Last week, Japanese financial giant SBI Group made a series of significant announcements: first, it announced partnerships with Circle, Ripple, and Startale, followed by a collaboration with Chainlink to jointly promote stablecoins, RWA tokenization, and cross-border payment solutions. In just a few days, SBI transformed from the image of a "traditional financial institution" to one of Japan's most proactive Web3 players.

This is not just an ordinary business collaboration; it seems more like a signal released by SBI to the market: it aims to seize the opportunity of the next round of financial infrastructure transformation, upgrading from a "financial service provider" to a "digital asset infrastructure provider." Against the backdrop of the imminent launch of the yen stablecoin and the gradual formation of the Asian crypto corridor, this move undoubtedly positions SBI at the forefront of Japan's financial digital transformation.

Traditional financial giants are building Japan's digital financial landscape

SBI's story dates back to 1999 when it was still known as "SoftBank Investment," named after the initials of SoftBank Investment. After becoming independent in 2006, the company officially changed its name to SBI Holdings, Inc., headquartered in Tokyo. Initially, it focused on three core businesses: securities, banking, and insurance, and gradually expanded into asset management and biotechnology, forming a comprehensive group spanning finance and healthcare.

Over the past twenty years, SBI has grown from a "small player" to a heavyweight in Japan's financial market. It is even seen as the strongest challenger outside of the "big three banks" (Mitsubishi UFJ, Sumitomo Mitsui, and Mizuho) — a candidate for the "fourth largest bank." Today, SBI's business framework revolves around five major sectors: financial services, private equity investment, asset management, crypto assets, and next-generation businesses. This diversification strategy not only solidified its position in the Japanese market but also laid a natural foundation for its later foray into the digital asset space.

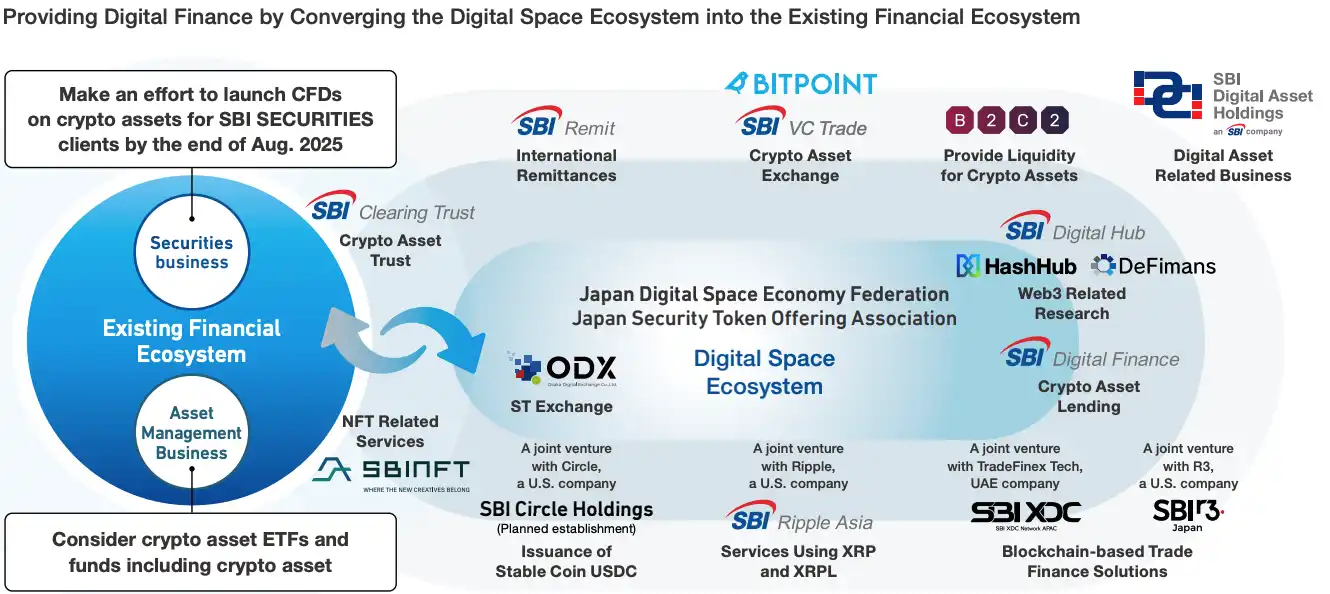

More importantly, SBI is not just jumping on the bandwagon. Behind its recent frequent announcements of partnerships, it has actually been deeply involved in the crypto ecosystem for many years. Leveraging its traditional financial roots in securities and asset management, SBI has gradually expanded its territory into trading, payments, custody, lending, and liquidity services, almost building a complete infrastructure for digital finance. At the same time, it has not missed the new opportunities in Web3, experimenting with NFTs, decentralized finance, and the tokenization of real-world assets. Crucially, it has dared to ally with international giants: whether it's Ripple, Circle, or R3, all are collaborating with it to explore new possibilities in stablecoins, cross-border payments, and tokenization.

In other words, today's SBI is no longer just a traditional financial group in Japan; it resembles one of the few "dual engines" in East Asia — rooted in traditional finance while accelerating forward in the wave of crypto finance.

From zero to one: SBI secures Japan's only stablecoin license

In the stablecoin arena, SBI has taken full advantage of its "first-mover compliance" position. Back in 2023, when Japan's Financial Services Agency relaxed the ban on foreign stablecoins being issued domestically, SBI quickly sensed the opportunity and signed a strategic partnership with Circle. Just a year later, its subsidiary SBI VC Trade completed the trading registration of USDC, becoming Japan's first and only company to hold a stablecoin license, and was the first to bring USDC to market.

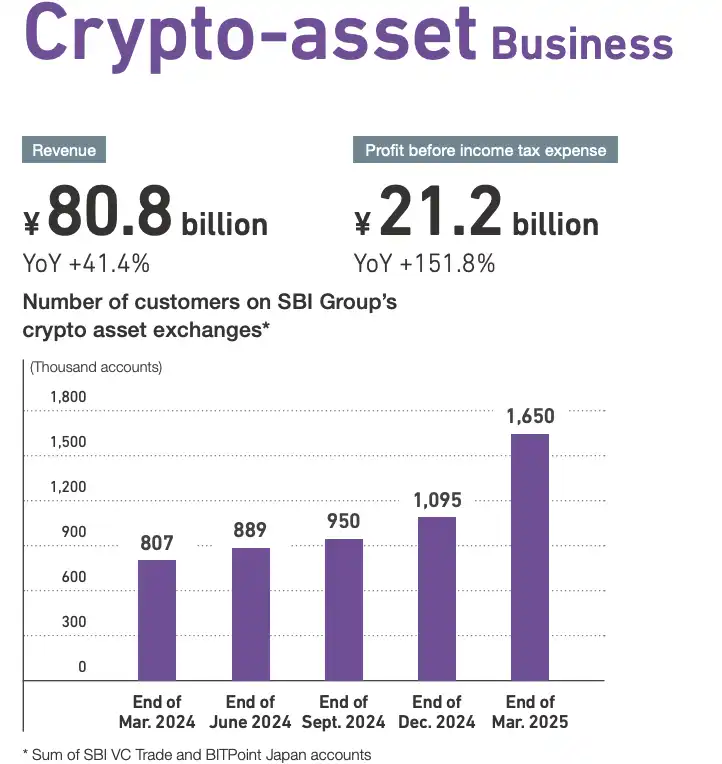

Following this, SBI and Circle established a joint venture, Circle SBI Japan, specifically to promote the adoption of USDC in Japan. When Circle went public in June 2025, SBI decisively invested $50 million, further binding the relationship between the two. Last week, the two companies expanded their cooperation again, planning to integrate USDC more deeply into cross-border payments and digital financial services. Through this series of actions, SBI not only leads its peers in compliance and infrastructure but also becomes a key bridgehead for Circle to enter the Asian market. The performance of its digital asset business is equally impressive: in 2024, related revenue reached 80 billion yen, a year-on-year increase of over 40%, with the number of users doubling from 800,000 to 1.65 million in just one year.

If USDC is SBI's "entry point" into the stablecoin world, then Ripple's RLUSD serves as its "bridge" for cross-border payments. Just last week, SBI announced that it would introduce RLUSD to the Japanese market, planning for a formal launch in the first quarter of 2026. The design concept of this stablecoin is straightforward: it combines the stability of the US dollar with the speed of blockchain, ensuring compliance and transparency while achieving near-instant settlement. For example, if a US user wants to send US dollars to Japan, the funds would first be converted into XRP, transmitted across borders via blockchain in seconds, and then exchanged back into yen in Japan, with RLUSD serving as the anchor asset to ensure the stability and reliability of cross-border funds.

Through the "dual-track approach" with Circle and Ripple, SBI has almost constructed a complete stablecoin landscape: USDC handles payment and trading, while RLUSD focuses on cross-border settlement and enterprise services. This parallel approach firmly positions SBI at the center of the Asian stablecoin landscape.

The rise of RWA, SBI builds Japan's version of "Robinhood"

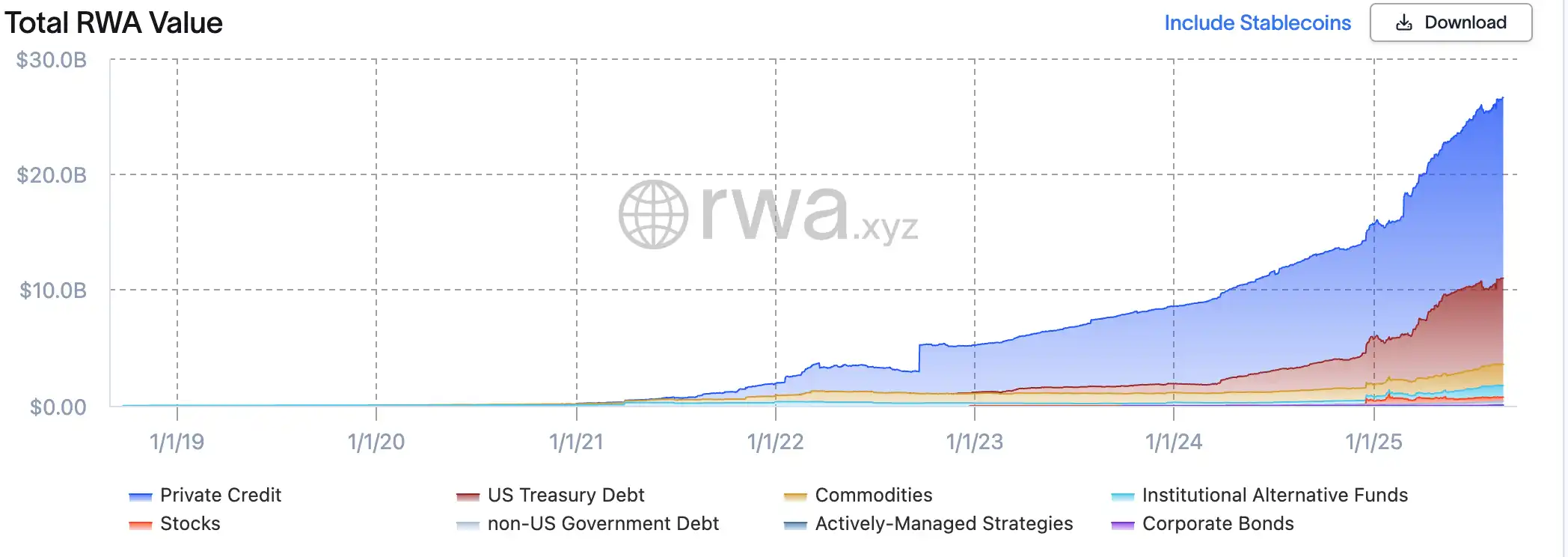

Beyond stablecoins, SBI is also focusing on RWA (real-world asset tokenization). This has been one of the fastest-growing sectors over the past two years — jumping from $5 billion at the beginning of 2023 to nearly $30 billion today, an increase of more than five times. Bonds, funds, and government bonds are currently the mainstream applications, but the proportion of stock-like assets remains below 1%, indicating significant potential.

Imagine buying a bond that traditionally requires a few days for settlement to complete, but once placed on the blockchain, it can be completed instantly like a transfer. For instance, a fund that traditionally has high investment thresholds and slow redemption can be tokenized, allowing it to function like a "digital ticket" that can be bought and sold 24/7. For investors, this offers unprecedented convenience; for institutions, it significantly enhances capital efficiency. It's no wonder that overseas giants like Gemini, Kraken, and Robinhood have launched similar around-the-clock tokenized trading platforms.

SBI clearly does not want to fall behind. In 2025, the group partnered with Web3 infrastructure company Startale to establish an on-chain tokenization platform in Japan, securing "milestone-based committed funding," aiming to build a complete system covering issuance, clearing, custody, and cross-chain interoperability.

More crucially, SBI is not going it alone; it has brought in Chainlink, the "plumber" of the global blockchain space. This company specializes in ensuring "interconnectivity" between blockchains. Simply put, it enables tokens on different chains to flow smoothly, much like interbank transfers. This time, Chainlink will assist SBI in ensuring the security and compliance of cross-chain transactions when tokenizing assets like bonds and real estate. Additionally, Chainlink will bring the net asset value (NAV) data of funds onto the blockchain, achieving transparency and allowing investors to track asset values at any time; its Proof of Reserve technology will also provide on-chain verification for stablecoins and funds, avoiding the risk of "paper assets" being disconnected from actual reserves.

If Robinhood's significance in the U.S. is to bring stocks and crypto derivatives to retail investors with "zero barriers," then SBI is attempting to carve out a similar path in Japan. With its deep roots in securities and banking, combined with its pioneering layout in stablecoins and RWA, SBI is striving to push tokenized assets into mainstream investment channels. For Japanese investors, this not only means the ability to trade stocks and bonds 24/7 like a transfer but also allows them to participate directly in the global crypto financial market within a compliant and secure framework. In other words, the RWA platform built by SBI is not merely a technical upgrade but a "Robinhood-style" financial inclusion experiment, potentially marking a watershed moment for Japan's capital market as it formally enters Web3.

From the fourth largest bank to a digital asset infrastructure giant

For SBI, entering the crypto world is not a spur-of-the-moment decision but a natural continuation of its strategy. Japan has long been in a super-low interest rate environment, and traditional financial businesses like banking and securities have become highly homogeneous, leaving little room for profit. Meanwhile, the global landscape of stablecoins and real-world asset tokenization (RWA) is entering a compliance fast lane. The Japanese Financial Services Agency (FSA) relaxed regulations on stablecoins in 2023, effectively lighting the green light for this new track. SBI chose not to sit on the sidelines but decisively took action, partnering with international players like Circle and Ripple, leaping from "industry observer" to "rule maker," and securing a position in the two most promising battlegrounds of stablecoins and RWA.

On a deeper level, this is not just an expansion of business but a leap in identity. In the past, people viewed SBI as "Japan's fourth largest bank"; now, it is attempting to upgrade to "the first infrastructure giant of the digital asset era." Currently, SBI is preparing to launch Japan's first Bitcoin futures on the Osaka Dojima Exchange and has set a goal to increase profits from its digital asset business to 50 billion yen by the fiscal year 2028, equivalent to a growth of 150%. This indicates that SBI's ambitions have already transcended the framework of traditional finance; it is genuinely betting on the future of deep integration between Japan's financial system and blockchain. In other words, SBI is not just betting on the price fluctuations of crypto assets but aims to become a key player in the reconstruction of the new global financial order.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。