Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

On the afternoon of September 2, 2025, Eastern Time (midnight Beijing time), U.S. President Donald Trump appeared as scheduled in the Oval Office of the White House and delivered a "major statement" via live television. Although he appeared 49 minutes later than scheduled, he immediately dispelled rumors of "critical illness" and "death".

In the week prior, Trump had been absent from public events for several days, and photos of bruises on his hands and legs circulated widely on social media, leading to heightened speculation about his health. At the end of August, U.S. Vice President J.D. Vance "spoke out" saying: if something happened to Trump, he was ready to take over as president. Subsequently, U.S. officials "added fuel to the fire": Trump was in good health and would be playing golf that morning. These two statements further excited conspiracy theorists, and "playing golf" became a meme for covering up the truth. Meanwhile, on the other side of the world, onlookers were busy forwarding rumors on WeChat about "Trump's wife appearing at a certain army hospital" and "road closures around a certain army hospital."

On social media, topics like "Trump is Dead" quickly trended, with some imaginative individuals even claiming "he has been replaced by a body double" and "the AI in the live stream looked quite realistic."

According to Google Trends, the search volume for the keyword "Trump resigns" surged by 400% that day; other Trump-related keywords also peaked around 2:00 PM before the event.

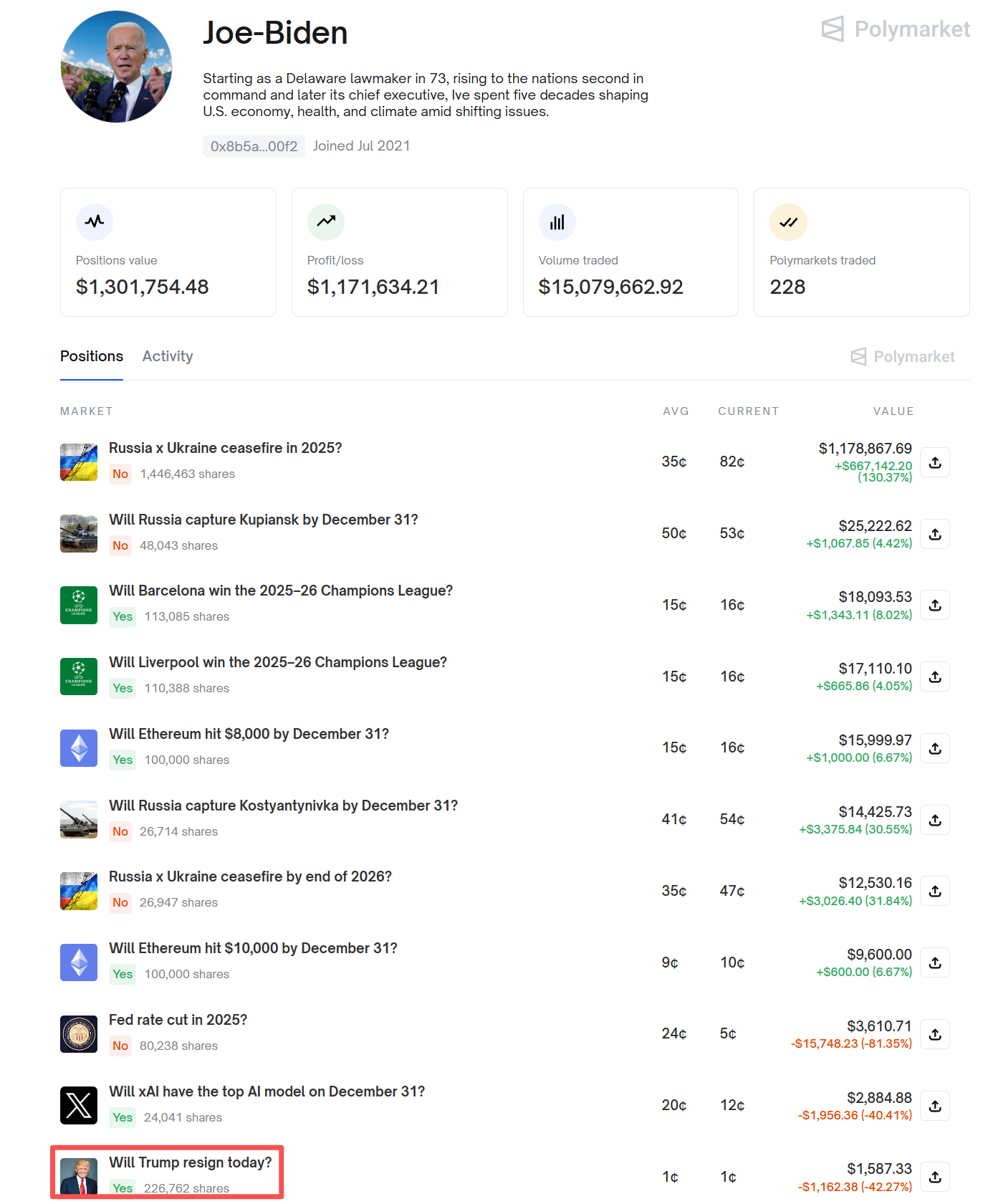

According to the prediction market Polymarket, the contract for "Trump resigning today" had a trading volume close to $10 million, but the probability remained low at below 1%.

Here is the nickname of a user who bought into "Trump resigning today."

Trump's final speech focused on tariff rulings and appeals. When faced with media questions about "whether he had seen the death rumors," Trump responded directly: "Didn't see it."

Health Controversy: How Trump's Health Affects Market Expectations

Trump's health has been a topic of concern since he entered politics. In 2025, at the age of 79, he returned to office, becoming the oldest sitting president in U.S. history, and his physical and cognitive state continued to spark controversy. According to the Wikipedia entry "Concerns About Donald Trump's Age and Health", discussions about this have traced back to his first campaign in 2016—when his personal doctor Harold Bornstein stated that Trump was "the healthiest president candidate in history." However, Bornstein later admitted that the letter was written based on Trump's own dictation. Additionally, his father, Fred Trump, was diagnosed with Alzheimer's disease in 1991, which heightened concerns about his potential risk of dementia.

Entering 2025, concerns about Trump's health significantly intensified. Between January and March, he exhibited red spots and bruises on his hands multiple times, leading to frequent public and media speculation. In April, the White House released an annual health report showing his weight at 224 pounds (about 102 kg) and a BMI of 27.6, categorizing him as overweight. At the same time, Trump underwent the Montreal Cognitive Assessment (MoCA) test, scoring a perfect 30, with the report concluding that he was "in excellent health."

Trump was found to have extensive bruising on the back of his hands during a meeting with South Korean President Lee Jae-myung.

In July, the White House confirmed that Trump was diagnosed with chronic venous insufficiency (CVI)—a common vascular condition in the elderly that can lead to leg swelling and recurrent bruising. His attending physician, Sean Conley, explained that Trump's hand bruising was related to his long-term use of aspirin (to prevent cardiovascular events) and frequent handshakes, and was not a serious symptom. However, related photos resurfaced in late August; on August 30, the "Trump is Dead" tag trended on X, with unverified information circulating that "Trump has only 6–8 months to live" and even "has been replaced by a body double."

The spread of rumors was not without basis. During the 2024 campaign, Trump frequently made verbal gaffes, such as mistaking Nikki Haley for Nancy Pelosi or stating in public that "World War II is about to happen." In July 2024, an article in The Conversation by psychologist Simon McCarthy-Jones pointed out that Trump's narcissistic personality traits and lower emotional stability may make him more susceptible to the psychological impact of the attempted assassination in July.

Despite rampant online speculation, the White House has consistently denied that Trump has serious health issues, even emphasizing that he "still frequently wins golf tournaments." From August 30 to September 1, the White House publicly shared photos of him playing at the Trump National Golf Club in Sterling, Virginia, attempting to quell external rumors.

On August 30, at the Trump National Golf Club in Sterling, Virginia, Trump was seen walking with his granddaughter, Kai Trump.

From the perspective of the cryptocurrency market, since his return to office, the government has rolled out a series of crypto-friendly policies, including signing the GENIUS Act (a stablecoin regulatory framework), repealing the SEC accounting standard SAB 121 from the Biden era, and establishing a Bitcoin strategic reserve mechanism through an executive order in March 2025. These measures aim to boost market confidence, increasing the global hash rate share of U.S. Bitcoin miners to 31.5%, with Bitcoin prices rising from $80,000 at the end of 2024 to around $109,000.

Currently, the Trump family's involvement in the cryptocurrency industry is deepening: the market capitalization of their tokens TRUMP and MELANIA has exceeded $1.5 billion, and the World Liberty Financial platform has also launched the WLFI token (officially circulating on September 1) and a dollar-pegged stablecoin USD1.

"Assuming the worst-case scenario" investment deployment: How to hedge risks in the event of Trump's potential resignation?

Meanwhile, Polymarket contract data shows that the probability of "Trump ending his term with a support rate below 40% in 2025" is about 20%, reflecting market uncertainty about his long-term performance in office.

Assuming Trump's health continues to deteriorate, ultimately leading to resignation or being forced out under the 25th Amendment (with a contract probability of 6% on Polymarket), the cryptocurrency market would face significant uncertainty.

Trump's "crypto vision" has been realized through a series of specific policies, including banning central bank digital currencies (CBDCs), allowing 401(k) retirement accounts to invest in crypto assets, and signing the GENIUS Act (supporting stablecoin development). Additionally, it is estimated that during the 2024 election period, political donations from the cryptocurrency industry totaled tens of millions of dollars, becoming an important driving force behind his policy direction. These crypto inclinations constitute a key pillar of the current market bull run.

If Trump were to suddenly leave office, some policies might face reversal, especially the Bitcoin strategic reserve plan (which currently holds digital assets like BTC and ETH, with a market value exceeding $50 billion). If Vice President J.D. Vance continues the crypto policies, market confidence may be restored; conversely, if Democratic forces take the opportunity to strengthen regulation (such as restarting the SEC lawsuits against Coinbase and Ripple), it could trigger a risk of massive market cap evaporation.

Based on the risk exposure and market behavior characteristics at different stages of the event, strategies can be developed in three steps: "short-term hedging - mid-term diversification - long-term layout":

Short-term Strategy (1-3 months after the event): Prioritize hedging, lock in profits

- Reduce high-risk assets: Prioritize selling meme tokens highly correlated with Trump, such as the TRUMP token, to avoid extreme volatility (after the attempted assassination in 2024, a certain unofficial TRUMP token on the blockchain once plummeted by over 30%).

- Shift to stablecoins: Move positions to highly liquid stable assets like USDC or USDT.

- Focus on prediction markets and derivatives: Use Polymarket to track the contract on "Will Vance continue crypto policies."

- Allocate traditional safe-haven assets: Increase exposure to gold ETFs (such as GLD). The historical correlation between Bitcoin and gold is about 0.4; if Trump leaves office and triggers political uncertainty, gold may rise.

Mid-term Strategy (3-6 months): Capture policy stability signals and technical rebounds

- Return to core assets: If Vance clearly commits to continuing the reserve plan, the target price for Bitcoin can be raised to $120,000. It is recommended to build positions in batches based on technical indicators (e.g., RSI < 30).

- Focus on Layer 2 and DeFi public chains: Prioritize chains less affected by policy, such as Solana (SOL) and Cardano (ADA). The former's TVL has surpassed $100 billion, and a position allocation ratio of 10%-20% is suggested.

- Use hedging tools: Hedge market volatility through options or futures.

Long-term Strategy (6 months or more): Build a counter-cyclical asset portfolio

- Focus on crypto infrastructure stocks: Such as U.S.-listed mining companies Marathon Digital and Riot Platforms, which benefit from mining policy dividends during Trump's term. Even if he leaves office, the 31.5% share of U.S. hash rate provides strong support, with an expected annual return of about 20%.

- Embrace RWA and stablecoins: As the advancement of CBDCs faces obstacles, the space for private stablecoins and RWA tokenization is rapidly expanding, such as the BUIDL fund launched by BlackRock.

- Establish a risk monitoring system: It is recommended to set warning lines, for example, when the probability of the "Trump being removed via the 25th Amendment" contract on Polymarket exceeds 10%, a mechanism to reduce positions by 50% can be triggered to hedge against potential systemic shocks.

Overall, the core principle of this strategy is: "Assume the worst, prepare the most." If Trump's health stabilizes, the crypto bull market is likely to continue; conversely, even if short-term market panic occurs, it may constitute a highly valuable "golden pit."

Conclusion: Rational Investment in Low-Probability Events

Although the controversy over Trump's health continues to ferment, from Polymarket's pricing perspective—the probability of "resigning that day" on September 2** has remained below 1%,** and the probability of resigning for the entire year** is only about 10%**—the overall market sentiment remains rational.

The probability of "Trump resigning for the entire year of 2025" on Polymarket is only about 10% (mean).

The crypto market is also stabilizing. Considering the Trump family's deep involvement in the crypto industry and the strong momentum shown in policies since his administration, the likelihood of him actively resigning or transferring power through the 25th Amendment in the short term remains very low.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。