Make the financial market truly globalized, democratized, and programmable.

Since the beginning of this year, the stock tokenization sector has suddenly become lively.

Projects like Robinhood, xStocks, Backed, and Swarm have all entered the arena, each trying different paths.

Why are the giants focusing on stock tokenization?

The market size is indeed tempting. The U.S. stock market has a market cap of $60 trillion, but global crypto users, especially non-U.S. users, have never had the opportunity to easily invest in U.S. stocks.

The opportunity is vast, and there are many players. But the problems persist: either the tokens are locked on the platform and cannot be withdrawn, or there is severe liquidity shortage leading to huge slippage, or there are too few covered assets to scale.

"Free circulation" and "liquidity depth" remain the key issues that urgently need to be addressed in this sector.

On September 3, the leading project in the RWA sector, Ondo Finance, launched Global Markets, which may be a powerful solution to these problems and a challenger to the current market landscape.

In introducing this new product, their official Twitter account made a profound statement:

"Not all tokenized stocks are born equal."

This is clearly a nod to the phrase "all men are created equal" from the U.S. Declaration of Independence, but it also implies another kind of equality:

Allowing global investors to have equal access to the U.S. capital market, no longer constrained by the high trading costs and flaws of existing products.

On the first day of the product launch, Ondo demonstrated an extraordinary scale.

Over 100 stocks and ETFs were opened for trading simultaneously, covering investor favorites from Apple, Tesla to the S&P 500 index, and even crypto concept stock MicroStrategy.

What is even more striking is its claim of near-zero trading costs, 24/5 trading hours, and deep liquidity achieved through "instant minting" technology.

This inevitably brings to mind stablecoins.

USDC and USDT have freed the dollar from the constraints of bank accounts, enabling 24/7 free circulation on-chain; now, Ondo aims to do the same for U.S. stocks, making Tesla, Apple, and the S&P 500 index as easy to use as stablecoins on-chain.

Although it is currently only open to institutional investors, we can still get a glimpse of the product from what has been publicly released.

The "stablecoin moment" for stock tokenization may really be coming.

Buy stocks like buying coins

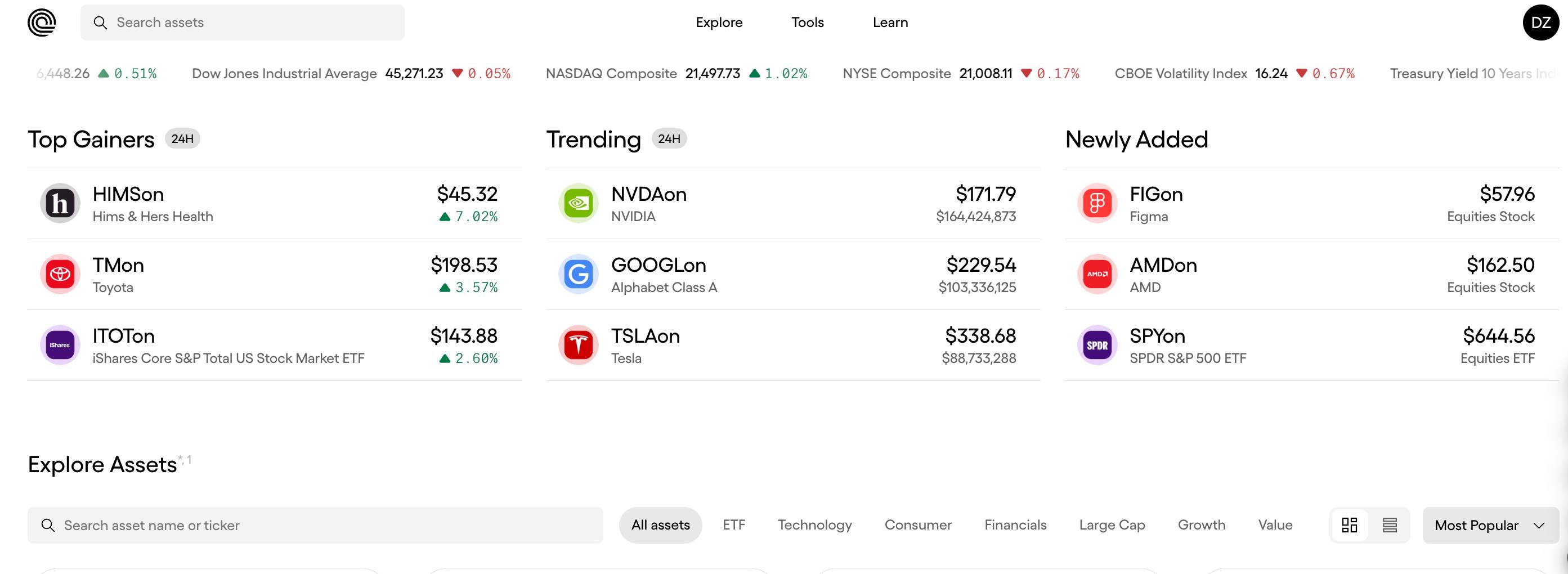

Opening the Ondo Global Markets interface, the first impression is one of familiarity and simplicity.

It looks more like a U.S. stock version of CoinMarketCap. Even if you have never traded U.S. stocks, it is easy to find a sense of closeness from the familiar layout and UI guidance.

At the top, the major U.S. stock indices are scrolling in real-time: the Dow Jones, Nasdaq, and S&P 500 live points; below are three sections: Top Gainers, Trending, and Newly Added.

Scrolling down, "Explore Assets" feels more like browsing a well-categorized U.S. stock supermarket.

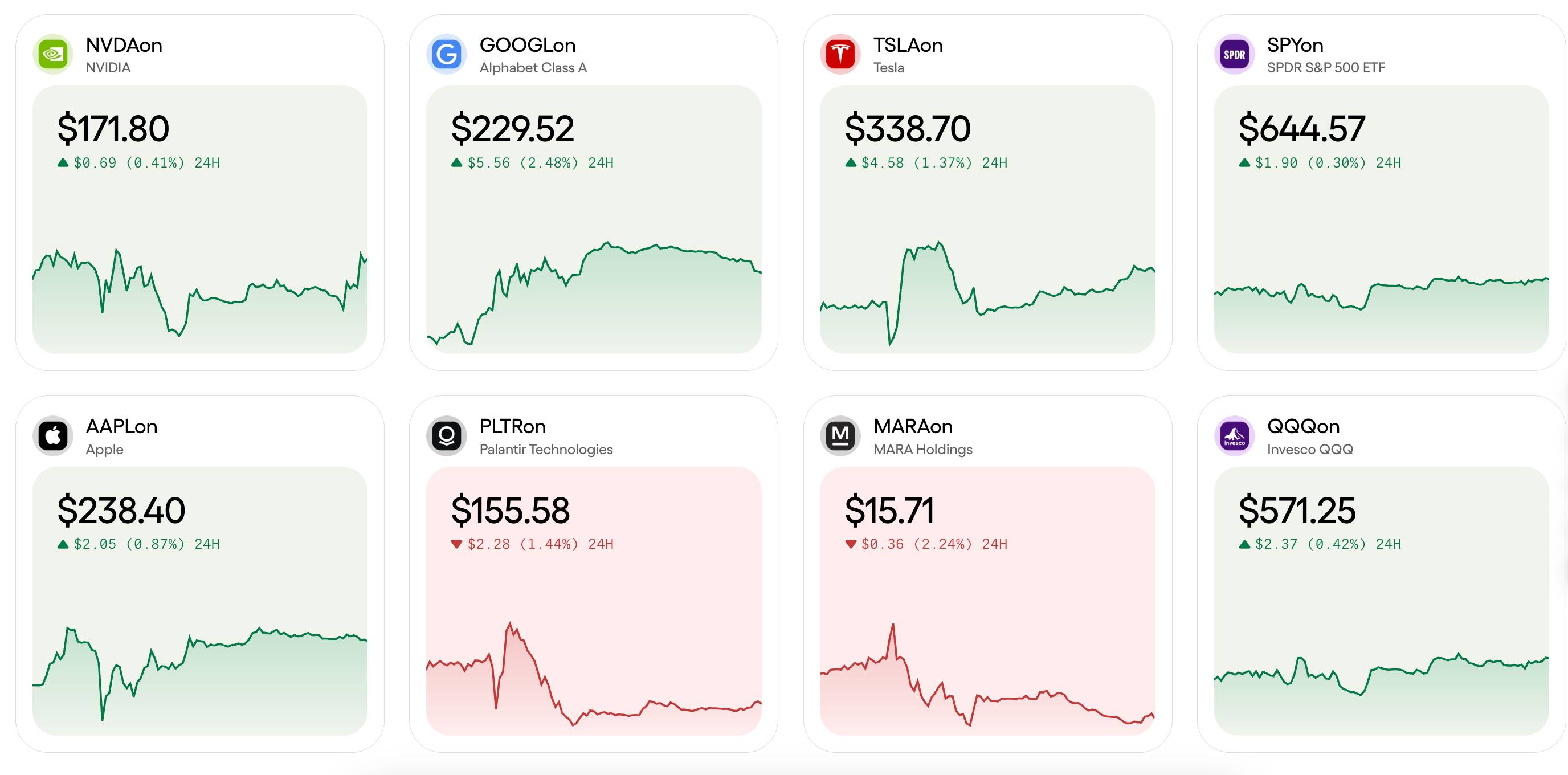

Under all asset categories, assets from different sectors such as ETFs, tech stocks, consumer stocks, and financial stocks are neatly categorized, and clicking in shows the real-time price and 24-hour candlestick chart for each token, very similar to the pages we see on aggregation sites in the crypto market.

However, each U.S. stock name is suffixed with "on," reminding you that this is Ondo's tokenized version.

In terms of total volume, the tokenized U.S. stocks on Ondo currently favor the tech sector. As of the time of writing, Nvidia had a 24-hour trading volume of $164 million; Google had $103 million; and Tesla had $88 million.

With a curious mindset, we also compared the prices of U.S. stocks on Ondo during the same time period with those in the real stock market. Interestingly, these prices do not completely equate to the real-time stock prices on Nasdaq.

According to Ondo Finance's official documentation, Ondo's tokens not only track stock prices but also include dividends.

In simple terms, if Apple’s stock pays a dividend of $1, the system will automatically use that $1 (after tax) to buy more Apple stock. So over time, one AAPLon might equal 1.05 shares of actual Apple stock, and the price will naturally be higher. This is akin to automatically enabling a "dividend reinvestment" feature.

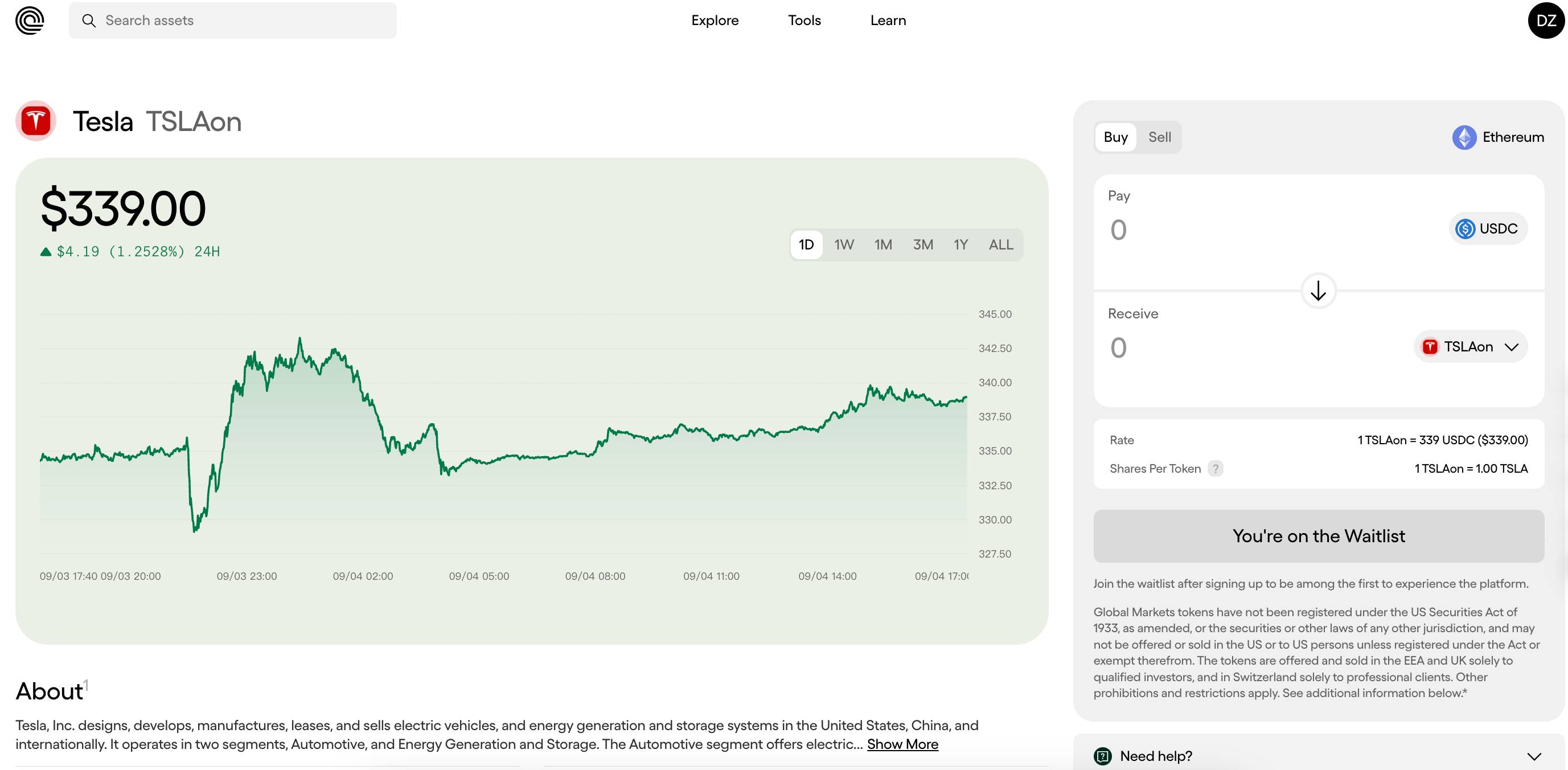

For example, in the image above, you can directly select Tesla's token TSLAon on Ondo and input the amount you wish to exchange in a DeFi-like Swap interface, using USDC stablecoin for payment.

Currently, the minimum purchase threshold is only $1, theoretically allowing any crypto user with a wallet to participate in U.S. stock investment. However, it is important to note that Ondo's market is built on Ethereum, so gas fees need to be considered; the official team has also stated that they will expand to BNB Chain, Solana, and their own Ondo Chain in the future.

If we exclude on-chain gas costs, Ondo does not charge the various fees typical of traditional brokers, such as account opening fees, account management fees, or platform usage fees; its revenue comes from approximately 0.01-0.03% trading costs during user transactions.

In simple terms, for a $1,000 transaction, the total cost is about $1, far lower than the standard fees of $5-10 or 0.1-0.5% charged by traditional brokers.

In terms of trading hours, the platform supports "24/5" trading—from Sunday at 8 PM to Friday at 8 PM (Eastern Time).

This flexibility is particularly friendly to Asian investors, who do not have to stay up late waiting for U.S. stocks to open. How continuous trading after U.S. stock market hours is achieved involves its unique technical architecture, which we will analyze in detail below.

Of course, all of this is currently only open to institutional investors, and individual users are still on the waiting list, but from the product design, Ondo is indeed building a more accessible U.S. stock investment platform.

How is deep liquidity and 24x5 trading achieved?

After experiencing Ondo's product interface and operation process, three questions naturally arise:

Is Ondo's liquidity better than other platforms? How can trading still occur after U.S. stock market hours? Without visible fees, how does Ondo make money?

Instant minting, inheriting Nasdaq's trading depth

First, let's look at the liquidity issue.

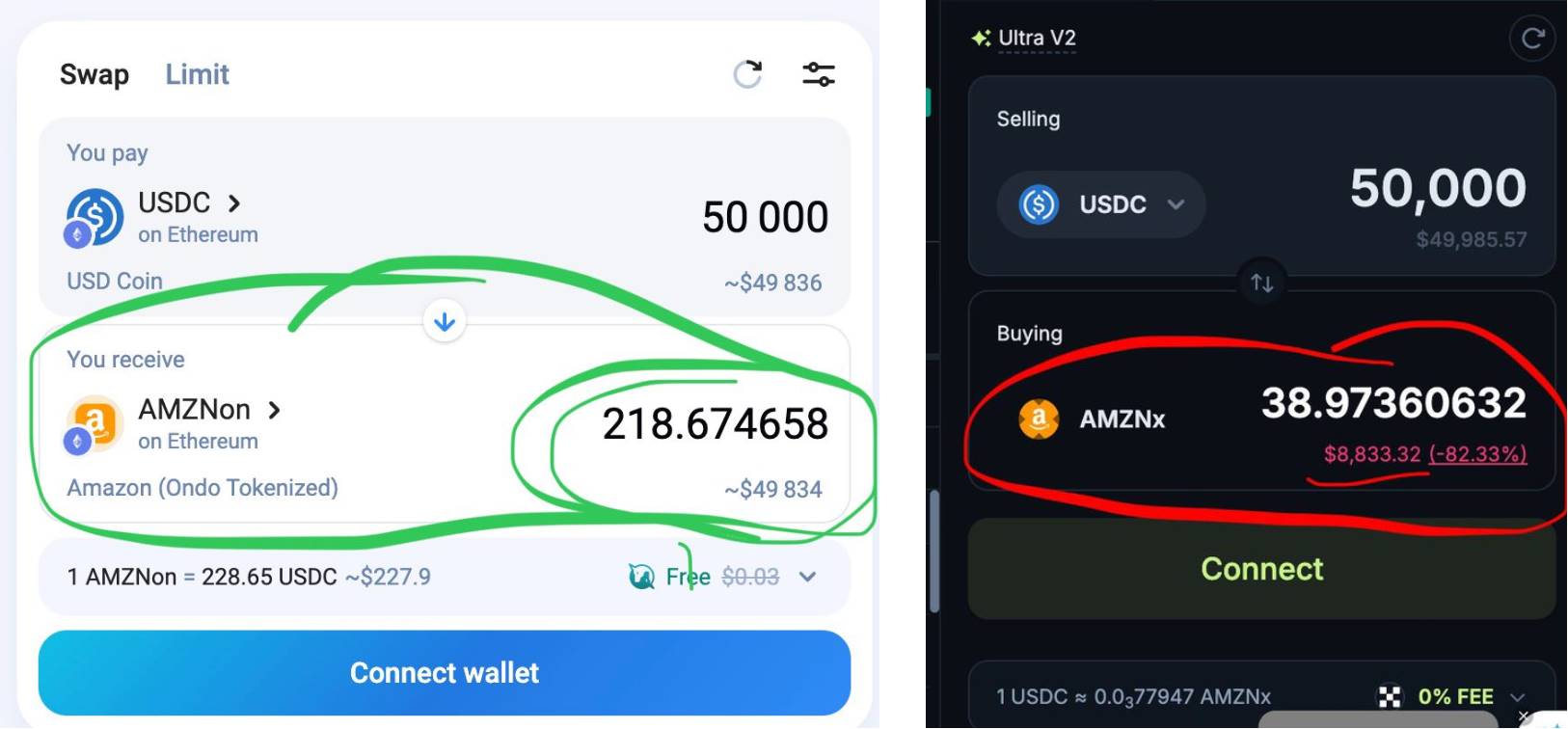

Recently, a Twitter user shared a set of comparison screenshots that visually displayed the liquidity differences. For the same $50,000 USDC to buy Amazon stock tokens: on Ondo, you can buy 218.67 AMZNon, worth $49,834; while on xStocks, you can only buy 38.97 AMZNx, worth only $8,833, showing a massive slippage of -82.33%.

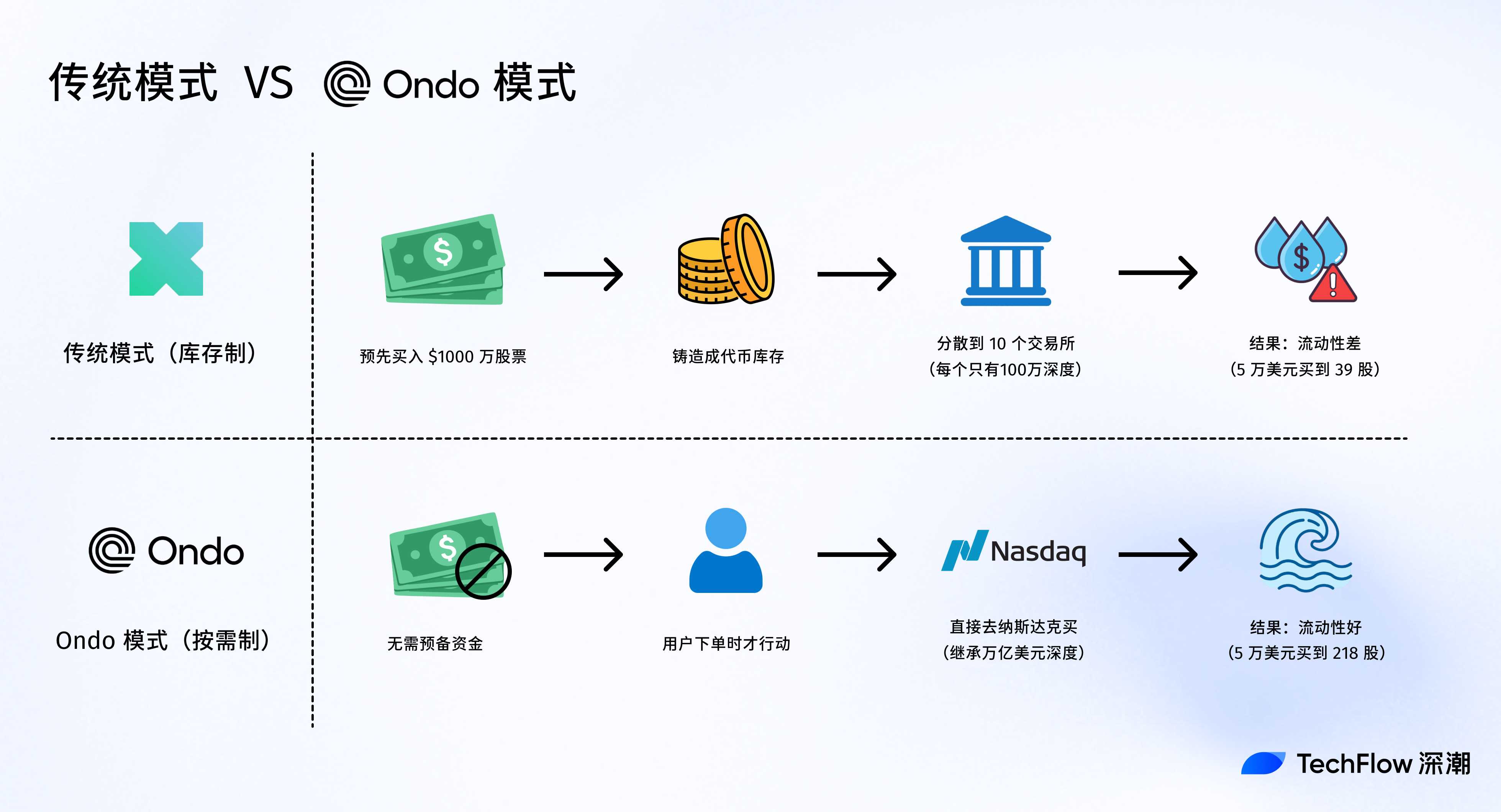

With the same amount of money, one can buy 218 shares, while the other can only buy 39 shares. Why is there such a huge disparity?

Ondo's CEO Nathan Allman explained this well in a tweet during the product launch, highlighting the key difference in the two completely different tokenization operating models.

Existing platforms, similar to a supermarket model: They need to stock up, meaning market makers must buy stocks in advance, mint tokens, and then distribute them to various exchanges' shelves. The problem is that supermarket shelf space and funds are limited. When someone wants to buy $50,000 worth of Amazon, if there is only $10,000 worth of stock on the shelf, they either can't buy it or the price will be pushed up to an outrageous level.

Ondo Global Market, similar to a delivery model: When a user orders to buy Amazon stock, the platform goes to Nasdaq to "procure" real stocks and mint tokens; when a user wants to sell, the tokens are immediately burned, and the stocks are sold on Nasdaq. There are no inventory limitations, no shelf space issues, and it directly inherits the daily trading depth of hundreds of billions of dollars on Nasdaq.

Nathan refers to this model as "instant, atomic minting and burning." More importantly, this model can easily scale to hundreds or even thousands of stocks because there is no need to prepare a funding pool in advance for each stock.

24/5 trading, 24/7 transfer

The official documentation states that trading hours are from Sunday at 8:05 PM to Friday at 7:59 PM (Eastern Time), covering almost the entire week. How is this achieved?

The answer lies in a dual-layer mechanism. The first layer is the minting and redemption layer, which relies on the traditional market.

Ondo not only connects to the regular trading hours of the NYSE and Nasdaq (9:30 AM - 4:00 PM) but also includes pre-market (4:00 AM - 9:30 AM), after-hours (4:00 PM - 8:00 PM), and overnight sessions provided by alternative trading systems like Blue Ocean (8:00 PM - 4:00 AM). These combined achieve 24-hour coverage on weekdays.

The second layer is the token transfer layer. For example, once the tokenized version of Tesla's stock, TSLAon, is minted, it becomes a standard ERC-20 token that can be transferred between users 24/7 like USDT. Even during weekends when traditional markets are completely closed, users can still trade tokens with each other.

Of course, the documentation also mentions that liquidity during the overnight sessions is relatively low, and large orders may need to be split.

Price Spread: A Transparent Profit Model

"We do not charge any minting, redemption, or management fees."

This statement in the FAQ document indicates that Ondo does not make money from these processes, but the second half is equally important: "Prices may differ slightly from the prices at which we buy and sell the underlying stocks."

This "slight difference" is the source of Ondo's revenue.

In financial markets, there is always a slight difference between the buying and selling prices, which reflects the cost and return of providing liquidity services. Traditional brokers also have price spreads, but they additionally charge $5-10 in fees. Ondo only charges the price spread and does not charge fees.

Specifically, when Tesla's stock price is $100, you might pay $100.01 to buy through Ondo and receive $99.99 when selling. This $0.02 (0.02%) difference is far lower than the total cost of "spread + fees" from traditional brokers (usually 0.5-1%).

This pricing model is common in markets like forex and gold. Ondo has compressed the spread to a very low level while eliminating all other fees.

For users, this means that the total cost of trading $1,000 worth of stocks may only be around $1, which is unimaginable in the era of traditional brokers.

Comparison with Current Competitors

Stock tokenization is not a new concept. From the early Mirror Protocol in 2021 to today's Ondo Global Markets, you can see a clear evolution in this sector.

The most conservative approach is for platforms to create a "walled garden," where tokens circulate internally and cannot be withdrawn to personal wallets, a typical example being Robinhood.

This model essentially just moves traditional brokers onto the blockchain, and aside from potential cost reductions, it does not truly leverage the advantages of blockchain. The user experience is similar to trading in a broker app, just with blockchain technology possibly used in the background.

The second type is xStocks, where tokenized U.S. stocks can be freely transferred on-chain, but liquidity is too poor, and large slippage makes big trades problematic.

Ondo may represent a third-generation approach: not creating a trading platform but building infrastructure.

Through the instant minting mechanism, Ondo addresses the core pain point of liquidity. More importantly, it has considered deep integration with DeFi from the start, such as Morpho accepting it as collateral and 1inch aggregating trades.

In simple terms,

Robinhood-type: Compliance-first, sacrificing openness

xStocks-type: Openness-first, but constrained by liquidity

Ondo: Attempts to achieve both openness and liquidity through technological innovation while maintaining compliance

This is not to say that Ondo will definitely win. Robinhood has a large user base, and xStocks has first-mover advantages and ecological positioning. But Ondo has indeed found a differentiated path.

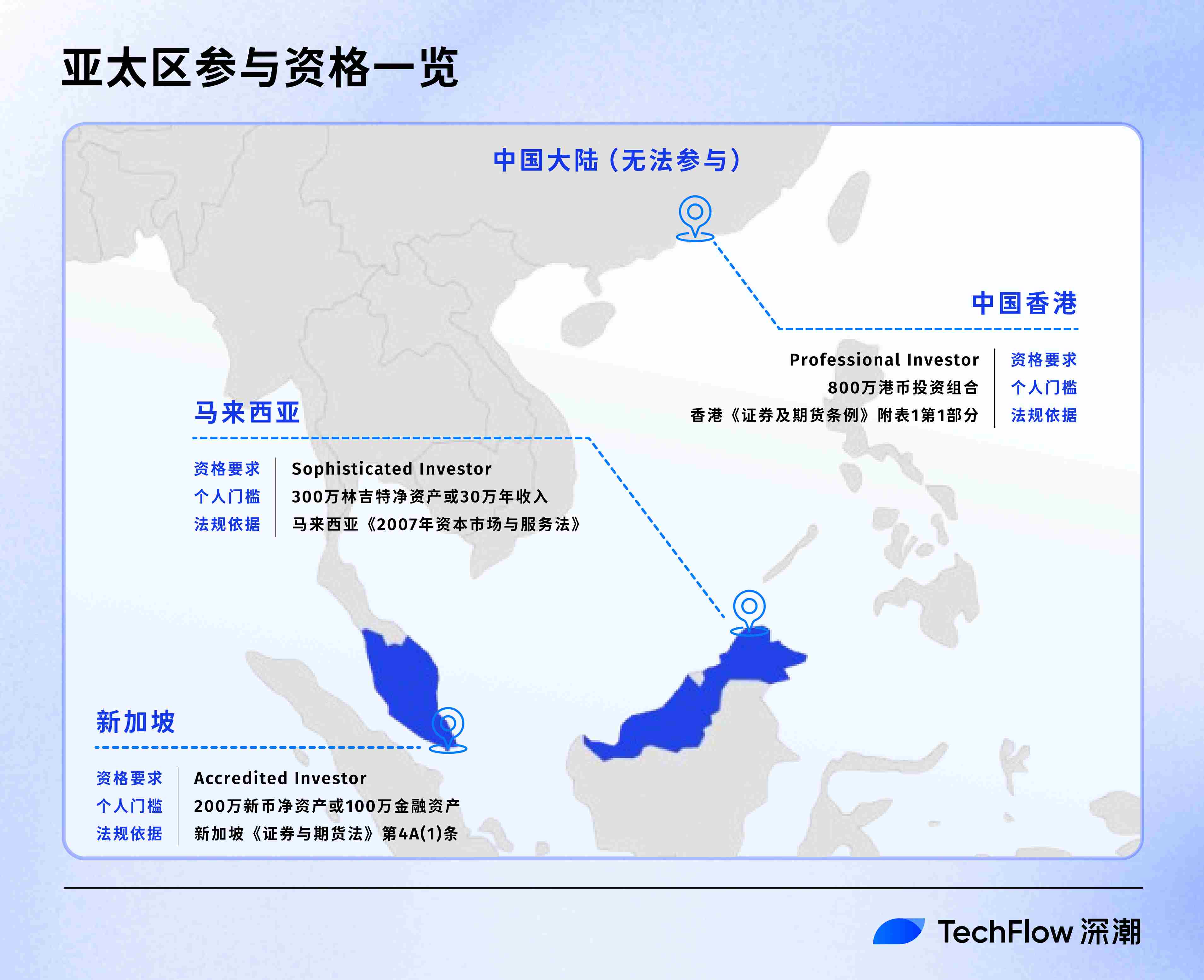

Overview of Participation Eligibility in the Asia-Pacific Region

For Asia-Pacific investors, Ondo Global Markets brings opportunities but also sets thresholds. The participation rules vary significantly across different countries and regions, and we can quickly understand the overall picture with a chart.

Aside from clearly prohibited and restricted areas, theoretically, other non-U.S. regions can participate. This means that users from countries like Japan, South Korea, Thailand, Indonesia, the Philippines, and Vietnam can participate as long as they complete basic KYC (identity verification).

However, it is important to note that Ondo Global Markets is currently only open to institutional investors, and individual investors, regardless of their region, still need to wait.

The Ongoing On-Chain Revolution

If you take a look at the partner list of Ondo Global Markets, you will discover even greater ambitions.

Under the big play of integrating crypto and stocks, what it aims to create is more likely a DeFi stock infrastructure, showcasing a clear technology stack:

Technical Foundation Layer: Chainlink provides price oracles and proof of reserves; LayerZero offers cross-chain capabilities, and BitGo and Fireblocks provide institutional-grade custody, allowing traditional financial institutions to participate with confidence.

DeFi Protocol Integration: Morpho has confirmed it will accept Ondo stock tokens as collateral. This means you can use Tesla stock to borrow in DeFi. The aggregation trading features of 1inch and CoW Protocol allow liquidity to flow freely across platforms.

User Entry Expansion: Integration with mainstream wallets like Trust Wallet, Bitget Wallet, and OKX Wallet lowers the usage threshold. Support from exchanges like Gate and MEXC provides centralized alternative channels.

Returning to the initial question, has the "stablecoin moment" for stock tokenization really arrived?

From a technical perspective, Ondo has indeed solved core challenges. Instant minting brings deep liquidity, zero fees lower the participation threshold, and DeFi integration creates new possibilities.

From a market perspective, the timing also seems ripe. The RWA market is experiencing explosive growth, institutions are beginning to accept it, and infrastructure is becoming increasingly robust.

But from a practical standpoint, the revolution has only just begun. Institutional primacy, regional restrictions, and unclear regulations are all obstacles that must be overcome.

Ondo Global Markets may not be the ultimate answer, but it represents the right direction: making financial markets truly globalized, democratized, and programmable. This process may take years, but the first step has already been taken.

For investors, it may not yet be the time for full participation, but it is definitely a moment to pay close attention.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。