Author: Luke, Mars Finance

Introduction: On the night of September 1, 2025, the eyes of the crypto world will focus on a code—WFLI. However, this is far from just another new coin launch celebration. When the name of the Trump family is deeply tied to a governance token that may "never be tradable," and ultimately heads towards global mainstream exchanges, we may witness a significant watershed moment in the evolution of the crypto industry. It forces us to ponder a deeper question: is this the ultimate form of the "Political Finance (PoliFi)" narrative, or is it a strategic "alignment" of the digital world, born from cypherpunk idealism, with real-world power?

From Symbol to Asset: A Carefully Crafted Narrative Evolution

The story begins intriguingly. World Liberty Financial (WLFI) left a thought-provoking remark in its early "Golden Book," suggesting that its token might forever remain a non-transferable governance symbol. This was interpreted at the time as a clever stance, both consolidating the identity of its supporters and distancing itself from direct financial speculation. However, with members of the Trump family—Eric, Donald Jr., and Barron—taking the stage as "Web3 ambassadors," and the project raising an astonishing $550 million through two rounds of sales, the weight of this "symbol" has long surpassed its symbolic meaning.

Tonight's unlocking is a key turning point as this grand narrative shifts from the first act to the second. WFLI has completed a daring leap from "political totem" to "tradable asset." This transformation is not coincidental but a carefully orchestrated evolution. It clearly indicates that WFLI's ambitions extend far beyond being a voting tool; it aims to build a financial ecosystem deeply embedded in the crypto economy, with Trump IP as its gravitational core.

The brilliance of this evolution lies in its unprecedented fusion of the two most familiar successful paradigms in the crypto world.

First is the cultural appeal of meme coins. Last year, the community-driven meme coin $TRUMP, with almost no utility, saw its fully diluted valuation (FDV) reach a staggering $73 billion, driven solely by market sentiment and cultural symbolism. It proved the immense traffic value of the Trump name in the crypto world.

WFLI, on the other hand, is the "official certified version" of this value. It is no longer a grassroots emotional celebration but a top-down strategic deployment. As Dennis Liu, a partner at Momentum 6, stated, WFLI "not only has official recognition but is also linked to U.S. Treasury bonds," greatly enhancing its credibility and potential ceiling. WFLI absorbs the spiritual core of meme coins but wraps it in a hard shell composed of institutions, stablecoins, and real companies.

PoliFi 2.0: When "Guerrillas" Meet "Regular Troops"

If meme coins like $TRUMP are the "guerrillas" of the PoliFi 1.0 era, stirring market sentiment with flexible, grassroots power, then WFLI resembles the "regular troops" of the PoliFi 2.0 era. Its emergence is setting a new, much higher threshold for the "Political Finance" sector.

The core of PoliFi lies in the direct linkage between political influence and financial assets. In the 1.0 era, this linkage was loose and emotional, with prices fluctuating wildly around news, tweets, and polls. WFLI represents PoliFi 2.0, a structured and capitalized new paradigm. Its armament is no longer hollow slogans but a luxurious lineup composed of real money and top industry resources. Looking at WFLI's investor list, we see not the frenzy of retail investors but the calm calculations of institutions:

DWF Labs, a crypto investment and market-making institution known for its shrewdness, invested $25 million.

The Web3 native fund Aqua1 Fund even announced a strategic purchase of $100 million in WFLI in June.

Additionally, Nasdaq-listed company ALT5 Sigma is also involved, with its CIO Matthew Morgan serving as an advisor to WFLI.

These names represent a consensus reached between the "old money" and "new elites" of the crypto world. They are investing not just in a token but in the potential of combining with powerful real-world influence. This combination has given WFLI a resource network that other projects find hard to match from the very beginning. It is not fighting alone but, in the posture of a "leader," rapidly building a vast ecosystem. From paving the way for RWA narratives with Ondo Finance and Plume Network, to stablecoin players like Ethena and Lista DAO, and core DeFi protocols on the Solana chain like Raydium and Kamino. WFLI uses its stablecoin USD1 as a hub, radiating its liquidity and influence to all corners of the crypto world. This approach clearly indicates that it aims to be not a short-term speculative target but a long-term financial infrastructure.

A Strategic "Alignment" in the Crypto Industry

This leads to a core question: when the top capital, technology, and talent in the crypto world begin to build around a political symbol on such a large scale, what signal does this send?

Rather than viewing WFLI as the Trump family's industry reaching out to Washington, it is better understood as a strategic investment and alliance by key participants in the crypto industry through WFLI as a vehicle, aligning with specific political forces.

This is no longer a revolution about code but a convergence of capital. The crypto world was born from distrust of traditional centralized financial systems, with its spiritual core being decentralization and resistance to censorship. However, as the industry grows larger, it increasingly cannot avoid collisions with the real world. From Wall Street giants like BlackRock issuing Bitcoin ETFs to tightening regulatory policies in various countries, all signal an irreversible trend: the crypto industry is being integrated into the global financial and power landscape.

In this process, rather than passively waiting in the complex lobbying of Washington, it is better to actively seek strong "allies." The emergence of WFLI provides a perfect example for such alliances. For crypto capital seeking certainty amid regulatory fog, supporting WFLI, in a sense, is a clear "alignment." It is as if to say: we can not only create technology and wealth, but we also understand and respect the power games of the real world, and we are willing to become players in it with our capital. When Sun Yuchen's TRON DAO became one of its largest independent investors with $30 million, and when DWF Labs included it in their portfolio, their decisions had long transcended mere technical or financial analysis, reflecting a judgment on future political trends and power dynamics.

The Direction of the Tide and Future Speculations

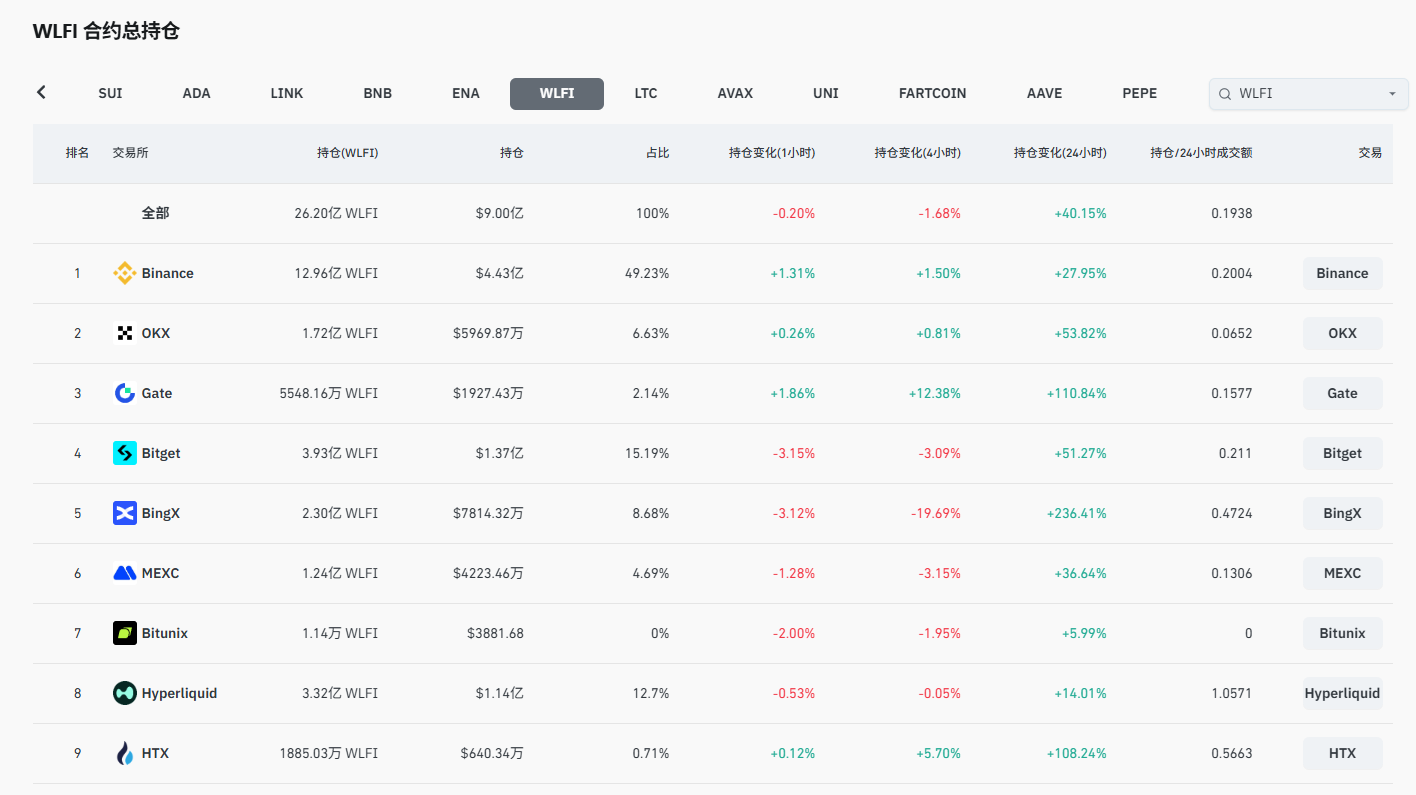

Tonight's launch coincides with a subtle moment. According to CoinGecko data, on the eve of the listing, the crypto market saw a widespread decline, with a total market cap evaporating by 1.5% within 24 hours. However, the market's coolness did not deter capital inflow. Coinglass data shows that the total contract holdings for WLFI have surged to $900 million, with a nearly 50% increase in 24 hours. The intertwining of ice and fire suggests a highly volatile start.

Market expectations have also shown an interesting divergence. In a Discord group with over a million WLFI holders, many small-scale investors view $0.47 as a key selling point; meanwhile, large holders have a longer-term target, generally looking above $1. This divergence is evident in every individual, with holder Bruno Ver stating that he plans to sell 10% of his position after trading starts, predicting a price range of $0.35 to $0.50. "I've already told my wife that we're going on a cruise in September," he admitted.

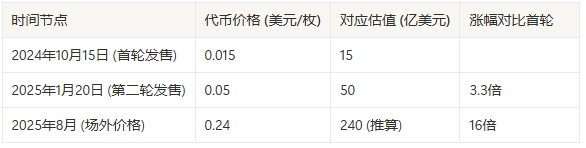

From Bruno Ver's cruise vacation to the long-term visions of large holders, and the continuously rising contract data, they collectively form a complex picture on the eve of WFLI's launch. The following valuation evolution chart clearly shows the upward trajectory of market expectations.

This chart represents not just price growth but a process of a narrative being continuously accepted and amplified by the market. The leap in valuation from $1.5 billion to $24 billion reflects capital's recognition of the power of the "Trump + crypto" combination.

However, regardless of how tonight's price unfolds, it is merely the beginning of this grand experiment. The true test for WFLI does not come from the initial hours of K-line after the exchange opens, but from whether it can genuinely deliver on its narrative—successfully transforming a massive political IP into a sustainable, scalable, and widely adopted decentralized financial ecosystem.

This is not just a test for the WFLI project but the ultimate test for the entire PoliFi sector. It will answer a long-standing question troubling the industry: is cryptocurrency a tool for disrupting real-world power, or does it ultimately become a new lever for real power to consolidate its influence?

Tonight, there are no answers, only the prologue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。