Original Author: Artemis

Translation | Odaily Planet Daily (@OdailyChina); Translator | Ethan (@ethanzhangweb3)_

Editor's Note: The crypto world has long suffered from a chaotic valuation system—different platforms show vastly different supply data for the same token, leading to distorted market cap calculations and inaccurate investment judgments. While traditional stock markets have long adopted standardized metrics like circulating shares, on-chain valuation is still in a rough exploratory phase. Recently, Artemis and Pantera Capital proposed a "Circulating Supply" framework, introducing the mature concept of circulating shares from the stock market into the crypto space. By excluding non-circulating tokens such as protocol holdings, this framework aims to provide the industry with a value metric that can be benchmarked against traditional finance. This transformation could become a key infrastructure for institutional capital entry and may reshape the entire valuation paradigm of crypto assets.

Editor's Note: The crypto world has long suffered from a chaotic valuation system—different platforms show vastly different supply data for the same token, leading to distorted market cap calculations and inaccurate investment judgments. While traditional stock markets have long adopted standardized metrics like circulating shares, on-chain valuation is still in a rough exploratory phase. Recently, Artemis and Pantera Capital proposed a "Circulating Supply" framework, introducing the mature concept of circulating shares from the stock market into the crypto space. By excluding non-circulating tokens such as protocol holdings, this framework aims to provide the industry with a value metric that can be benchmarked against traditional finance. This transformation could become a key infrastructure for institutional capital entry and may reshape the entire valuation paradigm of crypto assets.

The following is the full content, translated by Odaily Planet Daily:

Abstract

Currently, there are significant discrepancies in the supply metrics displayed by crypto data providers for the same token, which can severely impact the calculation of market cap or valuation multiples (such as market cap/revenue ratio). Artemis and Pantera Capital jointly proposed a simple framework called "Circulating Supply," calculated as total supply minus total protocol holdings. This model is similar to the concept of "outstanding shares" in the stock market (i.e., total issued shares minus treasury stock). Our goal is to enable investors to make clearer comparisons between tokens and stocks when conducting valuation comparisons.

Introduction

When purchasing stocks, investors typically focus on several key data points to understand the number of shares:

- Authorized Shares—The maximum number of shares a company is legally allowed to issue;

- Issued Shares—The total number of shares actually issued by the company;

- Outstanding Shares—The total number of shares held by all investors (excluding treasury stock held by the company);

- Float—The number of shares actually available for public trading.

Why are these data points crucial?

Because these metrics help investors clarify:

- Ownership—The size of the economic rights corresponding to the shares purchased by investors;

- Supply Risk—The potential number of additional shares that may flood the market in the future;

- Liquidity—The degree to which stocks can be traded smoothly without significantly affecting the price.

Source: Artemis

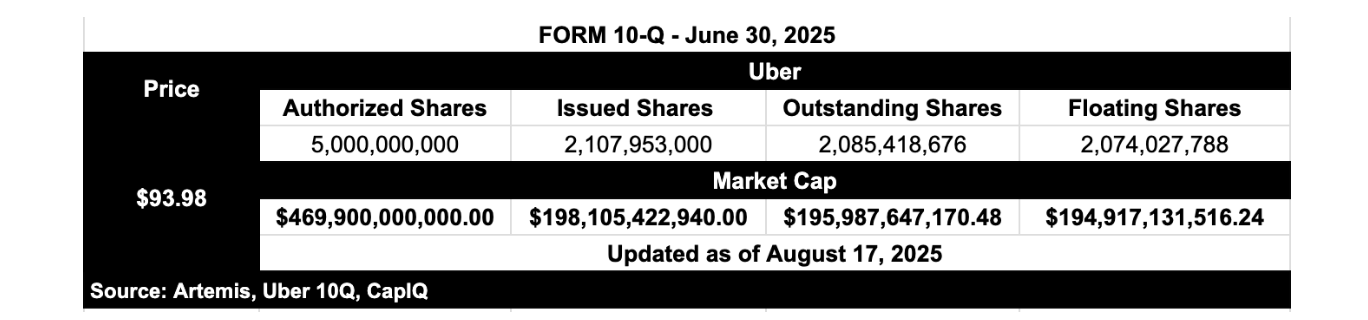

Let’s take Uber as an example for in-depth analysis:

- Authorized Shares: 5 billion shares → The maximum share limit Uber is legally allowed to issue. Public market investors almost never refer to authorized shares;

- Issued Shares: Approximately 2.1 billion shares → The total number of shares actually issued by Uber;

- Outstanding Shares: Approximately 2.09 billion shares → The number of shares currently held by Uber investors. This is the number of shares that public market investors truly care about;

- Float: Approximately 2.07 billion shares → The actual number of shares available for trading in the market.

Imagine: If Uber were valued based on authorized shares, its market cap would soar to $469 billion, with an expected price-to-earnings ratio skyrocketing to 70 times—this is clearly absurd. Authorized shares have never been used by investors as a basis for corporate valuation because "authorized shares × share price" does not reflect real economic value.

In reality, investors value Uber based on outstanding shares (approximately 2.09 billion shares). As of August 17, 2025, its market cap is approximately $195.9 billion, with an expected price-to-earnings ratio of 30 times. Outstanding shares accurately reflect the distribution of economic ownership of the company's value.

Current Issues with Token Supply Metrics

Currently, crypto investors mainly refer to "Circulating Supply," which is the number of tokens available for trading in the public market. However, this metric has serious flaws:

- Some statistics include locked tokens, while others exclude them;

- Some include treasury wallet holdings, while others exclude them;

- Standards for whether to deduct burned tokens vary;

- Projects may quietly release tokens without clear disclosure.

At the same time, the FDV (Fully Diluted Valuation) that investors often encounter also has issues: FDV = token price × total supply. This is akin to calculating Uber's market cap using authorized shares—assuming all shares are immediately circulated, resulting in an inflated market cap of $469 billion, which clearly does not align with economic reality.

Thus, investors find themselves in a dilemma: either choose a distorted FDV (which includes all potential supply) or adopt a "Circulating Supply" that is poorly defined and lacks uniform standards (a key flaw is that it often excludes issued but unlocked tokens).

Why is "Circulating Supply" the best compromise?

"Circulating Supply" (Outstanding Supply) accounts for all generated tokens while excluding the balance held by the protocol (such as those held by foundations, treasuries, or labs). This is akin to the "outstanding shares" concept in the stock market.

- Compared to FDV: It more accurately reflects economic reality;

- Compared to traditional circulating supply: It has a clearer definition and more unified standards;

- This metric is rooted in economic substance, providing investors with a reliable intermediate benchmark.

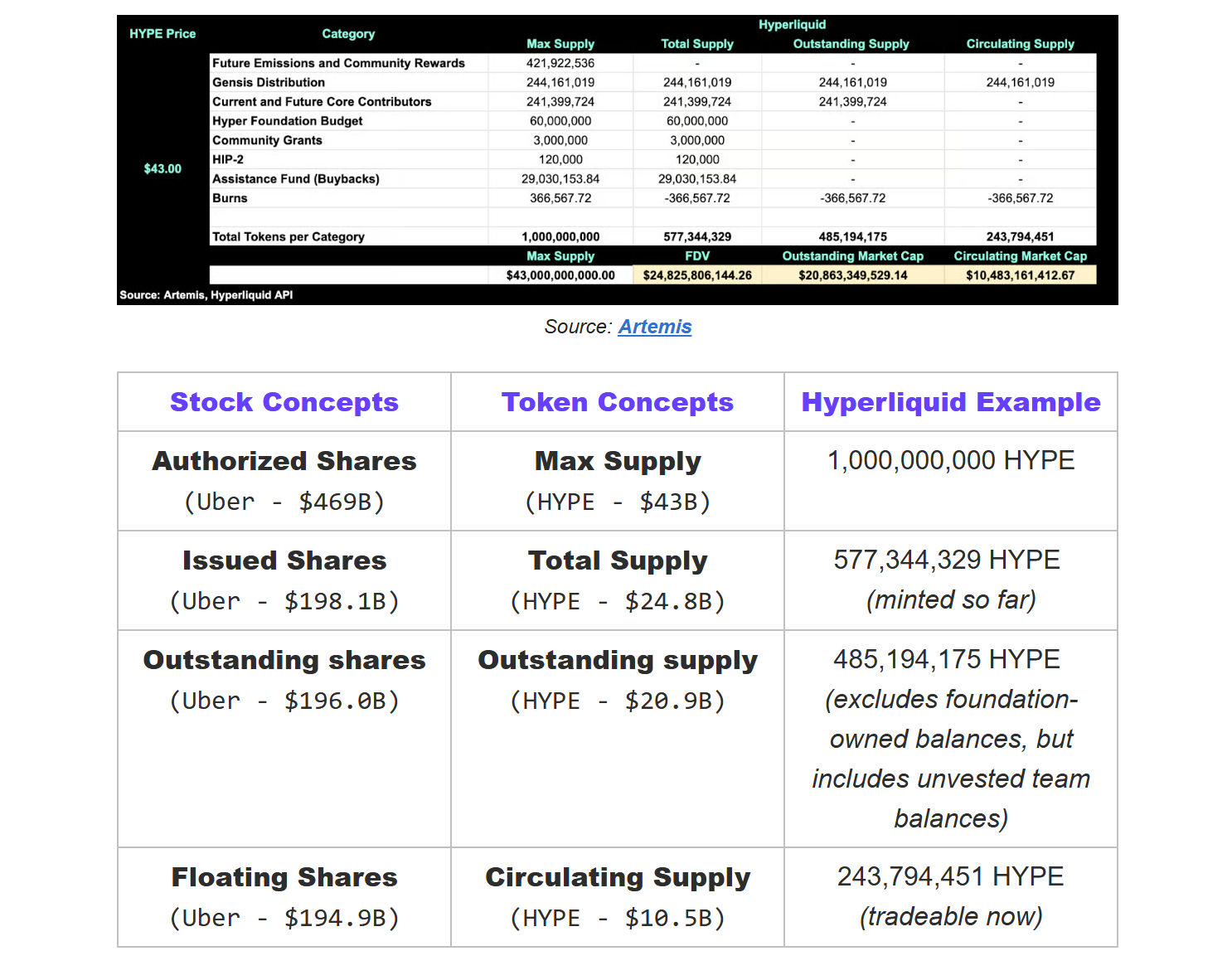

Real Token Example - Hyperliquid

Why is the Circulating Supply metric crucial?

For a long time, the crypto industry has defaulted to using FDV (Fully Diluted Valuation) = maximum supply × price for valuation. This is akin to calculating Uber's market cap using 5 billion authorized shares, which would inflate its valuation to about $469 billion, rather than the approximately $196 billion market cap typically shown on Google Finance.

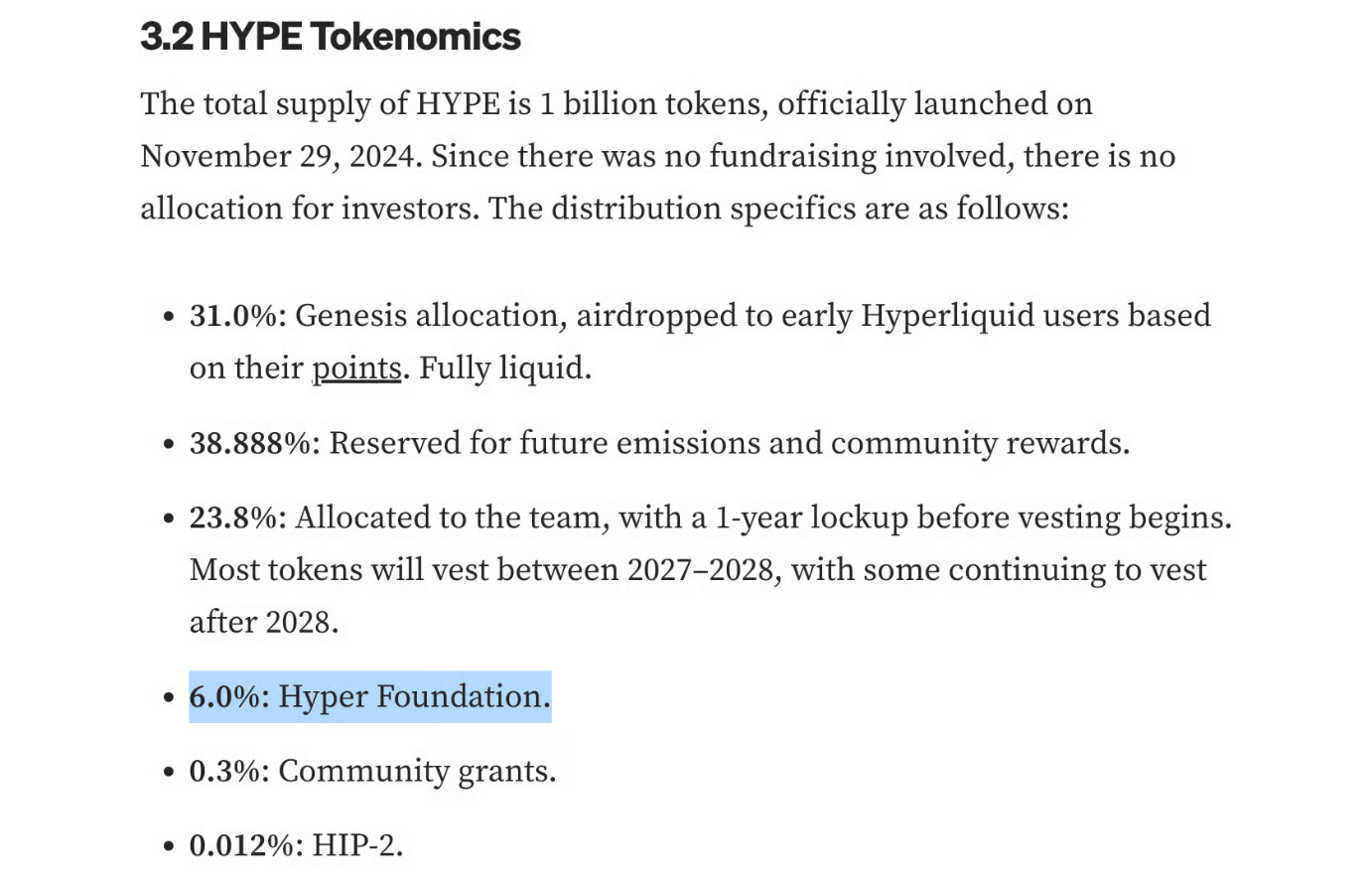

Subsequently, the industry shifted to using total supply for valuation, but this still overestimates actual value—because total supply includes all tokens held by the protocol. For example, Hyperliquid has 1 billion HYPE tokens, of which 6% (60 million) are held by the Hyper Foundation. These are assets controlled by the protocol, which can be used for operational input, ecosystem funding, or team incentives, and their economic attributes differ fundamentally from the tokens held by investors.

Source: Mint Ventures

Therefore, Hyperliquid's Circulating Supply valuation (approximately $20.8 billion) is closest to its real market value. This is similar to the concept of outstanding shares in the stock market—excluding treasury stock to reflect the total number of tokens actually held by all investors.

In contrast, its circulating supply valuation (approximately $10.5 billion) is closer to the actual number of tokens available for trading, akin to the float in stocks.

These supply metrics are critical because valuation multiples such as price-to-earnings or price-to-sales ratios calculated based on FDV will be artificially inflated—this effectively penalizes projects like Hyperliquid that hold a large number of unreleased tokens, putting them at a disadvantage in peer comparisons.

Note: Our definition of total supply differs from CoinGecko. CoinGecko counts all tokens (regardless of ownership), while we exclude permanently burned and ungenerated tokens to ensure that total supply accurately reflects the number of existing tokens that impact valuation.

Why are there contradictions in existing data?

Currently, when investors look at the HYPE token, they find that different data platforms present vastly different values:

DefiLlama shows a circulating FDV of $27.8 billion. Based on a token price of $43, this implies a circulating supply of approximately 647 million tokens—this even exceeds the current actual generation of 577 million tokens.

CoinGecko's circulating supply valuation is $14.5 billion, suggesting it believes the circulating supply is about 337 million tokens.

However, this number is likely overestimated because CoinGecko does not exclude all protocol-held wallets (such as the Hyper Foundation, community funding fund, and aid fund). In reality, a large number of these tokens have not yet entered the market, and the true circulating supply should be lower.

The problem is that these discrepancies can lead to valuation differences of billions of dollars. In the absence of a unified standard, different investors can have vastly different perceptions of the scale of the same token.

This is precisely why we need to promote "Circulating Supply" and "smarter circulating supply." The standard for token circulating supply not only enhances transparency but also achieves horizontal comparability with the stock valuation system.

Artemis Solution: Introducing New Standards for Circulating Supply and Smart Circulating Supply

Total Supply

Definition: The total amount of all generated (minted) tokens (excluding burned portions). Comparable to "Issued Shares" in the stock market.

Calculation Formula: Total Supply = Maximum Supply - Unminted Tokens - Burned Tokens

Circulating Supply (New Metric)

Definition: The portion of all existing tokens that excludes those held by the protocol itself (including foundations, DAOs, labs, or locked distribution contracts). The reason for excluding protocol-held tokens is similar to the stock market excluding treasury stock—these tokens exist but do not belong to external investors. Only tokens held externally reflect true ownership, liquidity, and market value. Comparable to "Outstanding Shares" in the stock market.

Source: Artemis

Calculation Formula: Circulating Supply = Total Supply - Total Protocol Holdings

Where total protocol holdings include:

- DAO/Foundation Holdings—Tokens held by entities responsible for governance or ecological development;

- Laboratory Holdings—Tokens held by laboratory entities that actually undertake protocol management functions in the absence of an independent foundation (such as ecological funds, distribution managers);

- Programmatic Distribution Contracts—Smart contracts that automatically release tokens to the ecosystem according to preset rules;

- Idle Funds—Tokens in on-chain funds managed by validators that have not yet been deployed (must be released through decentralized voting);

- Buyback Reserves (not burned)—Tokens that have been repurchased by the protocol but not yet burned.

Smart Circulating Supply (Optimized Metric)

Definition: The number of tokens currently available for immediate trading. Excludes locked tokens, unreleased internal/team holdings, and non-liquid treasury wallets. Comparable to "Float" in the stock market.

Source: Artemis

Calculation Formula: Circulating Supply = Circulating Supply - Locked Tokens

Why are dual metrics necessary?

- Transparency—Clearly distinguishes between generated tokens and those actually available for trading;

- Risk Assessment—Predicts potential supply that may enter circulation in the future;

- Standardization—Eliminates statistical ambiguities between different projects;

- Real Market Value—Accurate circulating supply means more precise valuations;

- Comparability—Achieves standardized horizontal comparisons across projects.

Summary Insights:

The stock market does not require guessing the number of shares or potential supply; this clarity builds market trust.

The crypto space should be the same. If the industry wants to gain institutional trust, it must provide institutional-level transparency. Through the standards of Circulating Supply and Smart Circulating Supply, investors will ultimately receive a transparency experience comparable to that of traditional financial markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。