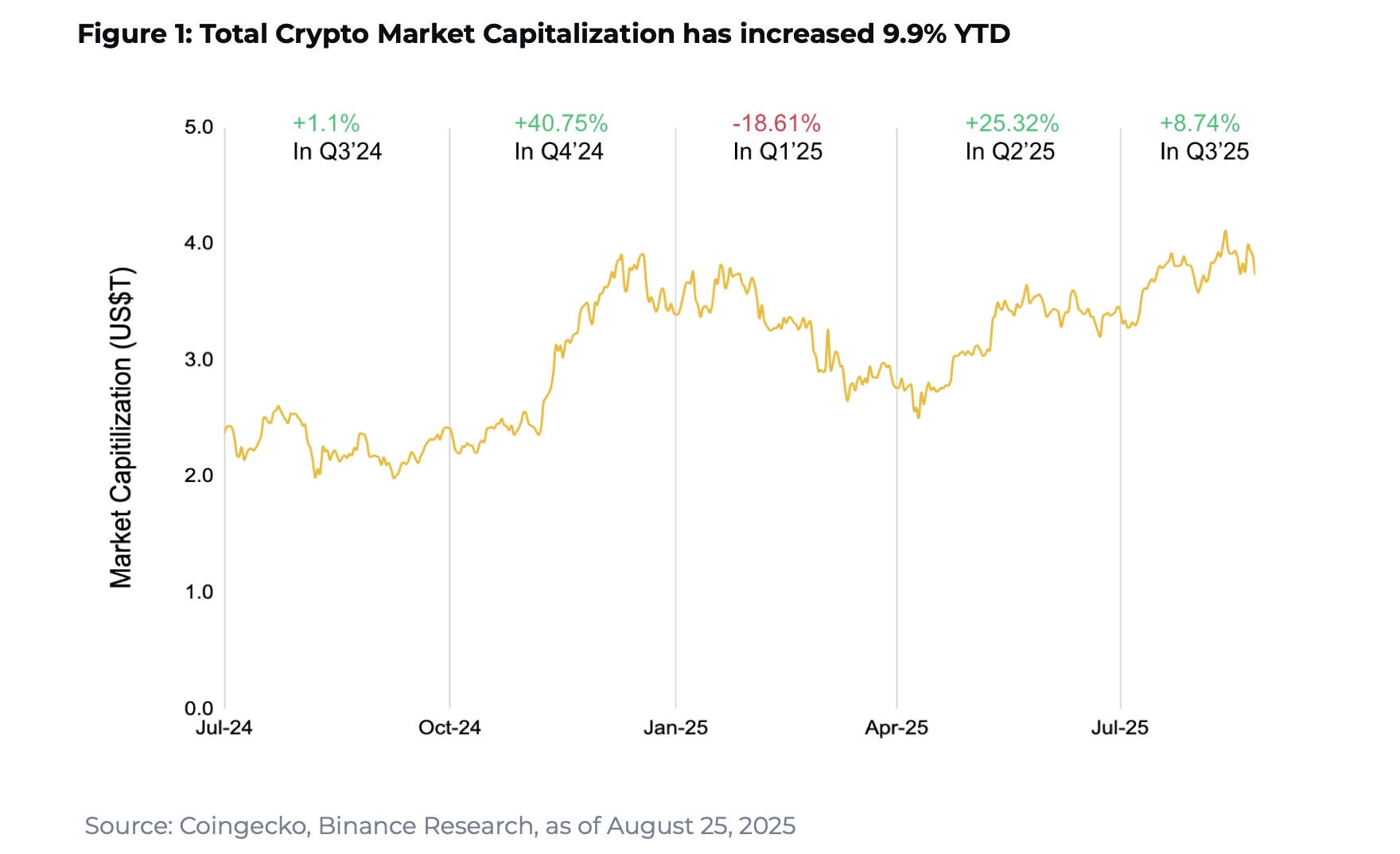

Total crypto market capitalization is up 9.9% year to date, adding more than $600 billion after weakness in the first quarter gave way to a second-quarter rebound and new highs into the third. The Binance Research report, shared with Bitcoin.com News, attributes the advance to a mix of policy clarity, growing institutional access, and stronger onchain activity across major sectors.

On the macro front, the report states that global M2 liquidity reaches a four-year high, marking the fastest six-month expansion since 2021. While monetary stances vary by region, the study notes that broader conditions remain supportive, with liquidity filtering into risk assets, including bitcoin and ether.

Spot exchange-traded funds are a central pillar of this cycle. Net inflows to U.S. spot bitcoin and ether exchange-traded funds (ETFs) exceed $28 billion in 2025, with cumulative holdings across spot BTC funds above 1.29 million coins since launch; Blackrock leads by assets under management, followed by Fidelity. The report adds that in-kind processes reduce frictions for large allocators, potentially making ETF flows stickier.

Stablecoin supply climbs more than 35% this year to roughly $277.8 billion, a series of new highs that the authors link to policy tailwinds and expanding uses beyond trading into payments and settlement. The paper highlights how rising stablecoin float often precedes greater market buying power.

Corporate treasuries continue to accumulate bitcoin. Public companies now hold about 1.07 million BTC—roughly 5.4% of the circulating supply—across 174 firms, with Strategy (formerly Microstrategy) accounting for about 59% of the total. The report also tracks a sharp monthly increase in public-company ether holdings alongside interest in staking.

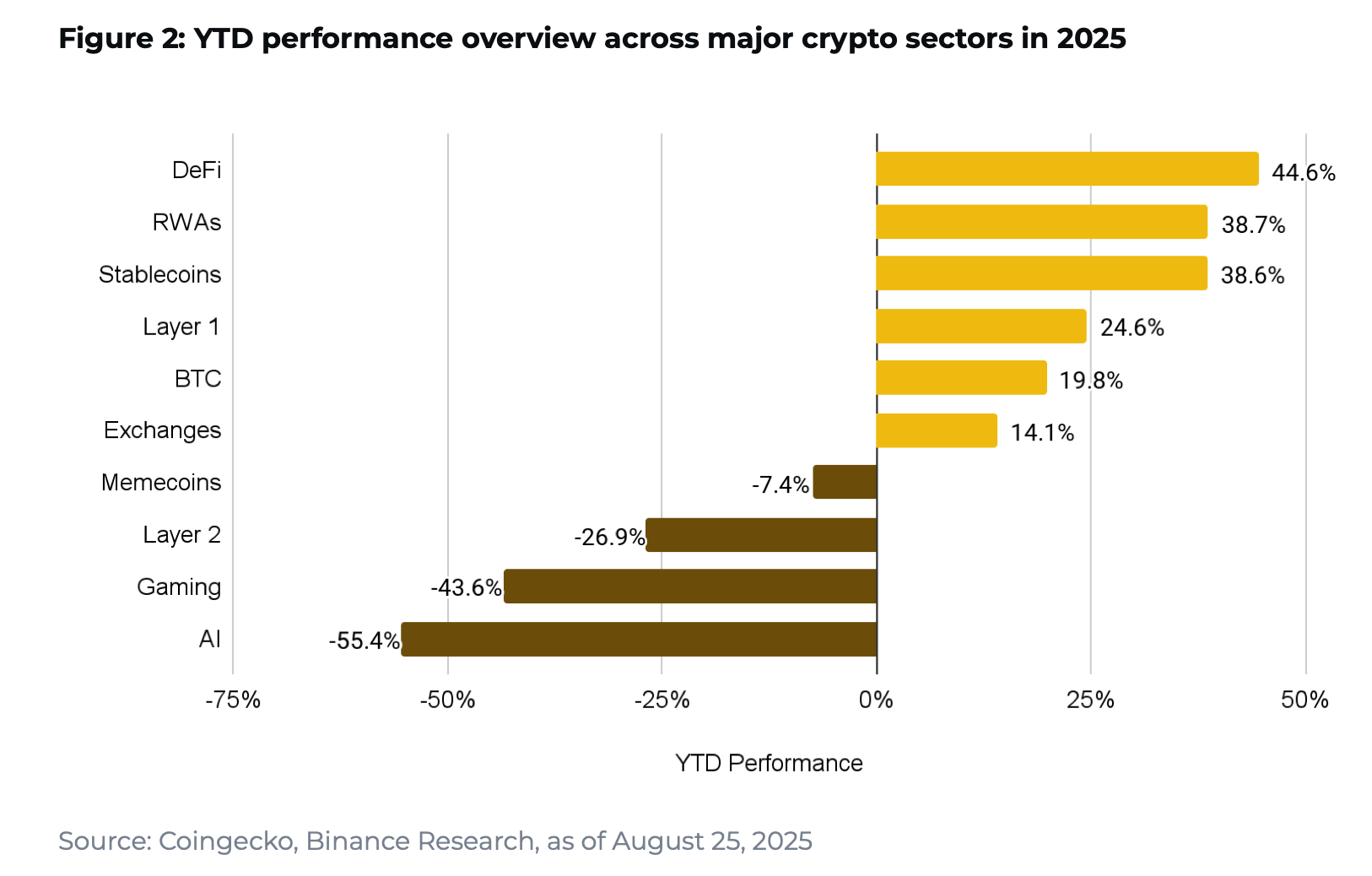

Market structure is shifting onchain. Decentralized exchange (dex) share peaks at 23.1% in spot trading and 9.3% in futures this year, while onchain lending total value locked reaches about $79.8 billion with higher utilization. Tokenized equities reach roughly $349 million in market value as issuers and venues expand.

The Binance Research analyst’s study frames these metrics as signposts for the next phase of 2025: easing bitcoin dominance from a midyear peak, deeper ETF participation, and growing decentralized finance (defi) activity—conditions that, together with elevated liquidity, set the stage for broader participation across major assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。