After Powell, who is next?

Written by: David, Deep Tide TechFlow

With 9 months left until Powell's term ends, discussions about who will succeed him as the Federal Reserve Chair have heated up.

The Federal Reserve Chair may be the most powerful economic position in the world. One statement can cause significant fluctuations in capital markets, and one decision can influence the flow of trillions of dollars. Your mortgage rates, stock market returns, and even the volatility of crypto assets are closely related to the decisions made in this position.

So, who is most likely to be the next chair? The market is gradually providing its answer.

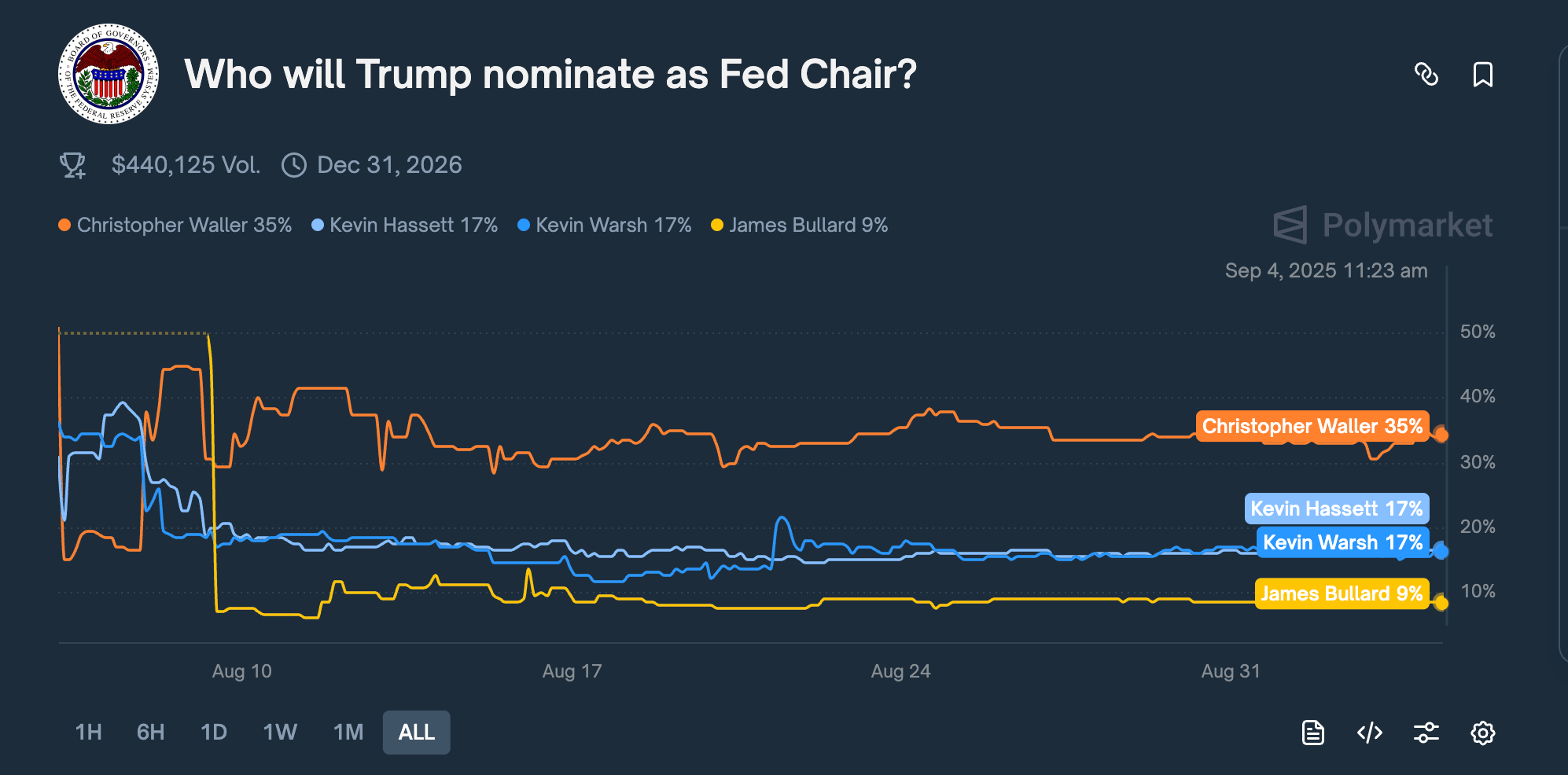

On August 7, on the prediction market Kalshi, the odds of Federal Reserve Governor Christopher Waller surged from 16% the previous day to over 50%, surpassing all competitors for the first time. Although the odds fluctuated afterward, Waller maintained his lead.

As of the latest data, Polymarket shows Waller still leading with a 35% probability, higher than other popular contenders Kevin Hassett and Kevin Warsh, who are at 17%.

Why is the market suddenly optimistic about this 65-year-old current Federal Reserve governor?

A recent report from Bloomberg may provide a clue: Trump's advisory team believes Waller is "willing to make policy based on predictions rather than current data" and has "a deep understanding of the Federal Reserve system."

More importantly, Waller was nominated to the Federal Reserve by Trump in 2020. At the FOMC meeting on July 30, Waller also did something particularly noteworthy:

He, along with another governor, Michelle Bowman, cast a dissenting vote, arguing that the Federal Reserve should cut rates by 25 basis points. This was the first time since 1993 that two governors simultaneously opposed a decision to maintain interest rates.

What Trump needs now is a Federal Reserve Chair who can advocate for rate cuts without being perceived as a puppet of the White House; from this perspective, Waller seems to fit the bill perfectly.

Political Acumen, Timing, and Positioning

To understand Waller, we must start with this dissenting vote.

First, some background: The Federal Open Market Committee (FOMC) of the Federal Reserve meets eight times a year to decide on the U.S. benchmark interest rate. This rate is the overall throttle of the U.S. economy, determining the cost of borrowing between banks and subsequently affecting all loan rates.

Participants must collectively vote on changes to interest rates. For decades, these votes have almost always passed unanimously. In the culture of the Federal Reserve, publicly casting a dissenting vote is seen as a challenge to the authority of the Chair.

The FOMC meeting on July 30, 2025, was particularly sensitive.

The Federal Reserve had maintained interest rates at 4.25%-4.5% for five consecutive meetings. Meanwhile, Trump was attacking Powell daily on Truth Social, calling him "too late" and "stupid," demanding immediate rate cuts to stimulate the economy.

Just two weeks before this meeting, on July 17, Waller delivered a speech at the New York University Money Market Dealers Association, which was quite pointed:

"I used to tell my new colleagues that a speech is not a murder mystery --- directly telling the audience who the murderer is is telling them the point."

The focus of this speech was, of course, his belief that the FOMC should cut rates by 25 basis points; and the "murderer" was projected onto the Federal Reserve.

Publicly stating his position generally does not align with the behavior of central bank officials. But this may have been a carefully chosen moment for Waller to engage in political maneuvering.

By publicly expressing his views in advance, it could make his dissenting vote at the official FOMC meeting two weeks later appear to be based on long-term professional judgment rather than succumbing to some political pressure.

On July 30, when Waller and Bowman cast their votes against maintaining interest rates, it was indeed the first time since 1993 that two governors opposed the decision simultaneously, which certainly drew attention.

The signal the market read was that there were rational dissenting voices within the Federal Reserve; but from Trump's and his team's perspective, this seemed more like a statement and alignment from Waller.

Even more cleverly, Waller also expressed his views on the current tariff policy: "Tariffs are a one-time increase in price levels and will not cause persistent inflation." This statement became a hallmark of his media citations.

To translate this, the subtext of this statement is:

Trump's tariffs will indeed push up prices, but only temporarily. Therefore, interest rates should not be kept high because of tariffs. Clearly, Waller's viewpoint neither criticized Trump's tariff policy nor provided an economic basis for rate cuts.

Using an economic theory to resolve a political dilemma; choosing the right moment to express the same stance on rate cuts as the president.

Betting Against Former Treasury Secretary, Predicting Economic Soft Landing

If casting a dissenting vote showcased Waller's political acumen, then accurately predicting the economic trajectory demonstrated his solid professional competence.

First, some background.

In June 2022, U.S. inflation reached 9.1%, a 40-year high. What does this mean?

If you saved $10,000 at the beginning of the year, by the end of the year, your purchasing power would only be $9,000. Gas prices doubled, and the price of eggs rose from $2 to $5.

The Federal Reserve faced a tough choice. To reduce inflation, it had to raise interest rates. Raising rates would make loans more expensive, leading businesses to be reluctant to borrow for expansion, and consumers to be hesitant to take out loans for homes and cars, cooling the economy and reducing inflation.

But the problem is that too strong a remedy could lead to trouble. Historically, every time the Federal Reserve has significantly raised rates, it has triggered an economic recession.

At this point, a rare public debate erupted in the economics community.

On one side were three heavyweight economists: former Treasury Secretary Summers from the Clinton era, former IMF Chief Economist Blanchard, and Harvard economist Tomasev.

In July, they published research arguing that the Federal Reserve could not control inflation without causing a "painful" spike in unemployment. To bring inflation down, the unemployment rate would inevitably rise. This is an economic law, akin to a physical law.

Summers' team calculated that to reduce inflation from 9% to 2%, the unemployment rate would need to rise to at least 6%. This would mean millions would lose their jobs.

But Waller disagreed.

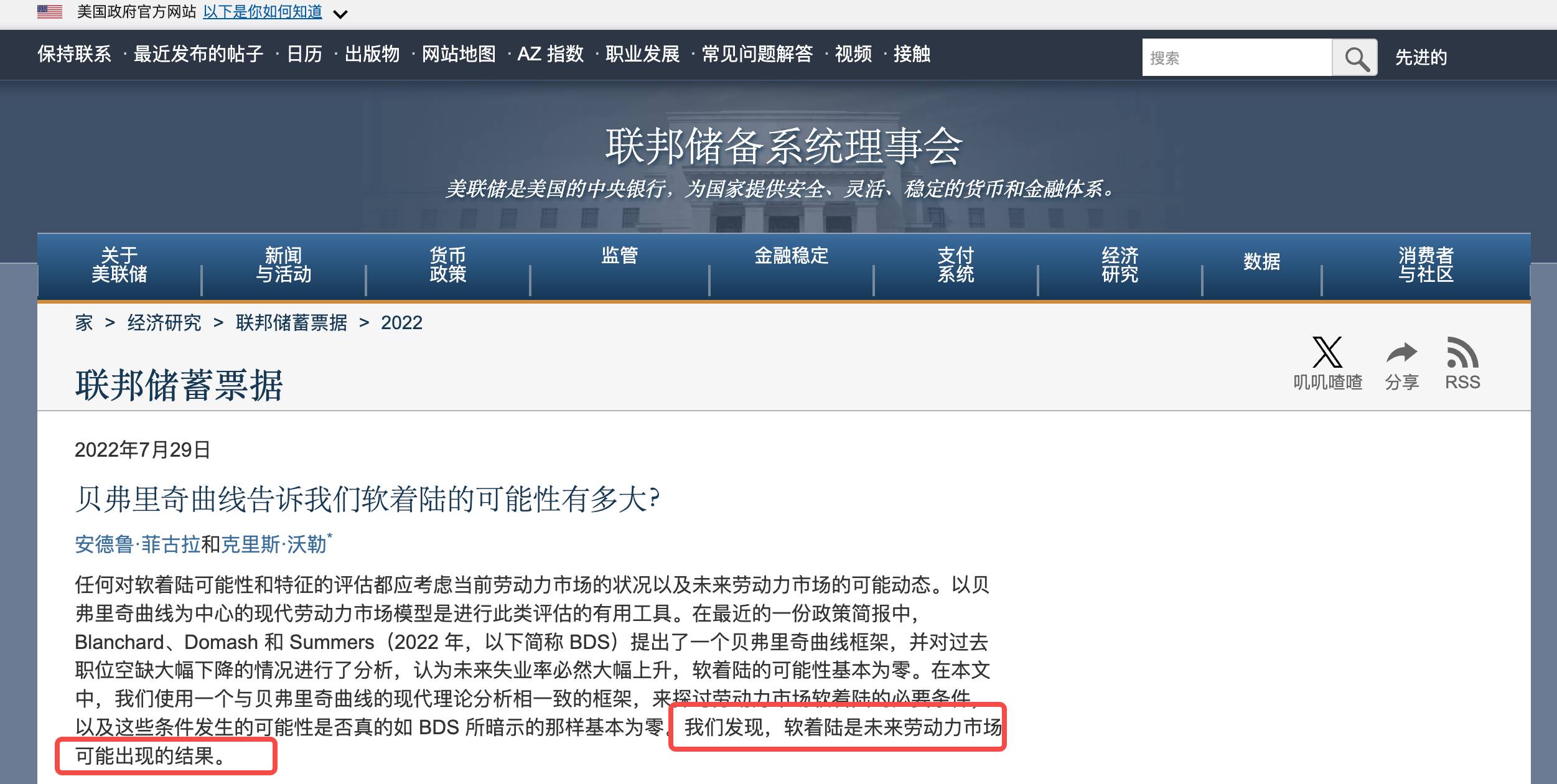

On July 29, he and Federal Reserve economist Andrew Figura published a paper titled “What Does the Beveridge Curve Tell Us About the Likelihood of a Soft Landing?”, directly challenging the conclusions of Summers' team.

Waller's core argument was that this time is different because the pandemic caused unprecedented distortions in the labor market.

Many people retired early, and many were unwilling to work due to the pandemic. This led to an inflated number of job vacancies; it wasn't that the economy was so hot that everyone was hiring, but rather that there were fewer people willing to work.

The conclusion of the paper was that a soft landing is a "reasonable outcome," and the U.S. could return inflation to normal with only a slight increase in the unemployment rate.

On August 1, Summers and Blanchard quickly countered, stating that Waller's paper "contains misleading conclusions, errors, and factual inaccuracies."

Central bank officials typically use cautious language, and scholars are usually polite with one another. But this time, both sides spoke very harshly, seemingly defending the correctness of their economic theories.

The market, of course, sided with Summers. After all, he was a former Treasury Secretary, and Blanchard was a former IMF Chief Economist. Waller's position was merely that of a Federal Reserve governor.

The next 18 months became a public validation and wager.

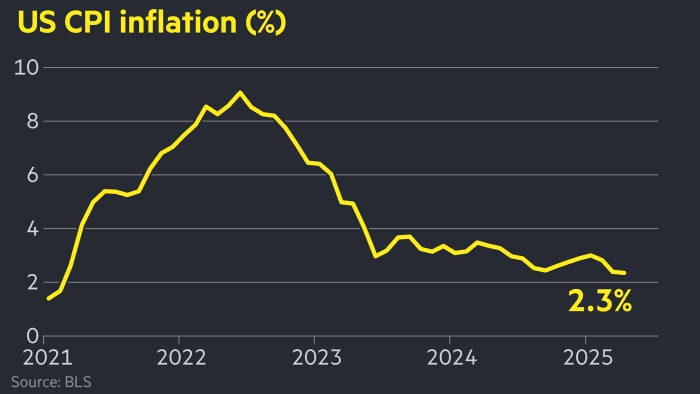

By the end of 2022, commodity prices began to fall. In early 2023, supply chain pressures eased. The Federal Reserve did indeed raise rates significantly, from nearly 0% all the way to 5.5%.

Everyone was waiting to see if a wave of unemployment would come, but the results were surprising.

By the end of 2024, the inflation rate had dropped below 3%, while the unemployment rate was only 3.9%. There was no recession and no mass layoffs.

In September 2024, Waller and Figura updated their research paper, even adding an "s" to the title --- changing from "soft landing" to "soft landings," suggesting that this was not a coincidence but something that could be repeated.

Waller won this bet.

The academic confrontation also proved that Waller had the ability to challenge authority and make independent judgments; for Trump's team, this was even more valuable. They saw someone who dared to challenge the mainstream and believed in the resilience of the American economy.

Midwestern Scholar, Boldly Entering Washington

Waller is different from most people who serve at the Federal Reserve, having a unique career path.

Born in 1959 in Nebraska City, Nebraska, a small town of only 7,000 people, he spent his childhood in South Dakota and Minnesota, both agricultural states in the Midwest, far from the financial centers of the East Coast.

The seats on the Federal Reserve Board are typically occupied by a certain type of person: Ivy League graduates who have worked on Wall Street or held positions in Washington's government departments. They often speak the same language and share similar worldviews.

Waller clearly does not belong to that category.

Waller's starting point was Bemidji State University, where he earned a bachelor's degree in economics; you might not have even heard of this place in northern Minnesota, where winter temperatures can drop to minus 30 degrees.

Such a growing environment may make it easier to see the real America, as well as the ordinary people living in small towns, taking out loans to buy homes and cars, and worrying about jobs and prices.

In 1985, Waller obtained his Ph.D. in economics from Washington State University and began a long academic career.

First at Indiana University, then at the University of Kentucky, and finally at the University of Notre Dame; for a full 24 years, he taught and conducted research. Waller's research focused on monetary theory, one of the most abstract branches of economics.

This kind of research clearly won't get you on television or make you a star economist, but it may come in handy at critical moments. In 1996, Waller co-authored a paper titled “Central Bank Independence, Economic Behavior, and Optimal Terms”.

This paper examined a practical and timely question: How long should the term of a central bank president be?

The core finding of the paper was: if the term is too short (for example, 2 years), the central bank president will yield to political pressure because he wants to be reappointed. If the term is too long (for example, 14 years), he may become out of touch with reality and inflexible.

Twenty-five years later, this theoretical paper became a practical guide.

In 2020, when Trump publicly criticized the Federal Reserve and called for rate cuts, Waller, who had just joined the Federal Reserve, faced a choice: to fully comply or to completely resist?

He chose a third path: to support rate cuts at certain times, such as casting a dissenting vote in July 2025; but the reasoning must be professional, not simply because the president wanted a rate cut.

This subtle sense of balance, neither completely independent to ignore political realities nor so dependent as to lose professional judgment, was precisely what he had studied over 20 years ago.

In other words, Waller navigates the Federal Reserve not by instinctively walking a tightrope, but with a set of academically validated balancing theories.

Before joining the Federal Reserve, Waller also had experience "leveling up" in a "training ground."

The Federal Reserve is not a single institution but is composed of the Board in Washington and 12 regional Federal Reserves. Each regional Federal Reserve has its own research department and policy inclinations.

In 2009, at the age of 50, Waller left academia to join the St. Louis Federal Reserve as the research director, where he worked for 11 years. Waller managed a research department of over 100 people, with daily tasks including analyzing economic data, writing policy reports, and preparing for FOMC meetings.

What truly changed the trajectory of his career was his nomination to the Federal Reserve Board by Trump in 2019.

This nomination was itself controversial. Waller's confirmation process was not smooth; Democratic senators questioned his independence, given that he was nominated by Trump. Republican senators worried that he was too academic and not "loyal" enough.

On December 3, 2020, the Senate narrowly approved his appointment by a vote of 48 to 47, one of the closest votes in recent years. At 61, Waller entered the highest decision-making body of the Federal Reserve, older than most governors. But this turned out to be an advantage.

Most Federal Reserve governors have predictable paths: elite schools → Wall Street/government → Federal Reserve. They enter the centers of power in their 40s, having ample time to build networks and learn the rules of the game.

Waller is different. He spent 24 years in academia and 11 years at a regional Federal Reserve, arriving in Washington only at the age of 61.

Compared to other governors, Waller has fewer burdens and owes no favors to Wall Street; at the same time, having worked at the St. Louis Federal Reserve, he knows that the Federal Reserve is not a monolith, and differing voices are not only tolerated but sometimes encouraged.

When Trump's team evaluated who could succeed Powell, they likely saw these very traits:

An older individual who no longer needs to prove anything; someone with independent judgment who knows how to express himself within the system.

Good News for Crypto?

If Waller really becomes the Federal Reserve Chair, what benefits might it bring?

The market's first reaction is that Waller will cut rates. After all, he cast a dissenting vote in July supporting a rate cut. Trump has also consistently called for lower rates.

But looking closely at his record, the situation is more complex.

In 2019, when the economy was strong, Waller supported rate cuts. In 2022, when inflation soared, he supported aggressive rate hikes. By 2025, he shifted back to supporting rate cuts…

His principles seem clear: loosen when necessary, tighten when needed. If he becomes Chair, monetary policy may be more "flexible," not necessarily mechanically following Trump's rules, but quickly adjusting based on economic conditions.

However, Waller's real distinction may not lie in traditional monetary policy but in how he views new phenomena like cryptocurrencies and stablecoins.

On August 20, when asked how the Federal Reserve would respond to financial innovation, Waller said, "There is absolutely no need to worry about digital asset innovation"; in February of this year, at a stablecoin conference in California, he stated that stablecoins are "designed to maintain stable value relative to national currencies."

Note that he emphasizes the relationship with national currencies, not something independent of the monetary system. This difference in perspective could lead to fundamental policy shifts.

Currently, the U.S. attitude toward digital assets is defensive, concerned about money laundering, financial stability, and investor protection; the regulatory focus is on "controlling risks."

Waller explicitly opposes central bank digital currencies, arguing that "it is unclear what market failure it would solve in the U.S. payment system," but he supports another path: allowing private stablecoins to innovate and take on the functions of a digital dollar.

However, all these ideas are predicated on Waller's ability to withstand pressure.

He has not experienced a true financial crisis test. When Lehman Brothers collapsed in 2008, he was teaching. When FTX went bankrupt in 2022, he had just joined the Federal Reserve and was not yet a core decision-maker.

Transitioning from governor to chair is not just a change in position. Governors can express personal opinions, but every word from the chair can shake the market.

When the stability of the entire financial system rests on one's shoulders, "innovation" and "exploration" may become luxuries. Whether crypto is entirely a good thing remains uncertain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。