Author: White55, Mars Finance

In the structurally differentiated crypto market of 2025, institutional capital is reshaping investment logic at an unprecedented pace. The rise of the Digital Asset Treasury (DAT) strategy marks a shift from traditional venture capital to directly accumulating crypto assets, with Solana (SOL) becoming a core target in this transformation.

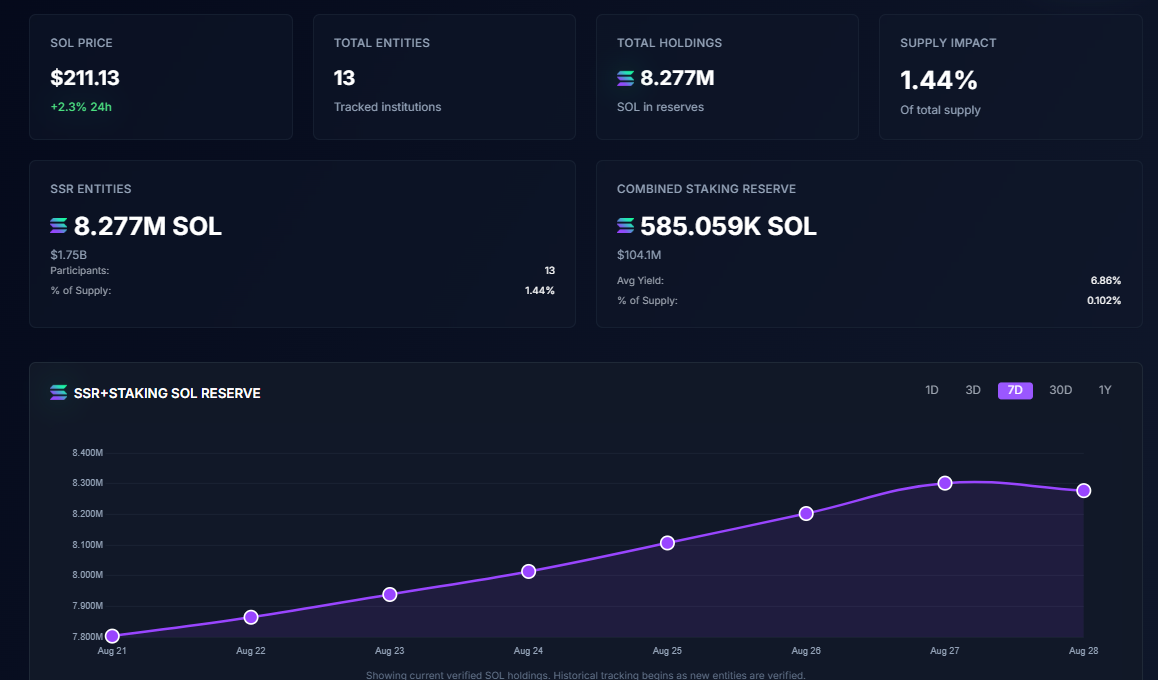

Data from strategicsolanareserve shows that the current Solana DAT reserve exceeds 8 million SOL, approximately 1.75 billion USD.

Recently, Pantera Capital announced a fundraising of 1.25 billion USD, while institutions like Galaxy and Multicoin launched a 1 billion USD fund, and Sharps Technology added 400 million USD — totaling nearly 2.5 billion USD dedicated to building SOL DAT entities. Although this scale is only 1/5 of the holdings of Bitcoin DAT giant MicroStrategy (now Strategy), it represents 2.4% of SOL's current circulating market value, with its capital efficiency far exceeding similar strategies for Ethereum (ETH) or Bitcoin (BTC). This article will delve into the core logic behind this phenomenon.

1. The Explosion of SOL DAT: The Mathematical Advantage of Capital Efficiency

1.1 Trading Supply: SOL's Structural Dividend

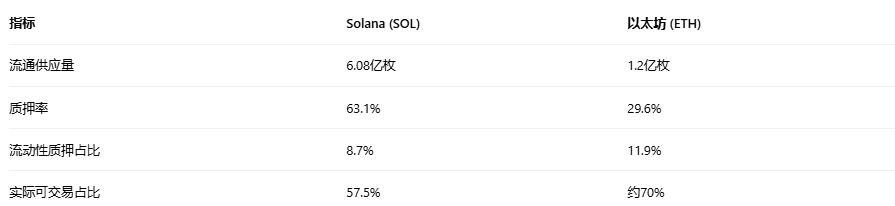

Of Solana's circulating supply (608 million), 63.1% has been staked (approximately 384 million), while liquid staking tokens (LST) account for only 8.7% of the total staked amount (33.5 million). This means that the actual freely tradable SOL in the market only accounts for about 57.5% of the circulating supply (approximately 350 million), and withdrawals require at least two days. In contrast, ETH's staking rate is only 29.6%, with LST accounting for 11.9%, resulting in a significantly higher tradable supply. This difference leads to a stronger price-driving force for SOL with the same amount of capital.

Table: Comparison of SOL and ETH Staking and Liquidity

1.2 Market Capitalization Leverage Effect

Currently, SOL's market capitalization is approximately 104 billion USD, only 19% of ETH (540 billion USD) and 4.7% of BTC (2.19 trillion USD). Therefore, the effectiveness of every 1 USD invested in SOL DAT is equivalent to 5 times that of ETH and 22 times that of BTC. If we further consider the tradable supply, this efficiency gap expands to 11 times for ETH and 36 times for BTC. For example, 2.5 billion USD of new SOL DAT funds can cover 2.4% of the circulating supply, while the same amount of funds covers only 0.46% and 0.11% for ETH and BTC, respectively.

1.3 The "Premium Flywheel" Mechanism of DAT

DAT entities raise funds by issuing shares to purchase tokens, with their stock prices often exceeding the net asset value (NAV) of the held tokens. Taking Bitcoin DAT leader Strategy as an example, its stock trading premium rate has long maintained between 120%-150%. This premium allows DAT companies to issue additional shares at a higher valuation, creating a positive cycle of "raising funds → increasing token holdings → pushing up NAV → attracting more investors." New entrants into SOL DAT are replicating this strategy, accelerating capital accumulation.

2. Unlocking the FTX Legacy: A Turning Point in Crisis

2.1 Unlocking Scale and Market Pressure

In March 2025, the first batch of 11.2 million SOL (valued at approximately 1.48 billion USD) from the FTX bankruptcy estate was unlocked, accounting for 2.29% of the circulating supply at that time. This batch of tokens was previously sold to institutions like Galaxy and Pantera at a discounted price of 64-102 USD per token (current market price is approximately 190 USD), yielding a paper return of 67%-165%.

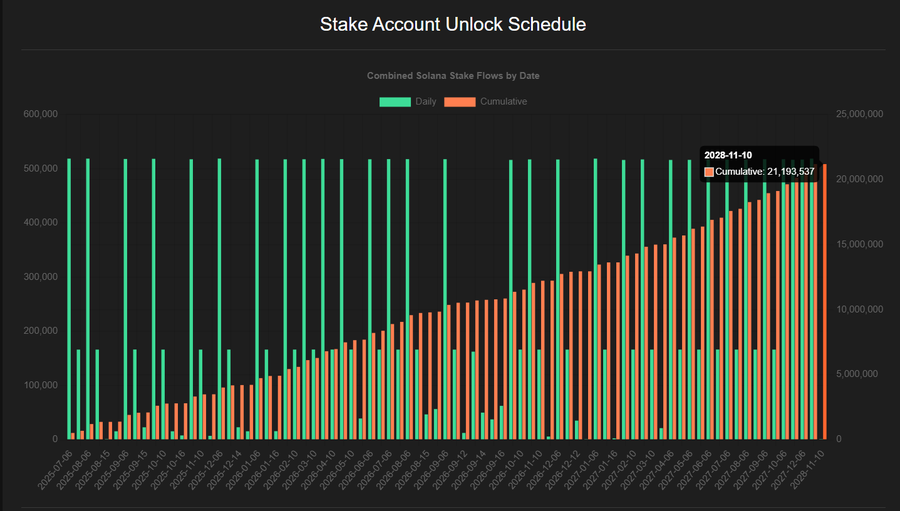

According to @4shpool(gelato.sh) data, there are still about 21 million SOL units to be unlocked until 2028, with a total value of approximately 4 billion USD

As of August, about 5 million SOL remain to be unlocked (valued at 1 billion USD), and a total of 21 million SOL (valued at 4 billion USD) will be gradually released from 2025 to 2028.

2.2 The "Floodgate" Effect of DAT

The newly established SOL DAT entities have become key to digesting selling pressure. The 2.5 billion USD fund from Pantera and Galaxy is likely to directly absorb the FTX legacy SOL through over-the-counter agreements, avoiding shocks to the secondary market. This operation has dual advantages:

- Price Discount: Acquiring tokens at a cost 5%-10% below market price, equivalent to a capital efficiency increase of 5.3%-11.1%;

- Liquidity Buffer: Reducing the impact of spot selling on prices.

3. The Inflation Dilemma: The Achilles' Heel of SOL Growth

3.1 Dual Pressure of Inflation and Unlocking

SOL's current annual inflation rate is approximately 4.5% (based on circulating supply), combined with the unlocking of FTX legacy tokens, the new circulating supply in the coming year will reach 37.5 million (27.5 million from inflation + 10 million from unlocking), equivalent to 6.2% of the current circulating supply. At a market price of 190 USD, an annual capital inflow of 7.125 billion USD (an average of 19.5 million USD per day) is needed to offset the selling pressure. In contrast, ETH is close to a deflationary state (staking yield of 3.2%), with its inflation pressure almost negligible.

3.2 Economic Model Flaws

The high inflation of SOL leads to its actual yield being nearly negative:

- Low Fee Revenue: Solana's average transaction fee is only 0.002 USD, and stakers' income mainly relies on new coin issuance (i.e., inflation);

- High Capital Cost: Borrowing SOL in DeFi protocols costs nearly 3 times more than ETH.

- This sharply contrasts with ETH — the latter has high transaction fees (1.2−15), and almost all fees go to stakers, resulting in a positive real yield.

4. Efficiency Competition: The Path to Breakthrough for SOL DAT

4.1 Trading Supply Compression Strategy

SOL DAT can further reduce the tradable tokens in two ways:

- Reinvesting Staking Rewards: Automatically converting 6%-7% of annual staking rewards into SOL, locking in long-term holdings;

- LST Conversion: Collaborating with protocols like Jito and Marinade to convert holdings into yield-bearing assets (such as mSOL, jSOL). Currently, 40% of staked SOL in the Solana ecosystem has been locked through LST.

4.2 The Synergistic Effect of ETFs

Although SOL spot ETFs have not yet been approved (with a predicted approval probability of 38%-84%), existing ETP products like REX Shares' BONK ETF (code SSK) have already provided an average daily capital inflow of 2 million USD. If more regulated products are launched, SOL DAT can serve as a "front liquidity pool," providing tokens to ETFs and earning premiums.

4.3 Upgrading Ecological Value Capture

Solana is transitioning from a "Meme Chain" to a diverse ecosystem:

- RWA Breakthrough: The white paper "Tokenized Stocks on Solana" proposes a new paradigm for capital markets, with institutions like Franklin Templeton already making moves;

- AI Agent Network: Low costs and high TPS support large-scale deployment of AI agents, creating native consumption scenarios.

These upgrades will enhance the practical demand for SOL, reducing reliance on pure capital inflows.

5. The Dilemma of ETH DAT: A Double-Edged Sword of Institutional Narrative

5.1 Limitations of Institutional Positioning

ETH DAT (such as The Ether Machine) focuses on the narrative of "on-chain government bonds," with advantages in:

RWA Hub Position: 70% of on-chain RWA issuance occurs on the Ethereum mainnet and L2;

Stablecoin Reserves: WETH's share in Circle's USDC reserves has risen to 6.7%.

However, this also leads to low capital efficiency: institutions are more inclined to view ETH as a low-volatility allocation asset rather than a high-growth target.

5.2 Marginal Effects of Technical Upgrades

Although the Dencun upgrade reduces L2 costs by 90%, and Verkle Trees are expected to improve node efficiency, these improvements have limited impact on prices. ETH's upward momentum mainly relies on event-driven factors such as the approval of spot ETFs (probability 75%), rather than ecosystem activity — its DEX trading volume has already been surpassed by Solana.

Table: Core Comparison of Efficiency between SOL and ETH DAT Strategies

6. Conclusion: An Era Where Efficiency Reigns, the Window for SOL DAT

The explosion of SOL DAT is by no means coincidental; it is essentially a choice of efficiency under the triple factors of market capitalization leverage, trading supply scarcity, and ecological growth potential. Although inflation and unlocking pose short-term resistance, the 2.5 billion USD of new DAT funds (especially the over-the-counter absorption of FTX legacy SOL) will serve as a crucial buffer. If Solana can accelerate the advancement of the Firedancer client (increasing TPS to 1 million) and reduce the staking inflation rate to below 1.5%, its monetary property shortcomings will gradually be addressed.

In contrast, while ETH's positioning as a "financial infrastructure layer" is solid, its high tradable supply and low volatility characteristics make it difficult for its DAT strategy to replicate SOL's capital efficiency. The true winners in the future may be investors adopting a dual-track allocation: a conservative mix of 70% ETH + 30% SOL to capture institutional dividends, and an aggressive mix of 40% ETH + 60% SOL to maximize efficiency advantages.

Ultimately, the outcome of this DAT competition will not depend on technical beliefs, but on who can capture the highest proportion of trading supply at the lowest cost. Solana's 350 million tradable SOL is becoming the most scarce battlefield for crypto capital in 2025.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。