Key Points

- In August 2025, OKB surged over 450%, becoming the most remarkable performance among mainstream platform tokens.

- A one-time burn locked the total supply of OKB at 21 million, completely rewriting the narrative of scarcity.

- X Layer positions OKB as the sole Gas token, supporting core scenarios such as DeFi, payments, and RWA.

- Discussions related to OKB have surged on platforms like X, Reddit, and Telegram, with unprecedented market enthusiasm.

- For XT users, the OKB/USDT trading pair is becoming a window to observe opportunities and risks during the transformation of platform tokens.

In August, OKB shocked the entire market: While Bitcoin and Ethereum stagnated, OKB/USDT soared.

With a total supply cap locked at 21 million, the launch of X Layer, and heated community discussions, this once low-profile platform token has been thrust into the spotlight of the entire market.

The question is: Is this surge the beginning of a long-term revaluation, or just a temporary peak?

To answer this question, we need to review the development history of OKB.

From its initial role as a platform token on OKX to now becoming the Gas fuel for X Layer, OKB has been evolving at every step.

In the following content, we will break down the timeline of OKB, price trends, new application scenarios, and compare it with other platform tokens to help traders think about the possible future paths for OKB.

Table of Contents

OKB Rise Timeline: From Platform Token to Core Fuel of OKX X Layer

Price Trend Analysis: The Explosion of OKB/USDT on Major Trading Platforms

The New Utility of OKB: How X Layer Enhances OKX Ecosystem Value

Market Discussion: Why Platform Token Investors Are Focusing on OKB

Platform Token Comparison: A Direct Showdown Between BNB, OKB, XT, and CRO

OKB Rise Timeline: Evolution of Platform Token to Core Fuel of X Layer

Every major market movement has a story behind it. The surge of OKB in August 2025 was not a coincidence, but rather a series of positive events stacking up until the market could no longer ignore them.

March 2025: OKX Ecosystem Expansion Lays the Foundation for OKB

OKX quietly expanded its DeFi and cross-chain layout. Although the price did not react much at the time, it laid the groundwork for future market movements, and observant traders had already sensed that significant actions were brewing.

Image Credit: TradingView – Q2 OKX Price Action

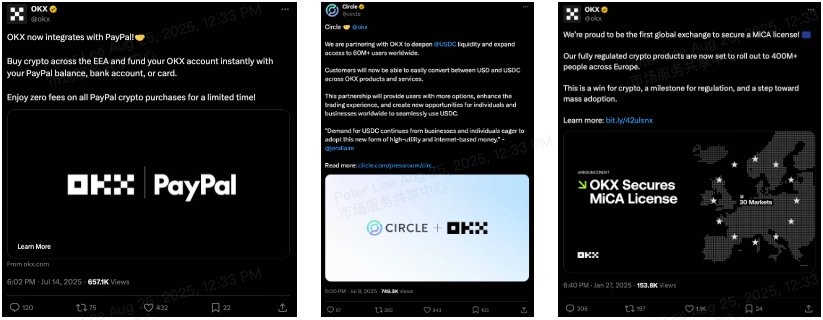

July 2025: Cooperation and Compliance Boost Confidence in OKB

During this phase, OKX announced several major positive developments:

- Partnership with PayPal, making it easier for European users to buy cryptocurrencies

- Collaboration with Circle, supporting direct exchange between USD and USDC

- Obtained EU MiCA compliance, further enhancing regulatory trust

These initiatives significantly broadened the accessibility of OKB and allowed investors to see the long-term layout of OKX.

_Image Credit: OKX Official X Announcements (Partnership with _CircleandPayPal, andMiCA License Milestone)

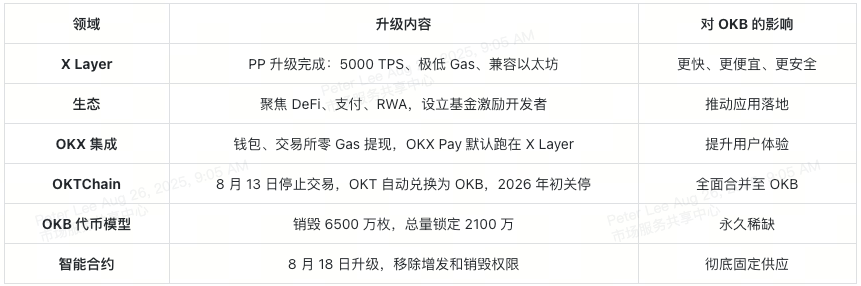

August 5, 2025: X Layer Upgrade Makes OKB the Gas

OKX officially completed the "PP upgrade," with X Layer becoming a second-layer network based on Polygon technology, significantly enhancing performance:

- TPS increased to about 5000

- Transaction fees nearly zero

- OKB became the sole Gas token

This means that OKB has upgraded from a "discount coupon" type platform token to the fuel that supports the operation of the entire chain.

August 13, 2025: OKB Super Burn Locks Supply at 21 Million

OKX burned over 65 million OKB in one go, permanently locking the total supply at 21 million. This operation endowed OKB with both "Bitcoin-like scarcity" and "Ethereum-like Gas functionality," completely rewriting the narrative.

Learn More FromOKX Support Center Announcement

August 21-22, 2025: Market Explosion

The market reacted immediately, with spot and contract trading volumes skyrocketing, and the price of OKB breaking through $200 and peaking at $258. At one point, it surpassed BTC and ETH in trading volume.

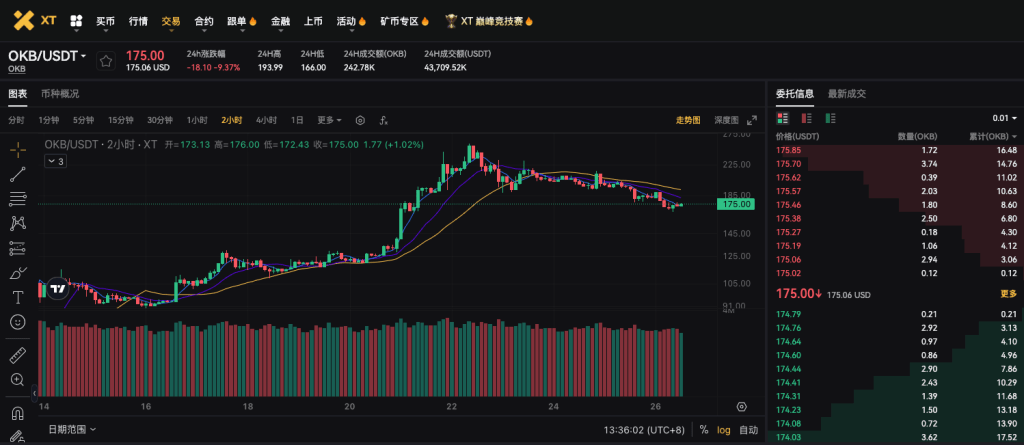

By the end of August, OKB was no longer just a platform token but a star asset in the exchange ecosystem. For XT users, this directly translated into a result: the demand for the OKB/USDT trading pair has become stronger, with greater liquidity.

XT.comOKB/USDTspot trading pair

Price Trend Analysis: The Explosion of OKB/USDT on Major Trading Platforms

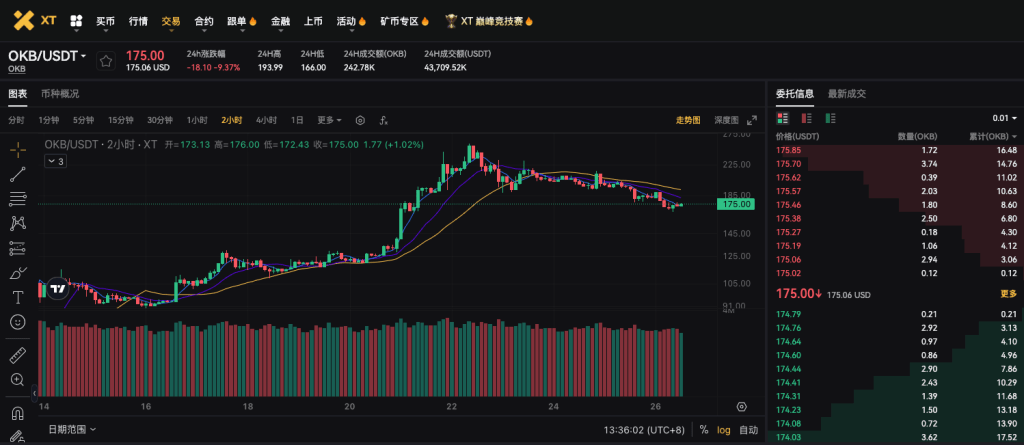

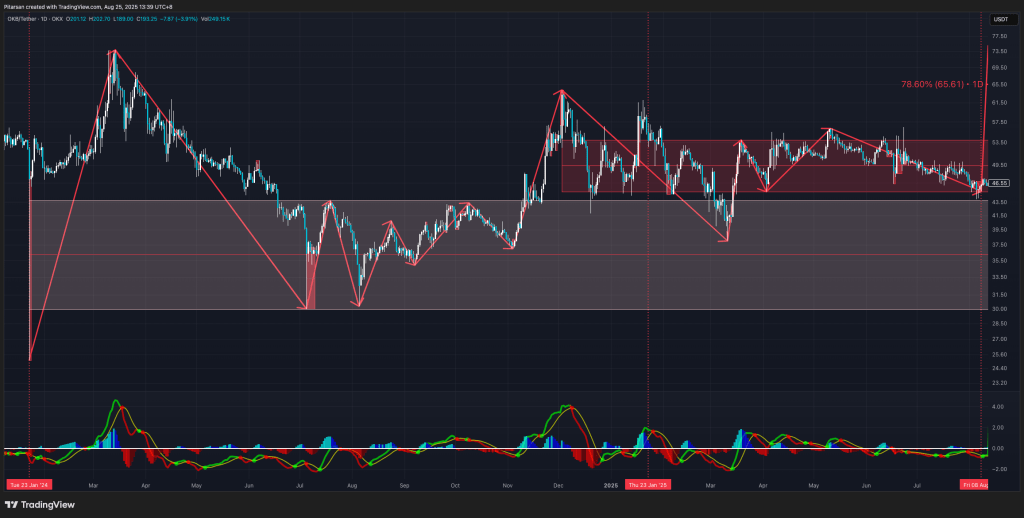

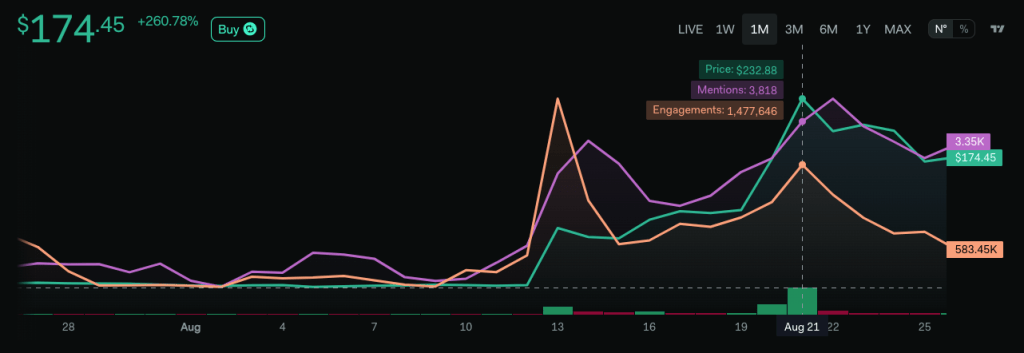

For months, OKB had been oscillating quietly in the $40–50 range, almost going unnoticed. Until August, the trend of OKB/USDT suddenly shifted from sideways to a straight upward surge, catching many traders off guard.

Image Credit: TradingView – OKB/USDT Price Action Daily Timeframe

Inflection Point: August 13 OKX Announcement Ignites the Market

The real turning point came on August 13. Once the news broke, OKB/USDT skyrocketed from $47 to $126 within just a few hours, achieving a daily increase of 170%, setting the tone for the subsequent market movement.

Surge Phase: OKB/USDT Breaks Key Price Levels

The upward momentum did not fade quickly:

- By August 21, OKB broke through $200;

- On August 22, it even reached a new high of $258;

- For a platform token that had long been undervalued, this was almost a complete revaluation.

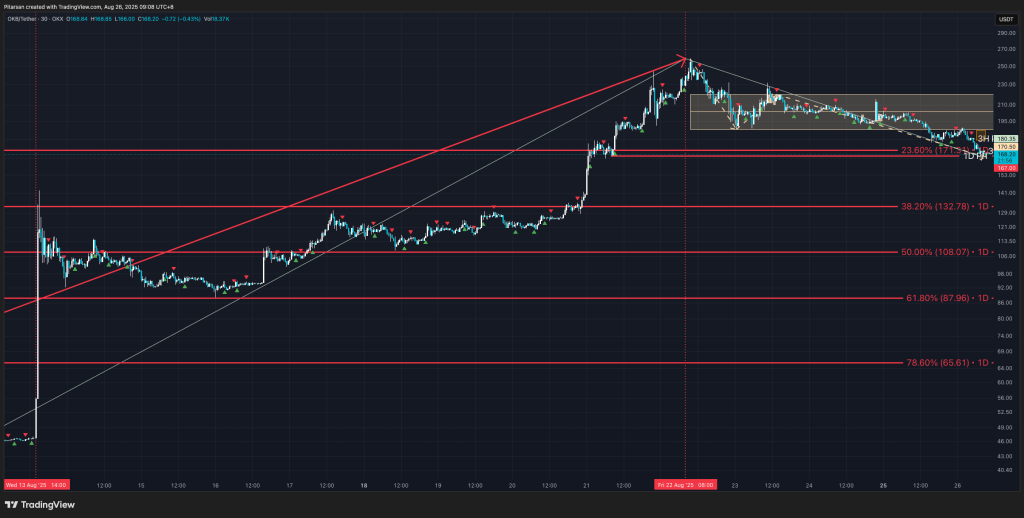

Image Credit: TradingView – OKB/USDT Price Action 30 min Timeframe

Trading and Contracts: Platform Token's Popularity on CEX Soars

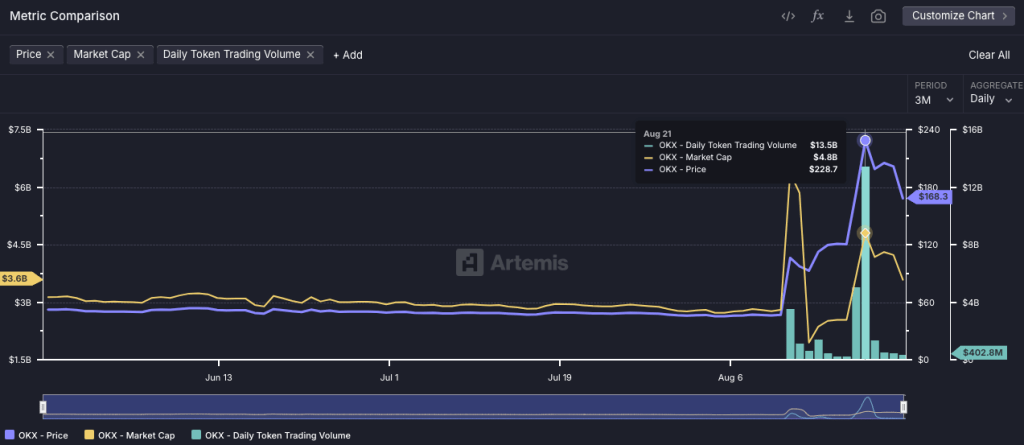

Both trading volume and price exploded. On August 21 alone, the daily trading volume of OKB exceeded $13 billion, briefly surpassing BTC and ETH.

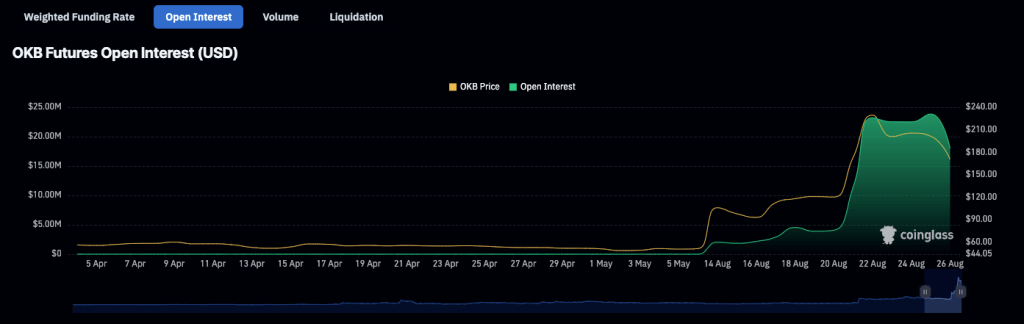

The contract market was equally vibrant:

- Open interest in contracts doubled within 24 hours;

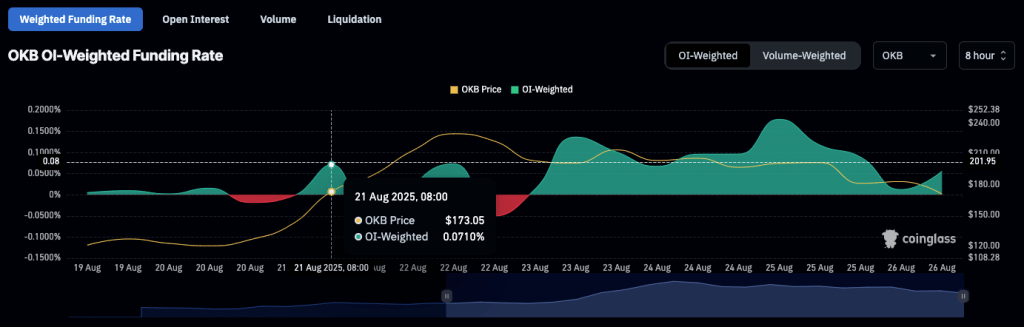

- Funding rates quickly turned positive;

- Bulls paid high premiums to maintain their positions.

This indicates that the market has strong confidence in the continued rise of OKB.

Image Credit:Artemis – OKB Daily Trading Volume

Image Credit:Coinglass – OKB Futures Open Interest \u0026amp; Weighted Funding Rate

Consolidation Phase: Healthy Pullback of OKB/USDT

After the surge, OKB retraced to the $170–200 range. On the surface, it seemed under pressure, but when combined with the overall market trend, it was easy to understand: Bitcoin was oscillating around $113,000, and Ethereum hovered around $4,700, with the entire market digesting previous gains.

For experienced traders, a one-third pullback after a surge is actually normal. OKB stabilizing above the key support level (23.6% daily Fibonacci retracement) is more like a healthy consolidation rather than the end of the trend.

Image Credit: TradingView – OKB/USDT Price Action 30 min Timeframe

Insights: Lessons for Traders from Platform Token Trends

OKB's performance reminds us that the movements of individual tokens can significantly deviate from the overall market. While Bitcoin and Ethereum slowed down, funds continued to flow into altcoins, and the ongoing inflow into Ethereum ETFs also increased market liquidity.

In this context, the sudden revaluation of OKB seems reasonable—the changes in supply mechanisms and ecosystem upgrades jointly ignited this market movement. The larger insight is: Explosions are never isolated; they are often the result of multiple factors accumulating, and the market will enter a digestion phase after the frenzy before determining the next direction.

The New Utility of OKB: How X Layer Enhances OKX Ecosystem Value

Scarcity explains part of OKB's appeal, but what truly determines how far it can go is often its utility. In 2025, OKB's role underwent a qualitative change: it is no longer just a fee discount on OKex and OKX but has upgraded to become the "fuel" of a second-layer blockchain.

Changes Brought by X Layer: Reshaping the Value of Platform Tokens

X Layer is a second-layer network built by OKX based on Polygon technology, aiming for speed and scale:

- Capable of processing about 5,000 transactions per second

- Transaction fees are nearly zero

- Highly compatible with Ethereum, allowing developers to integrate seamlessly

The official focus areas include DeFi, global payments, and tokenization of real-world assets (RWA). These fields are either hotspots for explosive growth in the coming years or the most regulated and highest-threshold tracks, presenting both challenges and opportunities.

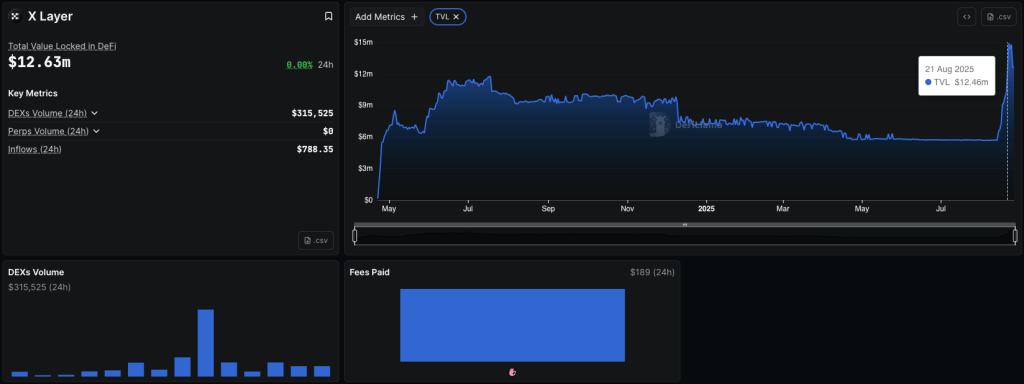

Image Credit:DeFiLlama – X Layer Onchain Figures Overview

OKB Becomes the Sole Gas: Core Logic of OKB/USDT Trading

On X Layer, OKB's positioning is very clear—it is the only Gas token.

This means that:

- Every transfer

- Every smart contract call

- Every dApp operation

requires the consumption of OKB. The value of the token is directly linked to the activity on the chain.

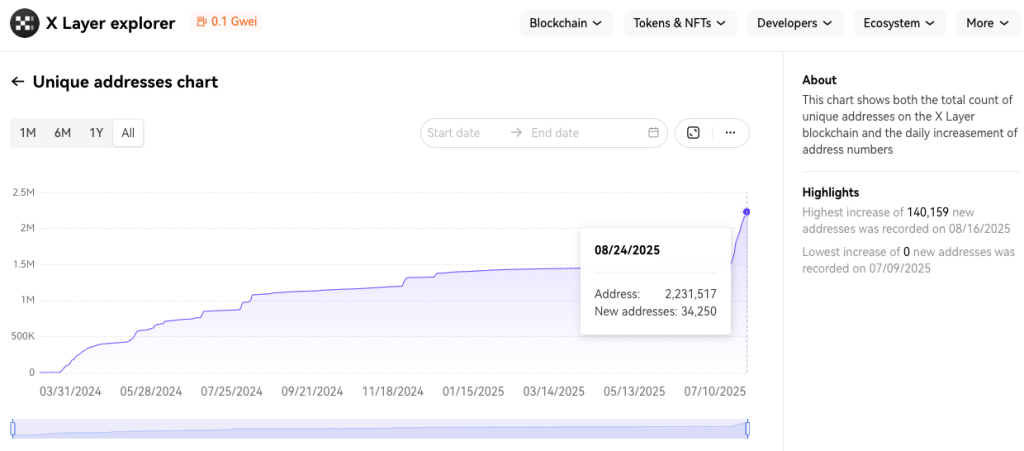

As of the end of August 2025, over 90% of the OKB** total supply has migrated to X Layer**. The number of on-chain addresses has surpassed 2 million, with hundreds of thousands of addresses actually holding OKB. This is both a strong signal from the OKX team and a reflection of community willingness.

Image Credit:OKX X Layer Block Explorer – Unique Addresses

Thoughts from XT and OKX Users: The Unknowns of X Layer Adoption

For traders focused on OKB/USDT, the real test lies in whether these new utilities can translate into long-term real demand.

- Will developers choose X Layer over other competing networks?

- Can DeFi and RWA applications bring sustained on-chain activity?

- Can the combination of scarcity and utility truly support a new long-term valuation?

The answers are not yet conclusive. But it is certain that OKB is no longer an ordinary exchange platform token; it carries the future of a blockchain behind it. This means greater potential but also more uncertainty.

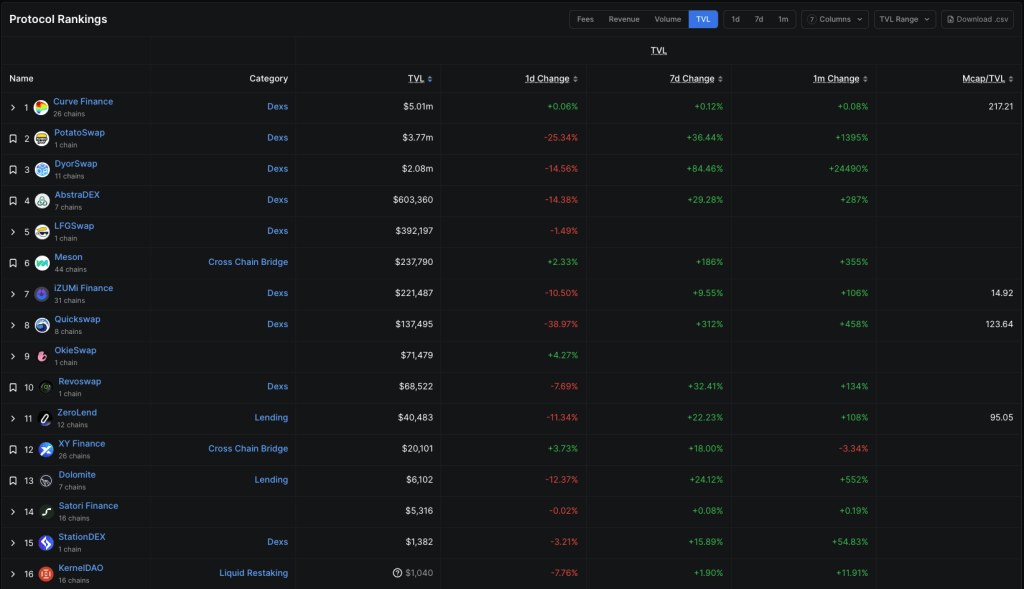

Image Credit:DeFiLlama – X Layer Ecosystem Overview

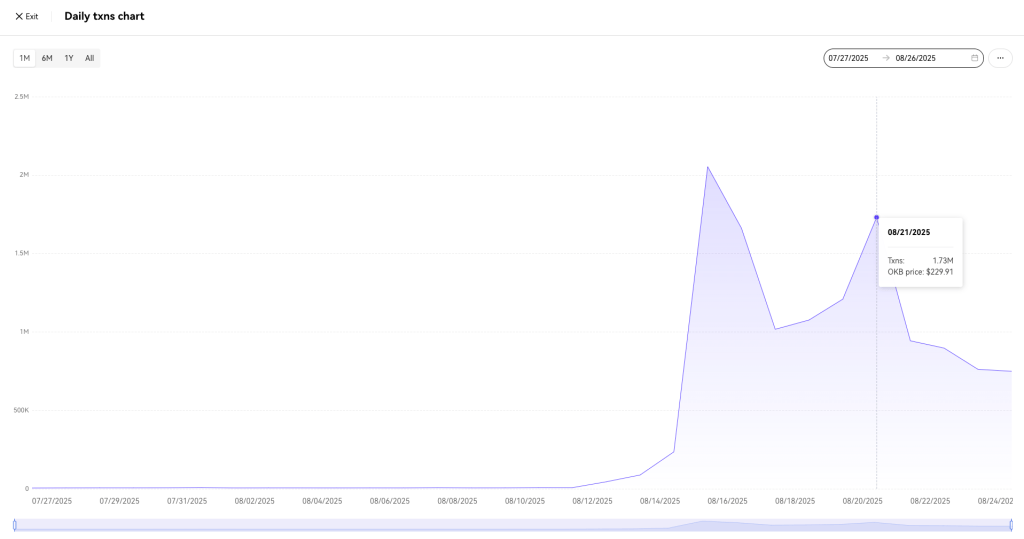

Image Credit:OKX X Layer Block Explorer – Daily Transactions

Market Discussion: Why Platform Token Investors Are Focusing on OKB

Once a token starts to rally, community discussions naturally follow. In August, OKB became one of the hottest topics in the market, and the activity and attention in the community are worth a closer look.

X, Reddit, Telegram: Explosion of Topics Around OKB and X Layer

X (formerly Twitter):

- Analysts and KOLs shared charts, calling this burn event a key turning point, with some even comparing it to the Bitcoin halving.

Reddit and Telegram:

- Various posts and group chats are filled with X Layer cross-chain tutorials, price trend discussions, and debates about whether this rally is sustainable.

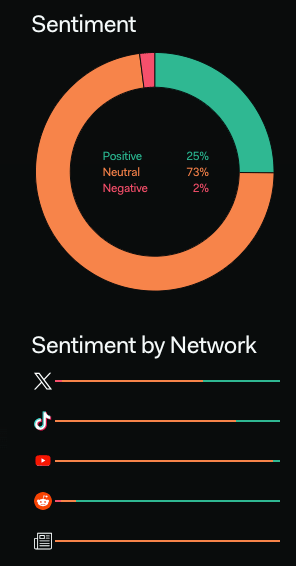

Image Credit:LunarCrush

LunarCrush Data:

- The mention and interaction index of OKB reached an annual high in August, indicating that the hype has spread beyond the original community.

Image Credit:LunarCrush

Management's Voice:

- OKX founder Xu Mingxing also publicly reminded traders to be aware of risks, which not only added authority to the discussion but also attracted more attention.

Interpreting the Heat Around OKX and X Layer: Opportunity or Bubble?

The energy of the community can indeed drive up the market, but it can also amplify expectations. The atmosphere is somewhat reminiscent of when BNB first started, with loud voices and strong confidence. However, enthusiasm alone cannot guarantee long-term growth.

Traders may need to consider:

- Is this wave of attention merely a short-term reaction to token economics news?

- Will developers truly choose to build applications on X Layer, converting hype into actual demand?

- When the novelty wears off, can the market's momentum continue?

For XT users, the OKB/USDT spot trading pair is where sentiment and operations intersect. Opportunities arise not only from fundamentals but also depend on how long this community discussion can last.

Platform Token Comparison: A Direct Face-off Between BNB, OKB, XT, and CRO

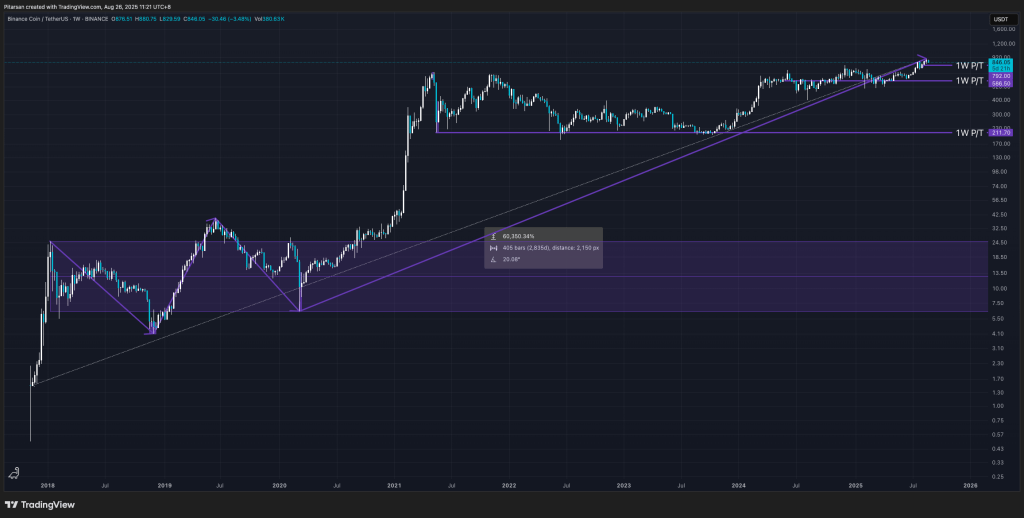

The rise and fall of platform tokens are often closely tied to the performance of the exchanges themselves, with BNB being the classic example.

BNB initially served as a fee discount token, but with the launch of BNB Chain, it became the Gas token on the chain, truly gaining utility. Early investors witnessed its rise from under $10 to a peak of over $800. BNB's success set a benchmark for platform tokens: only when "utility" and "adoption rate" come together can a platform token achieve long-term explosive growth.

Image Credit: TradingView – BNB/USDT Price Action Weekly Timeframe

OKB's Scarcity + X Layer Transformation

OKB has recently undergone a significant transformation:

- A one-time burn of 65 million tokens, permanently locking the total supply at 21 million;

- Becoming the sole Gas token on X Layer, with core scenarios focusing on DeFi, payments, and RWA;

- The combination of scarcity and utility evokes memories of BNB's early growth trajectory.

XT: A Steady Rising Potential Stock

XT, the native token of XT.com, has also performed well recently:

- In August 2025, it rose over 20%, from about $5.3 to $6.5;

- It provides Gas for the XT Smart Chain, and is also used for staking, fee discounts, and platform incentives;

- Compared to OKB or BNB, liquidity is relatively low, but the upward trend indicates increasing market attention.

XT.comXT/USDT_ Spot Trading Pair_

CRO's Stability but Lack of Scarcity

CRO remains the core token of the Crypto.com platform, offering rich ecological benefits, but it lacks the "scarcity + on-chain utility" dual narrative that OKB possesses, putting it at a slight disadvantage in competition.

Key for Traders to Watch: Who Can Replicate BNB's Curve?

The real question is: Can OKB or XT replicate the long-term adoption curve of BNB?

The decisive factors remain:

- Developer activity

- User growth rate

- Whether practical scenarios can continue to expand

OKB Outlook: The Future of OKX Platform Token and X Layer Adoption Rate

The surge in August may seem like the end of a market cycle, but in reality, OKB may have just opened a new chapter. The total supply cap of 21 million establishes scarcity, while X Layer assigns OKB the role of blockchain fuel. What happens next will largely depend on the speed and breadth of the entire ecosystem's development.

Key Observations: Applications, Utility, and Ecosystem Strength

- Application Implementation: Will DeFi projects, payment services, and RWA platforms truly choose to build on X Layer?

- Sustained Utility: As the network shifts from speculation to usage, can the demand for OKB remain stable?

- Ecosystem Strength: Can developer activity and user growth keep pace with the upgraded rhythm?

Volatility in OKB/USDT: Risks and Opportunities Coexist

No asset will only rise without falling. OKB has already shown significant volatility, and a pullback is almost inevitable. For some traders, if they believe in the fundamentals of OKB, these pullbacks may actually present new entry opportunities.

Looking at the Platform Token Ecosystem: Can OKB Achieve Long-Term Value?

Historically, platform tokens have generally performed well in bull markets. In 2025, OKB took a distinctive step with the combination of "burning + utility." The question is whether these actions can truly translate into long-term usage and adoption.

For XT users, the OKB/USDT spot trading pair is worth long-term attention. It can not only reflect whether scarcity and utility can combine to create lasting value but may also reveal whether the frenzy in August was a fleeting moment or the beginning of a larger story.

XT.comOKB/USDT_ Spot Trading Pair_

Frequently Asked Questions About OKB, OKX, and OKB/USDT

Q 1: What is the current role of OKB?

OKB is both a utility token on the OKX platform and the only Gas fuel on the X Layer network.

Q 2: Why is the total supply cap of 21 million so important?

The burn operation in August 2025 permanently locked the supply of OKB at 21 million, establishing a scarcity model similar to Bitcoin.

Q 3: What changes are reflected in the OKB/USDT trading?

This trading pair reflects both market speculation interest and the actual demand brought by X Layer.

Q 4: How does OKB differ from other platform tokens (like BNB and CRO)?

BNB has a more mature ecosystem, CRO focuses on payment scenarios, while OKB combines scarcity with on-chain utility.

Q 5: What risks are associated with trading OKB?

The adoption of X Layer still carries uncertainty, and OKB's price may also experience significant volatility after a surge.

Q 6: Is the rise of OKB just speculation?

Community enthusiasm has indeed played a role, but the real driving factors also include structural changes, such as the burn and X Layer upgrade.

Q 7: Where can I trade OKB/USDT?

The OKB/USDT spot trading pair is already available on XT Exchange and OKX, with ample liquidity for participation at any time.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with more than 1 million monthly active users and over 40 million user traffic within the ecosystem. We are a comprehensive trading platform supporting over 1000 quality cryptocurrencies and 1300 trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options, including spot trading, margin trading, and futures trading. XT.COM also features a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。