Policy and Market Sentiment Drive the Rhythm of Token Listings

This article is jointly published by K1 Research and Klein Labs

Overview of Research Methods

This report analyzes the token listing paths and market logic of South Korean exchanges, combining listing data from January 2024 to July 2025. Using a panel fixed effects regression model, it quantifies the impact of factors such as BTC price, trading volume in Korean won, and policy windows on the number of token listings. Through statistical analysis and return calculations, we reveal patterns in the listing rhythm, track preferences, and token price performance of the three major exchanges, providing quantifiable references for project teams to choose listing timing, exchanges, and marketing strategies.

Key Highlights

South Korea's Market Size and Activity Lead Globally: Since 2025, the trading volume of cryptocurrencies priced in Korean won has consistently ranked second globally, only behind the US dollar market, and has long been a leader in altcoin trading, demonstrating a high acceptance of new coins and ample liquidity. For project teams, this is a high-potential market willing to experiment.

Dual Drivers of Policy and Market Sentiment in Token Listings: Panel regression results indicate a significant positive correlation between the average monthly BTC price and the number of token listings on exchanges, suggesting that market heat directly influences listing decisions. Additionally, policy windows amplify this effect, showing the combined impact of regulatory signals and market sentiment. For project teams, when entering the South Korean market, it is essential to consider market heat, investor attention, and policy timing comprehensively, to reasonably arrange the listing rhythm, enhance project exposure, and optimize trading liquidity, achieving a strategic listing layout.

The "Bridge Effect" of Token Listings and Market Diffusion Mechanism: Overall, Bithumb and Coinone play a "bridge effect" in the listing rhythm, with some tokens listed on these two exchanges before entering the larger trading volume of UPbit. Coinone's listing performance is particularly notable, achieving a secondary amplification of price and trading volume. Project teams can prioritize Coinone as an entry point and gradually expand to larger exchanges, realizing the linkage and release of resources and heat. All three exchanges belong to the DAXA alliance, and the internal transmission effect further enhances market diffusion of token listings.

Differentiated Layout in Exchange Selection: There are significant differences in user profiles, listing rhythms, and market influence among exchanges, and merely pursuing the largest platform is not the optimal strategy. For project teams, it is crucial to match the type of exchange and listing order based on token characteristics, community structure, and promotional budget to improve the return on investment.

Localization and Multi-Channel Integration for Market Promotion in South Korea: An effective market entry strategy in South Korea relies not only on the application for token listings on exchanges but also includes Naver keyword optimization, local crypto forum topic guidance, offline event marketing, and KOL collaborations. Project teams should synchronize the listing rhythm with localized marketing to create a closed-loop conversion from awareness to trading volume.

1. Introduction

In the global cryptocurrency landscape, South Korea is rising at an astonishing pace. Since 2025, the total trading volume of cryptocurrencies priced in Korean won has reached $663 billion, making it the second-largest cryptocurrency market globally, only behind the US dollar. Notably, South Korea has maintained a long-term global leadership position in altcoin trading, boasting the highest trading volume of altcoins worldwide. Up to 25.4% of the South Korean population actively participates in cryptocurrency trading, a level of engagement that is extremely rare globally. This enthusiasm has also given rise to the unique "kimchi premium" phenomenon.

At the same time, the South Korean government is actively reshaping its cryptocurrency regulatory framework, moving away from previous restrictive policies towards a new phase that encourages innovation and market development. The recently launched cryptocurrency ETF roadmap and stablecoin development plan not only inject new institutional benefits into the market but also further solidify South Korea's strategic position as an important cryptocurrency market in Asia and globally.

Against this backdrop, studying the potential of the South Korean cryptocurrency market can provide project teams with practical strategies for "how to enter South Korean exchanges" and reveal opportunities and risks in this unique market for investors. This research report will focus on the listing paths and performances of South Korea's five major exchanges—UPbit, Bithumb, Coinone, Korbit, and GOPAX—analyzing the latest data from 2024 to 2025 for a more micro and in-depth understanding, helping readers comprehensively grasp the listing ecology and market logic of South Korean exchanges.

2. Preparation Before Listing: Marketing is Not Everything, but It Is Indispensable

Successful token listings depend not only on the project's hard power and technical level but also on marketing and publicity, which are equally essential. Especially on South Korean exchanges, where listing requirements are strict and numbers are limited, projects must possess strength in technology, community, and market recognition simultaneously. Below, we organize several key local marketing methods from the perspective of exchanges, focusing on their roles in enhancing project exposure, gaining user recognition, and attracting capital attention, providing reference experiences for successful token listings:

2.1 KOL and Community Influence

In the promotion and listing process in the South Korean market, high-quality local KOLs and community resources are indispensable. Currently, several active and professionally content-producing South Korean crypto communities have long been entrenched in the market.

On Telegram, KOL communities with a coverage of 20,000 to 40,000 members, known for their professional and high-quality content, include:

● MBM Creator Academy (@MBMweb3)

● We Crypto Together (@WeCryptoTogether)

● Cobacknam Announcements (@cobacknamannounce)

● Yobeul’s World (@yobeullyANN)

● Telegram Coin Rooms & Channels - CEN (@emperorcoin)

● Jammin123 (@muijammin123)

● Fire Ant CRYPTO (@fireantcrypto)

● Youth Passion Flavor House Co., Ltd. (@minchoisfuture)

These groups are early-established core OG communities, possessing historical depth and influence, and gathering experienced and atmosphere-creating active players, enjoying high popularity in South Korea.

Additionally, there are smaller communities with around 10,000 stable members, which, while relatively smaller in scale, have more precise user profiles and higher stickiness, including:

● CRYPTO Sea (@crypt0_sea)

● KOOB Crypto 3.0 (KOOB Crypto) (@kookookoob)

● Coin Boy’s Crypto Story (@coinboys)

● Naback’s coin life (@ysytop2)

● Lee Dojin Metaverse Announcement (@leedojin2)

Considering that South Korea has a population of only 50 million, a few tens of thousands of followers is already a significant scale compared to English-speaking communities. Unlike English-speaking regions, the usage habits of South Koreans show that the use of X is still a minority (though there is a trend of some KOLs and users migrating to X), with more people using Kakao and Telegram. Due to stricter speech controls on Kakao, the number of users on Telegram is relatively higher.

These KOL communities not only have a wide coverage but also play an important role in industry information dissemination and market sentiment guidance, providing a solid foundation for project landing and volume enhancement in South Korea. Additionally, there are many unlisted KOLs who also possess certain influence.

2.2 Media Coverage and Article Promotion

In the promotion and listing process in the South Korean market, high-impact and locally preferred authoritative media coverage is also crucial, as it can quickly establish project credibility and effectively expand market awareness and participation.

CoinNess

CoinNess is a leading cryptocurrency media platform in South Korea, focusing on real-time translation and publication of overseas news. Its Live Feed service provides investors with the fastest market updates. As the largest institutional-level crypto investment information provider in South Korea, CoinNess also collaborates with the South Korean national news agency Yonhap Infomax to exclusively provide real-time cryptocurrency news sources. (@coinnessgl)

Blockmedia

As South Korea's first blockchain-specific media, Blockmedia has long focused on trends in traditional finance and the crypto market, project progress, and regulatory dynamics. Although its real-time reporting is slightly inferior to CoinNess, it has earned a reputation in the industry for high-quality content and in-depth analysis, covering a range of topics including regulations, technology, and lifestyle. (@with_blockmedia)

TokenPost

TokenPost is South Korea's largest blockchain and cryptocurrency media outlet, frequently participating in government blockchain forums, Asian crypto summits, and technical seminars as an official partner media. It has a data platform and industry research department that provides customized intelligence and in-depth analysis services for institutions and enterprises, combining authority and professionalism. (@tokenpost)

Bloomingbit

Bloomingbit is an authoritative crypto information platform under the influential and credible comprehensive financial media group—Korea Economic Media Group—providing 24/7 news and market reports on blockchain and cryptocurrencies selected by industry experts. Bloomingbit combines broad influence with professional interpretative ability, becoming an important information source for institutional investors. (@bloomingbit_io)

2.3 Professional Consulting Firms and Research Platforms

Due to some investors' difficulty in fully understanding the structure and key points of projects, the marketing of crypto projects for token listings thus relies on professional consulting firms and research teams to help interpret the core value and market potential of projects, providing investors with in-depth analysis and decision support.

Despread

As a leading crypto data analysis platform, its in-depth market research and industry trend reports help project teams understand market dynamics and accurately assess competitiveness, allowing for more targeted marketing strategies. (@DeSpreadTeam)

Xangle

With its strong blockchain data analysis capabilities and transparent project review mechanisms, Xangle provides investors with authoritative risk assessments and decision support, serving as an important information platform in the crypto industry. (@Xangle_official)

Tiger Research

Through in-depth research, GTM consulting, and strategic investment, Tiger Research not only gains insights into industry trends but also helps projects optimize growth paths and market strategies, promoting the long-term development of the Web3 ecosystem. (@TigerResearch)

K1 Research

With its advanced market analysis capabilities and strategic data-driven decision-making, K1 Research provides in-depth market insights and trend forecasts for crypto projects and investors. Through data analysis, it helps optimize investment decisions and risk assessments, supporting the sustainable development of the crypto ecosystem. (@K1_Research)

2.4 Other Methods

SEO Optimization: Based on the aforementioned methods, a more refined SEO layout can be developed specifically for the South Korean market, especially on the Naver platform, where the effects are best. If the strategy is appropriate, it can significantly enhance project exposure and increase the success rate of token listings.

In-depth Forum Viral Marketing: By combining community engagement with viral forum marketing, it can effectively amplify discussion heat and user attention, achieving cross-layer penetration. For example, posting meme images that resonate with Korean culture on popular local platforms like Coinpan can often stimulate spontaneous user-generated content and dissemination, creating sustained heat diffusion.

Offline Events: Offline events are an important part of marketing projects in South Korea. These include community study groups, seminars, and hosting informational sessions where tokens are distributed on-site. Such activities can enhance user trust and brand stickiness while promoting interaction among community members and word-of-mouth marketing.

Event Sponsorship: This includes sponsorship of both cryptocurrency and non-cryptocurrency events. A common example in cryptocurrency event sponsorship is hackathons. In non-cryptocurrency event sponsorship, sports events are the most widespread, such as soccer, racing, and esports events, which not only increase awareness of the project among potential users but also significantly enhance brand influence.

Kaito Marketing: Kaito marketing is based on algorithms and data, providing ranking and metric tools that allow project teams to monitor user participation and interaction effects in real-time, achieving transparent and efficient targeted promotion. The cost structure is more friendly to small and medium projects, helping to enhance community activity and precise user reach, but care must be taken to avoid excessive noise that could lead to user aversion.

Professional Marketing Solutions: Engaging professional third-party marketing agencies for comprehensive managed marketing services, including brand positioning, community operation, content creation, and advertising placement, to enhance exposure and user engagement.

3. Basic Situation of Token Listings on South Korean Exchanges

3.1 Market Share

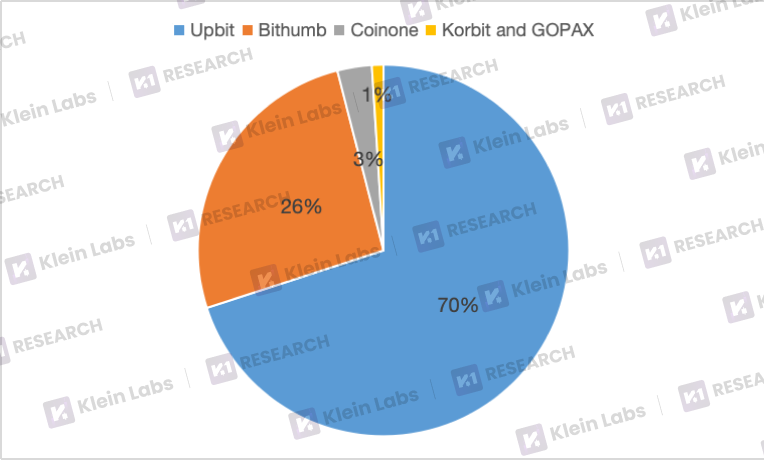

● UPbit: Due to competition from other exchanges launching trading fee reduction activities, UPbit's market share has gradually declined from a high of 86% in 2021, stabilizing at around 70% in February 2025.

● Bithumb: With proactive marketing strategies, especially a significant increase in marketing investment and the launch of zero-fee promotions since 2024, Bithumb has seen a notable recovery in market share, maintaining a trading volume of about 26%.

● Coinone: Since launching the "zero-fee early bird ticket" to attract new users in October 2024, along with community operation strategies like trading leaderboards and activity survey participation codes, Coinone has accelerated market share growth while solidifying its existing user base, currently holding about 3% market share.

Among all South Korean exchanges, the combined market share of the top three exchanges—UPbit, Bithumb, and Coinone—reaches as high as 99%, while Korbit and GOPAX together account for about 1%.

These major exchanges are all part of the DAXA alliance, which enhances the overall stability of the industry and the efficiency of token listing transmission through information sharing and market collaboration, while also creating a certain coordinated effect in the rhythm of new coin listings and market responses. In 2023, the five major cryptocurrency exchanges in South Korea established DAXA (Digital Asset Exchange Alliance) as a self-regulatory alliance aimed at improving the transparency, compliance, and investor protection levels of the cryptocurrency asset market. The alliance ensures that project teams meet safety and compliance requirements through unified listing standards while collaborating with regulatory agencies to promote policy improvements, thereby enhancing the overall compliance and transparency of the industry.

Since the virtual asset committee meeting in June 2025 confirmed that the "zero-fee policy" applies to the three major fiat-to-cryptocurrency exchanges in South Korea—UPbit, Bithumb, and Coinone—it has further consolidated and promoted the dominant positions of these three in the market.

3.2 Supported Trading Pairs

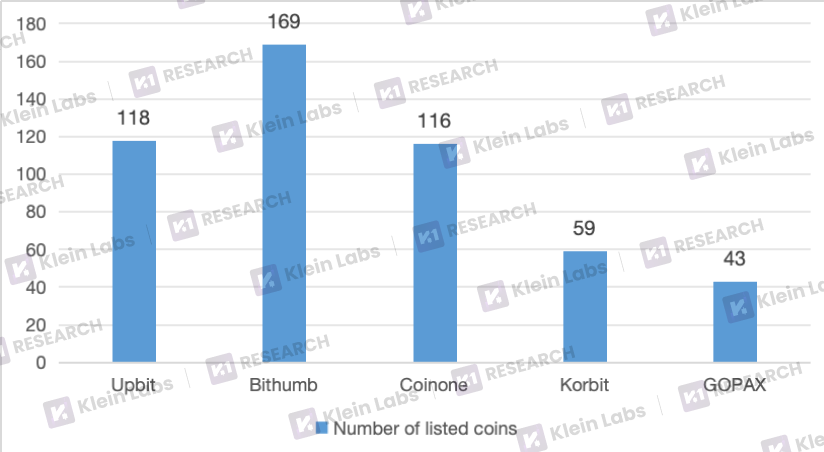

3.3 Number of Token Listings

To analyze the token listing situation, we selected the period from January 2024 to July 2025 as the statistical interval. This period not only covers a complete cycle of bull and bear markets but also includes important political nodes in the South Korean cryptocurrency market. This statistical interval can comprehensively reflect the changes in the number of token listings on South Korean exchanges and the market environment, providing reliable references for studying project listing patterns and marketing strategies.

Overall, during the statistical period, the number of token listings in the South Korean market showed a significant upward trend, particularly active in the second quarter of 2024 and the first half of 2025. During this period, almost all major exchanges accelerated the pace of new coin listings, and market activity rose to relatively high levels. This phenomenon is closely related to the policy environment.

● Second Quarter of 2024: The "Virtual Asset User Protection Act" is set to take effect on July 19. In the two months leading up to the official implementation of the new regulations, leading exchanges like UPbit and Bithumb noticeably accelerated their token listing and review processes, attempting to complete more project listings during the brief "window period" before stricter token listing and existing token review mechanisms are implemented. This concentrated token listing behavior during this phase directly boosted the overall number of token listings in the market.

● First Half of 2025: Political factors also played an important role. During the South Korean elections, Lee Jae-myung clearly stated that he would fully support the local cryptocurrency industry and promote the legalization and deregulation of cryptocurrencies. This policy expectation, along with the subsequent introduction of the "Digital Asset Basic Law," further strengthened market confidence. For the world's largest altcoin trading market, known for its activity and speculation, the implementation of this law is widely seen as a significant benefit, prompting exchanges and project teams to accelerate their layouts in the short term.

Specifically, against the backdrop of the overall market listing boom, the strategic differences among different exchanges also reflect their varying considerations in resource allocation, risk tolerance, and competitive positioning.

● Bithumb's number of token listings ranks first, ahead of other exchanges. Bithumb not only has advantages in user base and liquidity but also maintains a relatively aggressive listing pace to seize market opportunities.

● Among the top three exchanges, UPbit and Coinone have a similar number of token listings, reflecting a more stable and cautious listing strategy focused on maintaining existing ecosystem stability and compliance requirements.

● In contrast, Gopax and Korbit have relatively fewer token listings, indicating that these two exchanges have a smaller scale in introducing new coins. This is closely related to their limited market scale, financial strength, and risk control capabilities.

4. Token Listing Path Analysis

After gaining a preliminary understanding of the listing characteristics and overall situation of several major exchanges in South Korea, the next step will be to conduct an in-depth analysis based on specific token listing price data. By comparing the specific data on the types of tokens listed and their performance across different exchanges, we can more clearly outline their commonalities and differences in project selection, pricing strategies, and market feedback, thus providing a more intuitive and data-supported perspective for understanding the operational logic and competitive strategies of each exchange.

To more accurately grasp the overall patterns and trend characteristics of token listings in South Korea, this study will next focus on analyzing the three exchanges with the highest market share.

4.1 Analysis of Token Listings and Influencing Factors

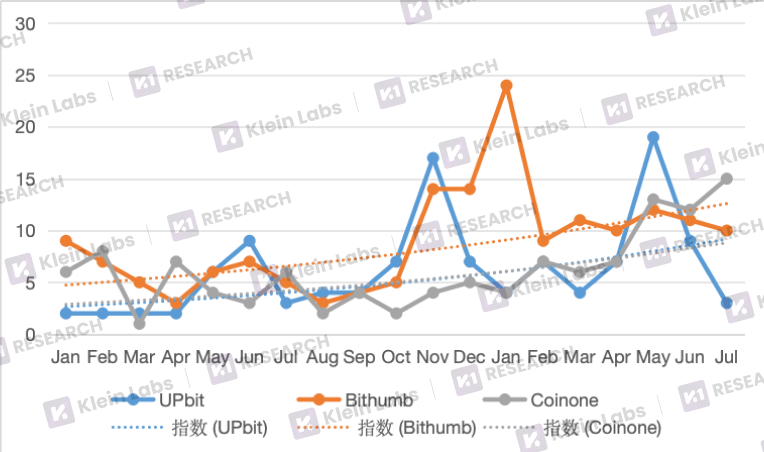

4.1.1 Monthly Token Listing Overview of the Three Major Exchanges

Overall Trend: Since November 2024, the number of token listings across the three major exchanges has shown an upward trend. The increase in token listings reflects heightened market sentiment. In November 2024, the results of the U.S. presidential election were announced, with Trump winning, bringing new confidence to the market. At the same time, Bitcoin prices continued to reach new highs, with popular sectors like Layer 1, memecoins, AI, and DeSci performing strongly, resulting in positive market sentiment. During this period, the actions of exchanges regarding token listings noticeably increased, reflecting the pattern that the number of token listings typically rises during bull markets.

Specific Analysis:

● UPbit: The overall peak characteristics are quite evident, with significant differences between periods of dense listings and smoother periods, showing three peaks in total, occurring in June 2024, November 2024, and May 2025. The latter two concentrated listings coincide with market bull runs:

In November 2024, Bitcoin rose nearly 40%, driving overall market prosperity;

In May 2025, Bitcoin broke through the $100,000 mark, and Ethereum also rebounded strongly, with listings concentrated in the Layer 1 sector, coinciding with the regulatory window period before the formal introduction of the "Digital Asset Basic Law."

Although BTC and ETH showed weak trends in June 2024, the overall market capitalization of the South Korean crypto market remained high, and exchanges launched a public official crypto asset information disclosure system, enhancing transparency, which also led to a peak in listings for Upbit that month.

● Bithumb: The number of token listings peaked in January 2025. Since November 2024, its number of listings rapidly climbed to 24 new coins in a single month, stabilizing at around 10 new coins per month, nearly double the average level in the first half of 2024. Since the strategic adjustment in 2023, Bithumb's market share has steadily increased. With the new president taking office and favorable conditions for the South Korean cryptocurrency market, it adopted a more aggressive token listing strategy to accelerate market share capture.

At the beginning of 2025, Bithumb accelerated its token listing pace to capitalize on user growth trends and attract more participants. This move is closely related to the fact that the proportion of new users among South Korean crypto investors reached 33% in December 2024, driven mainly by market sentiments such as Bitcoin halving and Trump's election victory, indicating that the user base is continuously expanding.

● Coinone: The token listing pace is relatively balanced, maintaining a stable high volume of listings in the first quarters of both 2024 and 2025. In May of this year, Coinone's number of token listings reached a significant peak, surpassing previous months' highs. This change is attributed to the previously launched fee reduction policy and marketing investments, successfully solidifying a loyal user base; at the same time, multiple favorable news regarding cryptocurrencies and the introduction of the "Digital Asset Basic Law" provided stronger policy support for Coinone. Based on these factors, Coinone chose to increase the variety of tokens listed, attracting more users by expanding the number of supported trading pairs, thereby further expanding its market share.

Similar to UPbit, Coinone also reached a phase peak in May this year; however, unlike UPbit, which saw a sharp decline in the number of token listings in July, Coinone set a new high in the same month. This indicates that the two exchanges have different strategies in responding to market conditions. Overall, the pace of token listings is closely related to BTC price trends and market sentiment, with Coinone more inclined to maintain an active listing strategy during bullish phases to attract users and sustain growth momentum.

From the index curve of the number of token listings, UPbit and Coinone show a generally similar trend, but their performance styles differ. UPbit's curve exhibits more pronounced peaks and troughs, forming periodic adjustments to help maintain overall balance; in contrast, Coinone's curve maintains a high synchronization with BTC price trends, remaining relatively stable and continuously upward, indicating that its listing strategy directly follows market conditions, pursuing stable expansion.

4.1.2 Quantitative Analysis of Influencing Factors on Token Listings

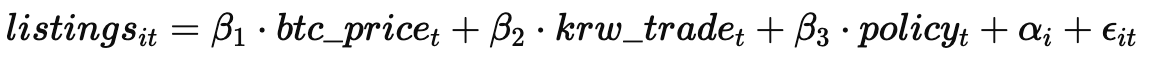

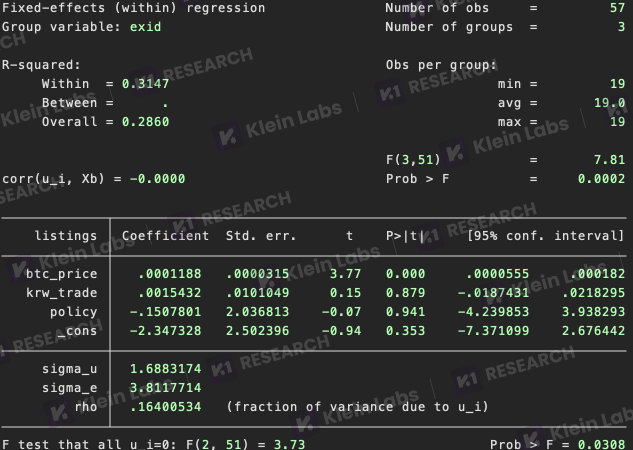

This section employs a fixed effects regression model using panel data, aiming to systematically assess the impact of BTC prices, KRW-denominated trading volumes, and policy factors on the number of token listings on major South Korean exchanges.

● Panel data has the advantage of simultaneously containing both time series and cross-sectional dimensions, allowing for the capture of dynamic effects of variables over time while controlling for individual differences. Compared to single cross-sectional or time series analyses, the panel method can effectively enhance estimation accuracy and reduce omitted variable bias.

● The introduction of the fixed effects model is primarily to control for time-invariant characteristics at the exchange level, avoiding interference from these long-term structural differences on coefficient estimates. By introducing exchange fixed effects αᵢ, the model can focus on changes over time, thereby more accurately identifying the marginal impacts of BTC price fluctuations, trading volume changes, and policy windows on listing decisions.

● In interpreting the results, this study uses p-values as the core measure of statistical significance. When the p-value of a variable exceeds 0.05, it means that at the 5% significance level, we cannot reject the null hypothesis that its "coefficient equals zero," indicating that the model does not provide sufficient evidence to prove that the variable has a stable statistical association with the number of token listings during the sample period. However, statistical insignificance does not equate to economic ineffectiveness. In the highly volatile environment of the crypto market, short-term sample noise, measurement errors of variables, and individual heterogeneity may obscure their true effects. Therefore, for variables with p-values > 0.05, we will adopt a cautious interpretation in our conclusions, providing supplementary discussions from the perspectives of economic significance and potential mechanisms, rather than relying solely on statistical significance for judgment.

We set the following model:

Where:

listings: the number of token listings by exchange i in month t

btc_price: the average BTC price for the month (in USD)

krw_trade: the total trading volume for the month denominated in KRW (in billions)

policy: policy dummy variable (1 = policy window period, 0 = no)

αᵢ: exchange fixed effects to control for long-term strategic differences among different exchanges.

Panel regression results indicate:

● BTC price is significantly positively correlated. For every $1 increase in BTC, the average number of token listings increases by approximately 0.00012; if the average monthly BTC price rises by $10,000, the average number of token listings will increase by about 1.19, with a very small p-value, indicating that this relationship is statistically robust.

● Changes in KRW-denominated trading volume are not significantly correlated with the number of token listings, possibly due to substantial short-term trading fluctuations and project heterogeneity, which do not directly drive the listing strategies of exchanges.

● The policy window period does not significantly impact the number of token listings, suggesting that different exchanges respond differently to policies.

● The fixed effect αᵢ helps control for long-term strategic differences among exchanges, allowing the model to focus on the impact of time dimension factors.

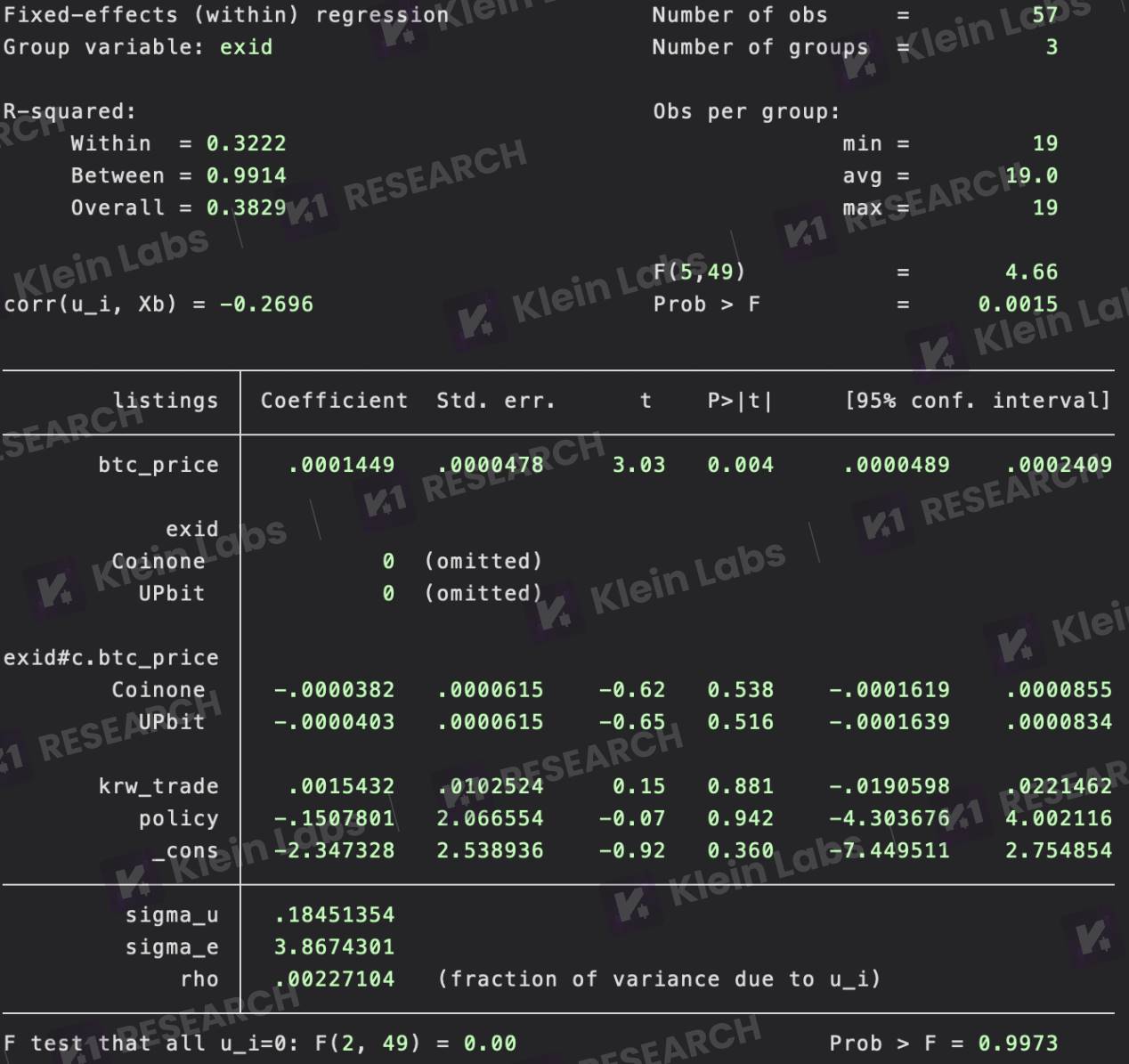

When further analyzing the differences among exchanges, the regression results show:

● In comparison, UPbit and Bithumb exhibit slightly lower marginal responses to BTC price changes, but the difference with Coinone is not statistically significant, indicating that the three major exchanges display a similar positive response pattern when facing BTC price fluctuations.

● Specifically, Coinone is particularly sensitive to changes in BTC prices. For instance, when the average BTC price increases by $10,000, the number of token listings on Coinone is expected to increase by about 1.45, indicating that price increases stimulate its listing of new tokens to capture market enthusiasm and investor attention.

● Overall, BTC price signals have a significant impact on the token listing decisions of South Korean exchanges in the short term and serve as an important reference for project teams in choosing listing windows.

Combining the two analyses, the conclusions indicate:

● During favorable market conditions, the three major exchanges generally adopt synchronized expansion strategies, but Coinone is more sensitive to market conditions.

● BTC price is the primary driver of the number of token listings, rather than a differentiation in strategies among exchanges.

● The South Korean crypto market is overall guided by macro market conditions, with the differences among exchanges having limited impact on long-term strategies.

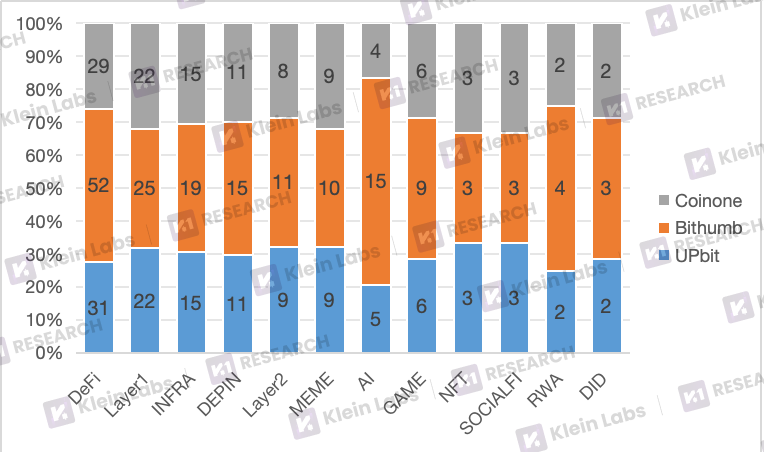

4.2 Analysis of Token Listing Preferences

To further investigate the listing preferences of the three major South Korean exchanges for new tokens, we conducted a systematic review and analysis of their recent token listings. This analysis provides project teams with referenceable listing strategies and helps investors identify potential investment targets, grasping the hotspots and trends in the South Korean local market.

Common Points

● In the listing structure of the three major exchanges, the number of DeFi, Layer 1, and Infra projects ranks among the top. This indicates that all platforms remain highly focused on listing tracks with practical application value, particularly emphasizing the DeFi ecosystem and the foundational infrastructure of Web3. DeFi projects account for about one-third of the total number of token listings.

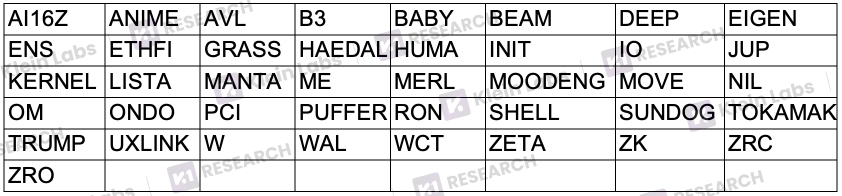

● In the DeFi sector, the three exchanges jointly listed 12 major high-quality overseas projects, including BABY, COW, DEEP, DRIFT, ENA, HAEDAL, JTO, JUP, KERNEL, PUFFER, W, and ZRO, all of which are representative projects with high global recognition and user bases, demonstrating the exchanges' convergence in selecting high-quality DeFi assets.

● In contrast, the number of listings in emerging sectors such as NFT and SocialFi is significantly lower across the three platforms. From the explosive growth in 2020 to the rollercoaster fluctuations in the market, followed by a prolonged winter for NFTs, market sentiment and liquidity have remained under pressure. Recently, the NFT market has seen a strong rebound, and the three major exchanges selectively listed three leading blue-chip NFT projects—PENGU, ME, and ANIME—while supplementing their top assets. However, overall, the three exchanges still maintain a relatively cautious and watchful attitude towards the NFT sector.

Differentiating Points

● Bithumb ranked first in the number of token listings during the statistical period, and compared to UPbit and Coinone, it has a higher proportion of new tokens in the DeFi and AI sectors, fully reflecting Bithumb's keen capture of market opportunities and hotspots during the AI boom in 2024, as well as its rapid response in listing strategies.

Coinone and UPbit have a high degree of overlap in overall token listing numbers and timing, but there is a clear differentiation in their specific token selection styles. Taking the DeFi sector as an example:

● UPbit independently listed established projects like COMP and BNT, which have long-term ecological support and have been market-validated, demonstrating a focus on stability and historical performance.

● Coinone, on the other hand, independently listed relatively new but promising innovative DeFi projects like NAVX and YALA, showcasing an open attitude towards emerging high-quality projects and forward-looking layouts, with a more inclusive selection standard that tends to support early innovative projects with long-term growth potential.

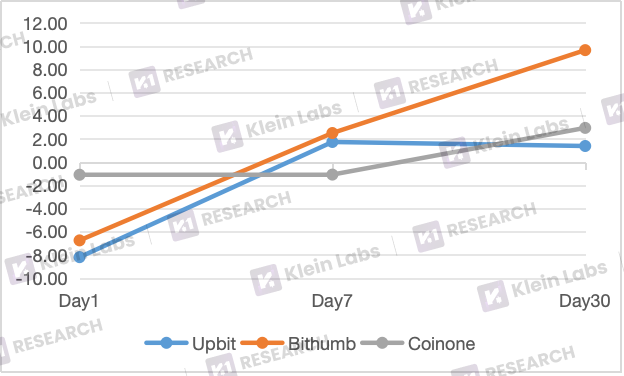

4.3 Token Price Performance Analysis

This study primarily focuses on the price performance of newly listed tokens on the three major exchanges. It examines the price changes on the 1st, 7th, and 30th days compared to the initial pricing set by the exchanges for the new tokens, to analyze their trends, volatility patterns, and market responses.

● The first-day price reflects the market's immediate acceptance of the new asset, influenced by speculative buying and FOMO emotions, making it a critical phase for initial market pricing;

● The price changes from the 1st to the 7th day can capture short-term market sentiment and initial recognition of the project's fundamentals, measuring the sustainability of market enthusiasm and helping to assess reasonable initial pricing;

● The price trends from the 1st to the 30th day reflect the long-term support of the token, as short-term speculation cools down and speculators exit, the changes in price and trading volume become important references for market recognition.

To calculate price returns and avoid extreme values affecting the overall trend, we excluded the top and bottom 25% of outliers and used a trimmed mean method for analysis, thereby more accurately reflecting the typical price volatility of the tokens.

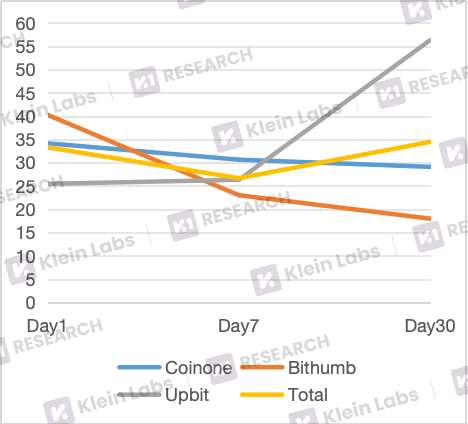

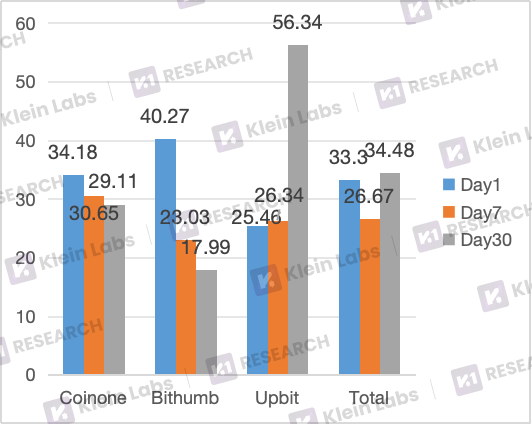

● UPbit: The average closing price on the first day is the lowest, possibly due to a large user base and concentrated selling by speculators, leading to price pressure on the first day. On average, UPbit's price quickly rebounds on the seventh day, with the rate of increase gradually diminishing, showing a steady upward trend after short-term adjustments.

● Bithumb: The price performance exhibits the largest average volatility, with both increases and decreases being quite strong, which may be related to the variety of tokens listed and high market activity. Although the curve indicates an upward trend for Bithumb, the steep slope and amplitude may also increase investor risk.

● Coinone: The price changes are the smallest, indicating a high level of stability and predictability. Throughout the observation period, its price trend remains stable, with the increase on the 30th day even surpassing that of UPbit, indicating that even with limited short-term fluctuations, the token still has the potential for sustained growth. This stable return means that investors face relatively low price volatility risk, making it more suitable for investment strategies that pursue steady returns and long-term investment value.

4.4 Return Analysis: The Bridge Effect of Token Listings

4.4.1 Research Methodology

In this study, we analyze the secondary indicator—token returns—to examine the impact of listings on South Korean exchanges on the price performance of newly listed tokens. Compared to absolute prices, returns have significant advantages:

Ignoring unit effects: Compared to absolute prices, returns are relative indicators that are not affected by token face values or trading unit differences, facilitating comparisons across different tokens and exchanges.

Reducing Scale Bias: The price differences among various tokens can be enormous, and directly comparing prices may lead to misleading conclusions. In contrast, returns can standardize the scale, highlighting the magnitude of changes rather than absolute values.

Capturing Market Reaction Sensitivity: Returns reflect investors' immediate emotions and behavioral responses to newly listed tokens, helping to measure the impact of the initial listing exchange on price fluctuations.

4.4.2 Token Selection and Sample Determination

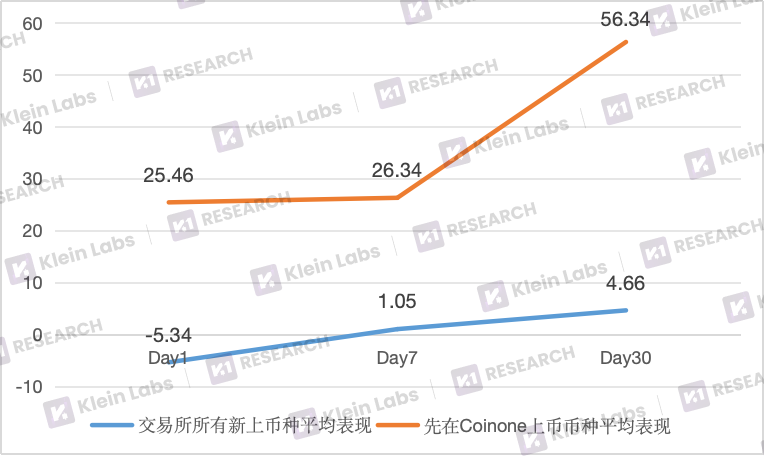

Data shows that both Bithumb and Coinone exhibit a certain "bridge effect." Specifically, Bithumb has 57 tokens that were first listed on its platform before subsequently being listed on UPbit; Coinone also shows significant performance, with as many as 41 tokens initially listed on Coinone before being gradually listed on UPbit and Bithumb, with an average listing interval of 93.6 days. This section will take Coinone as an example to analyze its characteristics in listing rhythm and market linkage.

For some representative projects, such as EIGEN, ENS, and ETHFI, Coinone's layout time even exceeds one year in advance. Overall, the average return performance of these tokens is better than the overall market level, further validating Coinone's "bridge role" in the ecosystem—namely, introducing potential assets early and channeling them to platforms with larger trading volumes and broader coverage.

This bridge effect is reflected not only in the time difference but also in return performance: tokens listed early on Coinone provide significant excess return opportunities for early participants, and when they subsequently enter other mainstream exchanges, they create a cross-platform price and liquidity transmission mechanism. Thus, Coinone plays a dual role as a project incubator and asset circulation hub within the South Korean exchange ecosystem.

4.4.3 Return Time Window Analysis

From the analysis of the time distribution of price performance, Coinone's listed tokens show the best overall return performance. In the three observation windows of the 1st, 7th, and 30th days, Coinone's returns are higher than the overall average level at two time points, while slightly lower than the average at the remaining time point. In contrast, UPbit and Bithumb only outperform the average at one time point, with the remaining periods lagging behind the overall market level.

Overall, in the short to medium term, projects listed first on Coinone and Bithumb tend to perform best; however, in the long-term development, UPbit demonstrates a more robust and superior average level.

● UPbit: Adopts a relatively conservative strategy in the early stages of new tokens, often listing them only after verifying market enthusiasm. The price performance on the first day is the weakest, but due to later liquidity and a large user base advantage, the return performance surpasses others by the 30th day, becoming the best performer, indicating that its tokens are more likely to attract funding attention and secondary boosts later on.

● Bithumb: The strategy relies more on market enthusiasm, with the best price performance on the first day, showing significant short-term effects, but the overall return rate declines significantly afterward, indicating that without subsequent maintenance and market operation support, short-term bursts are difficult to convert into medium- to long-term advantages.

● Coinone: Leverages the premium effect brought by its first-mover advantage, strategically positioning popular assets early, allowing early participants to gain arbitrage opportunities when tokens are listed across platforms, while also enhancing its appeal to early investors. Coinone tends to take on the risks of early token listings in exchange for the potential high-return token selection rights, consistently outperforming the overall average level of tokens across most time dimensions.

Based on the identified differences in token performance among exchanges, investors can formulate more targeted strategies according to their risk preferences and operational cycles:

● Short-term speculative funds: Should focus on the performance of new tokens on Bithumb on their first day of listing, taking advantage of short-term market enthusiasm to capture price differential opportunities.

● Medium- to long-term trend investors: Are better suited to track the performance of new tokens on UPbit over the 30 days following their listing, capturing subsequent funding attention and potential secondary boosts.

● Early layout dividend seekers: Should closely monitor Coinone's early listing dynamics, utilizing its first-mover advantage and bridge effect to gain premium returns during cross-platform listings.

4.4.4 Global Performance of Returns

Statistical results show that tokens listed on Coinone have average price performance far superior to the overall average level of all newly listed tokens, exhibiting a broad upward trend. This phenomenon indicates that these tokens, which were first listed on Coinone, not only possess strong project quality and market competitiveness but also reflect Coinone's foresight and precision in token selection. The ability to identify and introduce quality assets in the early stages is a significant manifestation of its bridging role within the South Korean exchange ecosystem.

The analysis results also provide a reference for a potential listing strategy: by choosing platforms with relative selection advantages for early listings, there is not only an opportunity to gain initial market attention and price performance but also to facilitate the expansion of liquidity and user coverage in subsequent larger exchanges, thus forming a complete market development path from initial exposure to medium- to long-term value accumulation.

5. Excellent Cases of Token Listing Marketing

The overall listing threshold for South Korean exchanges is relatively high: there are strict requirements for project technical strength, compliance, and team background, as well as high expectations for market potential, community foundation, and early user activity, resulting in a limited number of projects that can actually be listed. This means that project teams must adopt a dual approach in both project hard power and market promotion strategies when vying for listings on South Korean exchanges.

The following five projects have shown outstanding performance in early marketing, and their token price trends post-listing are also quite prominent. We have summarized and analyzed their marketing characteristics to provide references for other project teams. By referencing such successful cases, project teams can strategically layout their efforts in publicity, community building, media collaboration, and early user incentives, thereby enhancing the likelihood of passing reviews and achieving smooth listings.

5.1 UXLink

● Media Collaboration and Special Reports

UXLink has established partnerships with multiple blockchain media and industry research institutions to publish special reports and technical analyses, enhancing the project's market recognition. CoinDesk Korea conducted an in-depth interpretation of UXLink's cross-chain technology, boosting technical credibility; CryptoSlate published an interview article introducing UXLink's ecological layout and token economic model; TokenPost and BlockBeats shared reports in Korean and Asian communities, expanding market exposure and community attention.

● Ecological Expansion and Collaborative Layout

UXLink built its community on Telegram, with partners including the TON ecosystem, UOB, Arbitrum, and Animoca Brands. Through cross-chain interoperability, AMAs, and technical seminars, active users grew by 150% within three months, and daily trading volume increased by 200%, significantly enhancing liquidity and market influence while promoting the development of the decentralized finance ecosystem. Additionally, UXLink sponsored the Consensus Hong Kong conference and collaborated with BNB Chain and Meet48 to host the "AI Agent Rising" themed event in Hong Kong, further enhancing industry influence and community recognition.

● Incentive Mechanisms and User Participation

Participating in AIRDROP2049, SBT points were distributed through social relationships on-chain, incentivizing user interaction and community participation while enhancing on-chain reputation and activity.

5.2 Mantle Network

● Media Collaboration and Special Reports

Mantle Network systematically laid out media dissemination, collaborating with several well-known media and research institutions to publish special reports and technical analyses, significantly enhancing the project's influence within the industry. Klein Labs provided a comprehensive ecological interpretation for investor reference; Binance Square published an interview about Mantle Network, introducing its modular architecture and Eigen-DA data availability support, enhancing technical credibility; Messari conducted an in-depth analysis of the project, releasing a research report to increase capital attention; TokenPost and CoinNess shared reports on the project's progress in the South Korean market, expanding recognition in the Asian community.

● Community Operations and Social Media Promotion

Mantle Network actively operates social media and community platforms, building a highly engaged user base. X has over 800,000 followers, regularly updating project dynamics and interacting with the community; the official Telegram and Discord communities have over 200,000 members, regularly hosting AMAs and community discussion events to enhance user participation and sense of belonging. This refined community operation not only promotes information dissemination but also provides strong support for user activity and loyalty.

● Incentive Mechanisms and User Participation

Mantle Network enhances user activity and participation through incentive mechanisms. The Mantle Journey user participation program launched in August 2025, through Soulbound Token minting, allocates a 20 million MNT reward pool to participating users and applications, incentivizing community building and ecological activity. These incentive measures not only enhance user loyalty but also validate the economic attractiveness of the project ecosystem, effectively forming a self-reinforcing community loop.

5.3 Flock.io

● Media Collaboration and Special Reports

Flock.io systematically laid out media dissemination, collaborating with well-known media such as Messari and Cointelegraph Korea to publish special reports and market analyses, enhancing industry influence; Klein Labs provided a comprehensive interpretation of the project ecosystem, offering investment references; TokenPost reported on its progress in the South Korean market, enhancing local market recognition.

● Ecological Expansion and Collaborative Layout

5.3 Flock.io

Flock.io has collaborated with Alibaba Cloud Qwen and Base to introduce centralized AI models into decentralized platforms, achieving decentralized operations for on-chain transactions and wallet management. Through the Web3 Agent model, locally running AI assistants ensure user privacy while community AMAs and technical seminars significantly enhance user activity and market influence, strengthening decentralized ecological construction.

● Incentive Mechanisms and User Participation

Flock.io initiated the Qwen × Flock × Base AI hackathon. The event attracted participation from developers at South Korea's SKY universities and KAIST, utilizing federated learning technology to promote innovation and practical applications of decentralized AI models, reinforcing Flock.io's technological leadership and industry influence within the decentralized AI ecosystem.

5.4 BigTime

● Media Collaboration and Special Reports

BigTime has systematically laid out media dissemination, collaborating with well-known media such as CoinDesk Korea, CryptoSlate, and TokenPost to publish special reports and project ecological analyses, enhancing industry influence. Messari provided an in-depth interpretation of its gaming economic model and token incentive mechanisms, offering references for investors. BlockBeats reported on BigTime's community activities in the Asian market, increasing local market recognition.

● Community Forum Viral Marketing

BigTime implemented a viral marketing strategy through community forums, Twitter, and Discord, activating player interaction and information dissemination. By utilizing a game team formation mechanism and invitation code system, players are encouraged to actively invite new users, rapidly expanding the community size while enhancing user stickiness and brand influence.

● Incentive Mechanisms and User Participation

Participation in BigTime requires an invitation code, creating a short-term "hard-to-get code" craze that significantly boosts community activity. This reflects market demand. The project also offers multiple incentive measures such as free game OTC, voice channel support, daily NFT drop rate sharing, and advanced dungeon sharing, effectively enhancing user participation and community activity.

5.5 Sign

● Media Collaboration and Special Reports

Sign has systematically laid out media dissemination, collaborating with Tiger Research, CoinDesk Korea, CryptoSlate, and other well-known media and research institutions to publish special reports and technical analyses, enhancing industry recognition and capital attention. TokenPost and BlockBeats shared reports, expanding the project's exposure and influence in South Korean and Asian communities.

● Community Forum and Viral Marketing

Sign utilizes cultural symbols to build a strong sense of identity and belonging, successfully cultivating a self-sustaining community of over 50,000 members. The community exhibits high loyalty, with some core members even tattooing the Sign logo on their bodies, reflecting the project's deep cultural influence and social dissemination effects.

● Incentive Mechanisms and User Participation

Sign encourages user interaction and content sharing through on-chain tasks, airdrop rewards, and a fair incentive system based on Soulbound Tokens (SBT); a high proportion of community incentives combined with a diversified product matrix effectively penetrates the on-chain trust and distribution infrastructure market, promoting the vigorous development and ecological self-reinforcement of the "Orange Dynasty" community.

The above cases fully demonstrate that through systematic and multidimensional marketing strategies, projects not only gain capital attention and user recognition but also successfully enter the strictly regulated and limited South Korean exchange market. This indicates that the project's strength and market recognition have reached high standards, providing other project teams with valuable successful experiences and reference models.

6. Conclusion

In the global cryptocurrency landscape, the uniqueness and vibrancy of the South Korean market provide project teams with highly valuable reference samples. Data indicates that the resonance between policy and market sentiment significantly influences the listing rhythm; fluctuations in BTC prices not only affect investor confidence but also subtly alter the listing strategies of exchanges. This dual-driven mechanism of market and policy reminds project teams that when formulating global issuance plans, they must incorporate macro trends and regulatory dynamics into their decision-making framework.

Moreover, the "listing bridge effect" prominently reflected by Coinone is noteworthy—its early listings often signal attention and follow-up from other mainstream exchanges, bringing secondary liquidity and amplifying the project's market voice. This suggests that, in the face of limited resources, precisely selecting entry platforms may leverage the market more effectively than blindly pursuing large platforms.

However, the experiences of the South Korean market cannot simply be replicated. The user profiles of different exchanges, community cultures, listing review mechanisms, and localized promotional resources all determine a project's success or failure in this market. For project teams seeking international expansion, true competitiveness lies in their ability to deeply integrate data analysis, market judgment, and localized execution, presenting themselves on the most suitable platforms with the most fitting strategies at the right time.

The cryptocurrency market is ever-changing, but patterns have never disappeared. The South Korean case teaches us that a project's success depends not only on technology and concepts but also on a precise grasp of the market's microstructure and emotional fluctuations. In the future, facing such a stage, can project teams seize short-term benefits while laying the groundwork for long-term value? The answer depends on every strategic choice they make before taking that first step.

7. References

Kaiko: Korean Crypto Market Report

Simplicity: Token Launch Dynamics: The Science Behind Price Performance

Namu Wiki:South Korea's Cryptocurrency Regulation Controversy

[Video] Democratic Party Considers Establishing Digital Asset Agency.. Will Cryptocurrencies Be Managed Like Stocks?

DeSpread Research: 2024 South Korea Virtual Asset Individual Investor Trend Report

UPbit and Bithumb's 2025 Listing Strategies Diverged… Conservative vs. Aggressive

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。