August 2025 is a historically significant month for digital assets, with both Bitcoin and Ethereum reaching all-time highs. Bitcoin surged to $124,000, while Ethereum broke through $4,900, driven by strong institutional demand, ETF inflows, and widespread corporate adoption. Despite a pullback at the end of the month—Bitcoin closing at $108,000 and Ethereum at $4,300—the overall bullish structure of the market remains solid, supported by over $10 billion in stablecoin inflows. Meanwhile, the rapid rise of Digital Asset Treasury (DAT) companies and the gradual diversification of asset allocation beyond Bitcoin and Ethereum highlight the deepening integration of traditional finance and the crypto industry. However, the decline in the market net asset value multiples (mNAV) of some DATs suggests that the market may enter a consolidation phase. As expectations for Federal Reserve interest rate cuts approach, crypto assets are still expected to maintain momentum as risk assets.

BTC and ETH Reach New Highs

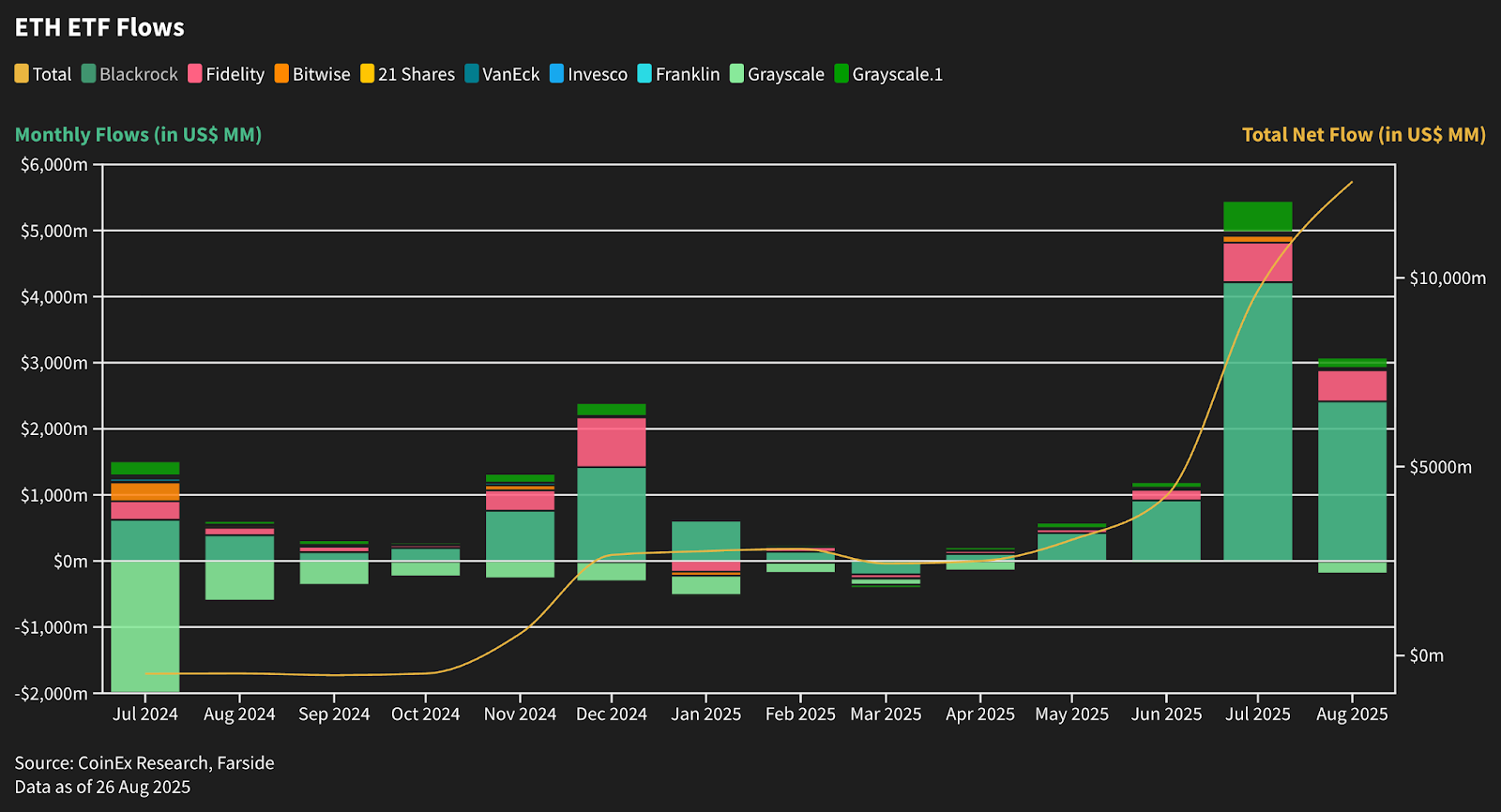

Bitcoin opened at $115,000 in August, continuing the upward momentum from July, and reached a new high of $124,000 on August 14. Ethereum performed even stronger, starting at $3,700 and breaking the 2021 record high on August 24, climbing to $4,900. Institutional funds continued to flow in, with Ethereum ETFs attracting $3.8 billion in August, following $5.4 billion in July.

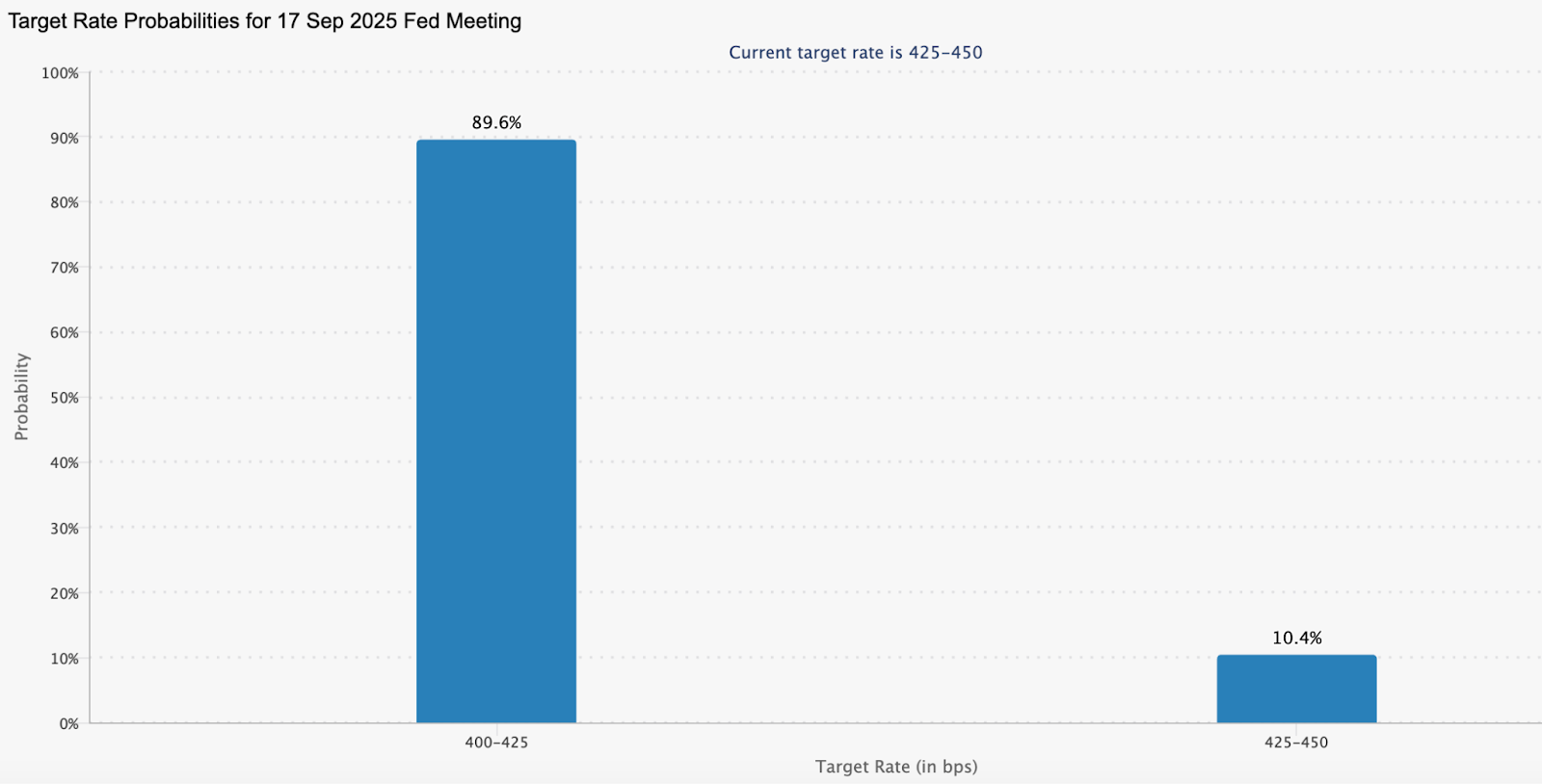

Bitcoin ultimately closed at $108,000, while Ethereum closed at $4,300. Despite the pullback, the overall bullish structure remains intact. The current market focus has shifted to macro policies, with the CME FedWatch tool indicating a 89.6% probability of a Federal Reserve rate cut in September, which could serve as a catalyst for a renewed strength in risk assets.

Source: CME FedWatch; Data as of September 1, 2025

Technical Outlook: BTC Consolidation, ETH Profits May Flow to Solana

Bitcoin's upward momentum is weakening, and it is expected to enter a consolidation phase in the short term, potentially testing the support level around $108,000 repeatedly, but the overall bullish pattern remains unchanged.

Meanwhile, some profits from ETH may flow into SOL, and the related narrative is gaining traction. Recently, the SOL/ETH ratio has shown a strong rebound and is expected to test the resistance level of 0.05716 again.

Ethereum Sets New All-Time High

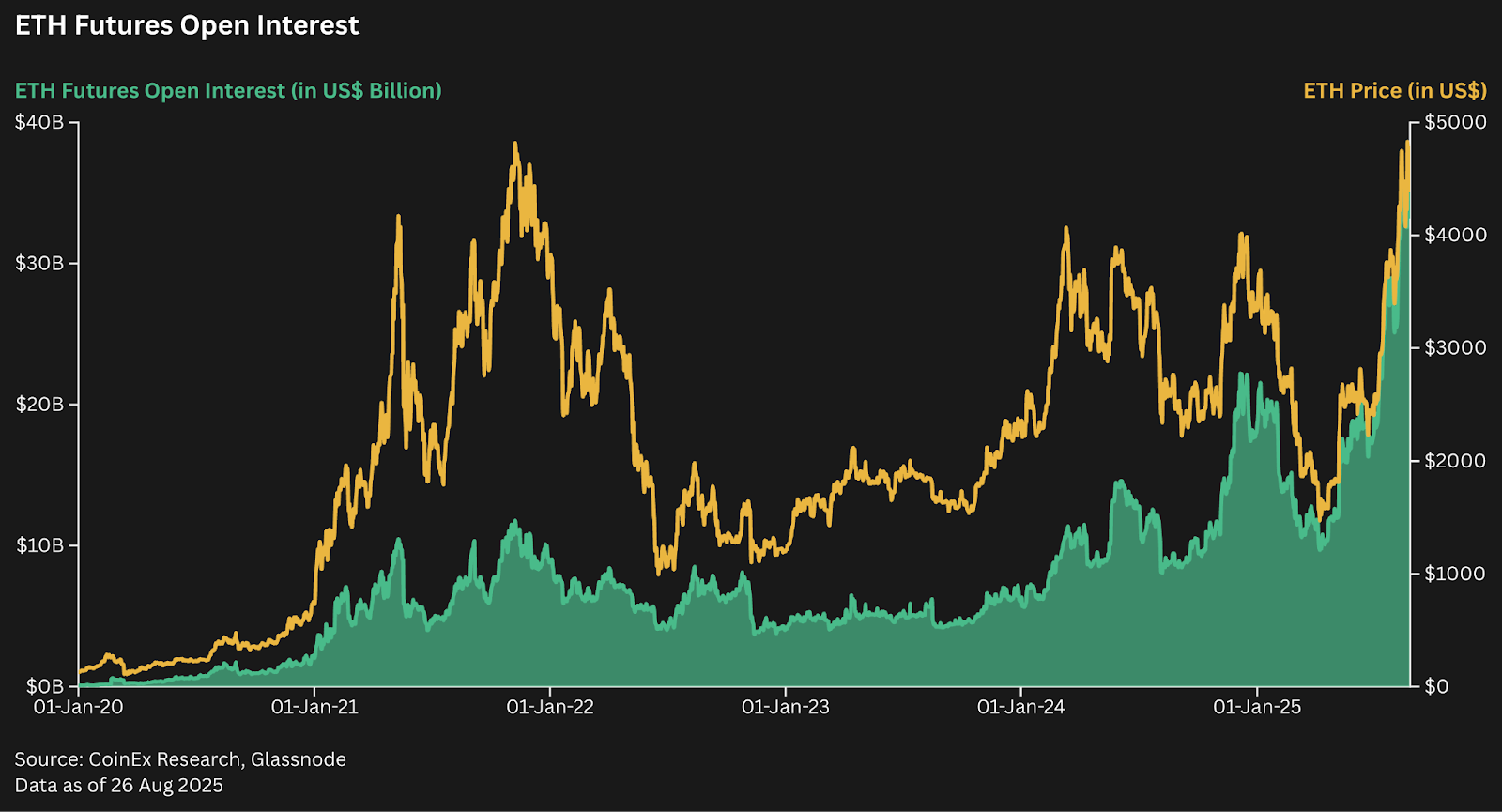

This month, driven by the ETH treasury companies and ETF inflows, Ethereum broke through $4,900, setting a new high. However, it is important to note that ETF inflows have begun to slow, and the leverage in ETH derivatives remains high, indicating that a consolidation period may precede the next round of increases.

For a deeper understanding of the core drivers behind this round of Ethereum's rise, please refer to our recent article “Ethereum Price Hits New All-Time High in 2025: Key Drivers and Future Outlook”.

Expansion of Digital Asset Treasury (DAT) Companies

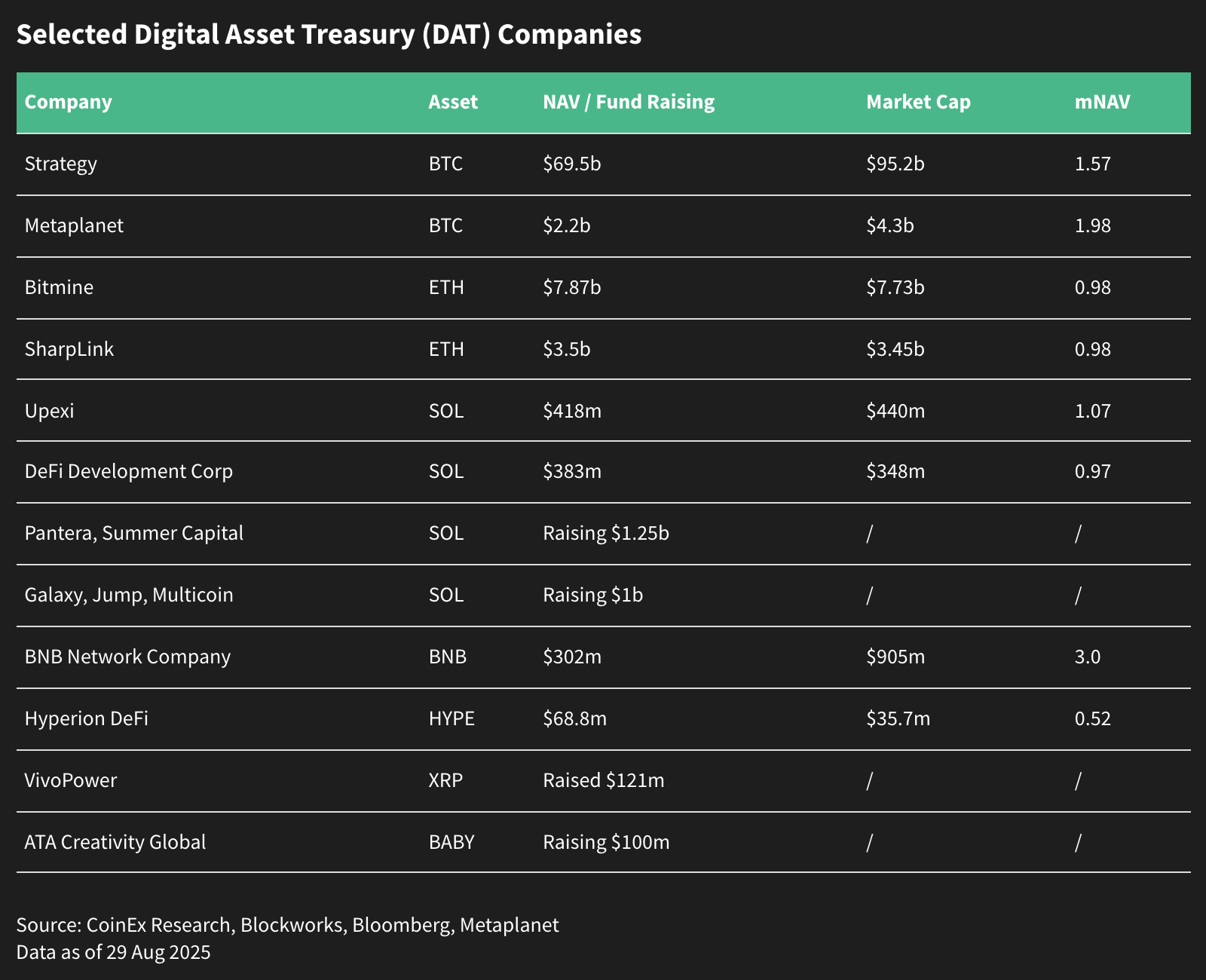

In July, CoinEx Research noted the rise of Ethereum-centric Digital Asset Treasury (DAT) companies. By August, the industry rapidly expanded, with companies like Pantera Capital and Galaxy Digital starting to fund Solana treasuries, while other institutions ventured into assets like BNB, XRP, HYPE, and BABY. This diversification trend reflects strong demand for altcoins in the market, and it is expected that companies in different regions will exhibit regional differences due to varying market and regulatory conditions.

However, the market net asset value multiples (mNAV) of some DATs have declined from high premiums to near 1.0 times, indicating that as competition intensifies and sentiment returns to rationality, valuations may face pressure.

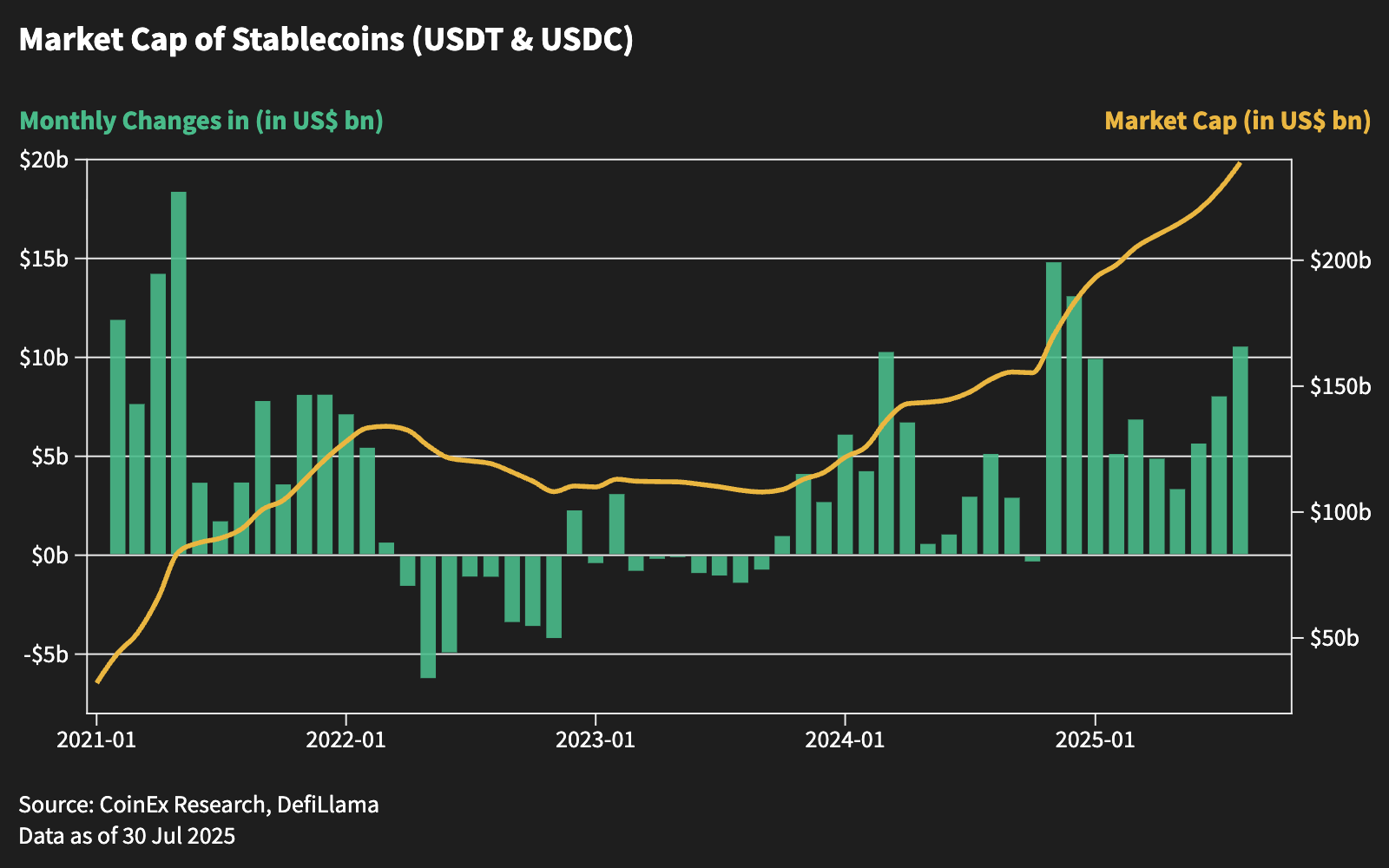

Stablecoin Inflows Exceed $10 Billion

In August, stablecoin inflows exceeded $10 billion, marking the fastest growth rate in the past eight months. This trend reflects increased market liquidity, accelerated capital deployment, and sustained investor activity. CoinEx Research views this as strong evidence of the robustness of the bullish market structure.

Outlook: Expansion After Consolidation

CoinEx Research believes that the dual all-time highs in August not only demonstrate the market's strength but also highlight the complexity and maturity of the current crypto market. Bitcoin and Ethereum remain the core anchors of institutional strategies, but the pullback at the end of the month indicates that the market needs some consolidation before the next round of increases.

At the same time, the rise and diversification of DAT companies underscore the further integration of crypto and traditional finance, but the compression of mNAV multiples also means that the market is distinguishing between speculation and sustainable models. The inflow of stablecoins exceeding $10 billion confirms the solid structural foundation of the bull market. As the shift in macro policies approaches in September, the market may welcome a new wave of growth, but investors should be cautious about leverage and valuation risks.

About CoinEx

CoinEx was established in 2017 and is a user-centric global cryptocurrency exchange. Since the founding of the leading mining pool ViaBTC in the Bitcoin industry, CoinEx has been one of the first exchanges to release proof of reserves (PoR) to ensure 100% security of user assets. Currently, CoinEx offers over 1,400 cryptocurrencies and has a user base of over 10 million across more than 200 countries and regions, equipped with specialized functions and services. CoinEx also issues a native token, CET, to incentivize user activities and continuously empower the platform ecosystem.

To learn more, visit: Website | Twitter | Telegram | LinkedIn | Facebook | Instagram | YouTube

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。