There is a market where there is demand.

Written by: Umbrella & David, Deep Tide TechFlow

On September 1, as the market's attention and liquidity were focused on Trump's $WLFI, the well-known on-chain detective @ZachXBT began to expose new information.

He revealed a list of paid promotions by overseas KOLs, documenting the paid promotion activities of several English-speaking KOLs on the X platform for crypto projects. The accounts involved were numerous, with total payments exceeding one million dollars; the price for a single tweet ranged from $1,500 to $60,000, depending on the KOL's influence.

ZachXBT pointed out that among the KOLs on this list, fewer than five accounts labeled their promotional posts as "advertisement," which means that the vast majority of KOLs did not disclose whether their posts were paid promotions or purely spontaneous shares.

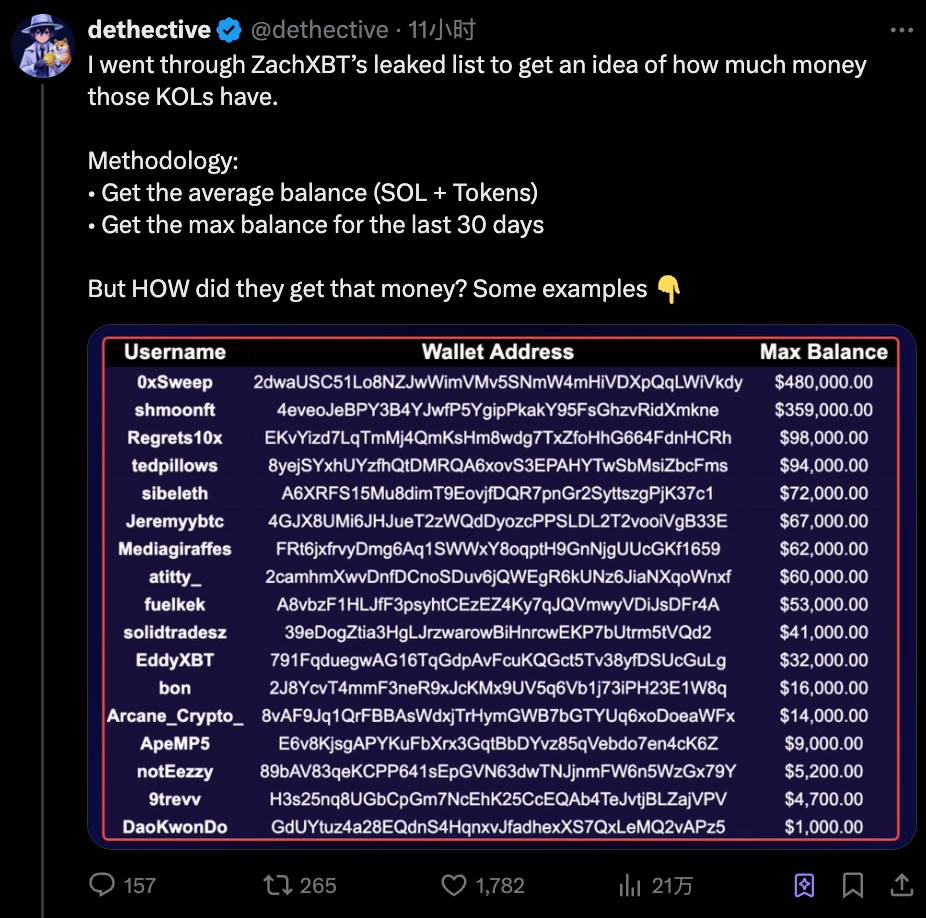

Subsequently, another detective @dethective conducted further analysis and organization of this original list, discovering that these overseas KOLs had even more creative ways of engaging in paid promotions.

One person, multiple accounts, earning double from the project party

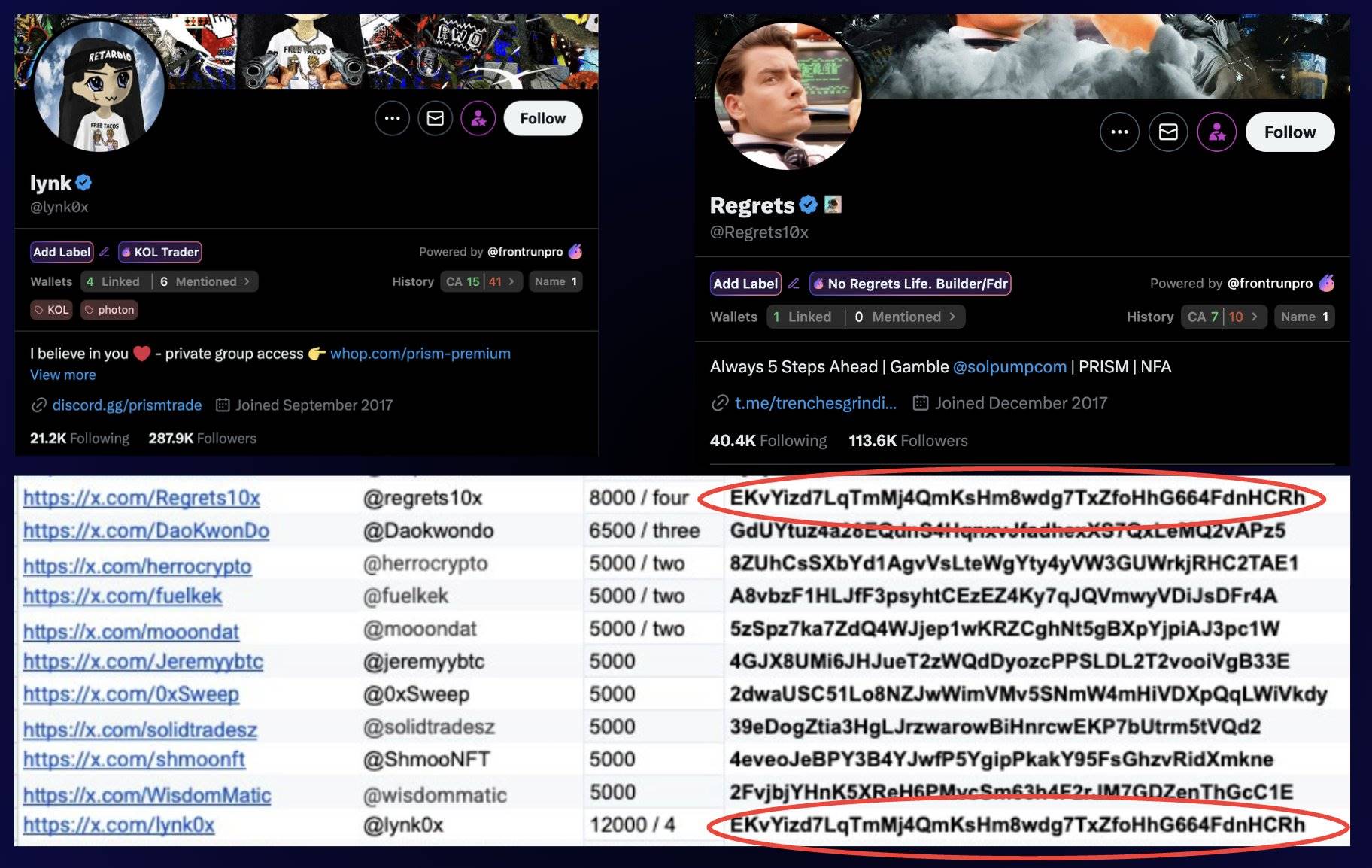

In @dethective's analysis, the first issue that stood out was that some wallet addresses appeared multiple times on the list.

This means that the same wallet could correspond to multiple KOL accounts, yet received promotion fees for the same project multiple times.

Taking the accounts @Regrets10x and @lynk0x as examples. The list shows that the former received $8,000 for four posts, while the latter received $12,000 for the same number of posts, likely due to the different follower counts of the two accounts.

However, their wallet addresses are identical:

EKvYizd7LqTmMj4QqmKsHm8wdg7TXzFoHHg664FdnhCRh

After cross-referencing, blogger @dethective found that there were about 10 similar cases of repeated wallets throughout the entire list.

One possible reason is that some overseas KOLs, in order to expand their influence, use secondary or associated accounts for promotions without changing their wallet addresses, leading to exposed traces;

But on deeper reflection, not changing wallet addresses, whether out of laziness or negligence, actually reflects a situation of cluster hype, where multiple accounts posting about the same project can more easily occupy social media timelines and attention, thus triggering FOMO among fans.

Of course, the two KOLs exposed were not idle either.

@lynk0x denied receiving any money in the comments, stating that @Regrets10x was just a friend and that sharing a wallet was purely coincidental. However, @dethective quickly presented evidence:

The aforementioned wallet received $60,000 from an airdrop from a project called "Boop," and to claim the airdrop, one must bind their X account. This indirectly proves the control relationship between the account and the wallet, making the denial somewhat untenable.

@Regrets10x's response was more casual; he did not directly address the accusations but stated that as long as he disclosed the paid promotion when posting, there was no problem;

Accepting paid promotions is understandable, and appropriate disclosure helps others understand the motives and interests behind the posts. Some more professional KOLs often add a note like "related interests" or "no related interests" at the end of a post.

But the problem lies in the fact that if two accounts belong to the same person, and the same promotional content is posted, one account openly reminds that it is an advertisement while the other remains silent, it resembles a strategy for creating a persona through an account matrix.

Moreover, some have turned the practice of mass account promotions into an industrial chain.

Previously, the research organization DFRLab published a study titled “Anatomy of a Twitter-Augmented Crypto Scam”, which mentioned that certain gray market operations could control dozens of accounts, posting nearly 300 tweets daily, creating false public recognition through mass account nurturing, automated retweets and replies, and cross-endorsement.

Operators typically acquire old accounts or register new ones in bulk, change the nickname and avatar, and become a brand new KOL, then use scripts to copy the same promotional language into the comments of high-traffic tweets to "attract followers."

“To The Moon”

After the list was exposed, another noteworthy point is that the profits from these overseas KOLs' wallets often highly overlap with the tokens they promote.

In other words, they are not casually posting to share "insights," but rather have received tasks, promoting the posts and then trading themselves.

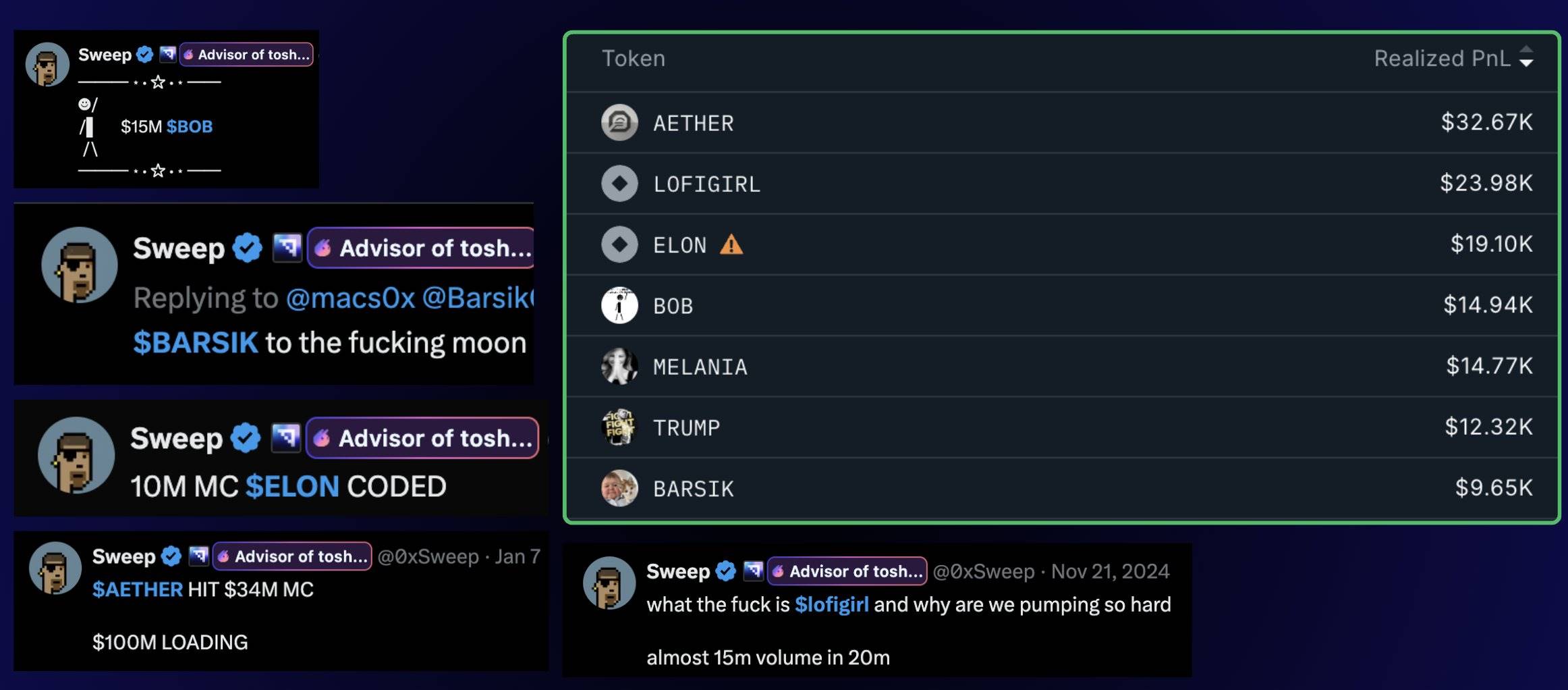

For example, the account @0xSweep, in @dethective's wallet analysis, shows that his largest profit sources are several tokens on the BullX trading platform: $AETHER, $BOB, $BARSIK, etc.

However, the backstory is that these tokens all have paid promotion records on the list exposed by ZachXBT; and @0xSweep's X posts repeatedly mention them, believing they have great potential and are "to the moon."

But his wallet records show that these profitable trades occurred just before and after the promotions, likely indicating that the project party paid him to post, and after he posted, the token gained popularity, allowing him to trade as well.

This also means that if an account keeps telling you about their trading insights, their income may not come from trading and market judgment.

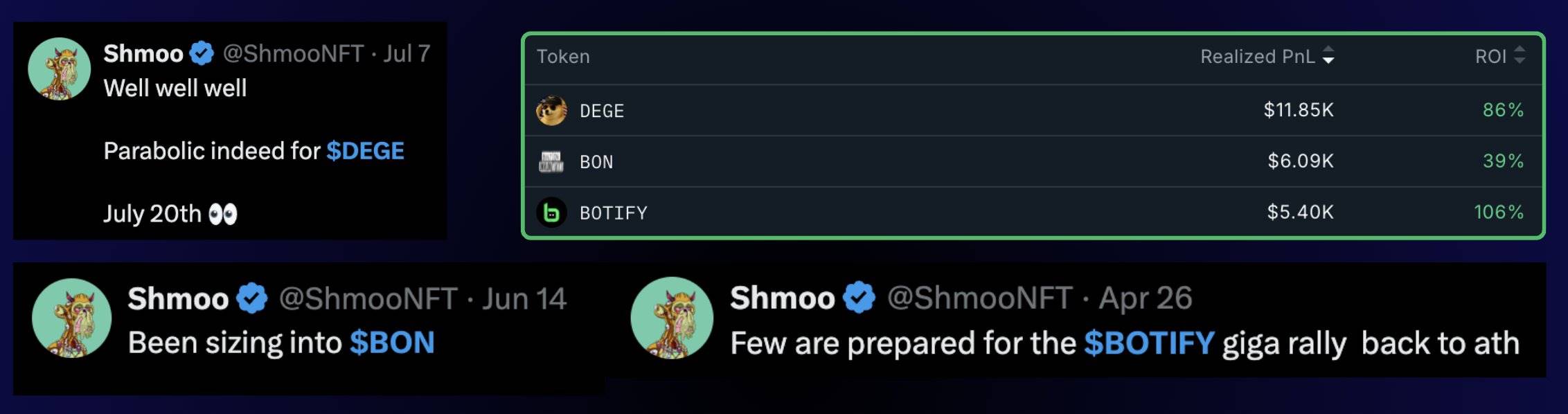

A similar situation exists with @ShmooNFT. His Telegram channel promotes about 10 tokens daily, seemingly enthusiastic in sharing.

However, wallet tracking shows that his few profitable trades, such as $DEGE, $BON, $BOTIFY, have all been promoted on X and appeared on the earlier list exposed by ZachXBT.

The core issue with this model is that the KOL's "advice" carries hidden interests: promotional posts not labeled as advertisements lead fans to believe they are genuine recommendations, when in fact they are paid collaborations.

If the tokens indeed have potential, it can be a win-win situation, but if the promoted tokens continuously drop to zero, the KOL's credibility and influence will also decline.

The cleverness of this scheme lies in the fact that these overseas KOLs may earn threefold.

First, they obtain free tokens through airdrops, then charge the project party for promotion fees, and finally sell the airdropped tokens after inflating the price through promotions.

And a common advanced tactic: after showcasing their profits to build an image of a "trading god," they establish paid groups to collect "membership fees."

There is a market where there is demand

At the end of the analysis post, @dethective also posed a thought-provoking question:

Why do some project parties still choose these accounts despite knowing the habits and tricks of certain overseas KOLs?

The answer is that there is a market where there is demand.

Some projects prefer this audience that "wants to get rich quickly," and some accounts mentioned in the earlier exposé perfectly attract this audience: they lack independent research capabilities, believe more in tips and luck, and try to discover an undervalued gem.

Such KOL accounts are often defined as "more commercially valuable" in a marketing market where bad money drives out good.

The exposé itself involves interest disputes, making it easy to create trouble without reward; however, as long as one or two recommended tokens succeed, it can easily be sliced and spread into the image of a trading master.

In a market where noise and truth are hard to distinguish, crypto investment is not as simple as following tips. There will always be bloggers who claim to earn endlessly, but the lost funds will never come back.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。