The fluctuations in the cryptocurrency market are like the waves in a turbulent sea, making people feel anxious. However, its charm lies in the fact that it never looks at your past report card. Stop saying "I'll enter the market when it stabilizes"; opportunities in the crypto world never lie in "stability." The real dividends always belong to those who dare to position themselves amid uncertainty. Market volatility is not a risk; not understanding the trend is the biggest risk.

Bitcoin is currently reported around $110,700, having fallen from a high of $124,000 to a low of $107,350. It has received effective support three times around $107,000 and has returned to the vicinity of the $110,000 mark.

From a technical perspective, short-term momentum has strengthened, with a golden cross forming in the short-term moving averages and the price breaking through the short-term moving averages. However, trading volume has shrunk significantly, indicating insufficient market participation, which creates a divergence between price and volume, weakening the reliability of the upward trend. The price is approaching a strong resistance level at $111,350, increasing the likelihood of consolidation or a pullback. Nevertheless, the daily chart still shows a bullish pattern, with the MACD on the daily chart indicating enhanced bullish momentum, and the overall trend remains dominated by bulls.

In terms of operations, it is recommended to primarily position long orders at lower pullback levels, with short positions at higher levels as a supplement. The operational range for long orders: positions can be established in the range of $109,500-$108,700, targeting $111,500-$110,300.

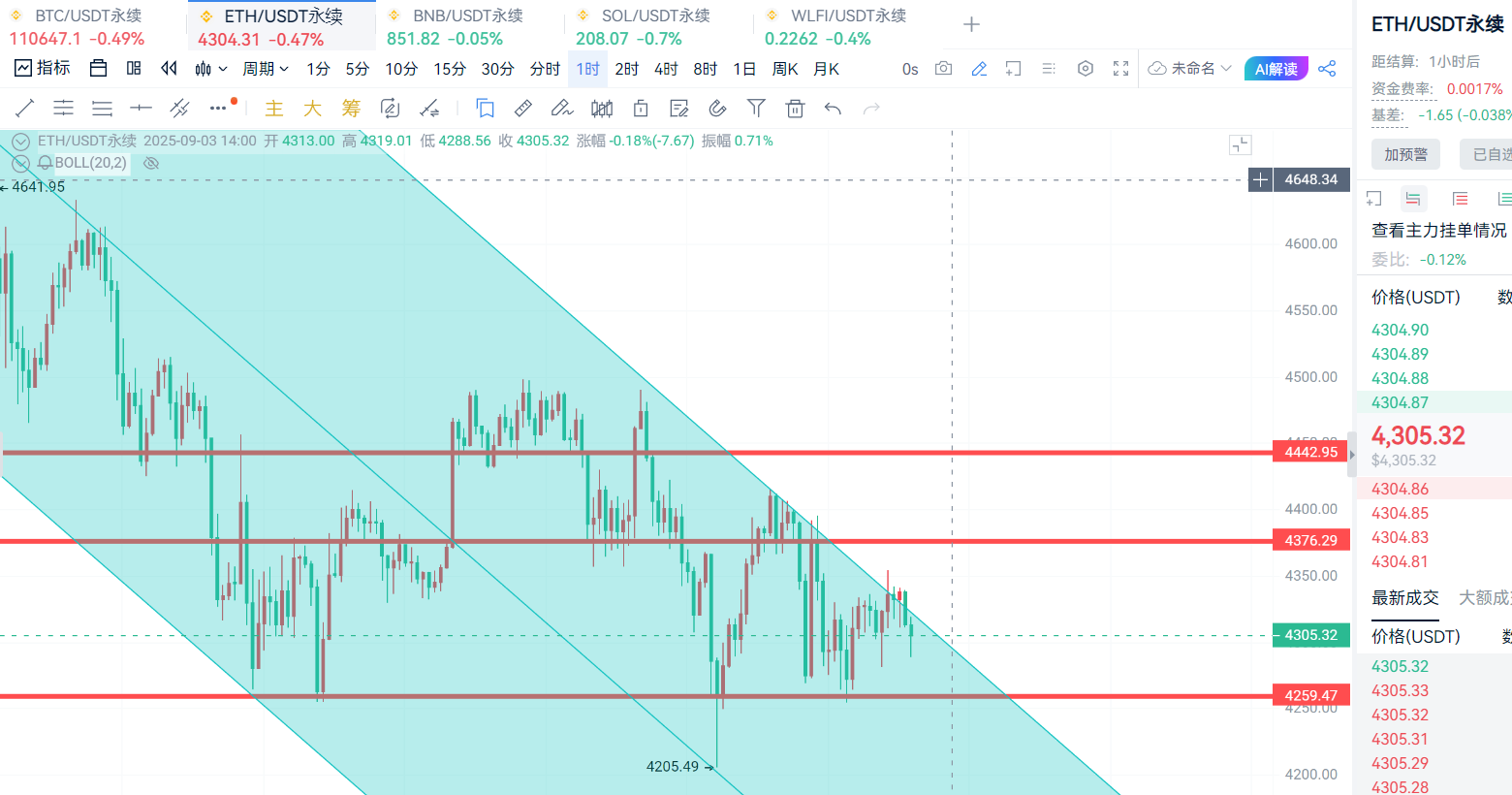

Ethereum's latest price is around $4,300, having dropped from a high of $4,956 to a low of around $4,205. Recently, there have been instances where ETH has risen more than BTC, and even when ETH rises, BTC falls, which some market analysts view as one of the characteristics of a mid-cycle bull market.

From a technical standpoint, the daily chart has shown continuous declines, with short-term sentiment leaning bearish, and the moving average system displaying a bearish arrangement, indicating continued pressure in the short term. Although there has been a rebound on the 2-hour chart, the strength is limited, and the latest closing shows a small bearish candle, indicating that selling pressure has not been fully released. The bearish momentum on the 2-hour MACD has weakened, but a strong reversal signal has not yet formed.

It is advisable to pay attention to the performance of key support and resistance levels, and consider range trading in the short term.

Operational range for long orders: positions can be gradually entered in the range of $4,250-$4,280, targeting the $4,350-$4,400 range.

Operational range for short orders: if a pullback occurs and pressure is felt in the $4,450-$4,400 range, consider light short positions, targeting $4,300-$4,330.

Due to the time-sensitive nature of price points, there may be delays in post reviews; specific operations should still be based on real-time market conditions. The above operational range analysis is for reference only. The cryptocurrency market is highly risky, so please manage your risk well and make cautious decisions when investing. If you are interested in specific indicator analysis or the impact of new market dynamics on prices, feel free to scan the QR code for the public account at the bottom of the article. You are welcome to visit.

Friendly reminder: The content of the above article is original to the author. The advertisements at the end of the article and in the comments section are unrelated to the author; please be cautious in discerning!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。