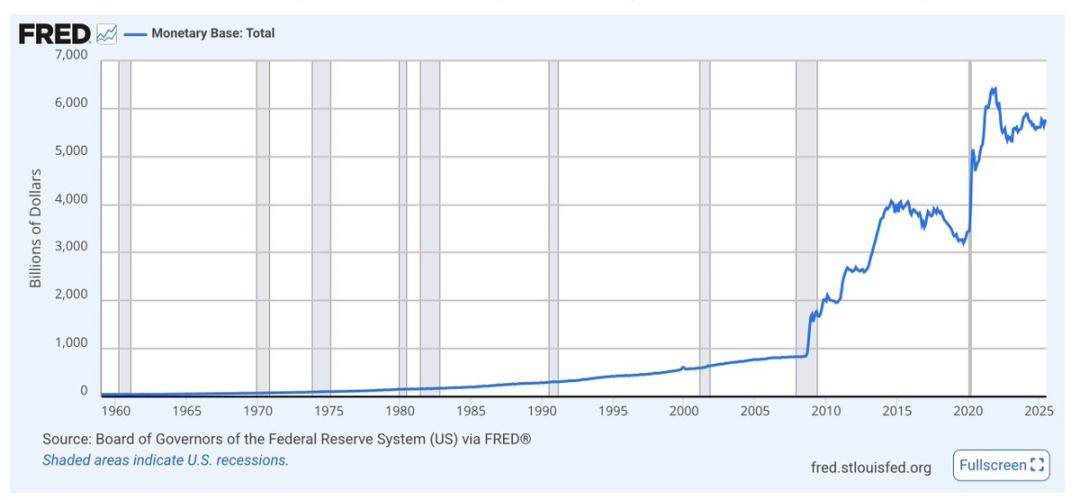

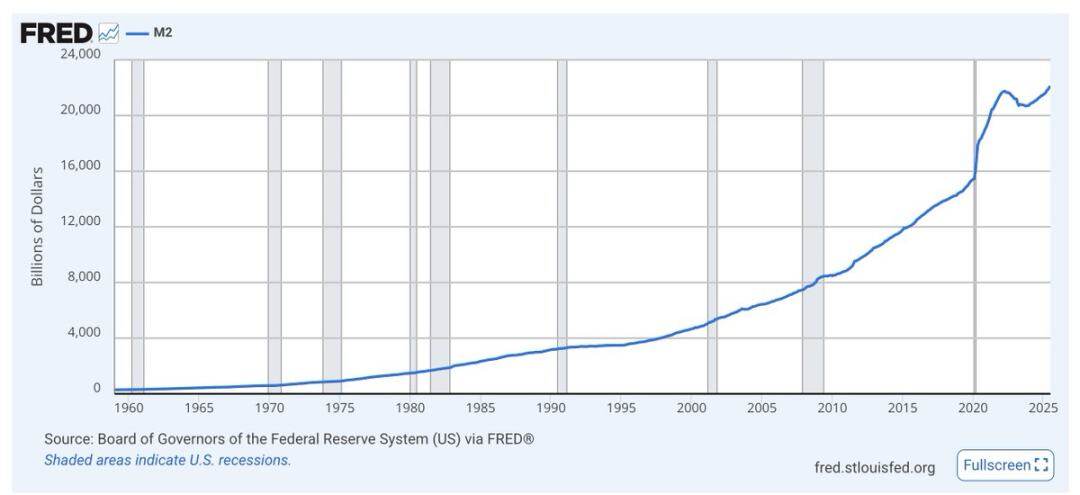

The base money supply, called M0, consists of cash and bank reserves. Look how much it spikes during crises; the overall trend is always upward.

The dollar has no long-term scarcity constraints; its supply keeps increasing. The proportion of dollars you hold in the total supply shrinks much faster than the returns can compensate because they keep printing money.

The issuance of dollars is rarely mentioned. Economists only focus on inflation and purchasing power, but in the long run, an increase in the money supply will devalue the dollar relative to assets. The more dollars printed, the less your money is worth.

M2 (M1 plus short-term savings) behaves the same way, spiking during crises, with a trend that is always soaring.

Don't get caught up in economists' debates; just look at the charts. Regardless of who is in power, the government will use printing dollars as an "economic and political lubricant." That's what dollars are for, not for saving.

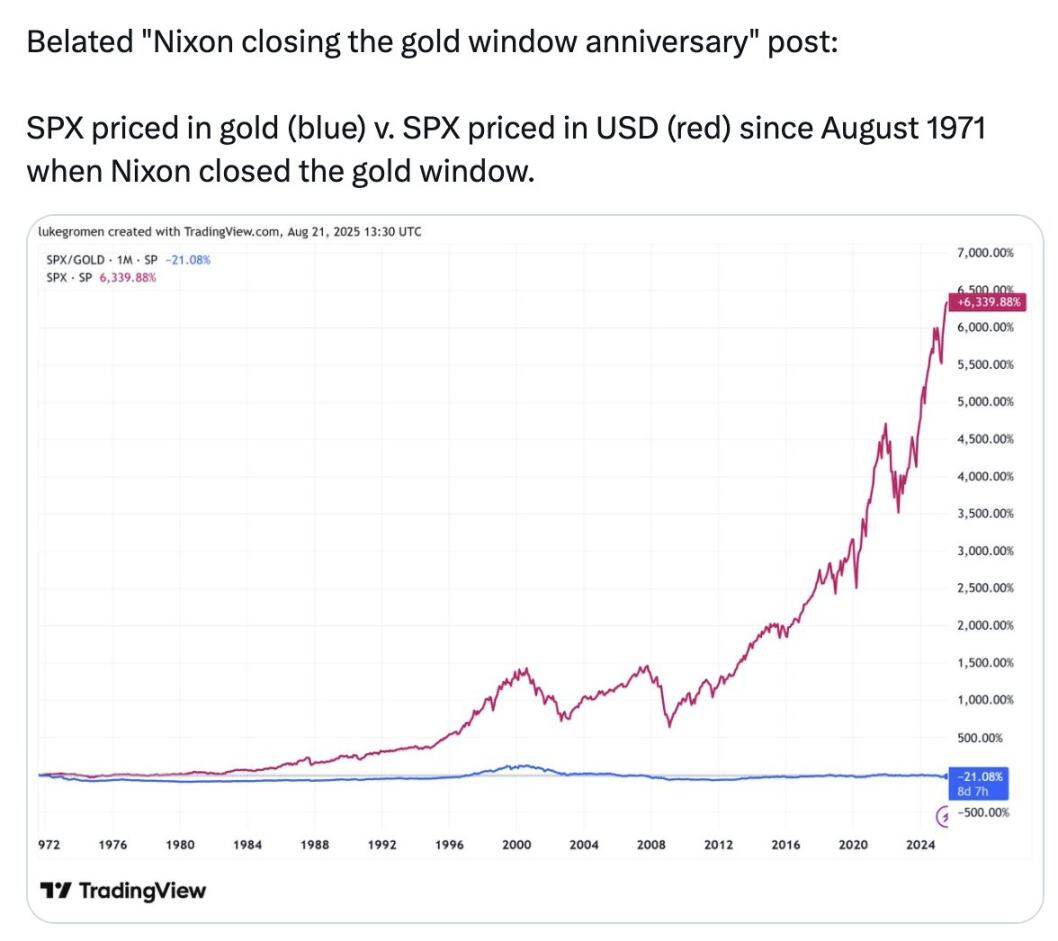

Look at the blue line in this chart:

The S&P 500 has increased by 6339% in dollars since 1971; however, when priced in gold, the S&P 500 has actually decreased by 21%.

Over the past 54 years, storing wealth in gold has been better than keeping it in the 500 largest and best-performing companies in the U.S.

This chart is not telling you to buy gold; it is trying to tell you: what they call "money," the thing we use to measure everything, the dollars in your bank account, are not real "money" at all. It cannot store value, it never has, and it never will.

What they call "money" is not a store of value. So this is the three-layer nested "scam":

- "Scam" One: Stealing your earnings;

- "Scam" Two: So-called returns are not real returns;

- "Scam" Three: Money itself is not "real."

So what should you do?

Keep some dollars for short-term needs, like daily expenses, taxes, and emergency funds. Earn returns in the form of government bonds.

Put all long-term wealth into a portfolio of assets that can store value over time: stocks and real estate are fine, but Bitcoin, Ethereum, and gold are also good. The latter three have limited supply and won't be diluted by inflation. These assets may seem risky due to their volatility, but volatility does not equal risk.

You can also put some mid-term wealth in government bonds; when long-term value-storing assets drop in price, invest cash into them. This is the essence of investing; as Buffett wisely said, be greedy when others are fearful, and fearful when others are greedy. Don't rush to act; think in terms of years or even decades when a major drop occurs.

Try to use cryptocurrency tools and exchanges to manage these. Avoid the most cutting-edge risks; this way, you can stay at the forefront while avoiding the pitfalls when cryptocurrency disrupts traditional finance.

Schools won't teach you this. But you need to learn, keep digging deeper, and protect your future.

Don't keep your money in the bank. Turn your money into assets and invest in cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。