Trump finally takes action against the Federal Reserve.

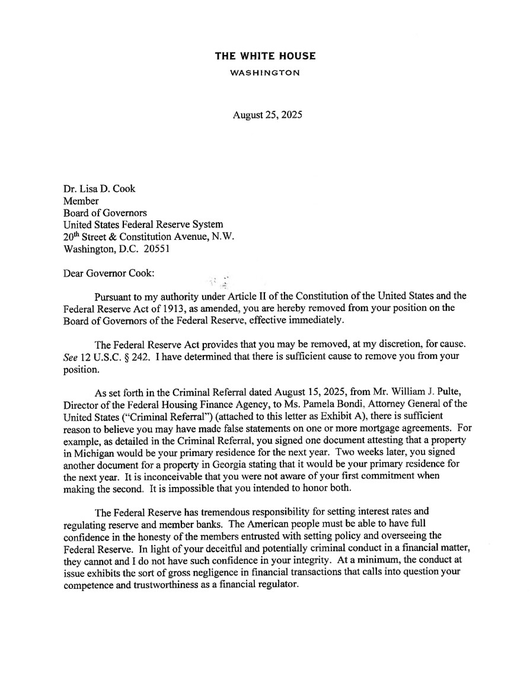

The issue of interest rate cuts has caused widespread anxiety, and Trump's big stick has finally swung towards the Federal Reserve. On the evening of August 25, Trump announced that he had dismissed Federal Reserve Governor Lisa Cook due to her alleged involvement in "mortgage fraud." This marks the first time in the 111-year history of the Federal Reserve that a president has removed a governor. In response to the accusation, Cook firmly stated that she would file a lawsuit regarding her dismissal. A battle between the president and the Federal Reserve is imminent.

In the midst of this rare chaos, the cryptocurrency market has suffered. Just yesterday, BTC briefly fell below $109,000, hitting a low of $108,600, a drop of 12.7% from recent highs. Ethereum, after reaching a high of $4,954, plummeted to $4,311. According to Coinglass data, as of yesterday noon, over $935 million in liquidations occurred across the network within 24 hours, with long positions being the primary targets, resulting in over $821 million in liquidations, affecting 168,320 people globally.

Can Trump dismiss Cook? Can he truly control the Federal Reserve? The drama that Trump is staging will ultimately make the entire market pay the price.

Let's first review the major events in the cryptocurrency space over the past few days. Just last week, Federal Reserve Chairman Powell spoke at the annual economic symposium in Jackson Hole, Wyoming, hinting that despite current inflation risks in the U.S., the Federal Reserve may still cut interest rates in the coming months. He stated, "In the short term, the risk of inflation in the U.S. is tilted to the upside, while the risk of job losses is increasing. Based on changes in the economic outlook and risk balance, the Federal Reserve's monetary policy stance may need to be adjusted."

Overall, this is a clear signal of "softening," and it can be reasonably assumed that a rate cut in September is a foregone conclusion. The market's reaction was immediate, with all three major U.S. stock indices closing higher that day: the Dow Jones rose by 1.89%, the S&P 500 increased by 1.52%, and the Nasdaq gained 1.88%. Even the often-criticized A-shares rose by over 3,800 points, signaling a bullish market. The chain reaction was also evident in the cryptocurrency market, with BTC rebounding to $117,000 and ETH performing impressively, breaking through $4,800 and reaching a historical high of $4,956 on August 25.

But good times never last long. Along with the prospect of interest rate cuts came fears of recession. On August 25, Moody's chief economist Zandi warned that the risks of a downturn in the U.S. economy are increasing. States accounting for nearly one-third of U.S. GDP have already entered recession or are very likely to do so, while another one-third of states are experiencing stagnation, and the remaining one-third are still expanding. Subsequently, the internationally renowned investment bank Barclays issued a new forecast, stating that during Trump's presidency, the likelihood of a recession in the U.S. is 50%. The market snapped back to reality from the joy of interest rate cuts, with U.S. stocks beginning to pull back, and BTC's movements closely following those of the stock market, while ETH continued to rise with institutional buying support.

Coincidentally, on the morning of August 26, another significant piece of news caught the market's attention. Trump suddenly announced that he had signed the document to dismiss Federal Reserve Governor Lisa Cook due to her alleged mortgage fraud. At the same time, Trump publicly shared an open letter to Cook on social media, stating that he had sufficient reasons to dismiss her, using strong language: "Given your deceptive and potentially criminal behavior in financial matters… I have lost confidence in your integrity."

As for whether the reasons are valid, we need to rewind to last week. Also on social media, Bill Pulte, director of the Federal Housing Finance Agency, accused Cook of declaring two properties as her primary residence to obtain more favorable interest rates, stating that he had submitted this accusation to the Department of Justice. What seems like a minor issue regarding property rates has stirred up a significant controversy under Trump's relentless efforts. Following this incident, Trump immediately retweeted the report, stating that "Cook should resign immediately." Cook then responded on social media, asserting that she would never resign due to bullying.

Breaking down the language, it seems absurd that a Federal Reserve governor could be labeled "dishonest" and face dismissal merely for trying to pay a little less on a mortgage, regardless of the truth of the allegations. After failing to resolve the issue on social media, the situation escalated, and on the 25th, Trump signed the dismissal document, marking the first time in the Federal Reserve's 111-year history that a president has dismissed a Federal Reserve governor through an executive order.

Cook herself has taken a very strong stance, stating publicly that Trump has no authority to dismiss her and has hired renowned lawyer Abbe Lowell to take Trump to court. It is foreseeable that this will be a protracted legal battle.

Questions arise: Why Cook? Does Trump have the power to dismiss her? From a legislative perspective, while the president faces challenges in dismissing governors to ensure the Federal Reserve's independence, this power does exist. The Federal Reserve Act stipulates that the terms of Federal Reserve governors are long-term and fixed, and the president can only dismiss them for "just cause." However, this "just cause" is relatively vague, as no one has attempted such actions for many years. Rationally speaking, serious misconduct or moral issues could be considered as reasons.

As for why Cook, the signal conveyed is even clearer: Trump seems to be running out of cards in his confrontation with the Federal Reserve. In terms of decision-making bodies, the Federal Open Market Committee (FOMC) consists of seven Federal Reserve Board governors and five regional Federal Reserve Bank presidents who jointly determine the U.S. federal funds rate. Therefore, the Board of Governors is the core decision-making body of the Federal Reserve. The seven seats on the Board are nominated by the U.S. president and confirmed by the Senate. Except for the chairman and vice-chairman, whose terms are four years, each governor's theoretical term lasts up to 14 years, potentially spanning four presidential terms. This term system aims to reduce the impact of presidential turnover, helping the Federal Reserve maintain stability and laying the foundation for its independence.

Current members of the Federal Reserve Board, source: oanda

From the current composition of the Board, aside from Federal Reserve Chairman Powell, only two of the remaining six members were nominated by Trump during his first term. The other four members were all nominated by former President Biden. The impeached Cook is the first Black woman to serve as a Federal Reserve governor, having taken office in May 2022 with a term lasting until 2038. She was previously an economics professor at Michigan State University and served on the Economic Advisory Council during President Obama's administration. Cook has previously stated that the current president's trade policies may suppress U.S. productivity.

It is evident that the internal structure of the Federal Reserve is very stable, but this stability also has a natural shortcoming: a lack of flexibility and adaptability, as everything is data-driven. This characteristic, which the Federal Reserve has maintained for many years, has left Trump very dissatisfied. However, the objective existence of long terms makes it difficult for him to intervene quickly, leaving him struggling to balance policy proposals and inflation. Previously, Trump has repeatedly criticized Powell for not cutting interest rates promptly, and after trying various methods without success, it was only natural for him to shift his focus to the governors. Cook, who is already "not from his party" and has been caught in a scandal, became the prime target for political maneuvering, attempting to use her case to intimidate the Board. In reality, "mortgage fraud" is not a new issue; several members of the Democratic Party have also been investigated by the Trump administration.

At its core, under legal protection, the independence of the Federal Reserve is unlikely to be weakened in the short term. Trump's actions are more of a demonstration, exerting pressure to force the Federal Reserve to adhere to his personal views and, further, attempting to achieve a major overhaul of the Board to enhance his influence over the Federal Reserve. Earlier this month, Trump nominated his confidant Stephen Milan to replace a resigning governor, Kugler, whose term ends in January next year. If Cook's dismissal is successful, he will be able to place more "insiders" within the Federal Reserve. According to insiders, Trump intends for either Milan or former World Bank President Malpass to succeed Cook. Just yesterday, Trump stated on social media, "We will soon have a majority on the Federal Reserve, and we may transfer Milan to another longer-term position at the Federal Reserve; we must lower interest rates to alleviate housing cost pressures."

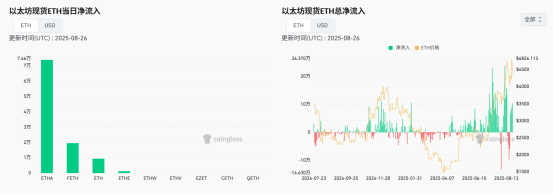

It is precisely under the multiple games of interest rate cuts and recession, Trump and the Federal Reserve that the market experienced a flash crash yesterday. BTC fell below the support level of $112,000, hitting a low of $108,000, while ETH also dropped to $4,311, down 12.97% from its peak. Panic sentiment is indeed present; after breaking below $112,000, BTC's turnover rate surged, with even small holders showing signs of exiting. However, overall, although it fell to $108,000, the bottom support remains effective, and ETH's performance has been even better. From the ETF perspective, on August 26, Eastern Time, Ethereum's spot ETF saw a total net inflow of $455 million, continuing four days of net inflows, with the daily inflow amount being more than five times that of BTC.

In terms of capital flow, it seems that more funds are moving from BTC to ETH, with approximately $2 billion in Bitcoin funds being reallocated to Ethereum on the day of the flash crash, indicating a more positive expectation for ETH among capital. Institutional buying operations are also ongoing, with ETH stock leader BitMine receiving 131,736 ETH from three institutional business platform addresses, including BitGo, Galaxy Digital, and FalconX, in the past 12 hours.

Currently, the performance of U.S. stocks shows that there is no widespread systemic risk, and market panic has eased, with BTC returning above $111,000 and ETH above $4,600. SOL has risen to $202 with the support of treasury news, and BNB has also returned to $859.

On the other hand, in addition to continuously exerting influence in the macro direction, another major cryptocurrency event involving Trump is also underway. On August 23, Trump's family cryptocurrency project World Liberty Financial (WLFI) announced that it would open for the first token application and trading on September 1, indicating that the WLFI token is indeed set to launch.

In terms of unlocking, to maintain price stability, early supporters will only unlock 20%, while the remaining 80% will be decided by community governance votes. It is worth noting that the tokens of the founding team, advisors, and partners will not be unlocked at launch. From the current pre-contracts, WIFI has dropped to $0.26 after surging to $0.55, although there is still significant upside potential compared to the early purchase prices of $0.015 and $0.05. However, under the current circumstances, the fully diluted valuation of WIFI is only $26 billion, which can only be described as mediocre. Although the founding team will not unlock immediately upon launch, it is not uncommon for contract hedging to realize value in advance.

It can be anticipated that on September 1, Trump's promotions and announcements will be plentiful, but whether this move will drain liquidity like Trump or provide benefits to the public remains uncertain. More likely, Trump will release new positive news for this easily withdrawable cryptocurrency garden on September 1.

Looking solely at cryptocurrency, with U.S. stocks pulling it along and policies supporting it, the independent market for cryptocurrencies is gradually fading. However, whether internally or externally, it seems to be closely related to Trump. Ultimately, it must be acknowledged that with the continuous politicization of the cryptocurrency market, Trump and the crypto space have become two sides of the same coin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。