Original | Odaily Planet Daily (@OdailyChina)

Yesterday, the market's attention was entirely focused on the WLFI TGE, which took place around 20:00 Beijing time. Some were waiting for the token unlock, others were engaged in long and short battles, while the rest hurried to buy and grab their friends' red envelopes, creating a bustling scene of prosperity.

Before the WLFI launch, there was a small incident. The market initially estimated the WLFI initial circulation to be 5 billion tokens or even lower, but after some debate, the makeshift WLFI team finally calculated the actual initial circulating supply to be approximately 24,669,070,265 tokens. The unexpected additional 19 billion circulating tokens caused WLFI to stumble before trading began, with the price dropping from $0.35 to below $0.30.

However, the FUD did not last long. After WLFI went live at 20:00, the on-chain price reached $0.45812, and after opening on Gate, it peaked at $1.1. An hour later, it hit $0.478 on Binance, with little price difference compared to other earlier opening CEXs. Based on the presale costs, the first and second rounds of public offerings achieved over 30 times and 9 times returns on investment, respectively.

So specifically, who is the MVP of this game? Let's conduct a simple "post-war settlement."

Trump Family Accepts $5 Billion in Paper Wealth

If the Trump family claims they earned little, no one would dare to say they earned much. According to the Wall Street Journal, the Trump family accumulated as much as $5 billion in paper wealth after the WLFI launch, likely marking the biggest financial success for the family since Trump's presidency. Currently, the Trump family holds about a quarter of the WLFI tokens. Previously, the White House disclosed in Trump's 2025 financial status document that he personally holds 15.75% of the total supply, or 15.75 billion WLFI tokens, in his crypto wallet.

Even at the current WLFI market price, the WLFI tokens held by Trump are worth over $3.62 billion. Although World Liberty Financial stated that the tokens held by the founder and team members are locked, it is unlikely anyone believes they haven't monetized through other means, such as dumping via the coin stock company Alt 5 Sigma Corporation. (Odaily Note: Previously, ALT 5 announced it would issue 200 million new shares, half of which would be directly used for token swaps with the WLFI project party.)

The Trump family is undoubtedly the MVP of this game. Earlier, the Financial Times estimated that the Trump family profited at least $350 million from TRUMP sales and market-making, and now with the WLFI launch, they directly accept about $5 billion. WLFI has likely become the Trump family's most valuable asset, surpassing their decades-long real estate portfolio.

Justin Sun Unlocks 600 Million WLFI, Not Selling

Justin Sun was once considered one of the largest individual holders of WLFI. According to public information, he holds a total of 3 billion WLFI, accounting for 3% of the total supply. According to Arkham monitoring, Sun received 600 million WLFI yesterday, currently valued at $138 million, but he stated in a post that he will not sell WLFI in the short term and will focus on increasing the total circulation of USD1 on TRON to 200 million.

Sun's decision not to sell is not surprising, as his purchase of WLFI was essentially a "political donation" to maintain a close relationship with the Trump family, ensuring his own "safety" and paving the way for future TRON or Huobi expansion into the U.S. market. Therefore, his gains are likely not directly derived from cash returns on investing in WLFI, but rather from the complex resource exchanges behind it.

On-Chain Whales' "Harvesting Moment"

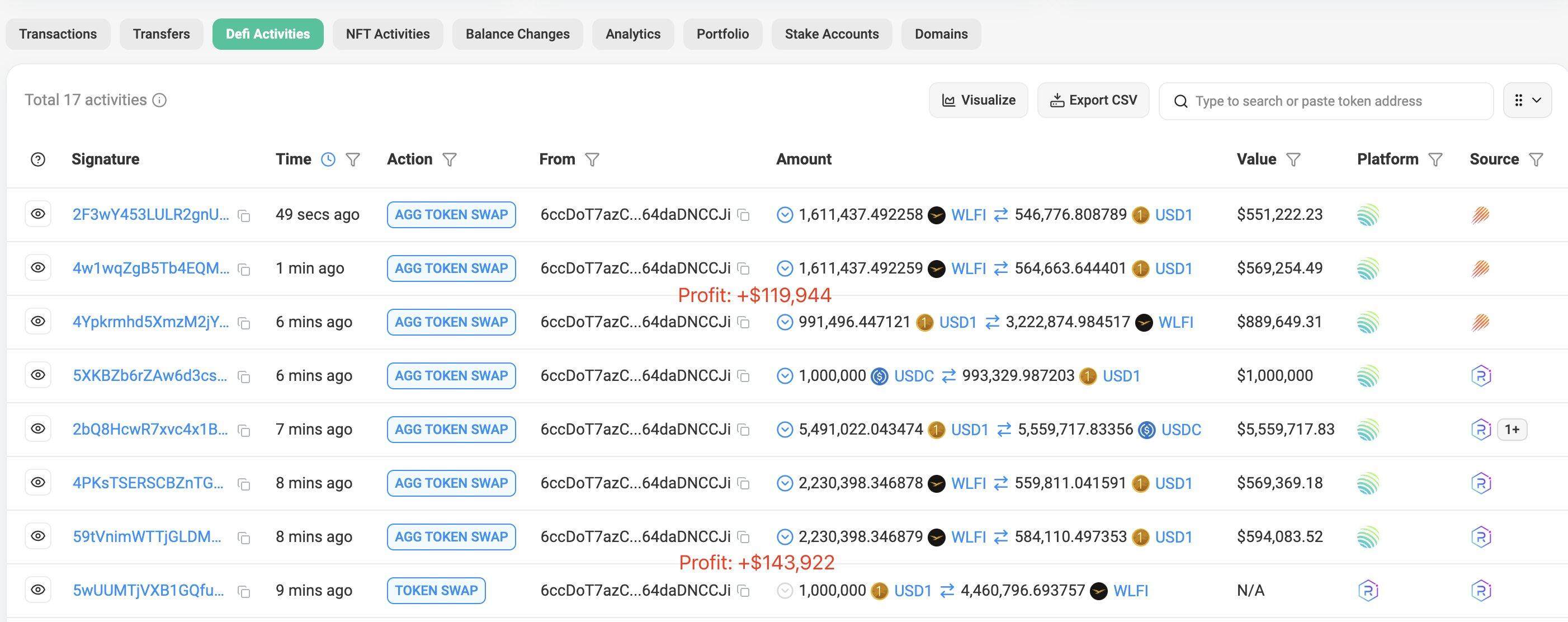

Compared to strategic players like the Trump family and Justin Sun, on-chain whales played the role of "wild players" in this game. Some profited from trading, while others chose to sell tokens directly, all achieving considerable gains. A smart money address starting with 6ccDoT earned a profit of $263,866 within 10 minutes of WLFI's launch through trading.

Faced with over 30 times returns on investment, many whales participating in the public offering chose to sell WLFI despite the high on-chain gas fees (Ethereum gas fees once soared to 129.327 Gwei). According to Lookonchain monitoring, when Binance opened WLFI deposits, three WLFI presale participants transferred a total of 160 million tokens to Binance.

At the same time, WLFI investor moonmanifest sold 10 million WLFI this morning after receiving 200 million WLFI from the unlock last night (having subscribed for 1 billion WLFI in the first round of public offering with 15 million USDC at a price of $0.015), recouping $2.1 million. Perhaps this whale still has confidence in WLFI's future performance. This morning, according to official news, a new governance proposal for WLFI has been launched, planning to use all fees earned from the protocol's liquidity (POL) for repurchasing and burning WLFI, thereby reducing the token circulation. If the token buyback plan is approved, it may boost WLFI's price.

However, other whales were not as patient as moonmanifest. According to on-chain analyst Ai Yi monitoring, half an hour after the TGE, four of the top 10 individual WLFI holders (TOP 6/7/8/10) chose to sell part or all of their holdings, and this morning, 80% of holders opted to take partial or full profits, with only TOP 2 & 5 not transferring or selling any tokens. TOP 6 holder convexcuck.eth chose to sell $3.8 million worth of WLFI to 36 buyers through the over-the-counter trading platform Whales Market.

Stablecoin Protocol Falcon Finance Provides Exit Channels for Big Players?

But big players may not need to worry too much about exit liquidity issues. Last night, DWF Labs partner Andrei Grachev announced that their stablecoin protocol Falcon Finance will support WLFI as collateral. Within this protocol, users can use WLFI as collateral to mint USDf. If choosing the classic minting model, 100 million WLFI (valued at approximately $27.9 million) can mint 19.81 million USDf.

This can almost be seen as a guaranteed exit channel for big players, because if WLFI continues to decline, the minter can choose to take away 19.81 million USDf. If WLFI's price holds, they can continue to maintain their collateral position.

“100 million WLFI may sell well in the market, but here you can directly mint 20 million stablecoins, which means you can run away with $0.2, this is a disguised liquidity exit channel,” my colleague, Odaily senior DeFi player Azuma pointed out incisively.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。