Original Title: "The Golden Age of Prediction Markets: Polymarket Frenzy, Kalshi Emerges"

Original Source: OneKey English

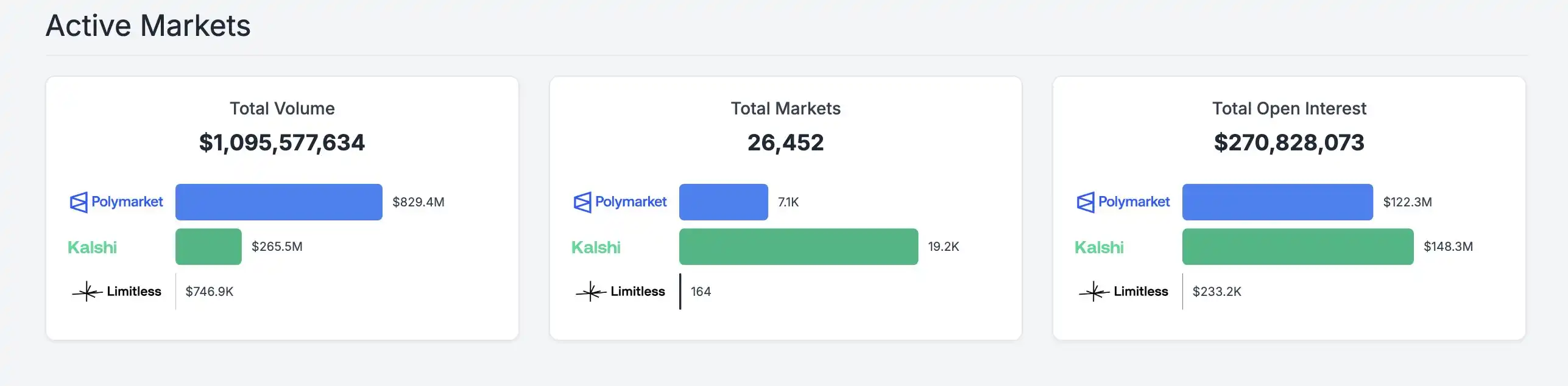

From the 2024 U.S. presidential election to the 2025 AI boom and sports events, prediction markets are booming. Polymarket's trading volume surged by over 300% during the election period, and the pricing ability of "collective wisdom" on-chain has garnered unprecedented attention. According to Polymarket Analytics, the cumulative trading volume of leading on-chain prediction markets has surpassed $1 billion, with nearly 30,000 markets established covering various topics such as politics, technology, sports, and cryptocurrency.

Why now? On-chain prediction markets are more transparent, secure, and resistant to censorship than traditional platforms; coupled with the gradual loosening of U.S. regulations, players like Coinbase and Kalshi are entering the space. These markets are attracting more and more users and funds; they are no longer just for entertainment betting but have become a new tool for information verification: when users bet real money, the price itself reflects the probability judgment under collective wisdom.

This characteristic is particularly prominent during major events. For example, in the 2024 U.S. presidential election, Polymarket priced Trump's chances of winning at 97% even before mainstream media; even when polls showed a "50-50" split, the market had already indicated a greater than 60% inclination. The betting of funds makes probabilities no longer mere talk but a signal worth referencing.

So, how do these markets actually operate? How does the on-chain prediction mechanism differ from the traditional model we are familiar with?

"Basic Mechanism of On-Chain Prediction Markets"

To understand on-chain prediction markets, let's first clarify how users place a "bet" in traditional prediction markets.

Suppose there is a market for the event "Will the Federal Reserve lower interest rates in September?" with only two outcomes: "Yes" and "No."

Bob believes the economy will weaken and that a rate cut is likely, so he bets $60 on "Yes"; Alice and James each bet $20 and $12 on "No," respectively. This results in a total of $92 bet in the market, with $60 on "Yes" and $32 on "No." On traditional platforms, users see not the so-called "probability," but the odds. For example, the platform might offer odds of 1.53 for "Yes" and 2.88 for "No."

The odds are actually derived from the distribution of funds:

"Yes" ≈ 60 ÷ 92 ≈ 65%

"No" ≈ 32 ÷ 92 ≈ 35%

The side with more bets has lower odds and thus lower returns when winning; the side with fewer bets has higher odds and thus higher returns when winning. For instance, if rates are indeed cut, the $60 bet can claim a share of the $92, yielding odds of about 1.53; if rates are not cut, the $32 bet can claim a share of the $92, yielding odds of about 2.88.

This is the operational logic of traditional prediction markets: user bets drive changes in odds, and the odds implicitly reflect the market's expected probability of the event's outcome.

"How Polymarket Moves Betting On-Chain"

Another core feature of traditional betting is its static and one-way nature. Once a bettor places a bet, their funds are locked until the event concludes and is settled. This process is irreversible. Bettors cannot adjust their positions based on new information or changes in circumstances during the event. There is no secondary market where bettors can "sell" their bets to lock in profits or reduce losses. To break this limitation, prediction markets have introduced core mechanisms from financial markets, achieving a paradigm shift from "betting" to "trading." We will continue with the market for "Will the Federal Reserve lower interest rates in September 2025?" to analyze the complete flow of funds.

Stage One: Market Creation

On Polymarket, anyone can create a prediction market without permission. When a market is created, a smart contract automatically generates tradable shares corresponding to the event outcomes, such as "Yes" and "No." The total number of shares is fixed, with the total value of each "Yes" and "No" share being 1 USDC. The market creator provides initial liquidity and receives corresponding shares, thus determining the initial price.

Stage Two: Opening Positions

Assuming in the early market, the probability of a rate cut is considered to be 40%: the price of "Yes" shares is 0.40. Alice believes the probability of a rate cut is underestimated and buys 100 "Yes" shares at a price of 0.40, spending $40 USDC. Alice's counterparty is Bob, who sells 100 "Yes" shares (or buys 100 "No" shares). Alice's $40 and Bob's $60 are locked in the smart contract as collateral. Alice receives 100 "Yes" shares, and Bob receives 100 "No" shares.

Stage Three: Market Fluctuation

Suppose the inflation report shows the economy is cooling more than expected. The likelihood of a rate cut increases significantly, and the price of "Yes" shares rises to 0.75. The value of Alice's shares increases from $40 to $75, yielding a paper profit of $35.

Stage Four: Closing Positions

Alice decides to sell her shares to lock in a $35 profit. Trader James believes a rate cut is a certainty and is willing to buy at a price of 0.75. Alice's sell order matches James's buy order. James pays $75 USDC directly to Alice. Alice's "Yes" shares are transferred to James.

Alice's $35 profit comes from the higher price paid by James. At this stage, there has been no loss of principal. Therefore, before settlement, traders' profits come from the real-time changes in other traders' probability judgments about the event. The money you earn comes from those who buy your shares at a high price, and the money you lose comes from the difference paid to the next holder when selling at a low price.

Stage Five: Event Settlement

Assuming Alice and Bob hold their shares until the Federal Reserve meeting concludes. The result is confirmed along with the fund distribution logic: an oracle confirms the final outcome. If "Yes" occurs, "Yes" shares are worth $1.00, and "No" shares are worth zero. Winners will redeem their corresponding shares for the funds locked in the smart contract. Losers will lose their invested principal.

For example, if the Federal Reserve announces a rate cut and "Yes" occurs, Alice will redeem her 100 "Yes" shares for $100 USDC. Alice's profit is $60, and Bob loses his entire $60. Alice's $60 profit is exactly Bob's $60 loss.

It can be seen that on-chain prediction markets like Polymarket are peer-to-peer, without a "house" as in traditional betting platforms. The flow of funds is entirely between participants, managed automatically and transparently by smart contracts. Trading profits come from real-time changes in other traders' probability judgments about the event, while settlement profits come directly from the principal invested by traders holding opposing final views. The entire process achieves decentralized, trustless fund circulation, providing crypto users with a more open "betting" world.

More importantly, when you are predicting the future, you are not just "talking big": you are betting real money. This characteristic can play a significant role in major events. Intuitively, the larger the total amount bet, the more meaningful the probability reflects potential outcomes and aligns with reality.

So when you want to determine whether a piece of news is true, the changes in prediction market probabilities can be very helpful. The most classic case is last year's U.S. presidential election. DragonFly partner Haseeb pointed out in a tweet analysis that the world's largest prediction market, Polymarket, made a judgment even before mainstream news media, declaring Trump's chances of winning at 97% before midnight Eastern Time. Moreover, even when polling models indicated a 50-50 chance for Trump and Harris, Polymarket had already provided its answer—Trump's winning probability exceeded 60%.

On-chain prediction markets are far more than just a gambling platform: through blockchain technology and financial means, they are expected to become a new generation of information dissemination and verification channels.

"On-Chain vs. Compliance: Why Kalshi is Criticized"

Compared to Polymarket, another prediction market, Kalshi, has recently sparked controversy by hiring 23-year-old crypto influencer John Wang as head of crypto operations around August 25, 2025, aiming to expand its digital asset domain. Upon the announcement, Kalshi's investors, including members of Paradigm and Multicoin Capital, responded very positively to the appointment.

Kalshi is another major player in on-chain prediction markets. In recent months, they completed a $100 million funding round at a $1 billion valuation, partnered with xAI to bring Grok into the prediction market, and had members of the Trump family serve as strategic advisors… At the same time, Kalshi is also the first event contract market in the U.S. fully regulated by the CFTC (Commodity Futures Trading Commission).

However, there are also some opposing voices within the native crypto community regarding Kalshi: Jordan from research firm Delphi Digital pointed out that Kalshi's centralized structure is not suitable for promoting as a crypto project; Uniswap team member Niko also stated that Kalshi should not be respected for damaging Polymarket's reputation and operations by spreading negative information during the election period.

Although there are some controversies in the community regarding Kalshi, data shows that it has already become one of Polymarket's main competitors, and its future development cannot be ignored.

"End"

On-chain prediction markets not only break the static limitations of traditional betting but also achieve a paradigm shift from "betting" to "trading" by introducing financial trading mechanisms, showcasing strong vitality through their transparency and decentralization.

As their mechanisms mature and platforms like Polymarket and Kalshi continue to develop, on-chain prediction markets are gaining unstoppable momentum, becoming an important force for future information pricing and risk hedging.

Disclaimer: The content of this article is for knowledge dissemination and educational purposes only and does not constitute any investment or financial advice; DeFi protocols carry high market and technical risks, and the prices and yields of digital assets can be highly volatile. Participating in digital asset investment and DeFi protocols may result in the loss of the entire investment amount; readers should understand and comply with local laws and regulations before participating in any DeFi protocols, conduct risk assessments and due diligence, and make cautious decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。