Reflecting on the rise and fall of BTCFi, we may need to reassess BTC's positioning in the crypto ecosystem.

Written by: Umbrella

On August 27, the BTC ecosystem project BitLayer launched on Binance Alpha. This once-promising BTCFi star project ended up writing a footnote for the entire sector with a dramatic plunge.

According to CMC data, BTR opened at $0.1511 but plummeted to $0.077 within just a few hours, with a daily drop of as much as 48.6%. As of today, August 28, the token is still down 44.3% from its historical peak, with a trading volume of $60.3 million in the last 24 hours and a trading volume to market cap ratio as high as 274%. This extreme speculative turnover rate exposes the awkward reality of the project lacking long-term holders.

What is even more thought-provoking is that, despite the on-chain TVL still maintaining a relatively high level of $429 million, the token's price crash clearly reflects the market's skepticism about BTCFi's ability to capture ecosystem value.

The opening plunge of BitLayer presents more than just a phenomenon of "listing equals peak"; it is a microcosm of the entire BTCFi narrative transitioning from fervor to decline.

The Collective Downfall of Mainstream Projects

The BTC ecosystem once birthed many phenomenal hot projects, but they all struggled to hide their inherent flaws and narrative contradictions.

Merlin Chain: $3.8 Billion TVL Reduced to $50 Million

As a former leader in BTCFi projects, the data changes of Merlin Chain are nothing short of shocking.

Within 50 days of its launch, the project attracted as much as $3.8 billion in BTC staking, with a peak TVL of $530 million, briefly becoming the star project with the highest BTC Layer 2 TVL and user count.

However, the reality is brutally harsh: according to DeFillama data, Merlin Chain's current TVL is only $5 million, a drop of over 90% from its peak. Its token Merl hovers around $0.115; although it has increased by 45.1% this year, it is still down 90% from its historical high. Even more heartbreaking is that its 24-hour on-chain inflow is only $1,946.

From being the undisputed leader in the sector to being treated like a rat in the street, Merlin Chain took only half a year. To this day, some people still occasionally mention Merlin, but almost all of it is in sarcasm and ridicule.

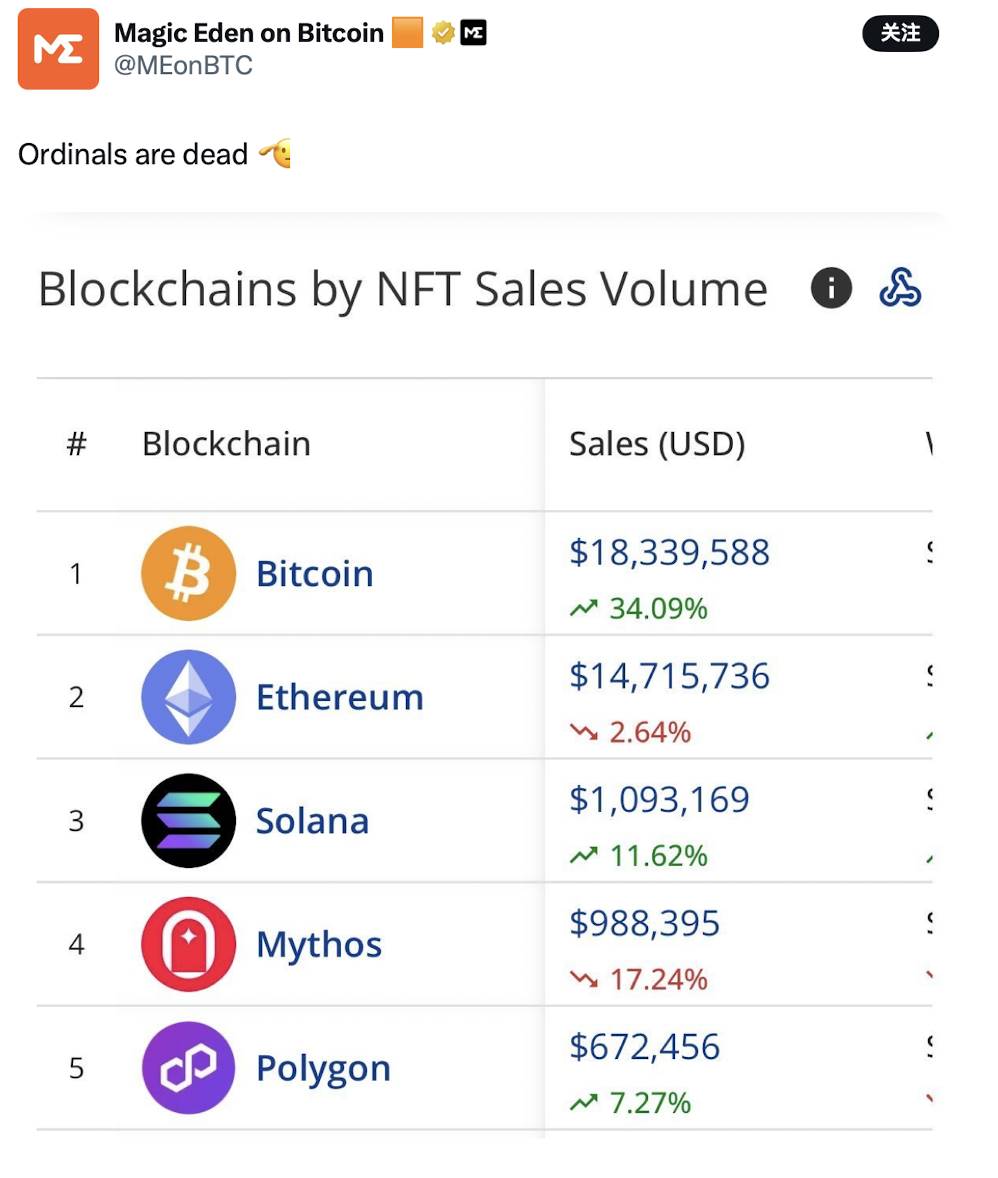

Inscriptions and BTC NFTs: From Celebration to Self-Mockery

The Ordinals inscriptions and BRC-20 tokens that once ignited the BTC ecosystem are now no longer in the limelight.

Recalling the winter when inscriptions were all the rage, every public chain was launching its own inscription products, leading to a nationwide craze for inscriptions. BTC, as the origin of everything in the crypto world, gave birth to popular projects like Sats and Ordi. The slogan "Buy Ordi today, drive an Audi tomorrow" still echoes in our ears.

Nowadays, the phrase "Ordinals are dead" has transformed from mockery to an inside joke, with even the official accounts of inscription projects starting to use this phrase for self-deprecation.

The BTC NFT market has fewer than 2,000 active users in the last 24 hours, accounting for only 1.7% of the entire chain's activity, far below that of the ETH or Solana ecosystems.

The actual utility of inscriptions and NFTs remains a controversial topic in the market, but the once-active users are leaving one by one. The loss of user confidence also indicates that this narrative is gradually being forgotten in people's minds as the fast-paced crypto market evolves.

In addition to Merlin Chain, BTC inscriptions, and NFTs, other BTCFi projects are also gradually exposing their shortcomings or flaws in their models.

Babylon's current TVL has reached a historical high of $6.3 billion, yet its token price has dropped 77% from its peak, revealing the shortcomings of its single staking model lacking innovative applications. Similarly, the popular BTC ecosystem project Core currently has a TVL of only $386 million, down over 70% from the beginning of the year.

The truth behind the data is even more severe: aside from Babylon, most BTCFi projects generate daily revenue of less than $50,000, far below the millions of dollars typical for traditional DeFi projects. This unsustainable business model is being ruthlessly exposed by the market.

Narrative Fatigue and Internal Contradictions

The fundamental dilemma of BTCFi stems from the technical limitations of BTC itself.

As "digital gold," BTC was not designed to have the programmability of smart contracts, which means all BTCFi applications must rely on sidechains, L2, or cross-chain bridges as compromises.

According to DeFillama data, in current mainstream BTCFi projects, bridged assets account for 80%-100% of TVL: Merlin Chain's bridged TVL accounts for as much as 80%, Core 94%, and BitLayer is nearly 100% reliant on BTC cross-chain.

This extreme dependence on cross-chain infrastructure not only increases security risks but also contradicts the core spirit of BTC's decentralization and autonomy.

On social media, discussions about BTCFi have shifted from early excitement and exploration to a phase of skepticism characterized by "prove-your-worth." More and more KOLs are listing the BTC ecosystem as a doomed sector.

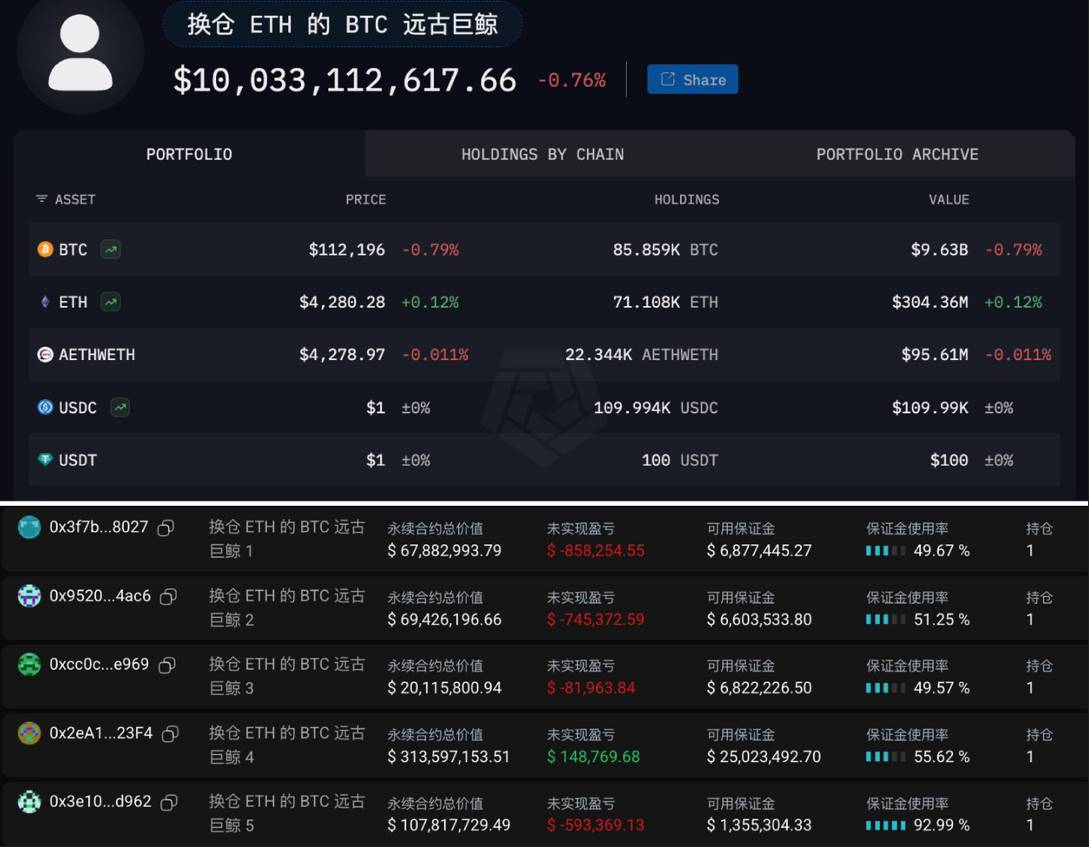

The attitude of market retail investors is also evident; expectations for the BTC ecosystem are being diluted repeatedly by the fresh narratives on ETH and SOL. The recent trend of whales selling BTC to switch to ETH undoubtedly pours cold water on this pile of ashes.

Image source: @Ai Aunt

On the other hand, the dire situation of the BTC ecosystem also reveals the internal contradictions of the economic models of most BTCFi projects.

To attract liquidity, project teams must offer high-yield incentives, but high yields often rely on token issuance, which dilutes long-term value.

The extremely high turnover rate of BitLayer and the user loss of Merlin Chain both prove the unsustainability of this mining-then-dumping model.

BTC, Returning to Its Spiritual Totem

Reflecting on the rise and fall of BTCFi, we may need to reassess BTC's positioning in the crypto ecosystem.

Unlike ETH, which was designed from the beginning as a "world computer," BTC resembles a crypto totem, and the role of a totem is to condense consensus and faith rather than functional expansion.

ETH can support the DeFi ecosystem because it has optimized for programmability at the architectural level. BTC's value proposition has never been about "what it can do," but rather "what it represents." Perhaps when we try to make BTC carry complex financial applications, we have already violated its essence.

Compared to BitLayer and Merlin, Babylon is relatively successful, and its success precisely proves that as a pure BTC staking protocol, it does not attempt to change BTC but instead leverages BTC's security to provide services to other chains. This "specialization" approach may be the correct way for BTC to participate in DeFi.

The decline of BTCFi is not a failure of BTC; this is evident from BTC's continuous breakthroughs to new highs this year. BTCFi seems more like a rational correction by the market against excessive financialization.

BTC remains the most important value storage tool in the crypto world, but it will never become, nor should it become, the next ETH.

Recognizing this may be a sign of the entire industry moving towards maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。