Abstract: Every casino has its own rules

The story of the first episode "Joan is Awful" from the last season of "Black Mirror": The female protagonist casually clicked "Agree," and as a result, the platform turned her daily life into a globally broadcast reality show based on a user agreement that no one bothered to read.

In fact, every industry has its own user agreement. The same goes for Perp; the clearing rules are the "user agreement" of this track.

It is neither sexy nor eye-catching, but it is extremely important. The same token can have different depths, different K-line trends, and different clearing mechanisms on each trading platform, leading to completely different outcomes for positions.

Today's examples of two perp dexes serve as excellent teaching materials: At the same time, while Binance's pre-market contract quotes did not show equivalent fluctuations, the price of XPL on Hyperliquid was pulled up to nearly +200% in about 5 minutes; and the price of ETH on Lighter spiked to $5,100.

In extreme market conditions, some rejoice while others despair.

In just one hour, multiple whales on Hyperliquid profited nearly $38 million to $46.1 million by pushing up prices to liquidate opposing short positions; among them, the widely watched address 0xb9c…6801e had been accumulating long positions since August 24, and after the "order sweep" at 5:35, it made about $16 million in profit within just one minute; HLP netted about $47,000 in this unusual movement. But the shorts were not so lucky; the XPL shorts of 0x64a4 were liquidated in a chain reaction within minutes, losing about $2 million; the shorts of 0xC2Cb were fully liquidated, losing about $4.59 million.

Rather than saying this is a case of "manipulation by bad actors," it is more accurate to say it is the result of the interaction between the clearing system and market structure, providing a new lesson for all crypto players: Always pay attention to depth and clearing mechanisms.

How is clearing generated?

At any perpetual contract platform, the first thing to understand is: Initial Margin (IM) and Maintenance Margin (MM): IM determines the maximum leverage that can be opened; MM is the liquidation line, and when the account equity (collateral plus unrealized profit and loss) falls below it, the system will take over the position and enter the clearing process.

Next, look at the price. The price that determines whether a liquidation occurs is not the last transaction price but the Mark Price. It is often determined by external indices, oracle predictions, and the platform's own order book, and is smoothed and manipulated-resistant; the index price is closer to a pure external weighted spot reference; the Last Price is the most recent transaction on the platform, which can easily be manipulated by instantaneous order sweeps.

So when "account equity < Maintenance Margin," liquidation is triggered. However, the specifics of the liquidation still depend on the platform's own clearing execution mechanism.

Hyperliquid: Letting the market absorb liquidation orders

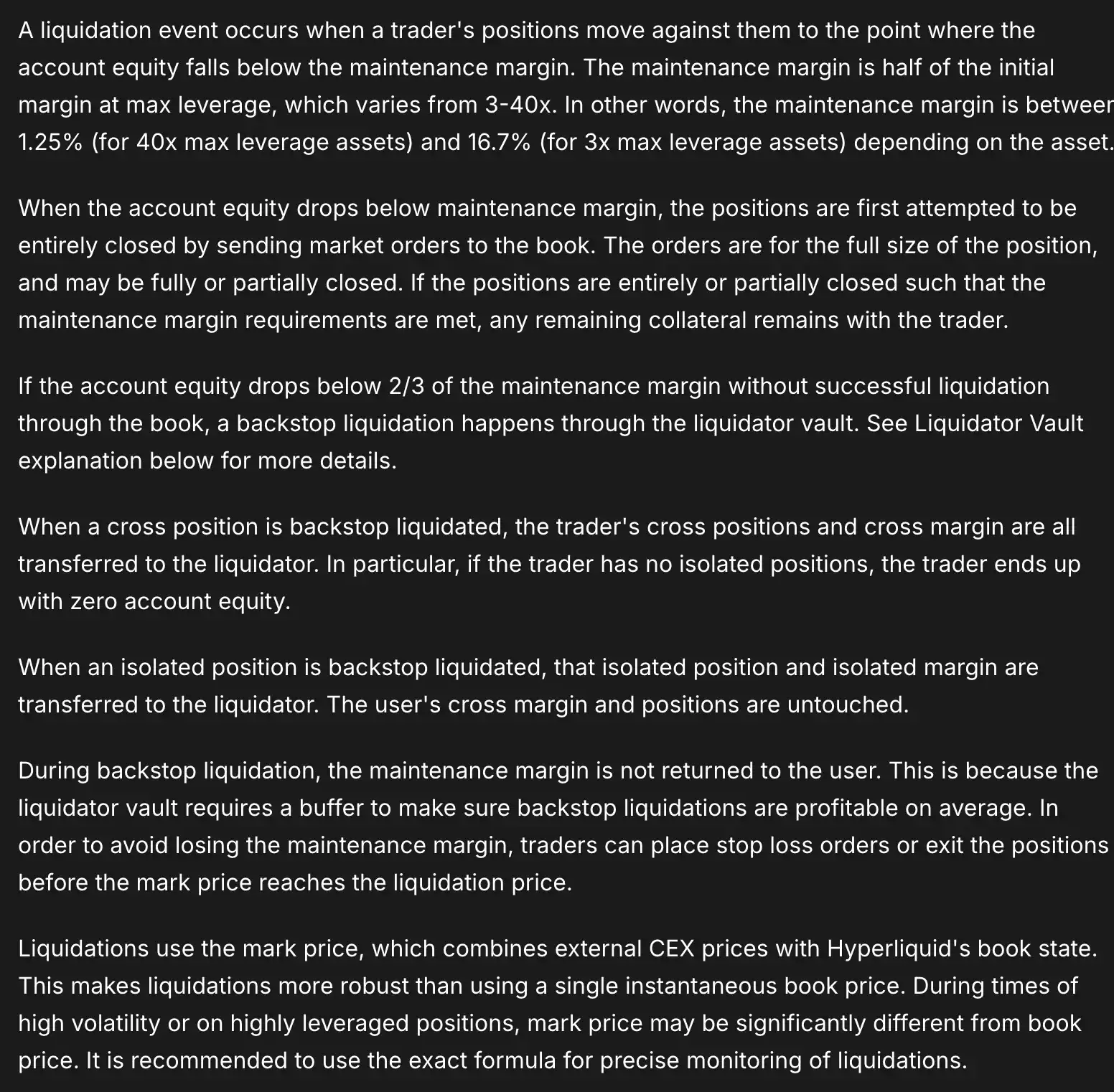

First, let's look at Hyperliquid. Hyperliquid's clearing mechanism is: When account equity falls below the Maintenance Margin (MM), the system prioritizes placing liquidation orders directly into the order book, absorbing risk in a market-oriented manner.

If it is a large position (e.g., >100,000 USDC), it usually clears 20% first, then cools down for about 30 seconds, and if triggered again, it may handle the entire position. If it cannot be cleared and further deteriorates to a deeper threshold (e.g., equity below 2/3 × MM), backup liquidation will be triggered, taken over by the community-based Liquidator Vault (HLP component). To ensure that "the safety net can continue," this step often does not return the maintenance margin.

The entire process does not charge a "liquidation fee," but in pre-market conditions where external anchors are weak and depth is poor, the liquidation action itself may further push the price in the same direction for a while, causing a temporary price spike.

At the same time, Hyperliquid's Mark Price is determined by external CEX quotes and its own order book; if the internal transactions dominate during volatility, it will also accelerate the triggering pace. Additionally, isolated and cross positions behave differently in the backup phase: when a cross position is taken over, the entire position and margin may be transferred; isolated positions only affect that specific position and its isolated margin.

So let's rewind to early this morning to briefly review the Hyperliquid XPL event. Starting at 5:35, Hyperliquid's XPL buy orders rapidly raised the transaction range by "sweeping the order book," with the Mark Price being dominated by internal matching, jumping far beyond normal levels.

For a side heavily crowded with shorts, this jump caused the ratio of account equity to maintenance margin to be instantly compressed: when equity falls below MM, the system takes over the position according to the established process. Next, the system will buy in the order book to cover shorts (larger volumes may be partially cleared first and enter a cooling period), and this set of cover buy orders will continue to push up the price and Mark Price, triggering more shorts to fall below MM. In a matter of seconds to tens of seconds, a positive feedback loop of "order sweep → trigger liquidation → liquidation sweeps the order book" is formed—this is also the mechanistic explanation for the price nearing +200% in just a few minutes.

If it still cannot be cleared on the order book, and the equity of the liquidated account further drops to a deeper threshold (e.g., 2/3 × MM), the backup liquidation mechanism will take over, continuing to absorb the buy orders to ensure that the risk is "eaten" within the system.

Once the order book regains depth and the liquidation queue is digested, the actively long addresses begin to take profits, and the price quickly falls from the high like a roller coaster—this is the entire process of "Hyperliquid's XPL nearly +200% in a few minutes → chain liquidation of shorts → rapid decline."

This is essentially the inevitable result of the coupling of pre-market liquidity depth + position crowding + clearing mechanism.

Does Lighter really face liquidation earlier?

Now let's take a look at Lighter. This morning, the ETH price on Lighter spiked to $5,100, which also attracted considerable attention. As a perp dex that is currently second in trading volume only to Hyperliquid and is very popular in the foreign CT circle, Lighter's price spikes have sparked multiple discussions.

Lighter has three thresholds: IM (Initial Margin) > MM (Maintenance Margin) > CO (Close-out Margin). Falling below IM enters "pre-liquidation," where you can only reduce positions; falling below MM enters "partial liquidation," where the system issues IOC limit orders to reduce positions at a pre-calculated "Zero Price." The design of the Zero Price ensures that even if executed at Zero Price, the account's health will not continue to deteriorate; if executed at a better price, the system will extract no more than 1% of the liquidation fee into the LLP (insurance fund). Further down, if equity falls below CO, it triggers "full liquidation," clearing all positions and transferring the remaining collateral into the LLP; if the LLP funds are insufficient to cover, ADL (Automatic Deleveraging) will be activated, knocking out a portion of the opposing side's high-leverage/large unrealized profit positions at their respective Zero Prices, striving to complete deleveraging without harming the innocent at the system level. Overall, Lighter sacrifices some "liquidation speed" in exchange for controllable account health and order book impact.

So does this mean that Lighter's liquidation price is much higher than other dexes and will liquidate earlier?

A more accurate answer is: Yes, but not entirely.

In simpler terms, Lighter's "earlier liquidation" is a phased "position reduction to extinguish fire": it issues IOC limit orders to reduce positions at "Zero Price," aiming not to worsen account health; many times it reduces positions to safety, which does not equate to liquidating you; only further deterioration to CO will result in a complete liquidation.

Therefore, it cannot be simply said that "Lighter is easier to liquidate," but rather that it has a gentler liquidation and position reduction process, spreading the risk and reducing the price impact caused by a one-time order sweep; the cost is that if executed at a price better than "Zero Price," a ≤1% liquidation fee will be charged into the insurance fund (LLP).

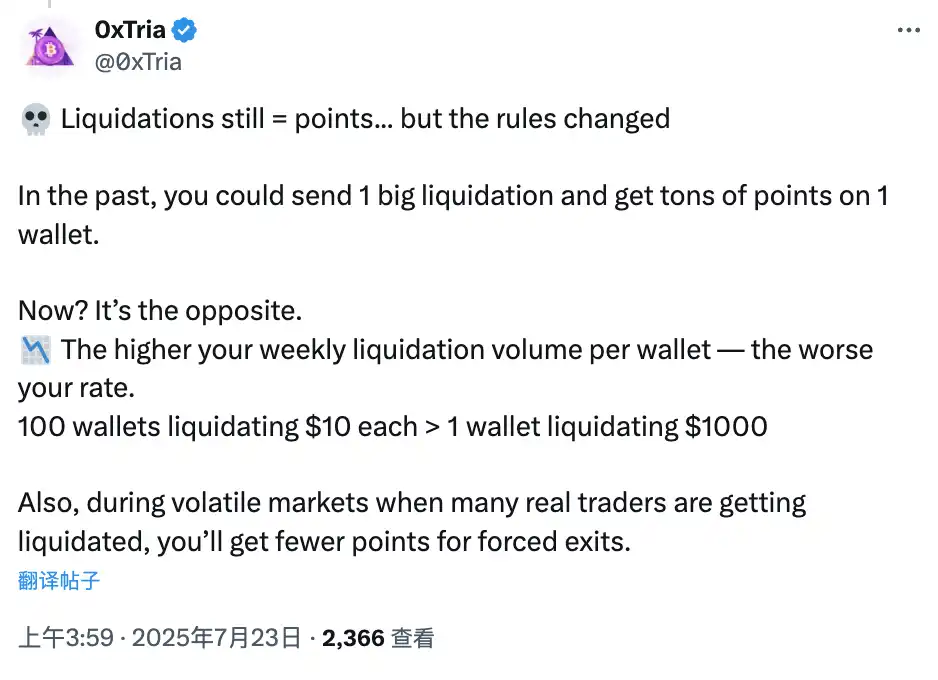

Interestingly, in the early days, Lighter's point weight for liquidation amounts was relatively high. According to analysis by Lighter community member 0xTria, the initial liquidation for accounts was "1 point for every $1 liquidated," while the community valued points at $15-30, which directly incentivized many users to use sub-accounts and new accounts to "liquidate for points" arbitrage. However, in subsequent versions after a few weeks, this weight was significantly reduced.

How to avoid being manipulated by bad actors

The crypto world is a survival of the fittest. For ordinary people, we should not think about how many times we can earn, but rather how to minimize the chances of being liquidated or being controlled by large players. So how can we reduce the possibility as much as possible?

Look at the chip structure

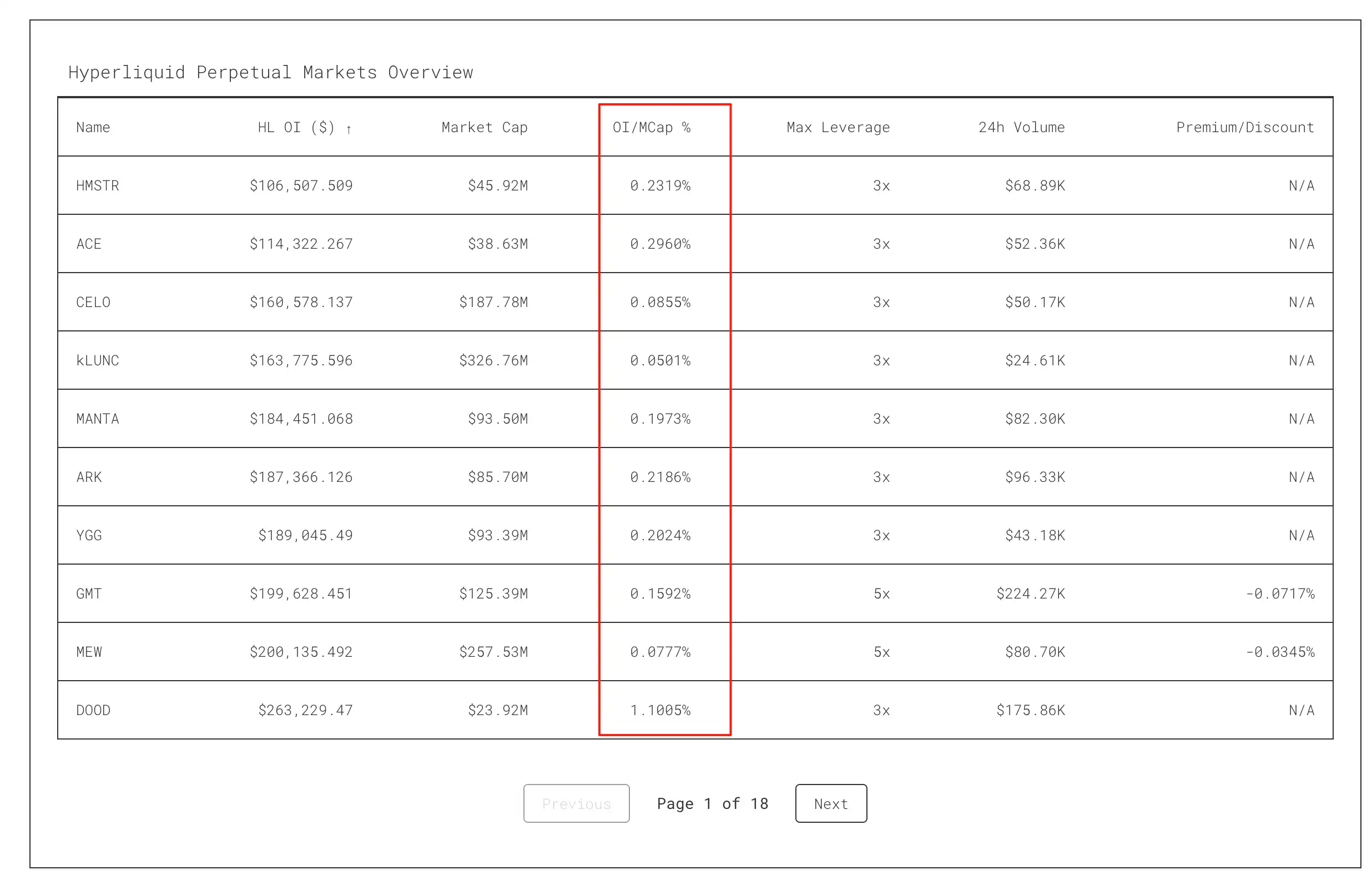

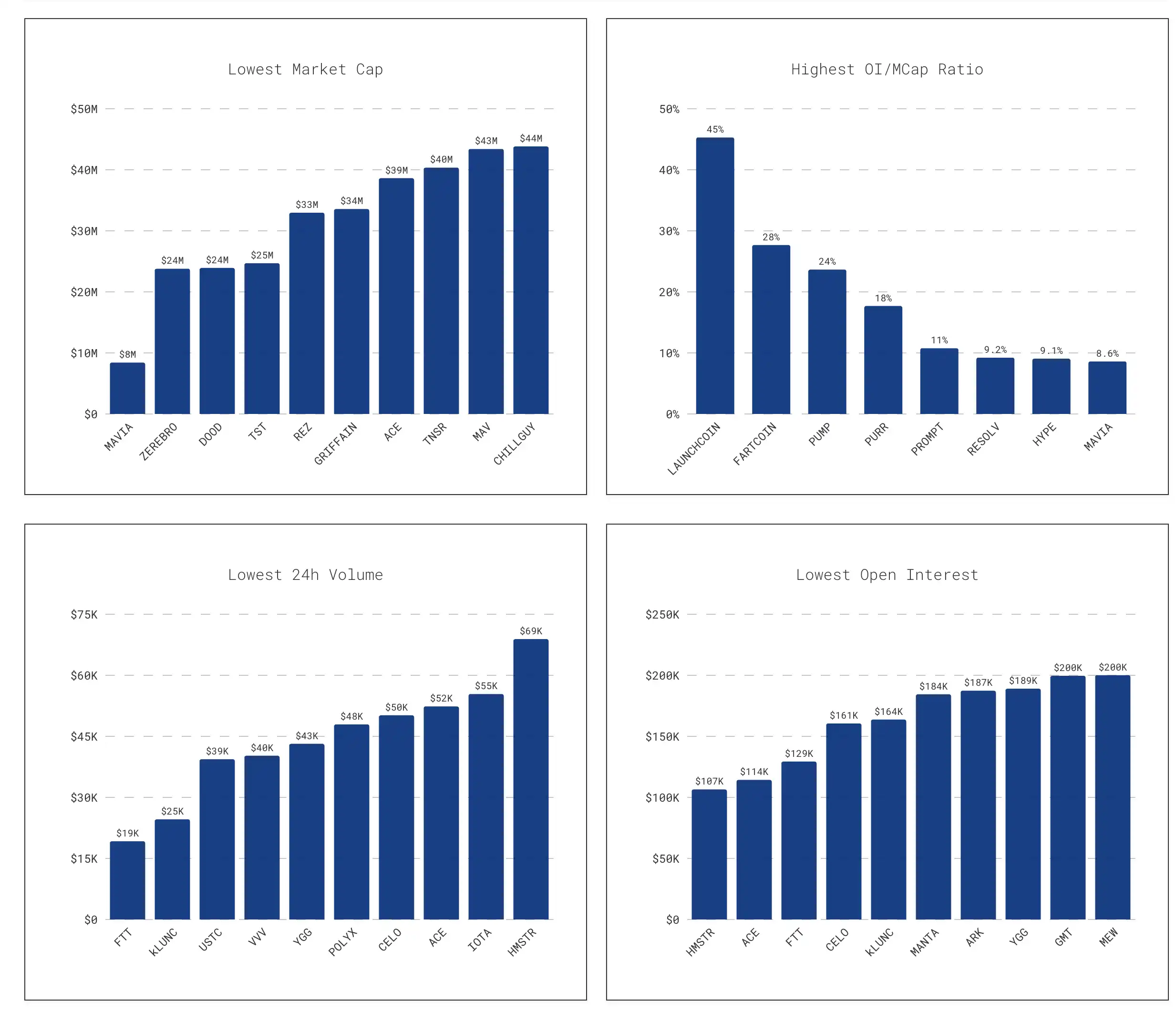

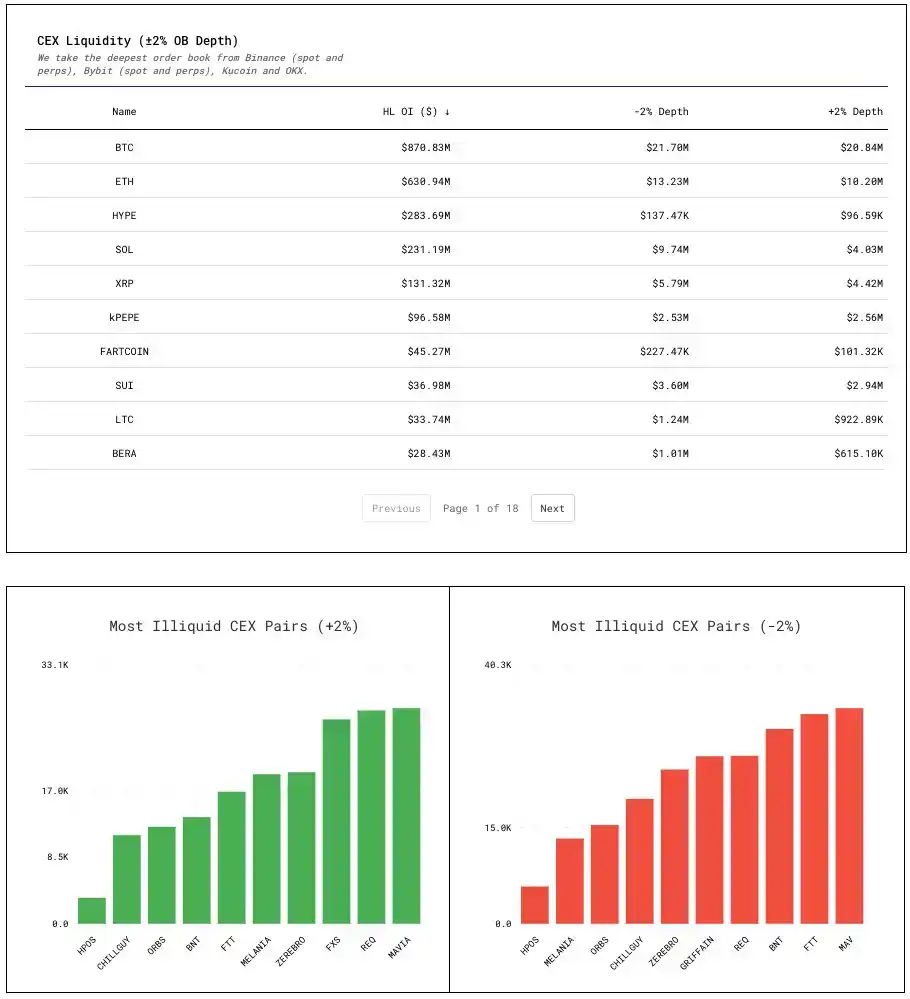

The data organized by the ASXN platform on Hyperliquid provides valuable insights:

For example, the OI/Market Cap ratio data. Open Interest (OI) divided by market cap, expressed as a percentage. The higher the ratio, the more the derivative positions occupy the token's volume, making it easier to be driven by capital. A typical example is when the positions inherited by the HLP liquidation vault once exceeded 40% of JELLY's circulating supply, causing the token price to tumble like a domino effect.

Similarly, the DEX liquidity table can quickly show the on-chain liquidity of tokens and their risk of being manipulated, as well as identify signs of hoarding by holders.

Funding rates and comparisons with major centralized exchanges can help us discover potentially manipulated assets. When large positions enter thin open interest, the funding rates may show anomalies compared to other exchanges.

Measure depth

How to measure depth? You can test how much it costs to push the price up or down by 2%: how much buy order volume is needed to push the price up by 2%. How much sell order volume is needed to push the price down by 2%.

This is the real thickness of the optimal buy/sell outer layer, which is the attack cost for large players. Assets with poor depth = lower costs to distort the price, leading to a lower manipulation threshold and naturally higher risks.

This also means that we should trade the most liquid tokens on the platforms with the best liquidity as much as possible.

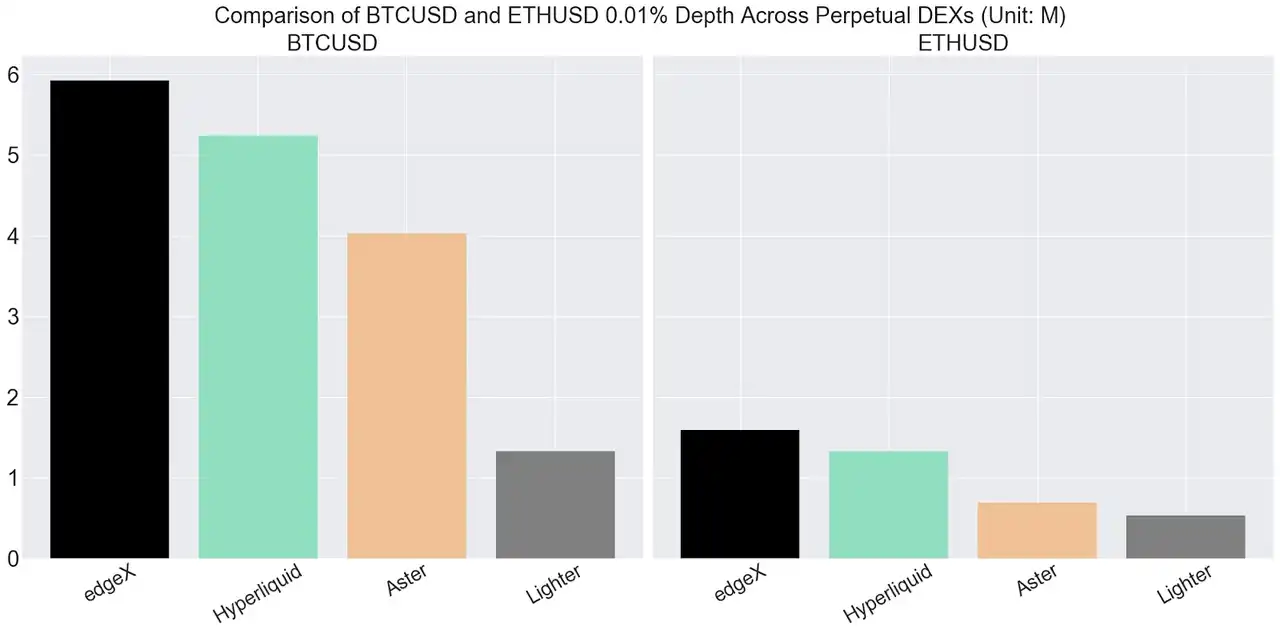

Taking the core BTC/USDT as an example, within a 0.01% price difference range, the depths of several currently mainstream perp dexes are: edgeX $6M, hyperliquid $5M, Aster $4M, Lighter $1M.

This also means that the liquidity of other altcoins will be far below this level and depth, significantly increasing the risk of manipulation, not to mention tokens like XPL that are traded in pre-market.

Make Sure to Read the Clearing Agreement

Those who can see the rules are usually better at understanding the risks they can bear.

Before starting formal trading, it is essential to read all the clearing rules: How is the Mark Price calculated? Does the platform primarily rely on external index prices, or does its own order book carry significant weight? Especially for pre-market or less popular tokens, be cautious about whether the Mark Price can easily be influenced by internal transactions. Monitor the Mark/Index/Last prices during normal and volatile periods to see if there are significant deviations.

Is there a tiered margin system? If so, the larger the position, the higher the maintenance margin, which means the liquidation point moves closer. Is the clearing path a market order sweeping the order book or a phased position building? What is the liquidation ratio? What are the triggering conditions for backup liquidation? Is there a liquidation fee? Where does the liquidation fee go—team revenue, vault, or foundation buyback?

Additionally, even if two trading platforms hedge against each other, there is still significant risk if depth and clearing mechanisms are ignored. Cross-platform hedging ≠ platform margin; these two matters should be viewed separately. Always set stop-loss orders if possible, and if you can use isolated margin, do so. Isolated margin will only affect that specific position and its margin, while cross margin should only be used with liquidity you can afford to lose.

Finally, it is important to note that the risks associated with contract mechanisms are greater than most people imagine.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。