Author: Thejaswini

Translation: Shaw, Golden Finance

Every financial advisor you encounter will start by preaching the power of compound interest.

Investing $500 a month in an index fund with an annual return of 7% will yield you $1.3 million after 30 years. This sounds great, but by the 15th year, that $500 monthly investment seems trivial, as rent has doubled, children have arrived, and your definition of "enough money" has shifted from "affording avocado toast" to "affording a good school district home." The traditional path assumes your expenses remain constant while your money grows slowly, but real life is quite the opposite.

So when you hear that someone can earn 15% to 20% annually through the cryptocurrency derivatives market, your first thought isn't about risk, but about the timeline. Finally, there’s a return that can outpace the rising cost of living.

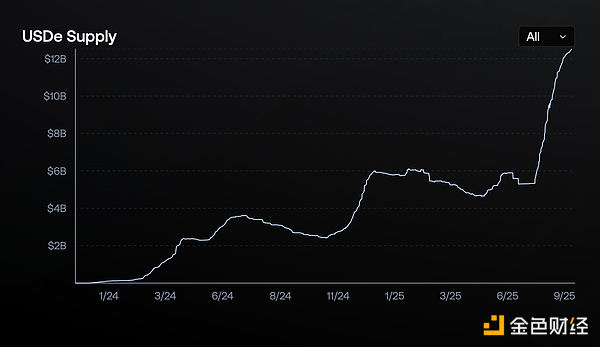

The following fact makes me want to delve deeper: a cryptocurrency protocol launched 18 months ago has seen its circulating supply surpass $12.4 billion in a short time, faster than any digital dollar in history. While USDT only reached $12 billion by mid-2020 (after years of slow growth), and USDC didn't surpass $10 billion until March 2021, Ethena's USDe has quickly surpassed both milestones, making it a speed race in the financial sector.

USDe is leveraging the structural inefficiencies of the cryptocurrency derivatives market.

This raises the core questions that every investor, regulator, and competitor is asking.

How did they achieve this so quickly? What are the actual risks? Is it sustainable? Or is it just another high-yield experiment waiting to collapse?

I attempt to answer most of these questions.

The World's Largest Arbitrage Trade

Ethena has found a way to turn the ongoing demand for leverage in the cryptocurrency market into a money-printing machine. Simply put, here's how it works.

By holding cryptocurrency as collateral and shorting an equivalent amount of cryptocurrency futures contracts, they earn the spread. This results in a stable synthetic dollar while profiting from the most reliable money printer in cryptocurrency.

Let’s analyze this further. When someone wants to mint USDe, they deposit crypto assets like Ethereum or Bitcoin. But Ethena doesn’t just hold these assets and hope they remain stable (oh, by the way, they won’t); instead, they immediately open a short position of equal size on a perpetual contract exchange.

If ETH rises by $100, their spot position will gain $100, but their short contract position will lose $100.

If ETH falls by $500, their spot position will lose $500, but their short contract will profit by $500.

The end result—perfect stability in dollar terms.

This is known as a delta-neutral position. You won’t lose money due to price fluctuations, but you also won’t profit.

So where does the 12%-20% yield come from? There are three sources.

First, they stake ETH collateral and earn staking rewards (currently about 3%-4%).

Second, they collect what is known as the "funding rate" from short contracts.

In cryptocurrency perpetual contracts, traders pay a funding fee every eight hours to maintain their positions. When there are more long positions than short positions (which is about 85% of the time), the longs pay the shorts. Ethena is always on the short side, collecting these fees.

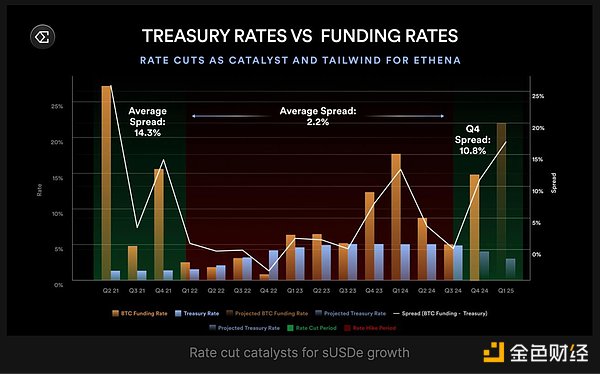

In 2024, the average weighted funding rate for Bitcoin was 11%, and for Ethereum, it was 12.6%. These are actual cash flows that leveraged traders pay to anyone willing to bet against them.

Third, they can earn from cash equivalents and treasury products held in reserves. Ethena holds liquidity-stable assets with partners who pay additional yields. USDC pays loyalty rewards, and holding USDtb can earn from BlackRock's BUIDL fund.

Overall, these funding sources generated an average annual yield of 19% for sUSDe holders in 2024.

In recent years, cryptocurrency funding rates have averaged between 8-11%. Combined with staking rewards and other income sources, you can achieve a yield that provides peace of mind. Isn’t that the key?

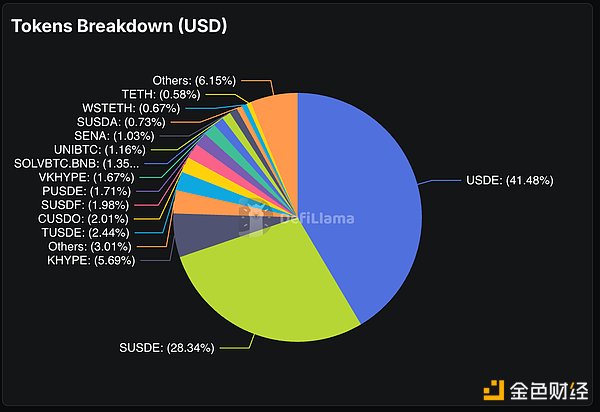

The Ethena ecosystem is driven by four types of tokens, each with different functions:

USDe is a synthetic dollar unit that maintains a target price of $1 through delta-neutral hedging. It does not generate rewards unless staked and can only be minted or redeemed by whitelisted participants.

sUSDe is a yield-bearing token obtained by staking USDe in the ERC-4626 protocol vault. Currently, all income from the Ethena protocol flows to sUSDe holders in the form of yield rewards. As Ethena regularly deposits protocol income, its value (in USDe) will also rise. Users can unstake after a cooling-off period and redeem USDe.

ENA serves as a governance token, allowing holders to vote on key protocol matters (such as eligible collateral assets and risk parameters). It also lays the foundation for future ecosystem security models.

sENA represents staked ENA positions. The planned "fee conversion" mechanism will allocate a portion of protocol income to sENA holders once specific milestones are reached. Currently, sENA can receive ecosystem allocations, such as the 15% token allocation proposed by Ethereal.

But there’s a significant catch. This model only works when people are willing to spend money to go long on cryptocurrencies. Once market sentiment reverses and funding rates turn negative, Ethena will start paying interest instead of earning income.

Why 2025 Will Be a Breakthrough Year for Ethena

Multiple factors are contributing to USDe becoming the fastest-growing digital dollar in history.

The perpetual futures contract market is experiencing explosive growth, with the open interest of major altcoins reaching approximately $47 billion in August 2025, while Bitcoin's open interest hit $81 billion. The increase in trading volume means Ethena has more opportunities to earn funding rate income.

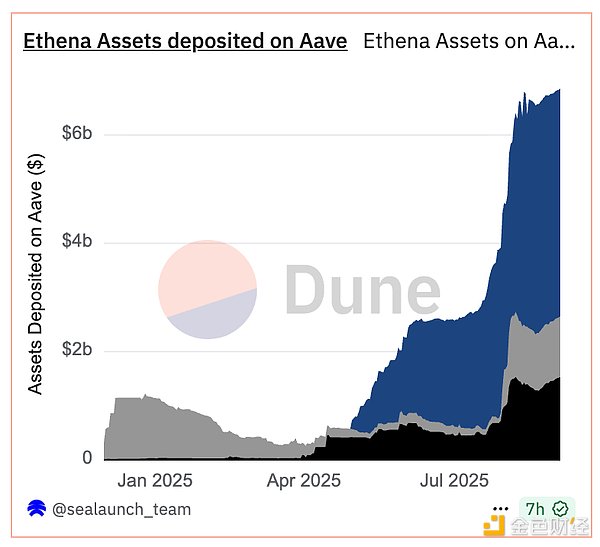

This accelerated development stems from a so-called "enhanced" financial engineering. Users have discovered that they can stake USDe to earn sUSDe (yield-bearing), then tokenize their sUSDe holdings on Pendle (a yield derivatives platform), and use these tokenized holdings as collateral on Aave (a lending protocol) to borrow more USDe. This creates a recursive yield loop, allowing experienced players to amplify their exposure to potential USDe returns. What’s the result? 70% of Pendle's total deposits are Ethena assets.

Additionally, $6.6 billion worth of Ethena assets are on the Aave platform.

This layer upon layer of leverage is all chasing those double-digit yields.

A special purpose acquisition company (SPAC) named StablecoinX announced plans to raise $360 million specifically to accumulate ENA tokens. This entity will use the proceeds to accumulate ENA tokens under a "permanent capital" mandate, creating a structural buyer to eliminate sell pressure and support governance decentralization.

Ethereal's permanent decentralized exchange. Ethereal is built specifically on USDe and attracted $1 billion in total locked value (TVL) before its mainnet launch. Users deposit USDe to earn points for the eventual token issuance, creating another massive consumption of USDe supply while also generating excitement for the first large application natively built on Ethena's infrastructure.

Ethena is collaborating with Securitize to build a permissioned L2 fusion chain aimed at introducing traditional finance through KYC-compliant infrastructure. This chain uses USDe as the native fee token, creating structural demand while also opening access for institutional capital that cannot interact with non-permissioned DeFi.

The market expects the Federal Reserve to cut interest rates twice before the end of 2025, with an 80% chance of a cut in September. When interest rates decline, traders typically increase their risk-taking behavior, driving up funding rates. USDe yields are negatively correlated with the federal funds rate, meaning that rate cuts could significantly increase Ethena's income.

- Ethena's fee conversion proposal. The Ethena governance body has approved a framework containing five metrics to activate revenue sharing with ENA holders. Four of the following five conditions have been met:

USDe supply exceeds $6 billion (currently at $12.4 billion), protocol income exceeds $250 million (over $500 million achieved), Binance/OKX integration (achieved), and sufficient reserve funds (achieved). The final requirement—the yield spread maintaining sUSDe at least 5% higher than sUSDtb—remains the only barrier for ENA holders to receive a share of protocol profits.

These conditions serve as safeguards for governance decisions, designed to protect the protocol and sENA holders from premature or risky profit distributions. The milestones reflect benchmarks for protocol maturity, financial health, and market integration. Ethena aims to ensure its sustainability and value before fully unlocking profit distribution.

Ethena has also been quietly establishing partnerships with traditional financial firms and cryptocurrency exchanges, allowing USDe to be used anywhere from Coinbase to Telegram wallets.

Institutional-Level FOMO

Unlike previous stablecoin experiments that developed purely through crypto-native use cases, USDe is attracting the attention of traditional financial institutions.

Coinbase's institutional clients can now directly access USDe. CoinList offers USDe with a 12% annualized rate through its yield program. Major custodians like Copper and Cobo are managing Ethena's reserves.

These are all related to institutional investors, as they provide platforms, custody, or services specifically designed to support qualified investors and institutional clients in the crypto market.

This model is similar to that of USDC and USDT, but the time span is much shorter. Major stablecoin providers took years to establish institutional relationships and compliance frameworks. Ethena completed this in just a few months, partly due to a matured regulatory environment and partly because its yield opportunities are simply too enticing to ignore.

Institutional adoption brings credibility, credibility brings more capital, more capital means higher funding rate capture, which supports higher yields, ultimately attracting more institutions. As long as the underlying mechanisms remain unchanged, it acts like a flywheel that continues to accelerate.

This speed comparison has an important prerequisite. USDe does not need to prove the utility, safety, or legitimacy of stablecoins to the world. In the market it enters, USDT and USDC have already taken on the heavy lifting in terms of institutional adoption, regulatory recognition, and infrastructure development.

Leverage Square

The high concentration on Pendle and Aave creates a single point of failure scenario, as risk managers would say. If Ethena's model encounters issues, it will not only affect USDe holders but also the entire DeFi ecosystem that relies on Ethena's capital flow.

If Ethena runs into problems, Pendle could lose 70% of its business. Aave would face massive capital outflows. Yield strategies relying on USDe would become ineffective. We would face a liquidity crunch across the entire DeFi system, not just a stablecoin decoupling issue.

The most concerning aspect of Ethena's development is how people are using it. The recursive lending loops on Aave and Pendle create leverage multipliers that amplify both yields and risks.

Users stake USDe for sUSDe, tokenize sUSDe on Pendle to obtain PT tokens, deposit PT tokens as collateral on Aave, and borrow more USDe, repeating this cycle. Each iteration amplifies their risk exposure to the underlying yields of USDe while also magnifying their risk exposure to any volatility or liquidity issues.

This is reminiscent of the CDO square structure that led to the 2008 financial crisis. A financial product (USDe) is used as collateral to borrow more funds, creating recursive leverage that is difficult to unwind quickly.

Maybe I'm just overthinking it, but if funding rates remain negative, USDe could face redemption pressure. Leveraged positions would face margin calls. Protocols relying on USDe's total locked value (TVL) would experience massive capital outflows. The speed of liquidations could outpace any single protocol's ability to cope.

Every high-yield strategy ultimately faces a question: what happens when it fails? For Ethena, several scenarios could trigger liquidations.

The most obvious scenario is a sustained negative funding rate. If bearish sentiment in the cryptocurrency market persists for weeks or months, Ethena will start paying funding instead of collecting it. Their reserves (currently around $60 million) provide some buffer, but not an infinite one.

A more severe risk is counterparty bankruptcy. While Ethena uses over-the-counter custody for its spot assets, they still rely on major exchanges to maintain their short positions. If an exchange goes bankrupt or is hacked, Ethena would need to quickly transfer contract positions, which could temporarily disrupt its delta-neutral hedging.

The leverage loops on Aave and Pendle introduce additional liquidation risks. If USDe's yield suddenly drops, recursive lending positions could become unprofitable, triggering waves of deleveraging liquidations. This could create temporary selling pressure on USDe itself.

Regulatory risks are also increasing. European regulators have forced Ethena to relocate from Germany to the British Virgin Islands. As yield-bearing stablecoins gain more attention, they may face additional compliance requirements or restrictions.

The Stablecoin War

Ethena represents a fundamental shift in the competitive landscape of stablecoins. For years, the focus of this competition has been on stability, usability, and compliance. USDC and USDT have competed on transparency and regulation, while various algorithmic stablecoins have vied for decentralization.

USDe changes the game through yield competition. It is the first mainstream stablecoin to offer double-digit returns to holders while maintaining a peg to the dollar. This puts pressure on traditional stablecoin issuers that can only retain the full yield of their U.S. Treasury holdings without providing any returns to users.

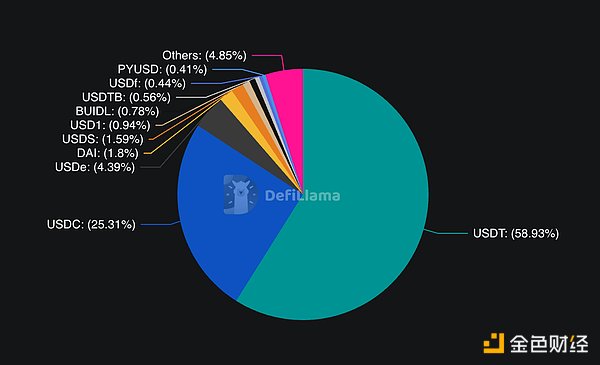

The market is responding. USDe currently holds over 4% market share among stablecoins, second only to USDC (25%) and USDT (58%). More importantly, its growth rate is faster than both. In the past 12 months, USDT grew by 39.5%, USDC by 87%, but USDe grew by over 200%.

If this trend continues, we may see a fundamental reshaping of the stablecoin market. Users will shift from zero-yield stablecoins to yield-bearing alternatives.

Traditional issuers will either have to share yields with users or watch their market share erode.

Despite the risks, Ethena's momentum shows no signs of slowing down. The protocol has just approved BNB as eligible collateral, and XRP and HYPE tokens have also met the thresholds for future inclusion. This will expand its potential market beyond Ethereum and Bitcoin.

The ultimate test lies in whether Ethena can maintain its yield advantage while managing systemic risks. If it can, they will create the first scalable, sustainable yield-bearing dollar in cryptocurrency history. If not, we will once again witness the dangerous stories of chasing yields in turbulent markets.

Regardless, the speed at which USDe reached $12 billion proves that when true innovation meets market demand, the development of financial products can exceed anyone's imagination.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。