Author: Frank, PANews

On September 1, the token WLFI, issued by the Trump family, officially launched, instantly stirring the entire cryptocurrency market. As soon as this token appeared, it landed in the top 25 of the global cryptocurrency asset rankings with a circulating market value exceeding $6 billion. However, its initial circulating supply, which far exceeded market expectations, also sparked significant controversy and market turbulence.

The enormous circulating supply and the extremely low cost for early investors caused the paper profits for whales to skyrocket immediately after the opening. In this capital feast, some were busy cashing out, some chose to hold their positions, and a large number of retail investors rushed in, chasing price fluctuations on the highly volatile candlestick charts, betting and speculating. PANews reviews the situation on the first day of WLFI's launch, deconstructing the capital maze behind this $10 billion event.

Circulating Supply Exceeds Expectations by 8 Times, Early Investors Unlock $1.9 Billion

The launch of WLFI was accompanied by a massive information shock, centered around one key number—the initial circulating supply. This number not only determines the token's market value but also directly reveals the vast network of interests and wealth distribution behind the project.

According to data released by the official source on the launch day, the total issuance of WLFI is 100 billion tokens, while the initial circulating supply reached an astonishing 24.67 billion tokens. This figure far exceeded the market's previous expectations of 3 to 5 billion tokens, indirectly laying the groundwork for the subsequent price volatility.

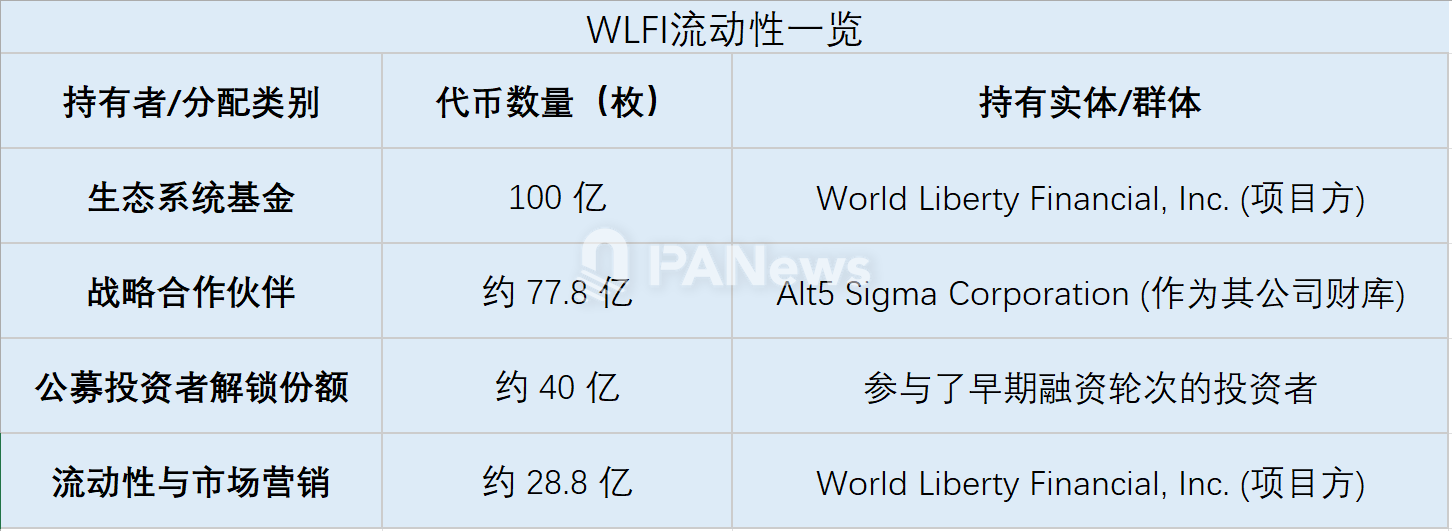

The composition of this 24.67 billion circulating supply is as follows:

It can be seen that among all the circulating tokens, the most direct and certain selling pressure on the market comes from the 4 billion tokens held by early investors. These investors acquired the tokens at extremely low prices of $0.015 and $0.05 through two rounds of financing, resulting in an average cost that is very low. Faced with dozens of times the investment return after the launch, their willingness to cash out is extremely strong. According to PANews' calculations, the average entry cost for this portion of tokens is about $0.027.

After the opening, the price of WLFI surged to $0.47, which means that the value of this portion of tokens reached $1.9 billion, making the value of these circulating tokens 3.48 times its initial investment of $550 million.

Controlling Over 83% of Liquidity, Trump Family Rakes in $6.5 Billion

In this token frenzy, the biggest beneficiaries remain the Trump family.

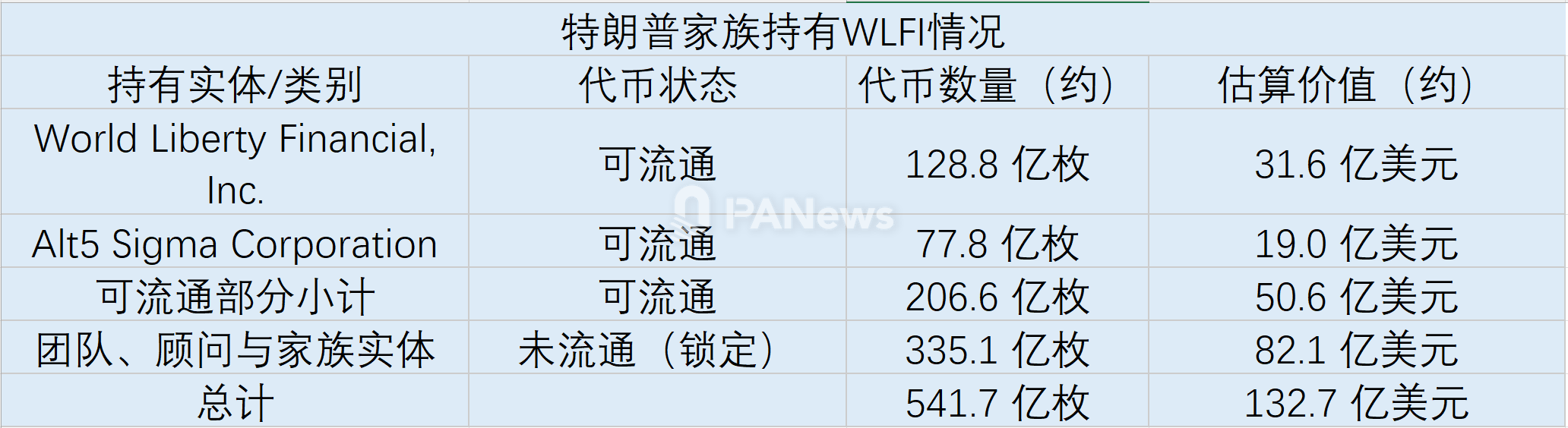

Among the currently circulating tokens, the Trump family controls approximately 20.6 billion tokens, accounting for about 83.7% of the current liquidity. Among them, the World Liberty Financial project holds 10 billion tokens for ecosystem development. 7.78 billion tokens are allocated to its strategic partner, Alt5 Sigma Corporation, as part of its corporate treasury. 2.88 billion tokens are used to provide initial liquidity and for marketing.

It is important to note that although Alt5 Sigma Corporation is a publicly listed company, it is still controlled by the Trump family. The WLFI treasury plan it adopted is also seen as a game of transferring assets from one hand to the other.

In addition, the Trump family previously obtained $550 million worth of tokens during financing and purchased $1.5 billion through Alt5's fundraising. Overall, through this token issuance, the Trump family has gained over $1.5 billion in cash revenue (calculated based on a 75% revenue distribution from token financing sales) and an estimated $5 billion in liquid token valuation. Additionally, the currently locked tokens are valued at approximately $8.21 billion.

This level of income has brought unprecedented wealth efficiency to the Trump family.

Most Top 10 Whales Choose to Take Profits, Justin Sun Claims No Sale Plans

During the intense volatility on the first day of WLFI's launch, the movements of several key early investors (i.e., "whales") attracted significant market attention.

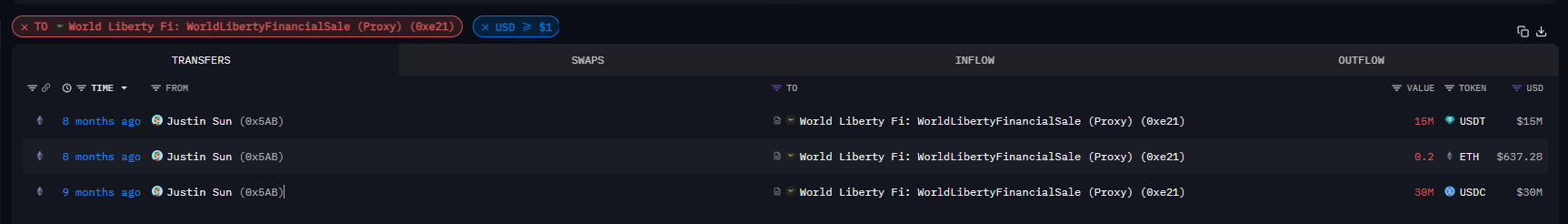

Justin Sun, one of the most well-known early investors in the project, has become a focal point for market observers regarding his holdings and public statements. Justin Sun holds approximately 3 billion WLFI tokens. According to multiple media reports, he invested $75 million in WLFI tokens, but based on actual on-chain data, this investment amount should be $45 million, which means his token cost is about $0.015.

On the launch day, he unlocked 20% of his total holdings, allowing approximately 600 million tokens to circulate. This portion of tokens was valued at as much as $178 million at that time. Despite the impressive profits, Justin Sun publicly stated that he has no plans to sell and emphasized his confidence in the project's long-term vision. Another investment institution, DWF Labs, expressed a similar long-term support attitude.

However, it seems that more whales do not share such patience. According to Ai Yi's statistics, 80% of the top ten public individual investors chose to sell or partially sell their tokens. This also brought significant selling pressure to the WLFI market.

As a result, after a surge in WLFI's price at the opening, it quickly faced a downturn, dropping to around $0.2 at its lowest, with a short-term decline of 56%. Even at the current price of around $0.24, the profits still far exceed the initial investment amount. Therefore, many whales opted for a strategy of recouping their costs first.

The dramatic price fluctuations led to large-scale liquidations in the derivatives market. According to Coinglass data, within just a few hours after WLFI's launch, the total liquidation amount across the network reached $12.36 million, with $8.51 million in long liquidations and $3.85 million in short liquidations. This indicates that a large number of leveraged long positions that chased high prices before the launch were forcibly liquidated during the price correction, further exacerbating the market decline. Before the launch, the total amount of open contracts for WLFI approached $1 billion, setting the stage for this large-scale liquidation.

However, the market's selling pressure may still be far from over. According to PANews' investigation, as of September 2, approximately 3.279 billion unlocked tokens had been claimed through smart contract interactions. This means that among the first batch of 4 billion unlockable tokens, about 18% (approximately 720 million tokens) have yet to be claimed by investors.

Overall, the intense volatility on the first day only absorbed the initial wave of selling pressure from the unlocked tokens, but greater uncertainty still looms in the future. The 720 million early tokens that have not yet been claimed will still bring selling pressure to the market in the short term, while the remaining 80% of locked private placement tokens are key variables that will determine the project's long-term trajectory.

The launch of WLFI represents an unprecedented successful wealth opportunity for the Trump family and early investors in the project. Through clever financial design and strong endorsement effects, it has created another cryptocurrency symbol in a short period. However, for other participants in the market, whether retail investors standing at high positions or leveraged traders facing forced liquidations, this is merely the beginning of a long game.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。