Written by: Babywhale, Techub News

Over a week ago, the American cryptocurrency exchange Gemini submitted a prospectus to the U.S. Securities and Exchange Commission (SEC) with plans to go public on Nasdaq. If Gemini successfully lists, it will become the third cryptocurrency exchange to go public in the U.S., following Coinbase and Bullish. However, unlike the first two, which clearly aimed to materialize company value, Gemini explicitly stated the use of funds from the IPO in its prospectus: general corporate purposes and repayment of all or part of third-party debts.

Exchanges have long been synonymous with easy profits in the Web3 world. Previously, screenshots circulated on X showing a certain exchange distributing bonuses to all employees, yet the founders, the Winklevoss twins, have managed to turn such a business into one that has suffered losses for consecutive years, which is quite puzzling. Let's take a look at the reasons behind Gemini's losses through the submitted prospectus.

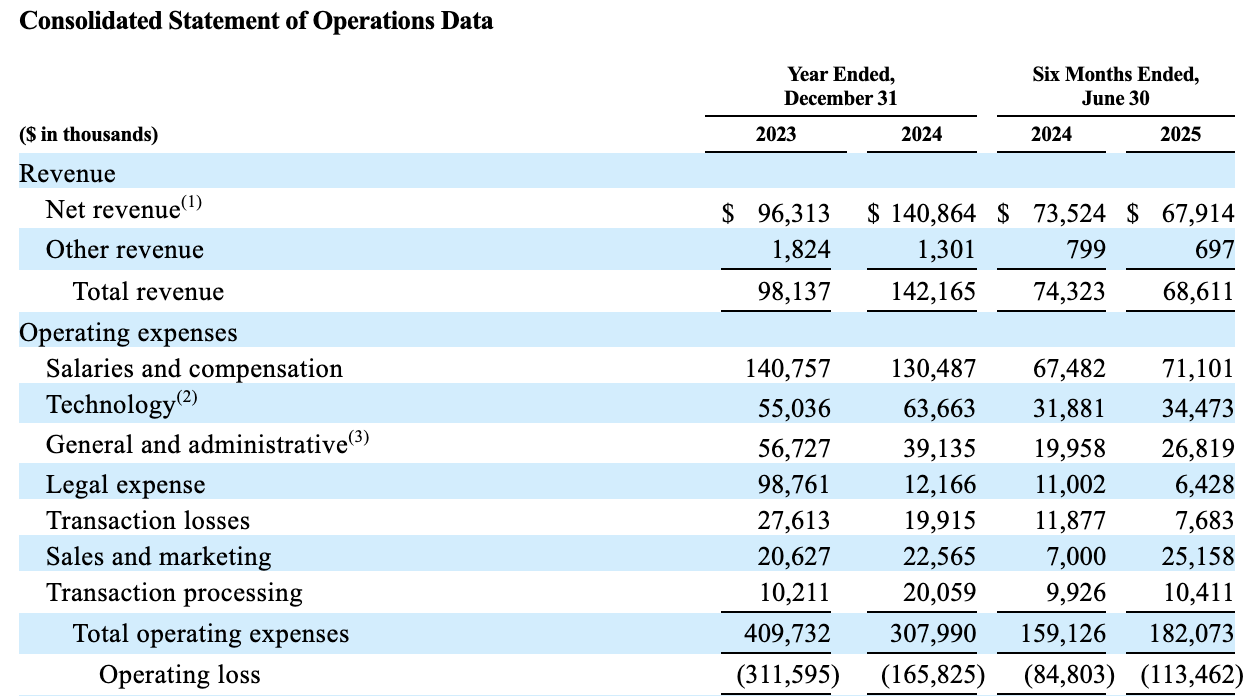

High Operating Costs, Declining Revenue

The financial information in the prospectus shows that Gemini's revenue for the first half of 2025 was approximately $68.611 million, a 7.6% decline compared to $74.323 million in the same period last year. Of course, this downward trend is not unique to Gemini; Coinbase also reported lower-than-expected revenue in the second quarter of this year, with a quarter-over-quarter decline of 26%. This indicates that although Bitcoin's price in the first half of this year far exceeded that of the same period last year, overall market trading enthusiasm remains low.

However, Coinbase's total revenue in the first half of this year exceeded $3.5 billion, more than 50 times that of Gemini. This means that Gemini's revenue for six months is equivalent to just over three days' worth of Coinbase's average revenue, which can indeed be described as meager.

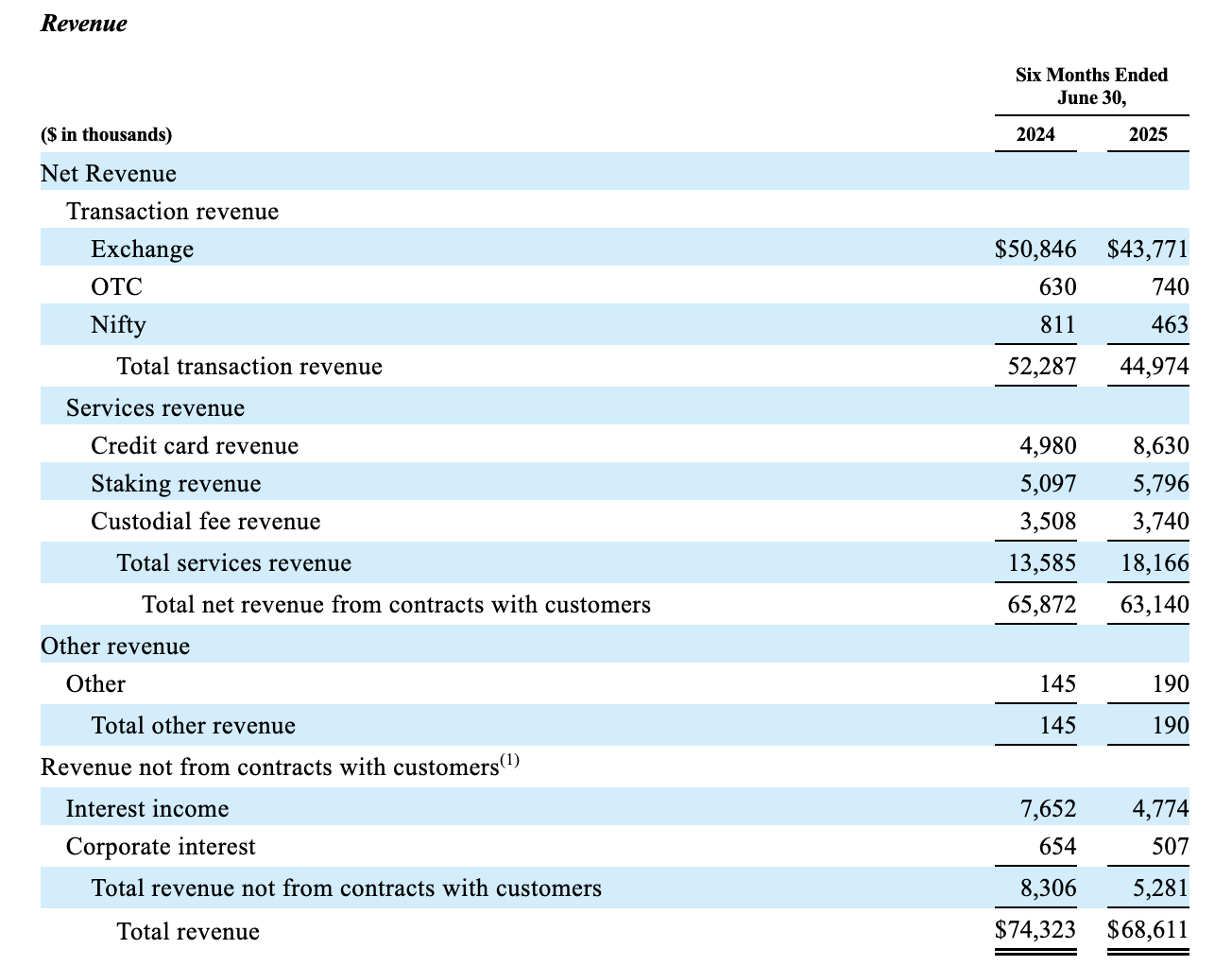

The specific components of revenue include trading income, service income, and other income. In the first half of this year, Gemini's trading income was approximately $43.771 million, down about 14% from $50.846 million in the same period last year. Gemini explained that the decline was due to an increase in trading volume on low-fee platforms and enhanced incentives for market makers, which led to a decrease of about $8.7 million compared to the same period last year. However, an overall trading volume increase of 3% reduced the absolute decline to around $7.1 million. OTC revenue grew approximately 17.5% year-over-year to $740,000, while revenue from the NFT platform Nifty plummeted 43% to $463,000.

Service income recorded year-over-year growth in the first half of this year, with credit card income increasing 73% to $8.63 million, keeping pace with the popularity of the "U Card" this year; staking income grew 14% year-over-year to $5.796 million, and custody income increased 7% year-over-year to $3.74 million.

In terms of overall customer service income, trading income decreased by about 14% year-over-year, while service income grew by about 33.7%. However, since trading income accounts for over 70% of total income, the overall revenue still recorded a decline of over 7%. Additionally, in other income, Gemini's stablecoin GUSD also faced a downturn this year, with redemptions by holders shrinking reserve assets, and the decrease in interest-bearing assets within the reserves led to a dramatic drop in interest income of 38% to $4.774 million in the first half of this year.

In terms of revenue, there was a significant decline in trading income and stablecoins. Although there was good growth in institutional-level businesses like credit cards, staking, and custody, the more significant consumer-facing business saw a noticeable decline. This is not good news for an exchange that is just starting its business.

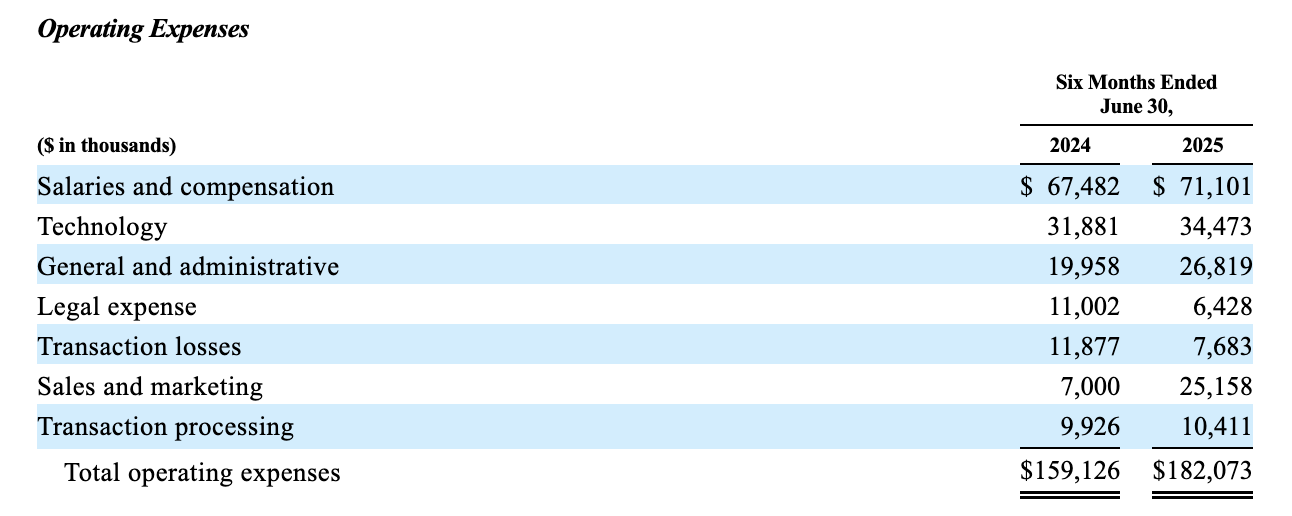

Regarding operating costs, there isn't much to analyze. Despite the company's poor operational status, Gemini has not given up on expansion and development, resulting in a 14.4% year-over-year increase in operating costs for the first half of this year, with marketing expenses rising more than twofold, and other costs like salaries also seeing some increase. The only noteworthy point is that, in the face of these rising fixed expenses, revenue has declined during the same period. Gemini's operating costs are not particularly high, but when paired with its meager revenue, it continues to operate at a loss. In recent years, the siphoning effect of large exchanges has become increasingly apparent, posing a significant challenge for second-tier exchanges.

High Long-term Debt, Tight Cash Flow

Gemini's submitted S-1 document does not display a balance sheet, but we can glean some insights from other data.

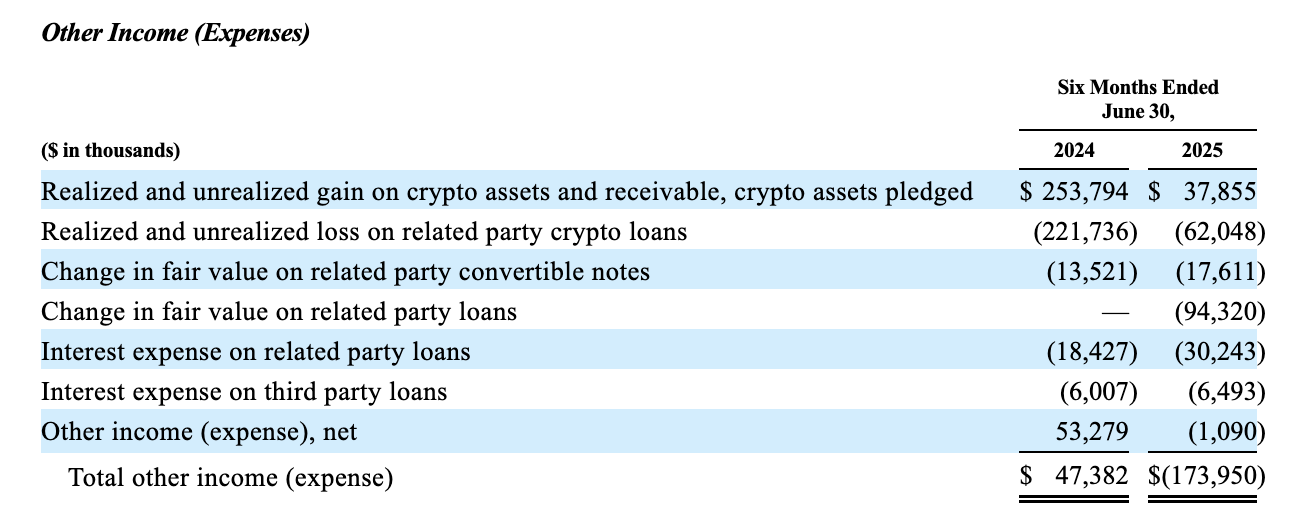

In the list of other income and expenses, there are numerous expenses and impairment provisions related to borrowing that have dragged down current profits. Excluding the first two items in the table due to significant data discrepancies caused by cryptocurrency price fluctuations, items 4, 5, and 6 all show increased interest expenses due to rising debt from debt-to-equity swaps or loans, caused by increases in quantity and price changes. Regardless, there is no clear indication in the table of a significant decrease in the number of loans.

Gemini's debt is not only high but also quite intriguing. Throughout the document, as of June 30 of this year, Gemini's debt includes loans from the founders' private investment company WCF and loans from Galaxy Digital (with a principal balance of $116.5 million). The amount borrowed from WCF is astonishing, including:

A total of 10,051 Bitcoins and 133,430 Ethereums starting from December 2022, with an interest rate of 4% to 8% per year. The remaining unpaid amount is still 4,682 Bitcoins and 39,699 Ethereums, valued at over $600 million based on the average price on June 30.

Unsecured convertible notes issued to WCF from September 2023 to March 2024, valued at $275 million, paid in cryptocurrency, with an interest rate of 4% to 16%, and no repayments made as of June 30. After the IPO, this portion of the loan can be converted into shares at a 20% discount to the IPO price.

A loan agreement signed with WCF in May 2024, with a maximum loan amount of $275 million, which has already been fully borrowed, with an interest rate of 4% to 16%, maturing on June 1, 2027.

A loan agreement signed with WCF in January 2025, with terms similar to the previous agreement, with a maximum amount of $200 million, and the remaining principal valued slightly above $130 million. Unlike the previous loan agreement, this portion of the loan will also be convertible into shares at a 20% discount to the IPO price.

Excluding the convertible bonds, the value of loans to the founders as of June 30 exceeded $1.28 billion, with total loans approaching $1.4 billion. This means that if Gemini maintains its revenue situation from the first half of this year in the second half, even if the revenue in 2025 is pure profit, it would take over 10 years to repay, not to mention that Gemini has been in a state of loss.

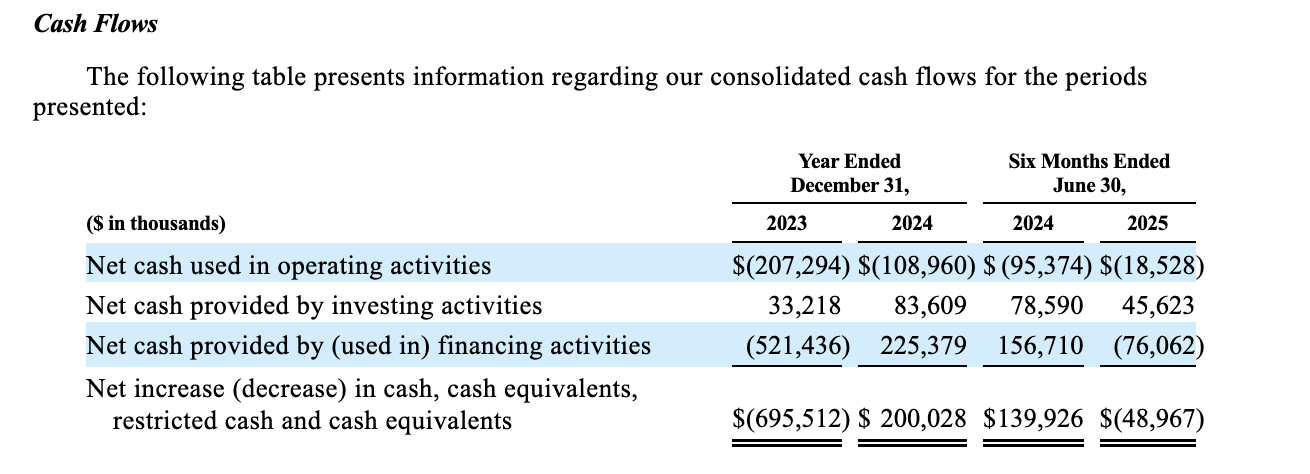

The cash flow situation is even more concerning. Although the first half of this year marked the first time in over two and a half years that net cash inflows from investments exceeded cash outflows from operations, the sustained negative operating cash flow over several years is indeed shocking. If a company has negative profits but maintains healthy cash flow, we can still have some expectations for it. However, continuous losses, negative cash flow, and even billions in debt primarily held by the founders make it feel like Gemini's IPO is more of a "last-ditch rescue."

The S-1 document submitted by Gemini is not a standard financial report, so the data available for analysis is relatively limited. Of course, the S-1 document contains a wealth of information beyond financial data, which readers can explore on their own, and this article will not delve into that.

From the publicly available data in the S-1, we can understand that Gemini's main revenue source, the consumer-facing business, has declined, while the business-to-business segment has seen slight growth but still accounts for a low proportion. Its extremely unhealthy debt structure and cash flow give the impression that the Winklevoss twins are trying to "recoup their investment" through the IPO. Given Gemini's current situation, its investment value is clearly low, but there are still some points worth looking forward to.

If Gemini successfully goes public and alleviates its debt and cash flow issues through financing, and if it can continue to increase revenue from its B2B business while improving the market share of GUSD in the context of promoting stablecoins in the U.S., then Gemini's valuation could have some room for growth. Therefore, if Gemini successfully lists, investors should pay attention to whether its post-IPO financial reports show changes in operating costs, revenue structure and absolute values, as well as debt and cash flow.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。