Since the passage of the "GENIUS Stablecoin Act" in July, market momentum seems to be shifting towards Ethereum.

Written by: He Hao, Wall Street Insights

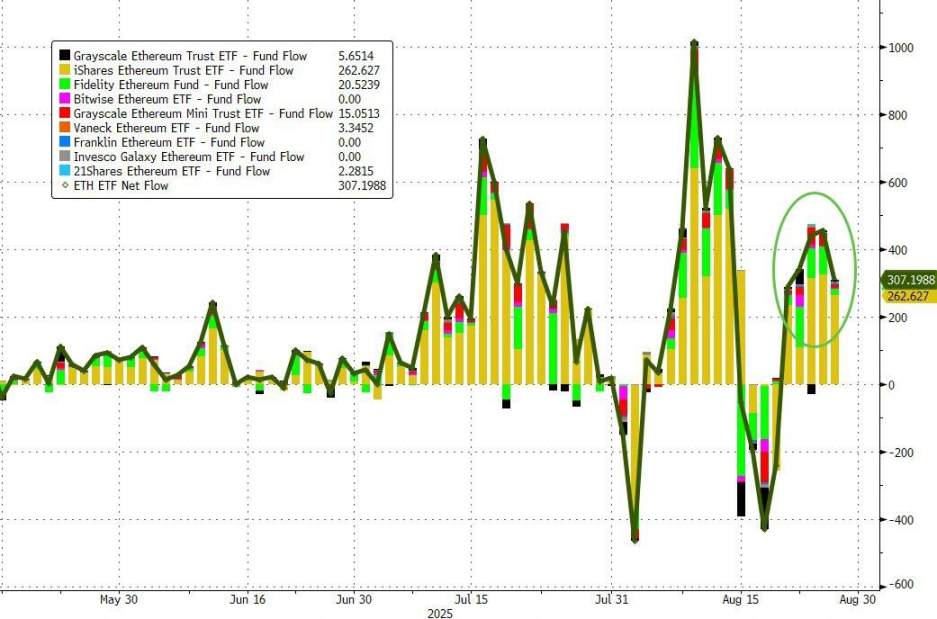

Spot Ethereum ETFs are trading explosively in the United States, attracting over ten times the capital inflow of spot Bitcoin ETFs in the past five trading days. According to CoinGlass data, since August 21, spot Ethereum ETFs have recorded inflows of up to $1.83 billion, while Bitcoin ETFs only saw $171 million during the same period, less than 1/10 of Ethereum's inflow.

This Wednesday continued this trend: 9 Ethereum ETFs saw inflows of $310.3 million, while 11 spot Bitcoin ETFs only recorded $81.1 million.

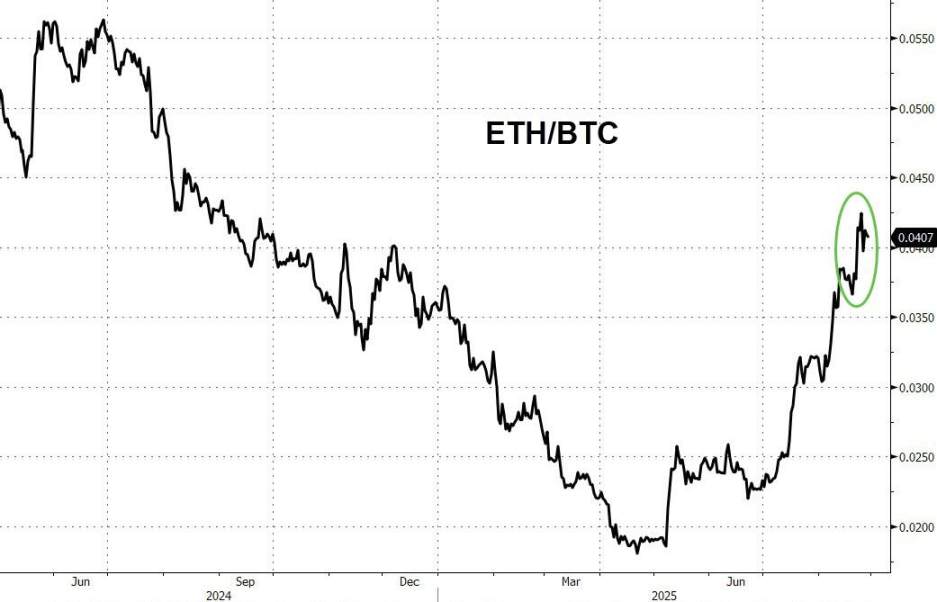

Since the beginning of this week, the rebound in Ethereum's price has also outpaced that of Bitcoin.

This large-scale capital shift towards Ethereum has caught the attention of industry observers. Insiders describe this change as very intense. Since early July, inflows into spot Ethereum ETFs have approached $10 billion.

Spot Ethereum ETFs have been trading for 13 months, with cumulative inflows reaching $13.6 billion, most of which came from the past few months. In contrast, spot Bitcoin ETFs have been listed for a longer time, trading for 20 months, with a total assets under management (AUM) of $54 billion.

Since the passage of the "GENIUS Stablecoin Act" in July, market momentum seems to be shifting towards Ethereum. The reason is that the Ethereum network holds the largest share of stablecoins and the tokenization market for real-world assets. VanEck CEO Jan van Eck stated this week, "This aligns perfectly with what I call Wall Street tokens."

According to Bloomberg ETF analyst James Seyffart, investment advisors are the largest holders of Ethereum ETFs, with a holding size of $1.3 billion. According to SEC filings, Goldman Sachs is among the top holders, with a holding size of $712 million.

The scale of digital currency ETFs is growing rapidly. Just looking at the largest Bitcoin ETF, IBIT, its AUM is quickly approaching that of the world's largest gold ETF, GLD.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。