Master Discusses Hot Topics:

It's Monday, so I'll start with the macro highlights. The PPI on September 10 and the CPI on the 11th are the two most important data points before the Americans cut interest rates. With employment in such a bad state, the market is hoping for a softer inflation data to provide a reason for a 50 or even 75 basis point cut this year.

But if the CPI continues to be high, it will directly ignite a stagflation farce, and the market will immediately panic. Over the past few days, Trump has been acting like a madman, constantly attacking Powell and shouting that interest rates are too high, which basically means he wants to force the Federal Reserve to back down. The real face-off will be at the interest rate meeting on the 18th of this month, where Trump and Powell will confront each other for the first time.

Back to the market, don't think too much about Bitcoin for now. The weekly close barely held around 111K. If next week's weekly close is below that, the next target will likely be 98K.

In simple terms, the market sentiment is weak right now, and the weekend spot premium has also dropped. The market has rebounded a bit, but it is still spinning in a dangerous zone. To break free, it must rise to 113.5K and establish a higher high; otherwise, don't think about any trend reversal.

Don't forget that after the last spike and bloodsucking, it fell for three consecutive weeks, and last week it even broke a new low. This structure is a downward oscillation, and I won't accept any rebuttals. The upper gap at 116.8K will eventually need to be filled, while the lower range of 105-98K is the order block support area. The market is grinding between these two coordinates. The direction is already very clear; overall, it is still moving in a downward oscillation rhythm, and the current rebound is just a liquidity grab.

Ethereum is even more frustrating, as it didn't rise at all on Sunday, stagnating around 4280 for two days. It gets smashed when it goes up and propped when it goes down, which is annoying. I would prefer it to first surge to 4380-4420 before crashing down, at least that would be more straightforward.

Currently, Ethereum's liquidity is completely stuck at 4515 and 4206, and the price will eventually have to touch these levels; it will either break through or get liquidated. But the key point is that this range is a hunting ground, and my view is very direct: first push up, then push down.

Additionally, Bitcoin is still stubbornly clinging to the short-term holders' realization price, and historically, it feels like this level won't hold for long. Combined with Ethereum's tug-of-war, there will definitely be significant movements this week…

Master Looks at Trends:

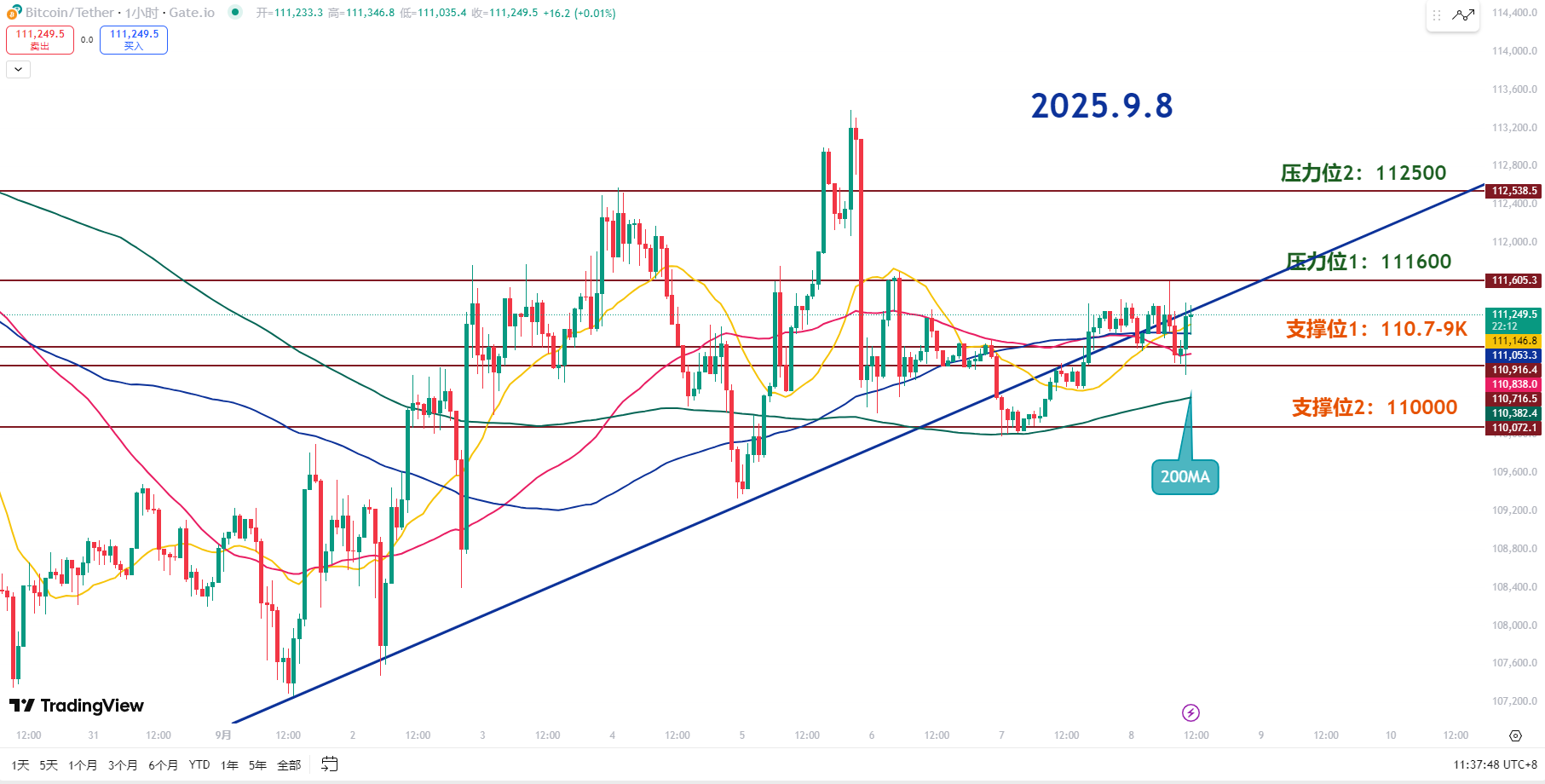

Resistance Levels Reference:

Second Resistance Level: 112500

First Resistance Level: 111600

Support Levels Reference:

First Support Level: 110.7-9K

Second Support Level: 110000

Short-term support at 107.7~9K must not be broken; otherwise, this rebound will just be a joke. The broken upward trend line resistance in the chart is at 111.3K; it must break through to stabilize and retest. The daily 200MA trend is also crucial; right now, it's in a box oscillation.

The first resistance at 111.6K cannot be surpassed without breaking the previous high of 111.3K. Only if it breaks through can there be hope to refresh the short-term high; otherwise, it will all be resistance. The second resistance at 112.5K is a key short-term resistance; if the 112K test fails, disappointment selling will definitely occur.

The first support at 110.7~110.9K must hold to maintain hopes for a rebound; if it breaks, the 60 and 120MA short-term trends will have to start over. The second support at 110K can be monitored at the 1-hour level 200MA; the lows must be lifted. If there is a short-term crash, this will be the lifeline for a short-term rebound.

9.8 Master’s Wave Strategy:

Long Entry Reference: Buy in batches in the 110000-110700 range, Target: 111600-112000

Short Entry Reference: Sell in batches in the 111600-112500 range, Target: 110700

If you truly want to learn something from a blogger, you need to keep following them, rather than making hasty conclusions after just a few market observations. This market is filled with performers; today they screenshot long positions, and tomorrow they summarize short positions, making it seem like they "always catch the tops and bottoms," but in reality, it's all hindsight. A truly worthy blogger will have a trading logic that is consistent, coherent, and withstands scrutiny, rather than jumping in only when the market moves. Don't be blinded by flashy data and out-of-context screenshots; long-term observation and deep understanding are necessary to discern who is a thinker and who is a dreamer!

This article is exclusively planned and published by Master Chen (WeChat public account: Coin God Master Chen). For more real-time investment strategies, solutions, spot trading, short, medium, and long-term contract trading methods, operational skills, and knowledge about candlesticks, you can join Master Chen for learning and communication. A free experience group for fans has been opened, along with community live broadcasts and other quality experience projects!

Friendly Reminder: This article is only written by Master Chen on the official account (as shown above), and any other advertisements at the end of the article or in the comments are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。