The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of coin friends. I welcome everyone's attention and likes, and refuse any market smoke screens!

A wave of data was released, yet it surprisingly did not drive the rise of the coin circle, leaving many users particularly confused; most are beginning to waver in their confidence in the bull market, leading many users to increasingly believe that interest rate cuts may signal the arrival of a bear market. The only good news is that OKB has returned to above 200. Today's article by Lao Cui is to help everyone regain confidence. Whether you trust it or not, the current downward trend in the market is present, but Lao Cui's views are always in line with investment giants like Goldman Sachs and Standard Chartered. Especially with the non-farm payroll data showing only 22,000 jobs, it almost indicates that interest rate cuts will begin in September. If there are no cuts in September, the only possibility left is a 50 basis point cut in October, followed by 25 basis points each month thereafter. Of course, these are future discussions; this year's interest rate cuts will be at least 75 basis points, which is basically consistent with last year's expectations. Many people currently attribute the market's movements to Powell's statements, believing they will offset the wave of funds from interest rate cuts. Lao Cui's response is simply three words: impossible.

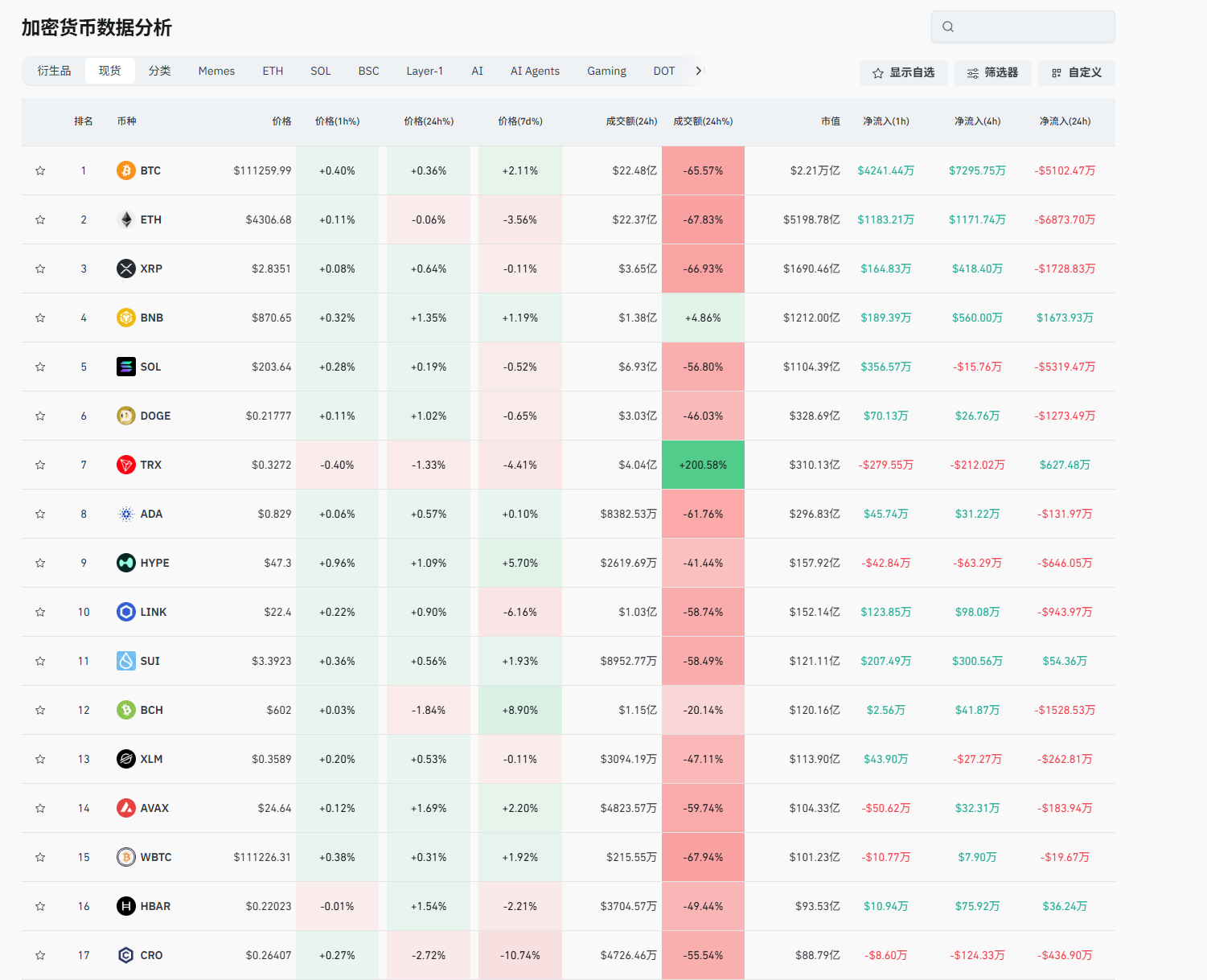

Every time there is a significant positive news and a historical turning point, it requires a period of twists and turns. Indeed, at this stage, the funding aspect, especially the funding structure of Bitcoin, has encountered significant issues, showing us that capital is exiting. Bitcoin has been experiencing a capital outflow of about 100 million daily, but everyone needs to compare this with the overall market value. Currently, Bitcoin still maintains a market value of 2.2 trillion, while in June, the market value was only between 1.5-1.8 trillion. Overall, the phenomenon of Bitcoin outflow is not very obvious. Additionally, with Ethereum seeing an inflow of another 100 billion, the overall market value of the coin circle has not changed significantly; it is just that capital is reselecting coins to drive up prices. This should not overly worry everyone; many friends are afraid that the growth of Ethereum or SOL will lead to Bitcoin outflow. Currently, Bitcoin can be seen as the index of the coin circle; it is the guiding lighthouse.

Mid-September has always been the bull market starting point envisioned by Lao Cui. Due to the fluctuations in August, the rhythm has been slightly disrupted. There is only about a week left until mid-September, and we will see if this timing is correct. For users who have not yet entered the market, there is still an opportunity, which can be considered the best entry point for the second half of the year. Ultimately, it depends on how everyone seizes it. Anyone involved in trading in the coin circle, especially contract users, should be clear that you are in a competitive relationship with the market makers, and even with all market traders. Your trading is against global players, and your goal is based on their losses to generate profits. This is why, under the current certainty of interest rate cuts, the market is instead moving downward. This is also a step in the market makers' strategy to induce shorts, which has already started since the end of August. However, the current returns are not significant, so the consolidation will continue for a while.

At the same time, the trend of gold is the best barometer, especially after the non-farm payroll data, the sharp rise in gold basically sets the tone for interest rate cuts. Do not be blinded by short-term fluctuations; domestic strategies do not affect the overall coin circle. Since May 19, 2021, there have been almost no domestic giants in the coin circle. The capital from the Asian market has left domestic capital, and it is all a remnant, which is not a concern. Everyone just needs to know that the U.S. will cut interest rates this year, and the EU will continue to maintain its interest rate cut rhythm, likely starting in November-December. The entire global finance is pushing the financial market forward, and the domestic real estate issues will also drive Lao A forward. The stablecoin licenses in Hong Kong will only be issued to companies starting with the national character, aiming for capital repatriation, which can only be considered a channel for repatriation. Countries like South Korea, Japan, and the EU are studying their own stablecoin blockchain methods, which will later promote the growth of the coin circle's market value.

Lao Cui does not advocate for everyone to enter the Bitcoin market, which does not mean that Bitcoin will decline. It is just that the returns on Bitcoin above 100,000 are not significant; the potential for doubling must match Lao A's cycle, and the time is too long, making the returns compared to other coins seem too lengthy. Currently, Lao Cui's main funds are primarily in SOL and OKB, with Ethereum holdings being somewhat burdensome. Those who have read Lao Cui's articles are very clear that the ability to hold Ethereum is partly due to its low price. At this stage, Lao Cui does not dare to easily enter. Of course, Lao Cui is optimistic about Ethereum hitting the historical high of 5-6K. After this bull market starts, Lao Cui will likely choose to cash out between 5500-6000, and the focus will return to OKB. Currently, in Lao Cui's personal view, OKB is the strongest dark horse, followed by SOL, while Bitcoin and BNB are the most stable. This reference can be used for some tentative entries into these types of coins around mid-September.

Regarding Bitcoin's prediction, the last historical high was set on August 14 at 124,545, after which it almost experienced a month-long downward oscillation trend. Lao Cui does not share the same speculation as the outside world; the prediction for the end of 2024 and early 2025 is still in the range of 130,000-150,000, and it currently meets this price level, only lacking a 10,000-point range. Therefore, for spot users' allocation, if the price is below 100,000 and has not been bottomed out in time, it is currently not suitable for spot users to enter. Unless everyone has a deep understanding of blockchain and can hold for 2-5 years, with this time recognition, a price above 150,000 is not a big issue. On the contrary, this year's Bitcoin is more suitable for spot users to operate; it is indeed very stable. As long as the stop-loss point can be controlled around 20,000 points, Bitcoin is very suitable for swing trading. The entry points previously provided to everyone have only been met by Ethereum; Bitcoin is looking for 105,000, SOL around 170, and OKB around 160-170, all of which are short-term contacts. Many friends have not yet entered, so I am summarizing and providing the entry positions again.

Lao Cui summarizes: Currently, the overall coin circle has shown signs of recovery. At this stage, if you want to enter the market, you can completely try with a small position. Also, do not forget the position ratio that Lao Cui previously provided: 10%-20%-30%, and finally 40%. Friends familiar with Livermore should already know that this ratio comes from there. Lao Cui has indeed felt the benefits brought by this position ratio through contract operations. Bitcoin should start to add positions every 2000 points, Ethereum every 200-300, SOL every 10 points, and OKB similarly. This method of adding positions can easily help everyone pull the average entry price down to the lowest point. If operating contracts, the ratio should be correspondingly reduced. The maximum addition should stop at 30% of the total funds, still primarily focusing on going long. Recently, Lao Cui is still mainly guiding the users in hand. Those with entry positions and those needing to break even can directly message Lao Cui, and I will reply to everyone.

Original creation by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and the big trend, not focusing on one piece or one area, aiming for the ultimate victory in chess. The novice, however, fights for every inch of land, frequently switching between long and short positions, only competing for short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this is at your own risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。