Author: @Web 3 Mario

Recently, the market seems to have entered a perplexing phase, with blue-chip cryptocurrencies maintaining high volatility and an undecided overall direction. The altcoin market has not ushered in the anticipated comprehensive bull market, while DAT assets or coin stocks are thriving in the traditional financial market. Prior to this, there have been many voices on social media characterizing this round of the bull market as being driven by traditional funds. I largely agree with this assessment, and this portion of funds has several distinct characteristics compared to past market cycles, such as being heavily influenced by macro factors, having a lower risk appetite, being more concentrated, exhibiting weaker wealth effect spillover, and showing less obvious sector rotation. Therefore, as significant changes occur in the macro environment, re-evaluating these changes will help us make correct judgments. Overall, I believe that as Powell adjusts the FED's decision-making logic, the performance of the U.S. job market will determine market confidence in a rate cut in September, thereby affecting the prices of risk assets.

What Powell's Speech Changed

We know that in the previous months, the core point of contention in the market regarding the macro economy was whether the FED, under Powell's leadership, could significantly cut interest rates within the year as desired by the Trump administration. First, why was the Trump administration so eager to pressure the Federal Reserve to cut rates, even at the risk of affecting the Fed's independence and, consequently, the credibility of the dollar, by influencing Fed decisions through administrative power? In previous articles, we have analyzed the Trump administration's adjustment goal in U.S. economic policy as "manufacturing return," but this goal encountered two obstacles during its implementation:

- Internal costs are too high to compete with international market competitors;

- Government debt is too high, lacking sufficient budget incentives for industry return;

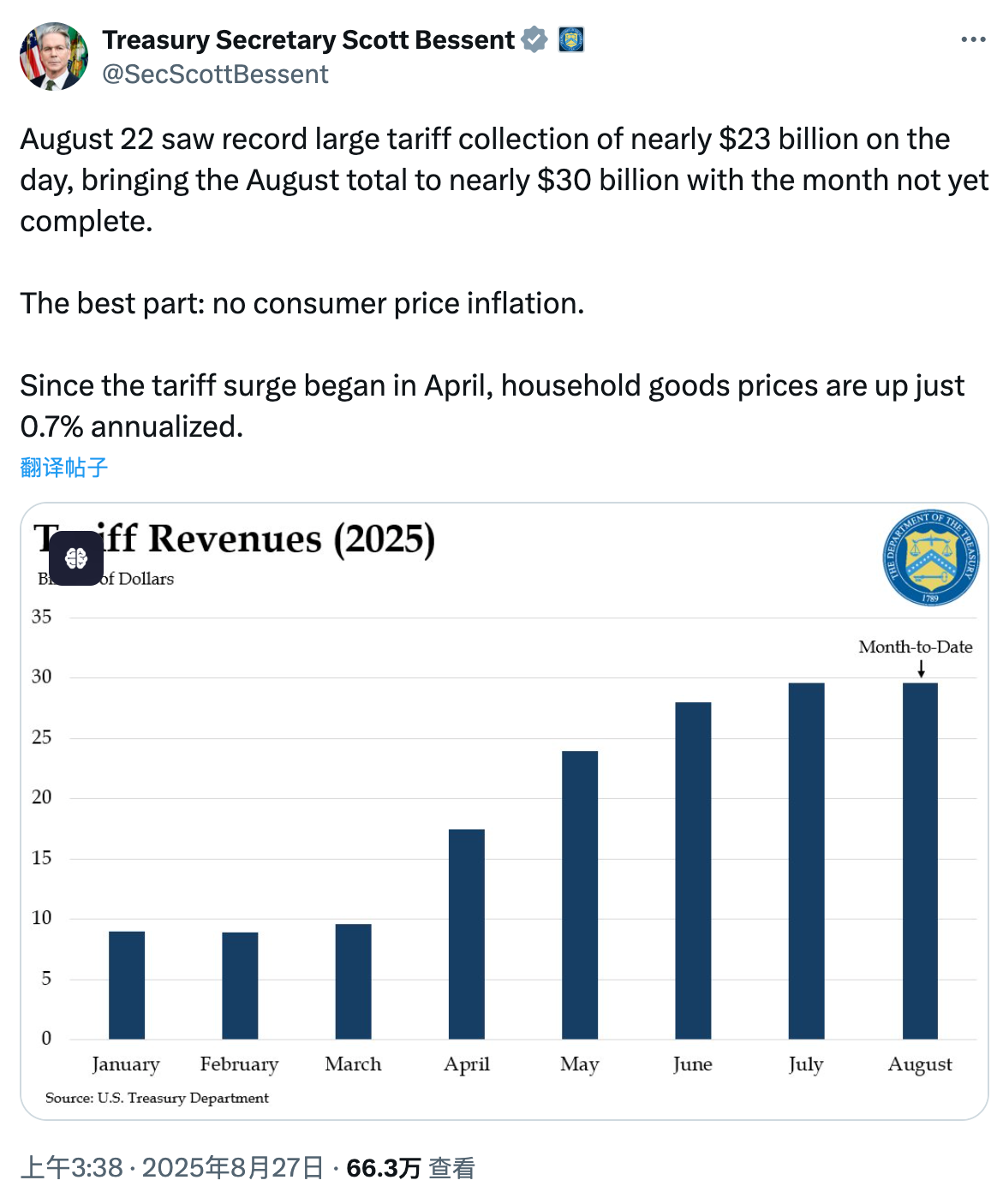

Observing the first half of the Trump administration, its policy implementation can be roughly divided into two steps. First, at the beginning of his election, he tried to fulfill his campaign promises as much as possible to enhance his governing authority, such as granting significant rights to DOGE and changing cryptocurrency policies. After consolidating the basic support, the Trump administration began to implement tariffs. The reason for pushing forward tariff policies after consolidating the basic support is that raising tariffs would raise market concerns about imported inflation, thereby increasing internal resistance. After gaining strong authority, through several months of negotiations, Trump's tariff policy framework has been initially established and has shown results. According to U.S. Treasury Secretary Basent, as of August 22, tariffs have brought nearly $100 billion in fiscal surplus to the U.S. in the past six months, and it is expected to reach $300 billion by the end of the year. In addition, many countries have made investment commitments, such as $550 billion from Japan, $600 billion from the EU, and $750 billion in energy orders.

It can be said that although internal costs cannot be immediately reduced in the short term, such as labor costs and logistics costs, because these costs need to be reset through a market clearing during a major depression, the Trump administration has, to some extent, changed the domestic market competition structure and capital structure through tariffs. Therefore, it is timely to lay the groundwork for the next policy, which is the FED's interest rate cut.

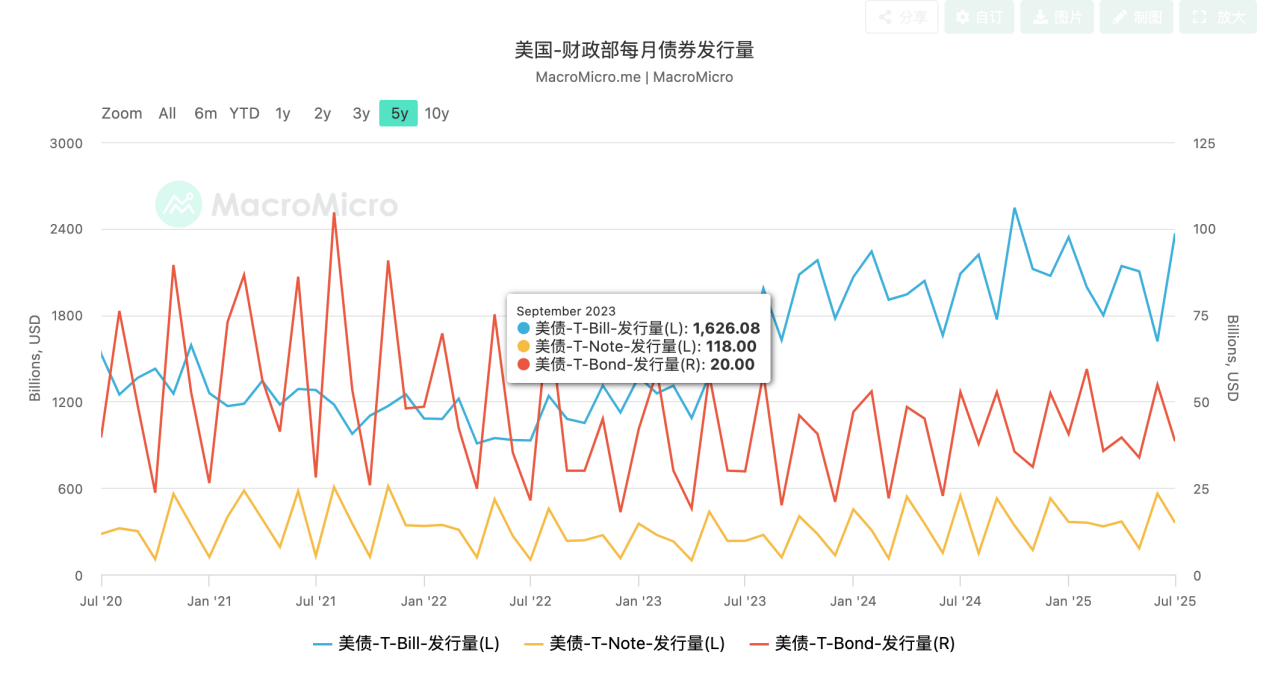

So, what can a rate cut change? There are mainly two points: first, it alleviates debt pressure. We know that during the previous Treasury Secretary Yellen's term, the U.S. Treasury's debt issuance structure increased the issuance of short-term debt, and Basent retained this decision. The benefit of this approach is that short-term debt rates are controlled by the Federal Reserve, reducing the burden of long-term debt on the Treasury. From the current situation, the market demand for short-term U.S. Treasury bonds is strong, which helps lower financing costs. However, the problem is also evident: it shortens the debt duration, increasing repayment pressure in the short term, which is why recent negotiations regarding the debt ceiling have become more vocal. A rate cut would mean lower interest payment pressure from short-term debt. Second, a rate cut will lower financing costs for small and medium-sized enterprises, helping to establish the industrial chain. We know that compared to large enterprises, small and medium-sized enterprises typically rely more on bank debt financing for operational funds. Therefore, in a high-interest environment, the willingness of small and medium-sized enterprises to expand financing will be impacted. After changing the domestic market competition structure through tariffs, it is also urgent to incentivize small and medium-sized enterprises to expand production, helping them quickly fill the supply gaps in the market and avoid inflation. Therefore, the Trump administration's pressure on the Federal Reserve to cut rates at this time is also something they will spare no effort to pursue, rather than a smokescreen.

Whether it is the active intervention in the renovation of the Federal Reserve headquarters or the relentless attacks on the extreme left, progressive, hawkish Governor Cook, these are all proofs of the Trump administration's active promotion. These methods seem to have borne fruit in Powell's speech at the global central bank annual meeting in Jackson Hole last week. Throughout the speech, the most surprising aspect for the market was that Powell, who has always expressed his commitment to defending the independence of the Federal Reserve, seemed to yield to Trump's strong pressure. Several core points in his speech can be used to express his attitude:

It was clarified that the risks in the U.S. economy have shifted from inflation to the job market;

The impact of tariffs on inflation will take time to manifest and is not a factor that triggers an inflationary spiral;

An update to the monetary policy framework, interestingly reducing the emphasis on the effective lower bound as a "characteristic of normal economic conditions."

In simple terms, this means that the Federal Reserve is no longer overly concerned about inflation caused by tariffs but is instead worried about a collapse in the job market due to economic recession, while the level of interest rate cuts can be seen as having no lower limit. The description of the effective rate can be elaborated slightly; the so-called effective rate refers to the point at which, when the central bank uses conventional monetary policy (mainly adjusting short-term policy rates), further rate cuts will have no impact on the economy once the rate is lowered to a certain level. This shift also aligns with the core of Trump's policy, as this "mutual pursuit" has also sparked market expectations for further liquidity easing.

Impact on the Cryptocurrency Market

We know that the cryptocurrency market is often seen as a canary for speculative sentiment in the global risk asset market. Therefore, after the speech was released, cryptocurrencies experienced a surge, and the subsequent pullback indicates that the market had already somewhat priced in a rate cut this year. After establishing a new trading logic, the market shifted from initial emotional expectations to rational expectations, thus requiring sufficient proof to assess the extent of the rate cut.

As for how deep the pullback will be, I believe the recent performance of ETH, which has been the hottest topic, is worth paying attention to. I think as long as the price does not fall below this upward channel in the short term, it indicates that investor sentiment has not shown a significant reversal, so the risk is controllable. In the coming week, indicators related to the job market will significantly impact cryptocurrency trends, especially next Friday's non-farm payroll data, which will bring great volatility to the market. If the employment data falls short of expectations, the probability of a rate cut by the Federal Reserve in September will greatly increase. If it exceeds expectations, it will indicate the resilience of the U.S. job market, and the pressure for a rate cut will be alleviated, possibly leading to further market pullbacks. In any case, the recent policy market reminds me of 2023, dominated by CPI-driven trends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。