Bridgewater Ray Dalio Concerns Over Trump Pressure on Federal Reserve

An interview with Ray Dalio, the American billionaire investor and founder of Bridgewater Associates, with the Financial Times discusses the heated topics of the US economy and cryptocurrency.

Ray Dalio Interview Focuses On:

Ray mentions critical issues, including the US debt burden, the Federal Reserve independence , Trump tariffs and policies, intervention in business, the growing trends of cryptocurrency and gold as stores of value.

-

U.S. Debt Crisis and the Risk of Economic “Heart Attack” within 3 Years

Dalio pointed to the dangerous trend of the U.S. economy, and that years of reckless spending have put the nation on the verge of a debt-induced economic heart attack. Using the analogy of the credit system and the human circulatory system, he said that debt can feed the economy provided it makes enough money to pay interest. But as the debt increases at a faster rate than the income, it becomes like plaque, restricting other vital expenditures.

Source: Bridgewater’s Ray Dalio X

Today, the U.S. government is burdened with huge responsibilities, and it has to pay $1 trillion in interest and about $9 trillion in rolling over debt. To add to the existing deficits, the government might have to sell about $2 trillion more debt next year, a classic debt cycle issue with the supply surpassing the demand. Dalio cautions that America might soon be plunged in 3 years into a deep financial crisis similar to past debt cycles in history, unless policymakers alter their ways.

-

Federal Reserve Independence and Inflation Fears under Trump Policies

Dalio emphasized the central bank's independence. Any interference, including threats of replacing Fed Chair Jerome Powell , would disrupt the economy. When the Fed gives in to Trump pressure and lets inflation run hot, the value of bonds and the dollar might plummet, weakening the creditworthiness of the U.S. and the use of the dollar as a global reserve currency.

He observed that U.S. Economic problems are timed with international holders selling off dollar-denominated assets, which is another indicator of dangers in the late phases of the big debt cycle. Interventions by central banks, such as printing money to fund the swelling debts, may further reduce the value of money and create more systemic vulnerabilities.

Source: X

-

Trump tariffs and policies pressuring Business and State Capital.

Dalio said that Trump taking direct stakes in such companies as Intel, Nvidia, AMD, and U.S. Steel was evidence of a transition to state capitalism in the U.S. He compared the present day to the 1928-1938 era when politics and inequality of wealth caused governments to take more and more control of businesses.

Instead of calling the economic model offered by Trump tariffs and policies, Dalio concentrated on the mechanics of greater government interference and how it could affect markets and investor confidence around the world.

-

Cryptocurrency, Gold, and Dollar Alternatives.

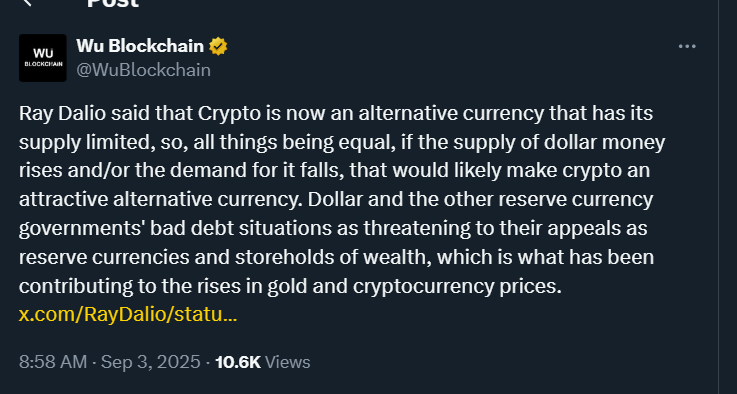

Dalio pointed out that cryptocurrencies, which have a limited supply, are turning out to be appealing alternatives to the strained fiat currencies. Increasing U.S. financial burden and the falling real purchasing power of dollars and Treasuries make crypto and gold attractive options for reserve.

Though he does not view stablecoins as systemic risks, he cautioned that high-debt fiat currencies will tend to devalue against hard currencies, as was the case in the 1930s-40s and 1970-80s.

-

Social and Political Processes.

Dalio made comparisons between the current extreme polarization in politics and the 1930s-40s, saying that wealth inequality, polarization in ideology, and a lack of trust in institutions lead to a volatile situation. He highlighted that the existing dynamics are influenced by five significant forces, such as debt cycles, political instability, geopolitical tensions, natural disasters, and technological disruptions, in particular, AI.

Conclusion

The insights provided by Ray Dalio highlight a complicated US financial system, central bank policy, government intervention, and the growing popularity of crypto and gold. He cautions that these trends may compromise the financial stability of the US and the international financial system. There is a sense of urgency to respond to them with measured policies and awareness among investors.

Also read: US Tariffs Under Fire: Trump Calls Emergency Meeting免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。