On August 26, Trump Media & Technology Group reached an agreement with the cryptocurrency exchange Crypto.com and the blank check company Yorkville Acquisition Corp. to jointly establish Trump Media Group CRO Strategy, Inc. This is a digital asset financial company focused on acquiring the native cryptocurrency token of the Cronos ecosystem ("CRO"). Yorkville Acquisition Corp. will apply to list its Class A common stock on NASDAQ under the ticker "MCGA."

Massive Capital Injection and Cross-Shareholding

According to the details of the agreement, the new company will receive multi-channel funding support, including $1 billion in CRO tokens, $200 million in cash, $220 million in warrants, and a $5 billion equity credit line from Yorkville-affiliated institutions. These funds will primarily be used to purchase and hold CRO tokens. Crypto.com will transfer approximately 684 million CRO tokens (valued at about $105 million) to Trump Media in exchange for 2.8 million shares of Trump Media stock and $50 million in cash. This cross-shareholding model not only binds the interests of both parties but also injects a crypto element into TMTG's Truth Social platform. Specifically, Crypto.com's wallet infrastructure will be integrated into Truth Social, and CRO tokens will be used for the platform's reward system, subscription services, and digital asset trading. This means that users of Truth Social may achieve a more seamless crypto interaction through CRO, further blurring the lines between media and finance.

Crypto.com CEO Kris Marszalek stated in the announcement that this collaboration "marks the transformation of CRO from an exchange token to an institutional-grade asset." He emphasized that the scale of the new entity will exceed the current market value of CRO, while providing unique value different from other digital asset treasuries through share lock-up and validator strategies. TMTG CEO Devin Nunes described this move as "a continued optimism for cryptocurrency," suggesting that companies should strategically plan their digital asset reserves to cope with future uncertainties.

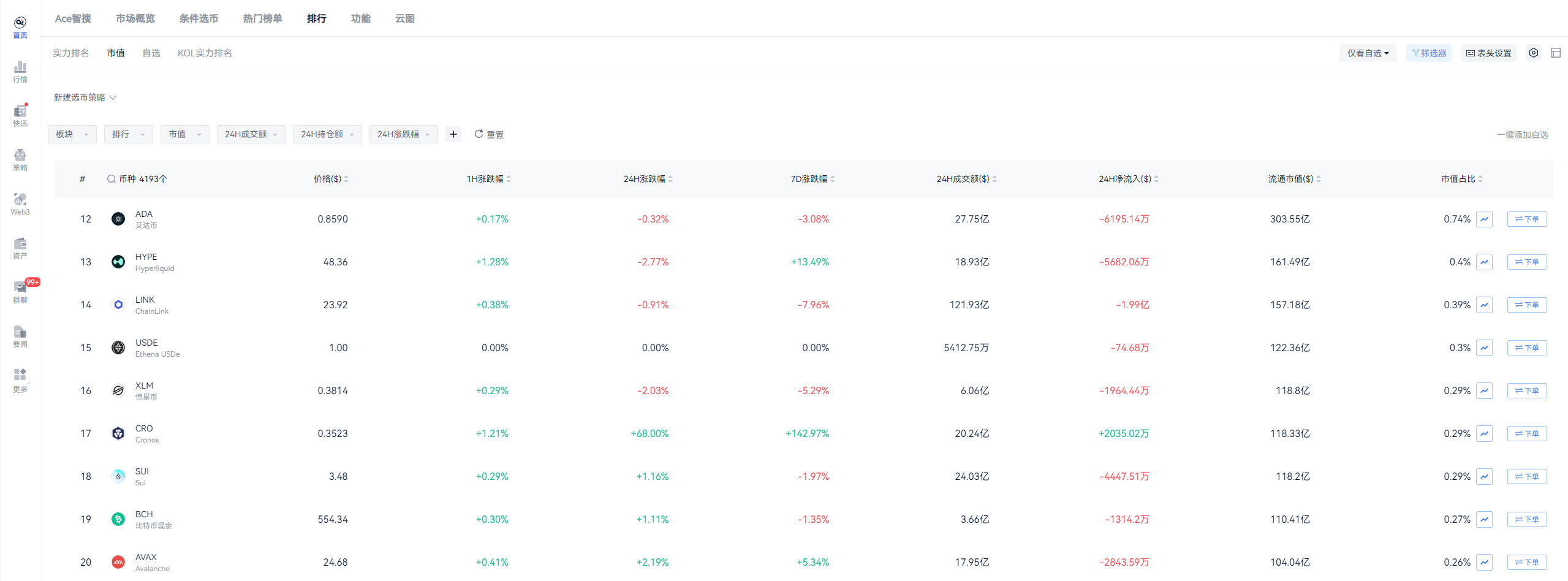

CRO Soars, DJT Stock Strengthens

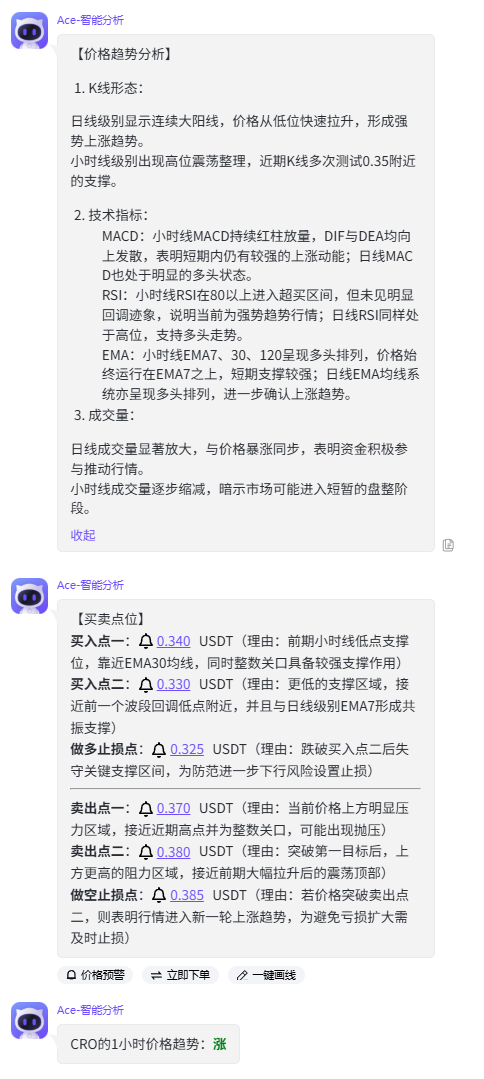

Upon the announcement, the market immediately responded positively. The price of CRO tokens surged by 25% to 40% within 24 hours, climbing from $0.14 to a peak of $0.38, with trading volume skyrocketing by 700% to $310 million. TMTG stock (DJT) also benefited significantly, rising 6.6% to $18.36 after the announcement, with intraday gains reaching as high as 10%. Although Yorkville Acquisition's stock price dipped slightly by 2.2% to $10.42, overall market sentiment remained optimistic.

Crypto analyst Alice Liu pointed out in a CoinMarketCap research report: "By anchoring CRO in the reward economy and corporate reserves of Truth Social, TMTG is essentially institutionalizing this token. This marks another example of companies viewing native tokens as treasury assets." However, not all voices are optimistic. Some users on X questioned the sustainability of this strategy, expressing concerns about the insufficient utility of CRO, which could lead to a valuation bubble.

Trump Family's Crypto Ambitions

This deal is not an isolated event but a continuation of the Trump family's crypto strategy. As early as the beginning of 2025, Crypto.com was one of only 20 invitees to the White House crypto summit. Subsequently, TMTG signed a non-binding agreement with Crypto.com to plan the launch of an exchange-traded fund (ETF) focused on domestic digital assets. In April, another SPAC deal involved Tether and SoftBank, creating a $3.6 billion Bitcoin accumulation company. These precedents show that SPACs have become the preferred path for crypto companies to go public, despite their lower transparency.

Trump's attitude towards crypto has shifted from cautious to proactive. In 2024, his family's World Liberty Financial project issued tokens, and a recent vote allowed for public trading, potentially increasing the value of Trump's holdings. TMTG, as the entity operating Truth Social, further injects political influence into the crypto space through this collaboration. Analysts believe this deepens Trump's connection with the industry and may influence U.S. crypto regulatory policies. Crypto.com has previously faced criticism for canceling its 2021 plan to burn 70 billion CRO tokens, with the community accusing it of controlling 80% of the voting rights, but the partnership with Trump may alleviate some of these concerns.

On a broader level, this strategy emulates MicroStrategy's Bitcoin accumulation model (now renamed Strategy, ticker MSTR). The company has been accumulating Bitcoin since 2020, currently holding approximately $100 billion worth, with its stock price rising fivefold alongside Bitcoin in 2024. Similar companies, including Japan's Metaplanet, are also accumulating Bitcoin through SPACs. TMTG's CRO strategy differs in that its shareholding ratio is higher (nearly 20% vs. MicroStrategy's 3% in Bitcoin), which may amplify price volatility risks.

Opportunities and Concerns Coexist

From a positive perspective, this treasury plan could drive institutional adoption of CRO. The Cronos blockchain focuses on DeFi, NFTs, and the metaverse, emphasizing interoperability. The new entity will become the largest holder of CRO globally and may participate in network governance through validators, enhancing the token's utility. With the integration of Truth Social, CRO could reach millions of users, promoting mainstream adoption. At the same time, this reflects corporate confidence in crypto as a hedge asset, especially amid increasing global economic uncertainty.

However, risks cannot be ignored. Exchange tokens like CRO are often criticized for lacking real utility, and their valuations are highly subjective. During the 2022 FTX collapse, its token FTT triggered a chain reaction as collateral for loans. TMTG's high concentration of CRO holdings could lead to amplified losses if market volatility occurs, causing stock prices to correlate with token prices. On the regulatory front, the U.S. Securities and Exchange Commission (SEC) has tightened scrutiny on SPAC transactions, and potential compliance issues could delay listings. Additionally, Trump's political identity may spark controversy, with some investors viewing it as a "celebrity effect" rather than substantive innovation. Market observers warn that while this model may boost prices in the short term, it relies on an overall crypto bull market in the long term. If mainstream assets like Bitcoin decline, the value of the CRO treasury will shrink.

The Trend of Integration Between Crypto and Politics

The collaboration between TMTG and Crypto.com signals the maturation of the crypto industry. It not only injects massive liquidity into CRO but also indicates that more companies will incorporate digital assets into their treasuries. In the future, if more companies follow suit, the total market value of the crypto market (currently $3.9 trillion) may further expand. However, this also reminds investors to assess risks rationally and avoid blindly chasing the "Trump effect." From a global perspective, this event may influence the crypto competition between China and the U.S. While China strictly regulates, the U.S. accelerates innovation through such transactions.

This article is for informational sharing only and does not constitute investment advice for anyone.

Join our community to discuss this event

Official Telegram community: t.me/aicoincn

Chat room: Wealth Group

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。