In the midst of strategizing, we decide the outcome from a thousand miles away. Hello everyone, I am Lin Chao, a global financial market observer, focusing on cryptocurrency market analysis, bringing you the most in-depth trading information analysis and technical teaching.

Yesterday, Lin Chao mentioned his views on the market trend for September. The market index indeed followed this trend, primarily moving sideways and downwards. The trading volume has been mediocre, with both BTC and ETH, the two mainstream coins, already below the 30-day moving average. However, it is worth noting that although the market is consolidating below the 30-day moving average, there has not been a waterfall-like large drop, which means it is just a short-term consolidation. It is still too early to say that the bull market has ended. As time goes on, the policy market in September is about to begin. The non-farm payroll data will be released on September 5, and the interest rate meeting will be held on September 18. This indicates that September will be an unstable month. The overall directional trend will also provide a clear answer this month.

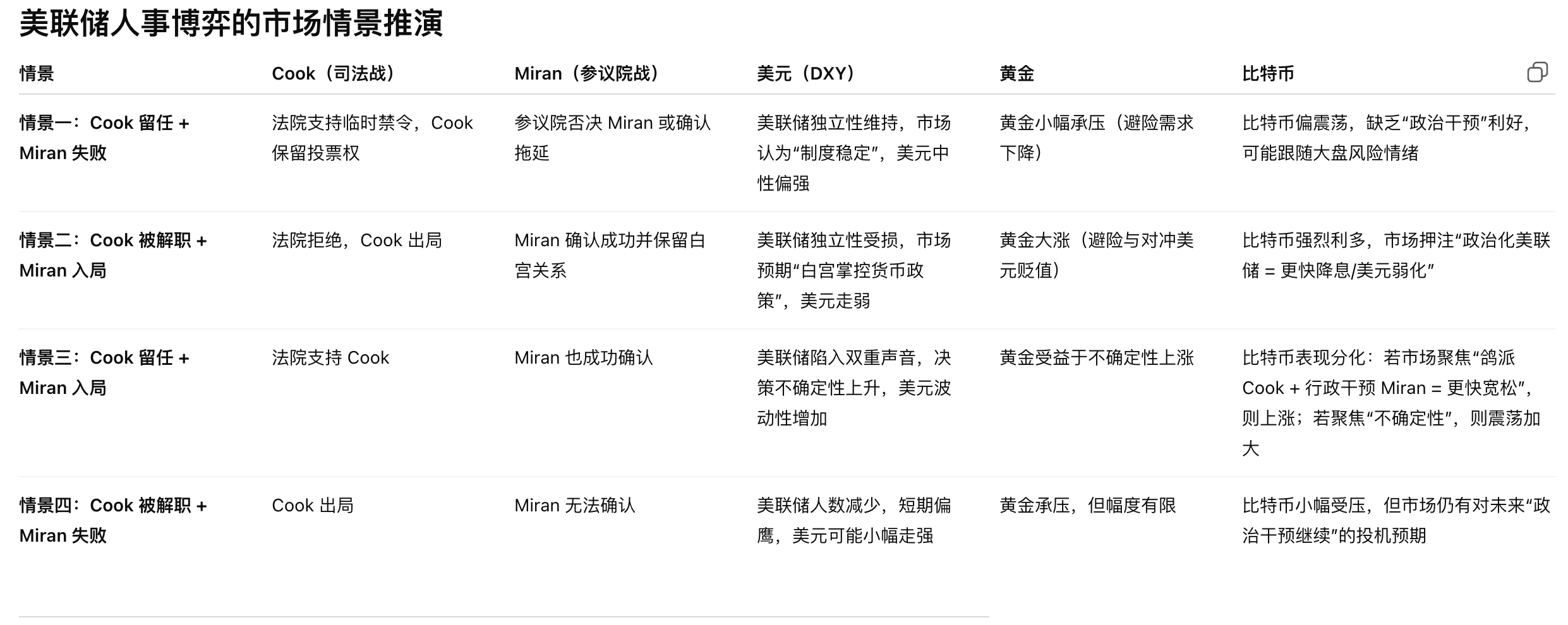

At the same time, the Federal Reserve is facing an unprecedented split. The recent changes in the Federal Reserve Board are complex, as Trump's "impulsive decision" has broken the original political tacit agreement and inertia, creating multiple historical firsts. Federal Reserve Board member Lisa Cook was directly appointed by Trump, marking the first time in U.S. history that a president has "fired" a member of the Federal Reserve Board. Meanwhile, Stephen Milan is attempting to concurrently serve on the White House Council of Economic Advisers (CEA) and the Federal Reserve Board in a "leave of absence" manner, breaking the ironclad rule established since the 1930s that "monetary policy is independent of the executive branch." This series of events has led to simultaneous interventions from the judicial and legislative systems into the president's executive power, closely examining the concrete performance of the U.S. "separation of powers." Cook has chosen to file a lawsuit within the judicial system, seeking to prevent the appointment from taking effect. Milan must go through the Senate confirmation process to take office. The simultaneous intervention of the judiciary and legislature in monetary policy personnel has almost no historical precedent. At this time, the Federal Reserve is not only facing the risk of "loss of independence" internally but is also caught in the crossfire between Congress, the courts, and the White House. The biggest point of contention currently is whether the president has the authority to dismiss a Federal Reserve governor. According to the "Supreme Court" regulations, board members typically serve a term of 14 years, and the president can only dismiss members for "just cause." This is different from the situation where cabinet ministers can be dismissed "at the president's discretion." Moreover, no president in U.S. history has successfully succeeded a Syrian president; Trump is attempting this for the first time. Whether "just cause" includes the president's belief of "misconduct/bribery" or is limited to serious violations or dereliction of duty needs to be ultimately determined by the court. Therefore, from the perspective of Syrian legal systems, Trump's restart action carries risks and establishes an interpretation of the Syrian Ministry of Foreign Affairs system. Cook: has been announced by Trump to be in court, but she is seeking "temporary relief" in court, hoping to retain her position until the lawsuit is resolved. If the court supports her, she may continue to participate in the interest rate meeting on September 16-17. If the court denies her, she will lose her voting rights, and the Federal Reserve will lack a "dovish" voice.

Lin Chao's Summary

Returning to the market, in recent days, Bitcoin has shifted from a wide fluctuation pattern to a narrow fluctuation, with major mainstream coins approaching the moving average, while small coins occasionally spike; the market is thus switching back and forth in different levels of fluctuations for harvesting. It’s not that we fear you making money, but rather that we fear you not participating; as long as you engage, there will always be times when you get carried away, and there will always be days when you fall into a pit. Lin Chao's conclusions are: 1. It is still not a good time to make trades, and the market is switching back and forth in different levels of fluctuations for harvesting. 2. This kind of market often accompanies a wave of false breakouts followed by an expansion of fluctuations in the opposite direction; 3. Although ETH's daily line appears flat, it has a fluctuation of over 5%, making this market difficult to navigate. Currently, the market is not only a stage where newcomers should avoid entering, but even experienced players may incur losses due to insufficient experience. The only way to preserve capital is to reduce operations.

Essentially, the end of a bull market, or the transition from an upward trend to sideways and then downward, is the process of buying pressure exhausting—splitting, splitting—leading to panic selling. A few days ago, I was curious about what form the market would take to adjust; the cryptocurrency market often moves first, followed by news stimuli. Recently, Nasdaq has strengthened its scrutiny of listed companies investing in cryptocurrencies, so I judge that the short-term outlook is bearish, but long-term may be bullish.

About Trading

Lin Chao has consistently emphasized that as a long-term trader, it is essential to establish your own trading rhythm and have a complete trading plan.

In the market, placing orders recklessly without a trading plan is almost equivalent to gambling. A qualified plan should cover at least five aspects: First, entry and exit: you need to clarify at what position to enter and under what conditions to exit, including stop-loss, take-profit, and trailing stop-loss. Second, risk control: including position size, maximum risk per trade, total position quantity, and how to handle major news. Third, maintain focus: determine the market and timeframe you want to trade, avoiding the temptation to trade everything you see. (Trends can make money, and sideways markets can also make money. But no one can profit from every single trade.) Fourth, market conditions: clarify under what market conditions you will act, whether in a trend, sideways, or volatile environment. Fifth, growth and goals. Is trading aimed at income or long-term appreciation? Is it a full-time job or a side job? How to find a balance between profit, loss, and reduction? A complete trading plan is not just a slogan; it should be able to answer: what gives you the right to enter? How to control risk? What is the goal?

In trading, losses and profits are never purely related. A 10% loss requires an 11% gain to break even; a 50% loss requires a 100% gain; once a loss reaches 70%, a 233% gain is needed to recover. This indicates one thing: to rebound, the necessary recovery must increase exponentially, making it almost impossible to recover through just one or two trades (in other words, trying to recover quickly will lead to the vicious cycle of over-leveraging). True risk management is not about finding ways to recover after significant losses, but about decisively cutting losses when they occur, keeping the account curve within a recoverable range. Since the key for traders to survive is not miraculous operations to recover losses, but rather not letting the situation spiral out of control from the very beginning.

Lin Chao would like to remind long-term contract traders: in trading, the most important thing is to manage yourself well; this self-management includes but is not limited to: 1. Manage your important emotions well, avoiding being too pessimistic or overly excited; 2. Manage the volatility of your mindset, etc. Methods: After a big win, do not immediately pull back; maintaining good winning results is one of the effective means to cultivate a good mindset and emotions; if every defense after an attack can be well executed, over time, it will form a memory and establish a trading system, creating a positive cycle. A positive psychological cycle is likely to make trading smooth; the most common mistake people make is becoming overly excited after achieving a temporary victory, getting carried away by excitement, trying to achieve too much too quickly, and failing to notice the subtle changes in the environment, continuing to push hard, resulting in profit retracement or even loss of principal, leading to urgent recovery measures that break the opportunity for a positive cycle.

If you are in a state of confusion—unable to understand technology, unable to read the market, unsure when to enter, unable to set stop-losses, not knowing when to take profits, randomly increasing positions, getting stuck while trying to catch the bottom, unable to hold onto profits, missing market opportunities, these are common issues for retail investors. Lin Chao can help you establish the correct trading mindset. A single profitable trade is worth more than a thousand words; finding the right direction is better than repeatedly facing defeat. Instead of frequent operations, it is better to strike accurately, making each trade more valuable.

The success of investment depends not only on choosing good targets but also on when to buy and sell. Preserving capital and making good asset allocation is essential for steady progress in the ocean of investment. Life is like a long river flowing into the sea; what determines victory or defeat is never the gains and losses of a single pass or a moment, but rather planning before action and knowing when to stop to gain.

The global market is ever-changing, and the world is a whole; follow Lin Chao to gain a top-tier global financial perspective.

This article is merely a personal opinion and does not constitute any trading advice. The cryptocurrency market carries risks; invest with caution!

For real-time consultation, feel free to follow the public account: Lin Chao on Cryptocurrency.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。