Bitcoin Eyes 100X Rally as Fed Rate Cut September 2025 Chance Surge

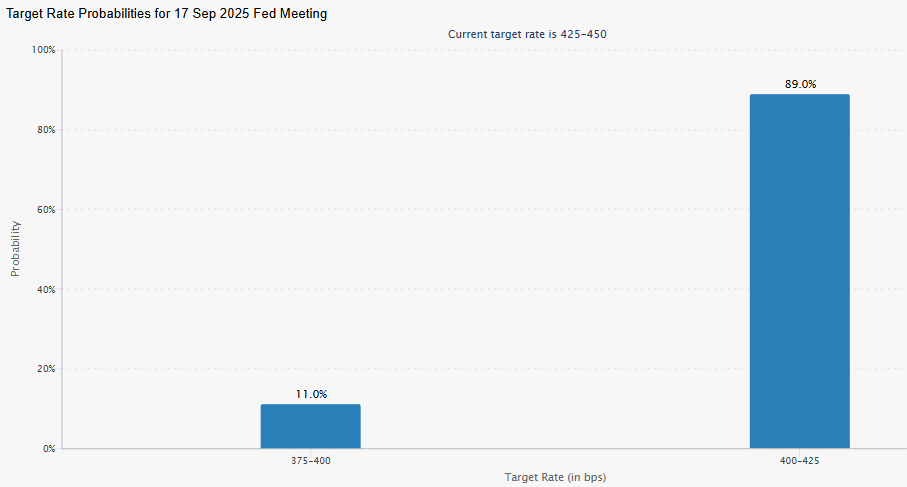

Markets are abuzz as investors prepare for the Fed rate Cut at the next FOMC meeting 2025 on 17 September. The present target rate is at 425–450 bps, and dealers now expect a clean 100% probability of easing. Statistics indicate an 89% probability of a 25 bps cut to 400–425 bps and an 11% probability of a more aggressive 50 bps cut to 375–400 bps.

Source: FedWatch

Source: FedWatch

Only last week, on 29 August 2025, there was an 86.4% chance for 400–425 bps and 13.6% predicted no change. A month ago, there was strong expectation in markets for a cut (94.6%), with only 5.4% predicting rates would remain unchanged. These numbers indicate growing conviction that the Fed rate cut date September 2025 could mark the start of a major liquidity boost.

Analysts Links to Bitcoin’s Past Balance Sheet Rallies

Crypto analysts highlight the link between Fed policy and Bitcoin surges . Crypto Rover noted, “The U.S. labor market is deteriorating. Powell may actually be too late. One thing is certain: rate cuts are coming. Risk assets will explode!” Since it began shrinking its balance sheet, BTC rallied +182%, moving from $39,000 to $124,000. Analysts warn that a return to expansionary policy could accelerate its growth even further, highlighting the crypto’s sensitivity to macro shifts.

History Proves Bitcoin Pumps Every Time Fed Tightening Begins

It is currently trades at $110,914.92, down 1.68% intraday, with a market cap of $2.2T and 24-hour volume of $50.67B. Volatility has kept BTC consolidating between $123,000–$105,000.

Historically, every tightening phase has sparked rallies. With the probability now near 90%, investors anticipate the FOMC meeting Schedule in September 2025 to mark the start of another potential uptrend.

Bitcoin Price Prediction : Analysts Eye 100X Surge Post Rate Cut

Bullish Case: Analysts forecast it could achieve a Bitcoin 100x gain if the Fed eases. Resistance is at $116,000–$120,000 and $124,000–$128,000, with support at $108,000. Moderate accumulation signals bullish momentum.

Bearish Case: Skepticism or delays may push BTC to $106,000, $102,000, and $98,000. Dropping below $98,000 may provoke deeper retracements to $92,000–$88,000.

100x Gain Scenario: If the trend goes bullish, it can touch $11,000,000 in 1–3 years. Experts have pointed out that this Bitcoin 100x scenario could change crypto history, based on liquidity expansion, adoption growth, and macroeconomic catalysts, 2025–2028 being potentially the record-breaking years for investors.

Conclusion

The September 2025 Fed rate Cut, scheduled for execution, would draw record-breaking market action. BTC would potentially reach a 100x growth, so it is essential for traders to monitor the FOMC meeting Schedule closely and be ready for a turbulent but potentially record-breaking crypto stampede.

Disclaimer: This is for general information purposes only and is not an investment advice. Do Your Own Research before investing.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。