Recently, $BTC has dropped from a high of 124,000 to a low of 107,350, while $ETH has fallen from 4,956 to a low of 4,257. Moreover, there has been a situation where ETH rises while BTC not only fails to rise but also declines.

Everyone is asking: Has the bull market ended?

So, has the bull left? What stage is the market really in now?

Let’s listen to CG, the chief researcher at ABC Alpha, for a detailed interpretation. The original text is as follows:

https://x.com/Cyrus_G3/status/1962142565605740854

The crypto bull market can be roughly divided into three stages: early bull, mid-bull, and late bull

In the early bull stage, capital and market confidence have just begun to recover from the scars and painful memories of the previous bear market. Market risk appetite is low, and funds generally choose the most stable assets to try, which is BTC. Therefore, in every bull market, BTC rises first, while ETH and other altcoins (alternative coins) show relatively weak gains, and there are even instances where BTC rises alone while ETH and other altcoins decline. At this time, BTC's market dominance often rises to over 60%.

In the mid-bull stage, market confidence is largely restored, risk appetite increases, and funds begin to try relatively high-risk assets. This is specifically manifested by funds starting to flow from BTC to the altcoin leader—ETH, where ETH begins to show daily gains exceeding those of BTC, and there are even cases where ETH rises while BTC declines. However, the altcoin season has not yet arrived.

In the late bull stage, the market goes completely crazy, risk appetite reaches its peak, FOMO (fear of missing out) emotions are rampant, leverage is maxed out, and funds start rushing into extremely high-risk altcoins, with some completely fundamental-less shitcoins and memes experiencing multiple-fold daily surges. Everyone feels that this time is different. The altcoin season officially arrives. At this point, BTC and ETH also begin to reach historical highs.

Then, liquidity suddenly retreats at some peak, the market crashes, and once again enters a long bear market.

Therefore, the different stages of the bull market are driven by the evolution of capital's risk appetite, which is essentially driven by human fears and greed.

To see this fact more clearly, let’s review history:

2017 Early Bull (December 2016 - Q1 2017)

BTC soared from around $700 in December 2016 to about $1,300 in February 2017, essentially doubling. At this point, BTC officially emerged from the ruins of the previous bear market, marking the slow onset of a new bull market. During this period, ETH was still hovering around $15.

2017 Mid-Bull (March - September 2017)

Due to the ICO boom, funds flooded into ETH, which rose from $20 to $300, achieving over 15 times growth in 7 months; during this time, BTC rose from $1,300 to $4,000, achieving about 3 times growth in 7 months, with BTC's growth significantly lower than that of ETH. The above data also verifies the characteristic of the mid-bull market where "ETH's growth exceeds that of BTC."

However, at this time, the market had not yet entered the final stage, and neither BTC nor ETH had reached historical highs; the altcoin season had not officially arrived.

2017 Late Bull (October 2017 - January 2018)

After a brief adjustment due to the 94 policies, ICOs completely entered a frenzy mode in October, where a white paper could raise hundreds of millions of dollars, and altcoins were everywhere, entering the final crazy stage of the ICO bull market.

Around December 16, 2017, BTC reached a historical high of $19,600; one month later, ETH reached around $1,400 on January 20, 2018, and then the market experienced a cliff-like drop, ICOs cooled down, and a comprehensive crash occurred, marking the end of this bull market.

Now let’s look at the bull market of 2021.

In early 2020, the global economy was impacted by the COVID-19 pandemic. On March 15, 2020, the U.S. urgently launched a quantitative easing (QE) policy. Therefore, from March 2020 to March 2021, there was a brief policy-driven bull market. However, even this policy bull followed the early bull - mid-bull - late bull pattern. Let’s briefly review:

Policy Early Bull (March 2020 - June 2020)

As soon as the news of the quantitative easing policy was released on March 15, BTC immediately emerged from the two-year-long bear market of 2018-2019. BTC rose from $5,000 in March to $10,000 in August, achieving a 2-fold increase in 3 months; during this time, ETH was mainly around $200, slowly moving upwards.

Policy Mid-Bull (July 2020 - February 2021)

With the strengthening of the quantitative easing policy, the world began to flood with money, and banks entered an era of 0% or even negative interest rates, leading global funds to seek returns everywhere. At this time, the Ethereum ecosystem in the crypto market began the DeFi Summer craze, with various DeFi farming models emerging.

During this phase, ETH continued to soar, rising from $200 in July 2020 to $1,900 in February 2021, nearly a 10-fold increase; while during this phase, BTC rose from $10,000 to $39,000, less than 4 times, with BTC's growth lower than that of ETH, consistent with the characteristics of the mid-bull market.

Policy Late Bull (March 2021 - May 2021)

During this phase, in addition to the astonishingly high APY DeFi protocols, various meme assets completely driven by emotions began to flood the market, and funds entered the final frenzy mode.

Soon, around April 15, 2021, BTC reached $62,800 and began to decline; one month later, around May 14, 2021, ETH reached $3,900, and the market began to plummet, with various DeFi farming collapsing, memes crashing, and the market once again entering a downturn.

This round of the crypto bull market driven by quantitative easing policies came to an end, and the market continued to decline until the end of June 2021.

Following that, from July 2021 to December 2021, the crypto market entered the regular bull market cycle of 2021.

Due to the previous policy bull's influence, in July 2021, the prices of BTC and ETH were both higher than the previous bull market (2017) highs (BTC $30,000 > $19,000, ETH $1,900 > $1,400), thus, the early bull market of the 2021 crypto bull market had already been previewed in the previous months, allowing the crypto market to directly enter the mid-bull phase in July.

2021 Crypto Mid-Bull (July 2021 - Early September 2021)

ETH rose from $1,900 to $3,900, more than doubling, while during this time, BTC's price rose from $30,000 to $50,000, an increase of 1.6 times. BTC's growth was lower than that of ETH, fully consistent with the characteristics of the mid-phase of the crypto bull market.

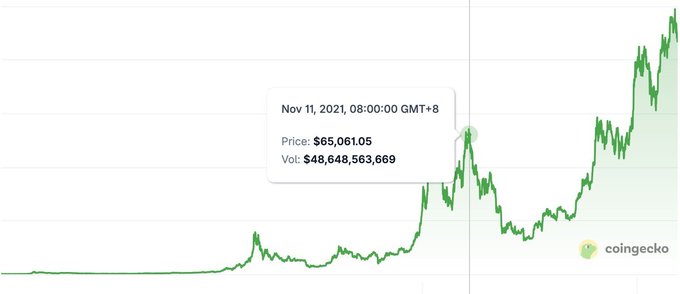

2021 Crypto Late Bull (September 2021 - November 2021)

During this phase, the crypto market saw a large number of derivative models of DeFi, such as GameFi and SocialFi, which were rough imitations of the DeFi model and also a residual heat of the DeFi craze. At the same time, a new wave of meme frenzy emerged again, with Shib experiencing a ten-thousand-fold increase in just three months from its birth at the end of August to November, and various animal memes flooding the market, leading to the final crazy stage.

On November 10, 2021, BTC surged to $69,000, reaching a historical high, and on the same day, ETH also reached a historical high of $4,878, then the market sharply declined, with GameFi and SocialFi narratives collapsing, and various memes crashing, leading the market into a slow bear phase once again.

So, what will the script of this bull market in 2025 look like? Will it be different from the previous two bull markets?

Current Stage (August 31, 2025) in the Crypto Bull Market

This bull market will indeed be different from the previous two. Because institutions have entered the market.

The entry of institutions will inject new and different forces into the crypto market. However, the fundamental rules of the three stages of a bull market will not change, because human nature does not change.

Let’s take a look:

From January to May 2024, due to the approval of BTC spot ETFs, the crypto market experienced a brief institutional bull.

On January 10, 2024, the BTC spot ETF was approved, and BTC rose from $39,000 at the beginning of January to $69,000 in May, reaching the high point of the previous bull market. During this period, ETH also rose, reaching a high of $4,000, but did not break the previous high. Subsequently, the market entered a three-month adjustment phase (May to August).

(Have you noticed that this institutional bull is very similar to the policy-driven bull from March 2020?)

From September to December 2024, with the official trading of ETH spot ETFs starting in July, more and more institutional funds entered the crypto market, especially with the announcement on November 6 that crypto-friendly Trump was officially running for president of the United States, which accelerated the influx of institutional power. Institutional forces began to take control of the crypto market.

During the period from September to December, BTC rose again from $53,000 to $109,000, doubling and breaking the $100,000 mark; ETH also broke through $4,000 from $2,100, but still did not break the previous high. During this time, a situation occurred that had never appeared in the previous two bull markets, where traditional altcoins remained stagnant while memes were rampant.

The core reason is that the crypto market has not seen a paradigm innovation similar to the ICOs of 2017 (which are essentially smart contract tokens) and the DeFi models of 2020; therefore, traditional altcoins did not take off. However, during this period, an alternative meme paradigm was born, namely the pump.fun paradigm.

Thus, from September to December 2024, there was a brief period where BTC rose, memes were rampant, and traditional altcoins were ignored, creating a barbell-style bull market. This phase was essentially still the institutional bull brought by the ETF.

After this bull market ended, many believed that this round of the bull market was over because BTC broke the previous high, and memes were rampant, resembling the late-stage market of the previous two bull markets.

As expected, starting in January 2025, with the Trump administration launching a tariff war and the Middle East war breaking out again, the market began to decline, with BTC dropping from a high of $109,000 to $75,000, a drop of 30%, and ETH falling from $4,000 to below $1,400, while memes plummeted, leading to widespread market despair.

Many people exclaimed that the bull market was over, and it indeed looked like it was over.

However, starting on April 9, 2025, BTC began to soar from $75,000, and by July 14, 2025, BTC broke through $120,000, reaching $123,000. At this time, ETH broke through $3,000 from $1,400.

A new round of the bull market was once again initiated, although it was still an institution-led bull market.

(At this point, we can see that the two phases from January to May 2024 and from September to December 2024 are indeed very similar to the policy-driven bull of 2020, both driven by strong forces outside of crypto.)

The period from April 9 to July 14, 2025, resembles the early phase of this crypto bull market, with BTC leading the rise and ETH following (still not breaking the previous high), while other altcoins remained almost inactive.

If we consider the period from April 9 to July 14 as the early phase of this bull market, then from July 14 to today (August 30), we are in the mid-bull phase.

The characteristics of the mid-bull phase are that ETH leads the rise, with ETH's growth exceeding that of BTC, and there are even instances where ETH rises while BTC falls.

The market from July 14 to August 30 has indeed shown this.

After ETH broke through $3,000 on July 14, it soared, while BTC appeared somewhat weak.

On August 9, ETH broke through $4,000, while BTC was at $118,000.

On August 24, ETH reached a historical high of $4,956, while BTC was at $116,000.

On August 31, ETH was at $4,450 and BTC at $108,500.

We have indeed seen that ETH's growth exceeded that of BTC, and there were instances where ETH rose while BTC fell, while altcoins still did not explode. This is indeed a typical characteristic of the mid-bull phase.

Therefore, I believe that we are currently in the mid-bull phase.

So, how long will this mid-bull phase last?

The mid-bull phases of the 2017 bull market lasted for 6 months; the mid-bull phases of the 2020 policy bull lasted for 5 months; and the mid-bull phases of the 2021 bull market lasted for 3 months.

Conservatively, assuming that this mid-bull phase lasts for 2-3 months, then the mid-bull phase that started in mid-July will likely continue until mid-September to mid-October. During this period, ETH will continue to lead the rise, while BTC's growth will remain lower than that of ETH.

If the mid-bull phase lasts until late September to late October, then starting in October until December, altcoins will explode, and various memes will flood the market, leading the bull market into a completely crazy late phase.

Of course, in this late phase, we may see another type of altcoin season—altcoin ETFs and altcoins led by institutions and listed companies. During this period, BTC and ETH will also reach new highs.

Finally, at the most frenzied moment in the market, it will suddenly come to a halt, and then enter the next cycle.

Summary

The bull market is divided into three stages: early bull, mid-bull, and late bull, driven by the evolution of capital's risk appetite from low to medium to high, fundamentally governed by human fears and greed.

- Early Bull: BTC leads the rise, ETH rises slightly, and altcoins remain stagnant.

- Mid-Bull: ETH leads the rise, BTC follows, and there are even instances where ETH rises while BTC falls, with altcoins slightly moving.

- Late Bull: Altcoin season explodes, memes are rampant, BTC and ETH reach new highs again, and then the market crashes.

The 2017 bull market and the 2021 bull market have basically verified these rules, and the 2025 bull market will also follow these rules.

Although the entry of institutions has brought new forces to the crypto bull market, the essence of the bull-bear transition will not change, because human nature does not change.

Given that currently, ETH is leading the rise, with ETH's growth exceeding that of BTC, and there are even instances where ETH rises while BTC falls, and the altcoin season has not yet arrived; therefore, the market is currently in the mid-phase of the 2025 crypto bull market, likely lasting until the end of September or October. Then from October to December, it will enter the late phase, with altcoins exploding, memes rampant, and then the market will once again enter the next cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。