Assuming the previous collapse of the coin-stock DAT was inevitable, how should investors respond? What strategies should be adopted? What algorithms and standards are there? Are there successful cases in the market? What are their core competitive advantages?

Reading Guide:

For those who haven't read the previous article, it's recommended to check: "How to Proceed After a Halving? Decoding the Anti-Fragile Mechanism and Breakthrough Code of DAT Enterprises"

If you simply want to see case analyses, you can read on.

Part Four: The Truth of the "Moat" and the Future of the DAT Model

After understanding the operational mechanism and risks of "coin-stocks," a core question arises: What is the long-term competitiveness and "moat" of DAT companies? Where will they head in the future?

4.1. The Truth of the Moat: A "Capital Flywheel" Dependent on Market Sentiment

The true "moat" of DATs does not stem from their business itself, but rather from a highly contextual and fragile financing advantage. Their core competitiveness lies in a powerful cycle of liquidity and financing costs: "Financing ability → Purchase more coins → Enhance investor return expectations → Attract more liquidity → Lower financing costs → Further enhance financing ability." This mechanism, known as the "capital flywheel," is essential for understanding their business model.

Positive Cycle (in a Bull Market):

This flywheel can generate strong positive momentum in a bull market.

High Premium as Fuel: The company's stock price trades at a price higher than its net asset value (NAV) of digital assets, creating an "equity premium" (mNAV Premium). This premium is the key fuel that starts the entire flywheel.

Financing Ability Activated: With a high premium, the company can engage in "accretive" financing by issuing new shares or low-interest convertible bonds, using overvalued stock to raise funds to purchase more digital assets, thereby expanding its balance sheet without diluting or even increasing the per-share coin amount.

Liquidity and Low Costs: When market sentiment is high and stock liquidity is excellent, the company can easily sell a large number of new shares in the open market without significantly impacting the price, greatly reducing the friction costs of financing.

"Buy, Buy, Buy" Reinforces the Narrative: The company continuously buys more digital assets with the funds raised, which not only increases the company's net asset value but also reinforces its market narrative as a "growth engine," attracting more investors and further driving up stock prices and premiums, creating a strong positive feedback loop.

Reverse Destruction (in a Bear Market):

However, this powerful engine has a fatal weakness: it completely relies on sustained bull market sentiment and high stock premiums. Once the market turns, the flywheel can quickly reverse, turning into a "death spiral":

Premium Disappears, Fuel Exhausted: When the underlying coin price drops, the stock price of the "coin-stock" will fall even more sharply, leading to a rapid contraction of its mNAV premium, even turning into a discount.

Financing Ability Frozen: Once the premium disappears, any financing through stock issuance will be "dilutive." At this point, the company can no longer engage in accretive financing, and its core growth story collapses. The financing ability—this sole moat—dries up instantly.

Negative Feedback Loop: The depletion of financing channels and the collapse of the growth narrative can trigger panic selling by investors, further suppressing stock prices, creating a vicious cycle that may ultimately lead to a stock price collapse.

Therefore, the moat of DATs is extremely narrow and unstable, as it completely depends on the fickle sentiment of the capital market. Once market sentiment reverses and the premium disappears, this moat will dry up instantly, and the company will lose its only competitive advantage.

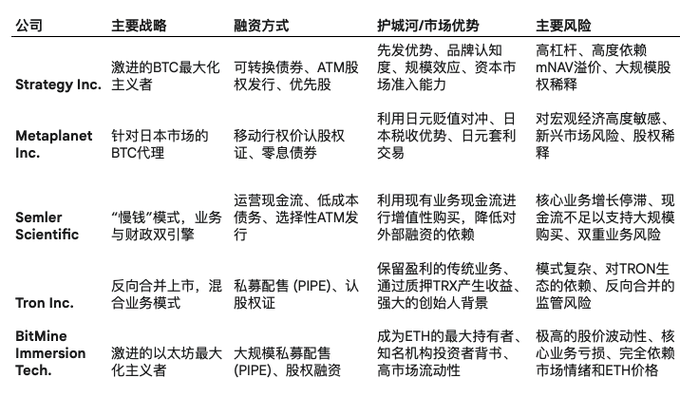

4.2. Comparative Case Studies: Practice and Variations of Strategy

Although the basic model is similar, different DATs exhibit significant differences in specific strategic execution, reflecting their different understandings of their positioning, market environment, and regulatory constraints.

Strategy Inc. (MSTR) - The Aggressive Pioneer

As the pioneer of the model, MicroStrategy's strategy is the most aggressive. It not only extensively uses various debt instruments (such as convertible bonds) to maximize leverage, but its founder Michael Saylor also creates a "soft moat" for the company through his strong personal brand and continuous evangelism. He successfully binds MicroStrategy deeply with BTC, making it the most recognized BTC proxy stock in the minds of global investors, which somewhat solidifies its mNAV premium.

Metaplanet Inc. (3350.T) - The Flexible International Adapter

The case of Metaplanet demonstrates how the DAT model can innovate and adjust according to the market environment of specific countries or regions. Its strategy cleverly leverages Japan's unique macro and regulatory environment:

Yen Carry Trade: Against the backdrop of the Bank of Japan maintaining ultra-low interest rates for a long time, Metaplanet borrows yen at nearly zero cost and converts it into BTC, which is expected to appreciate in the long term, thus engaging in macro arbitrage.

Moving Strike Warrants: Since Japanese regulations do not allow the common ATM issuance mechanism in the US stock market, Metaplanet innovatively uses warrants with a strike price linked to the previous day's closing price. This design ensures that the warrants are only exercised when the stock price rises, achieving a similar effect to ATM, allowing for dilutive financing at high stock prices.

Tax Advantages: Japan imposes high progressive taxes on individuals directly holding cryptocurrencies, while the capital gains tax rate for investing in stocks is much lower (around 20%). This tax difference makes it more attractive for Japanese investors to indirectly hold BTC by purchasing Metaplanet stock, creating localized demand for its shares.

Semler Scientific (SMLR) - The Cautious Business Integrator

Semler Scientific represents a more conservative strategy—the "Slow Money" model. The company plans to use the stable cash flow generated by its core healthcare business to gradually and prudently purchase BTC, aiming for a more "accretive" asset accumulation for shareholders. This model is theoretically more sustainable as it does not rely entirely on external financing. However, its challenge lies in the fact that the company's core business is facing growth bottlenecks and regulatory pressures, complicating the narrative of generating sufficient cash flow to support large-scale BTC purchases.

Tron Inc. (TRON) - Reverse Merger and Hybrid Model

The case of Tron Inc. showcases a non-traditional path to listing and business structure. The company, formerly known as SRM Entertainment, entered the public market through a reverse merger with TRON DAO and rebranded as Tron Inc. This strategy allowed it to quickly become a Nasdaq-listed company and focus on building a financial reserve for the TRX token. Its uniqueness lies in its hybrid business model: it retains its original business of designing and manufacturing custom products for large entertainment venues (such as Disney and Universal Studios) while exploring blockchain financial strategies. Additionally, the company actively utilizes its TRX reserves for staking, generating annualized returns of up to 10% through platforms like JustLend, providing non-dilutive cash flow for its operations. (From a bird's-eye view, the $TRX token has not left the Tron network.)

BitMine Immersion Technologies (BMNR) - The Aggressive Ethereum Whale

BitMine (BTMR) represents the aggressive expansion of the DAT model into assets beyond BTC. The company has transformed from a BTC mining business to focus on becoming the world's largest enterprise-level holder of Ethereum (ETH), setting an ambitious goal of holding 5% of the circulating supply of ETH. Its strategy is characterized by astonishing financing speed, accumulating billions of dollars worth of ETH reserves in a short time through large-scale private placements (PIPEs) and equity financing. This aggressive accumulation strategy has attracted high-profile investors, including Peter Thiel's Founders Fund and Stanley Druckenmiller, with Fundstrat's Tom Lee serving as chairman. However, BMNR's stock price performance is extremely volatile, experiencing thousands of percentage points of surges followed by significant corrections, highlighting its high-risk, high-reward nature. Due to its core business (mining) generating minimal revenue and being in a loss state, its valuation is almost entirely driven by market expectations of ETH prices and confidence in its financing ability.

Main DATs Strategic Comparison Analysis

4.3. The Next Evolution: "Productive Treasury"

In the face of the inherent fragility of passive holding strategies, the DAT model is undergoing a significant evolution, shifting from "Passive Treasury" to "Productive Treasury."

Traditional BTC financial strategies are essentially a passive "digital gold" strategy, where the assets themselves do not generate any cash flow. In contrast, the "Productive Treasury" model focuses on holding digital assets that can generate returns through network-native mechanisms, primarily public chain tokens that adopt POS consensus mechanisms, such as ETH and SOL.

By staking the held ETH or SOL, companies can directly earn token-denominated rewards from the protocol. This staking yield is an endogenous, crypto-native "interest" that does not rely on traditional credit markets, providing companies with a stable, non-dilutive cash flow source. The emergence of this model signifies that DATs may transition from purely financial engineering vehicles to operational companies with real crypto-native businesses. For example, companies like DeFi Development Corp. (DFDV) are focusing on accumulating SOL and generating staking rewards by operating validation nodes. (TRON Inc. is also considered to be at the forefront of this trend.)

This evolution towards "Productive Treasury" is a strategic response to the reality that the moat of the passive holding model is too fragile. By creating endogenous cash flows that are decoupled from capital market sentiment, these companies are attempting to build a broader and deeper economic moat, thereby reducing their extreme reliance on financing ability in bull markets and providing a more solid foundation for their long-term survival and development.

Part Five: Conclusion—Seeing the Essence Through the Fog

For investors looking to invest in such companies, it is essential to abandon the view of them as simple "crypto asset stocks" and instead evaluate them as highly speculative, actively managed leveraged funds. Their ultimate investment performance depends on the complex interaction of the following four core variables:

The price performance of the underlying crypto assets: This is the foundation for determining the company's net asset value (NAV).

The financial engineering capabilities of the management: This refers to how quickly, at what cost, and with what level of dilution the company can raise funds and convert them into assets.

Market sentiment in the stock market: This is key to determining the company's mNAV premium level, directly affecting its financing ability and the intensity of the "flywheel effect."

The net crypto asset holding per share: This determines the level of crypto assets allocated to each share.

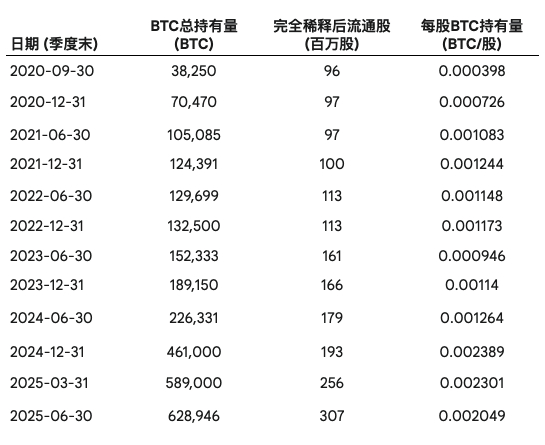

Taking Strategy InBTC as an example, when evaluating "coin-stocks," it is crucial to monitor the following key indicators rather than just focusing on the total BTC holdings announced by the company:

- Crypto asset content per share (fully diluted): This is the most important indicator of shareholders' real exposure. Investors should closely track its historical trend to assess whether the company's financing activities are accretive or dilutive in the long term.

Analysis of Equity Dilution and BTC Holdings per Share for Strategy Inc. (MSTR)

Trend of mNAV premium: Is the premium expanding or contracting? A sustained contraction of the premium is a clear signal of weakening market confidence and increasing risk. Comparing it with peer companies and related ETFs can better assess whether its valuation is reasonable.

Financing/Issuance Terms: Carefully study the specific terms of each bond issuance or share increase by the company, including the conversion price and interest rate of convertible bonds, as well as the scale and price of the ATM plan. These details reveal the company's future dilution risk and financial pressure.

Knowing the facts and understanding the reasons behind them.

The "capital flywheel" that drives DAT stock prices to soar in a bull market is precisely the fundamental reason for their accelerated decline in a bear market. Their core business model—financing to purchase more assets by leveraging high stock price premiums—is inherently a double-edged sword. This extreme dependence on capital market sentiment determines that their fate is inevitably closely tied to the cyclical fluctuations of the market.

May we always maintain a sense of awe towards the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。