In just 3 hours, the subscription amount exceeded 53 million USD, and within 30 hours, it surpassed 100 million USD, ultimately reaching over 250 million USD! The Creditlink project is continuously breaking financing records on the new Binance Smart Chain! In fact, just the subscription amount exceeding 250 million makes Creditlink the hottest project of the year. However, it was unexpected that the financing amount set by the project team was only 600,000 USD, and it was to launch at a mere 4 million USD ultra-low market cap; this operation is truly shocking!

$CDL Presale

Creditlink ($CDL) is the fourth project launched by Four.meme for its TGE. The presale lasts for 72 hours, and users can participate using USD1 and FORM. After the presale started, within just 3 hours, $CDL raised over 53 million USD1, and within 30 hours, it broke 100 million. This not only reflects the market's high recognition of its on-chain credit system but also highlights its scarce value in the current track.

The funds raised in this presale are mainly in USD1. Fourmeme tweeted to thank WLFI for their support of this presale, and WLFI's official account retweeted this tweet, confirming the collaboration. Subsequently, the official BNBChain account retweeted the tweet about $CDL's funding exceeding 100 million, also expressing support.

However, the most criticized aspect of this presale is that the project team did not disclose the presale price and financing target, making it difficult for everyone to judge how much they could actually obtain and the potential appreciation of the tokens. Fortunately, this information was disclosed promptly after the presale ended, and the disclosed price was indeed enticing.

Project Market Positioning and Product Highlights

Creditlink is building a new generation of AI-driven on-chain credit and reputation infrastructure, aiming to bring true identity and trust to the Web3 world.

In today's rapidly developing decentralized finance and applications, wallets have become users' digital avatars on the blockchain, but the lack of a unified and trustworthy credit system still leaves scenarios like DeFi, DAO, and airdrop distribution facing issues such as over-collateralization, witch attacks, and inefficiency.

Creditlink's vision is to ensure that every on-chain address possesses verifiable and transferable credit value. By aggregating multi-chain data and introducing AI behavioral analysis and dynamic scoring models, Creditlink transforms users' on-chain assets, interaction behaviors, and risk factors into clear credit profiles, releasing value through various means such as credit NFTs, queryable credit reports, and API interfaces.

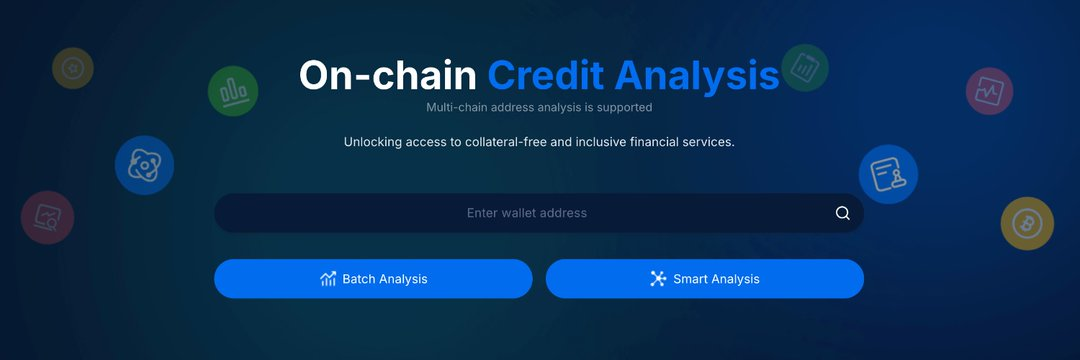

Currently, Creditlink has launched its Beta product, offering two core functions:

Smart Analysis — A multi-dimensional credit report for individual users, covering asset structure, DeFi participation, contract interactions, potential risks, and "hidden asset" discovery;

Batch Analysis — A batch address analysis tool for project teams, allowing the filtering of thousands of addresses at once, accurately identifying witch addresses and locking in high-value wallets, supporting precise airdrops, community operations, and risk control.

In addition, the official has previewed a new product: Token Analysis, aimed at helping project teams analyze contract health.

These modules will bring new application scenarios to Web3, including unsecured lending, credit-weighted DAO governance, fair and efficient airdrop distribution, reputation systems for Web3 social interactions, and even insurance, bonds, and financial derivatives based on credit.

Creditlink believes that on-chain behavior is the future of credit assets. By creating an open, transparent, and programmable credit infrastructure, it aims to shift decentralized finance from over-collateralization to credit-driven models, allowing every real user to gain fairer financial opportunities.

Unlocking Trust in Web3 is Creditlink's mission.

Creditlink TGE Information

● Token Name: CDL (Creditlink Token)

● Total Supply: 1 billion

● Pre-sale Total: 150 million (15%)

● Liquidity: 50 million (5%)

● Valuation (FDV): 4 million USD

● Token Price: 0.004 USDT / CDL

● Financing Target: 600,000 USD (soft cap)

● Presale Period: August 28–31, 2025

● Single User Purchase Limit:

○ USD1: 50–4000

○ FORM: 10–1000

The highlights are clear; Creditlink starts with a 4 million USD FDV, which is extremely low. This means the initial market cap is small, and the price can easily be driven by community funds.

Creditlink VS Previous Four.meme Projects

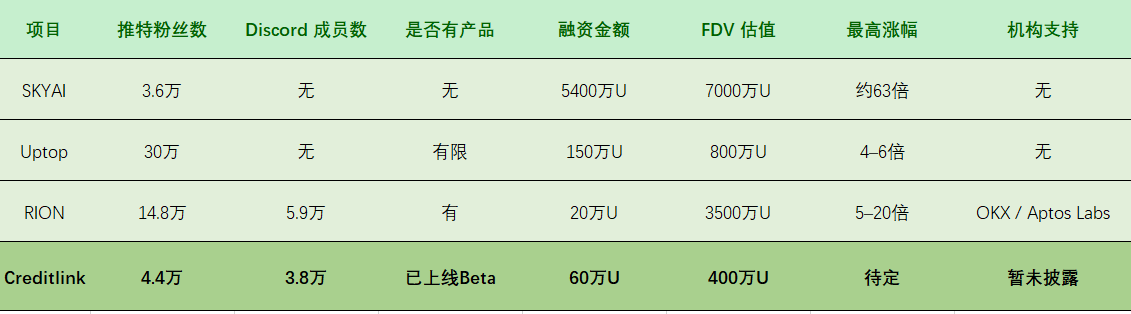

To provide a clearer comparison, let's compare Creditlink with several previous popular TGE projects:

In comparison, several points stand out:

1. Low Valuation

In today's Web3, most projects' TGE valuations start in the millions, with many even reaching hundreds of millions or billions in FDV, leaving little room for appreciation for holders.

Creditlink's FDV starts at only 4 million, significantly lower than the market average and previous Four.meme TGE projects like UPTON, RION, and SKYAI, resulting in less initial pressure.

2. Real and Usable Products

Many projects that only rely on marketing for TGE lack product delivery or have low-quality deliveries. In contrast, while SKYAI had no product at launch and UPTON had limited products, Creditlink already has tools running and supports multi-chain queries. According to the latest data disclosed by the official team, Creditlink App's user base has surpassed 270,000, which is a commendable achievement for a 3-month-old project.

3. Reasonable Financing

Compared to projects that often raise millions or tens of millions of USD, Creditlink only raises 600,000 USD, resulting in light circulation market cap pressure, avoiding situations where the market cap is too heavy and funds cannot be driven.

This also indirectly indicates that the project team is not in a hurry to obtain funds from the presale, showcasing the team's vision and strength.

Potential Estimation: Possible Multiples Range

Referring to Four.meme's historical data:

If it replicates Uptop's trend (4–6 times), CDL is expected to rise from 0.004 to 0.02–0.025 USDT;

If it follows a trend similar to RION (around 10 times), the price could reach approximately 0.04 USDT;

If market sentiment is as crazy as SKYAI (60 times), CDL could even hit 0.24 USDT.

Of course, the market conditions ultimately depend on market funds and community sentiment, but under the current conditions, a 10x potential is a reasonable expectation, with 20x or more depending on market atmosphere.

In Conclusion

Overall, Creditlink is a project with solid products, real market demand, and significant market potential. Currently, the community has only 40,000 followers, but the activity level is particularly high, with real data on both Twitter and Discord. Although no institutional endorsements have been announced yet, from the project's perspective, the team itself is not short of funds, which is why they chose to raise only 600,000 USD and launch at a 4 million USD ultra-low market cap, providing the community with investment opportunities.

It is believed that the project team aims to build long-term, and we look forward to the future products creating more value for the development of the DeFi ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。