Author: Frank, PANews

The high-performance public chain track is becoming crowded.

On September 2, the L1 Somnia, claiming to have a million-level TPS, announced the launch of its mainnet and stated that it had completed 10 billion transactions on its testnet. Its native token SOMI also simultaneously listed on mainstream exchanges like Binance. Behind the project is the British unicorn company Improbable, along with indirect backing from top-tier capital such as SoftBank and a16z.

In stark contrast to its powerful technical narrative and capital halo is the huge community controversy triggered during the airdrop phase, as well as the rapid cooling of interest after the launch.

Is this a potential stock temporarily underestimated by the market, or a carefully packaged marketing feast?

The Choice After Multiple Transformations of a British Unicorn and Top Capital

Somnia is not a grassroots narrative crypto project; the development company behind it, Improbable, has a significant background.

Improbable is a British company founded in 2012 by several Cambridge University graduates. The company's early business direction was distributed cloud computing platforms. With its core product, SpatialOS, Improbable secured a massive $500 million funding round led by SoftBank in 2017, becoming the largest funding round for a UK startup in history at that time. In 2019, Improbable signed a contract with the UK Ministry of Defence to apply its technology in military simulations, even being used in Ukraine's defense. Its founder, Herman Narula, was subsequently sanctioned by Russia.

In 2022, with the rise of the metaverse concept, the company shifted its focus to providing solutions for metaverse companies. However, the company has struggled to find a profitable path. It wasn't until 2023 that it transformed again, positioning itself as a "Venture Builder," focusing on incubating startups in the fields of artificial intelligence, blockchain, and the metaverse, and achieved annual profitability for the first time that year.

Somnia is an important project under this new "Venture Builder" model, with Improbable responsible for core technology development. Somnia's founder, Paul Thomas, previously worked at Goldman Sachs. According to official information, Somnia will receive a committed investment of $270 million. However, this $270 million is not directly invested by institutions like a16z, SoftBank, Mirana, or SIG, but is funded by Improbable, M², and the Virtual Society Foundation.

Is Million-Level TPS Strength or Illusion?

Of course, the most eye-catching label for Somnia is undoubtedly its claimed "million-level TPS." Somnia's high performance mainly relies on two core technological innovations: MultiStream Consensus and Accelerated Sequential Execution.

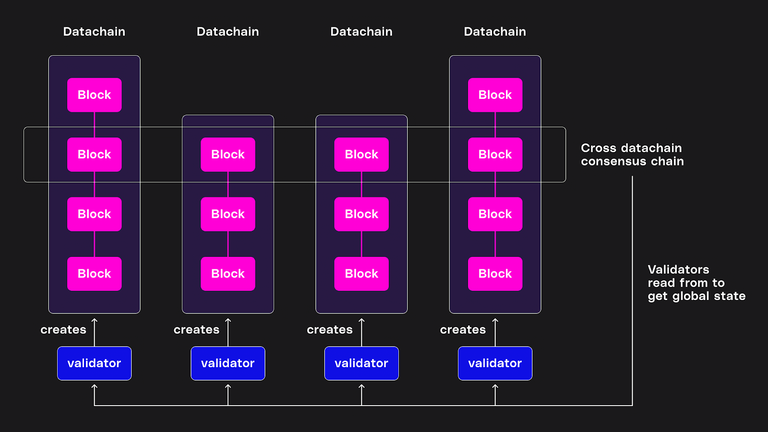

In simple terms, the innovation of the MultiStream Consensus mechanism lies in the fact that traditional blockchains are like a single-lane road where all transactions must queue for processing, easily causing congestion. Somnia transforms this road into a highway with countless lanes. Under this mechanism, each validator runs its own independent "data chain," allowing for parallel and asynchronous packaging of transaction blocks without waiting for consensus across the entire network. Meanwhile, an independent "consensus chain" patrols all data chains at a very high frequency (e.g., every 20 milliseconds) to synchronize and finalize their states. This "diversion and aggregation" design solves the single-point congestion problem and achieves extremely high throughput.

Accelerated Sequential Execution differs from traditional public chains in that many high-performance public chains use "parallel execution" schemes, which can lead to performance degradation when processing a large number of related transactions (such as popular NFT minting) due to state contention. The key to Somnia is compiling EVM bytecode into highly optimized native machine code, allowing transaction execution speeds to approach that of native code written in high-performance languages like C++. This means that even if transactions are processed sequentially, they can be fast enough to handle high-concurrency scenarios, effectively avoiding the troubles of state contention.

From a technical perspective, Somnia's technical architecture has certain engineering innovations. However, the promotion of "million TPS" carries a clear element of "conceptual substitution." Somnia officially admits that the 1 million TPS figure was achieved in an ideal environment on the developer network by executing ERC-20 transfer operations with minimal computational load. This testing does not represent the network load when running complex applications in the real world.

Data from Chainspect shows that the peak TPS record for Somnia's testnet within a 100-block window was around 25,000. Although this is a significant gap from its claimed 1 million TPS, it is objectively still considered a high-performance public chain. Similarly, while its testnet claims to have processed over 10 billion transactions, a large portion of this was driven by a few applications; for instance, a single on-chain game called Chunked contributed 250 million transactions in just five days. Additionally, the official statement indicated that over 118 million independent wallet addresses were created during the testnet phase, along with more than 70 ecosystem partners.

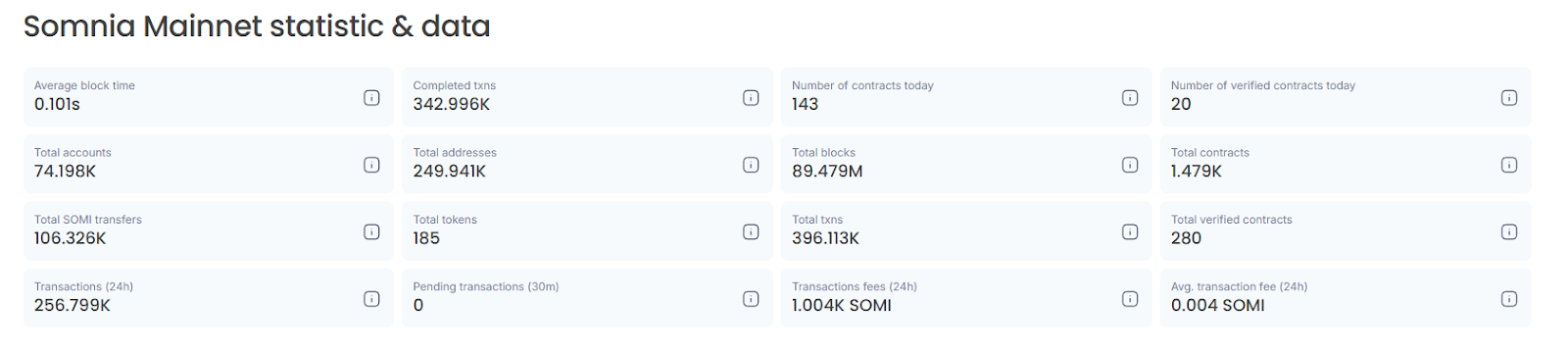

Observing its performance after the mainnet launch, on the launch day, Somnia had about 68,000 active users, with approximately 256,000 transactions in 24 hours. Overall, its actual performance remains to be seen.

Airdrop Sparks Ongoing Community Controversy

In contrast to its outstanding performance advantages and capital background, Somnia's reputation in the community is quite passive. The comment section of the official announcement of the mainnet launch is filled with complaints about airdrop ineligibility or inability to claim.

According to community feedback, this mainly stems from Somnia's lack of transparency in early rules, unfair distribution, and a complex unlocking mechanism with somewhat stingy allocations.

Many users reported that early users who followed official guidelines, completed numerous Odyssey tasks, claimed test tokens, purchased official NFTs, and even paid nearly $5 to complete KYC verification were ultimately told they were ineligible for the airdrop.

Additionally, some users pointed out that many genuine participants in the Chinese community were disqualified, while the airdrop ratio in the English community seemed higher, exacerbating community tensions.

Even for those who received the airdrop, the allocation of only 4.1% of the total supply, with only 20% unlockable at TGE and the remaining 80% requiring task completion for further unlocking, also offended those who received the airdrop.

In response to these controversies, Somnia founder Paul Thomas stated on social platform X that there were "account anomalies" in the query results, and the team is addressing them.

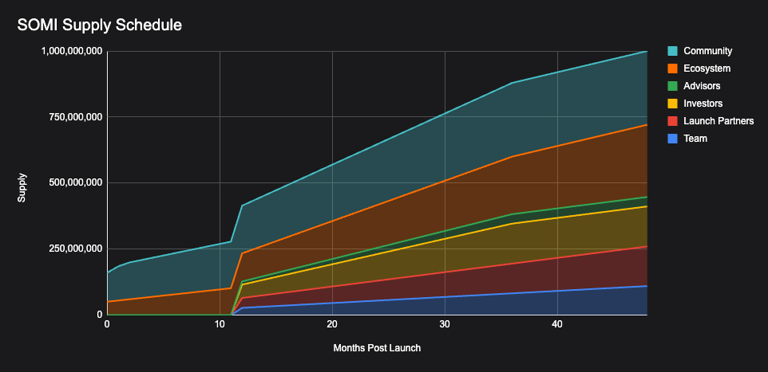

The total supply of the SOMI token is 1 billion, with an initial circulation of about 160 million (16.02% of the total). The core utility of the token includes paying gas fees, network staking, and future on-chain governance. To maintain the token's value, the protocol has designed a deflationary mechanism that destroys 50% of gas fees.

However, Somnia's capabilities in terms of resources should not be underestimated. On the day the token launched, multiple exchanges, including Binance, Bybit, Bitget, and MEXC, announced the opening of SOMI trading.

After the token launch, the SOMI price experienced a brief peak before quickly retreating, dropping from a high of $0.66 to as low as $0.42, and then stabilizing around $0.48, with a total market capitalization of about $480 million, ranking 437 on CMC.

In terms of network ecology, at the time of the mainnet launch, Somnia stated it had over 70 active development projects, mainly focused on gaming, such as Sparkball, Variance, and Maelstrom. To attract more developers, the Somnia Foundation launched a $10 million grant program and several incubator projects.

Summary

Overall, Somnia is a project with very distinct advantages and disadvantages. The positive aspect is that the performance advantages brought by Somnia's technical architecture could potentially make it the next fastest public chain, and it has the backing of capital giants like a16z, SoftBank, and Temasek, suggesting it has the potential to become a dark horse in the public chain space.

However, the downside is that its operations during the airdrop phase have led to significant controversy in the crucial community aspect. Additionally, high performance in the current market environment is a double-edged sword; on one hand, it can quickly attract market attention. On the other hand, it faces the challenge of actual delivery and the inability to verify popularity dissipating. Moreover, the entire industry has begun to experience aesthetic fatigue regarding the "high-performance narrative." If the ecosystem fails to produce a breakout product, even the highest performance will remain an unattainable dream.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。