How Major Economic Events Could Shape Crypto Market in September 2025

The coming week is filled with important economic updates that could decide where financial and crypto markets move next. Investors are closely watching because these numbers will be the final guide before the Federal Reserve’s September policy meeting.

Key Economic Triggers This Week

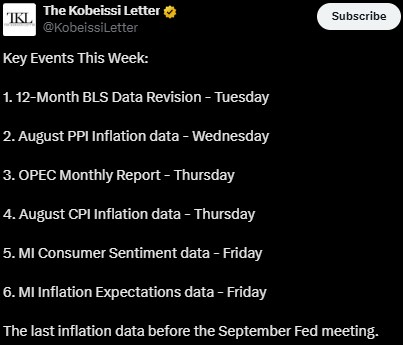

According to the economic calendar, several reports will shape investor sentiment:

Source: X

Source: X

-

Tuesday: 12-month BLS data revision.

-

Wednesday: Producer Price Index (PPI) inflation release.

-

Thursday: OPEC monthly oil report and the Consumer Price Index (CPI) inflation update .

-

Friday: University of Michigan consumer sentiment and inflation expectations.

These are not just routine numbers. Thursday’s CPI will be the last official reading before the Fed decides on rates.

Recession Warning Signs Flashing

Behind these updates, warning lights are flashing in the real economy. Construction spending dropped -2.8% year-on-year in July, one of the sharpest falls since the 2008 crisis. Even more concerning, spending has now declined in 10 of the last 11 months, the longest streak in 15 years.

At the same time, construction employment has fallen for three straight months, something last seen in 2012. Historically, such deep cuts in spending and jobs have almost always matched periods of recession.

The labor picture looks worse when long-term unemployment is considered. The number of people out of work for more than 27 weeks jumped to 1.94 million in August, the highest since 2022. This group now makes up 26.3% of all unemployed, a level higher than during most past downturns except the 2008 crisis and the pandemic.

How the Fed and Crypto Investors See It

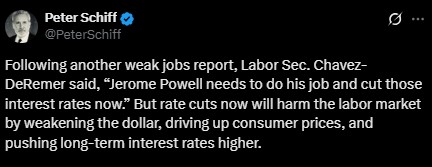

Pressure on Fed Chair Jerome Powell is mounting. Labor Secretary Chavez-DeRemer even said, “Powell needs to do his job and cut those interest rates now.” But according to Peter Schiff, cutting too early may weaken the dollar, lift consumer prices, and drive long-term interest rates higher.

Source: X

Source: X

For digital assets, the timing could not be more critical. At the time of writing, the global market capitalization is $3.84 trillion, up 0.62% in a day. Bitcoin is trading near $111,090, showing an intraday gain of 0.48%. Ethereum, XRP, Solana, Cardano, and Dogecoin also saw modest green moves.

Experts believe if the CPI shows inflation cooling, Powell may have some space to hint at cuts, and this will shift crypto market towards bullish zone in September 2025. That could support asset prices, including tokens. But if inflation stays hot, the Fed may remain cautious, and risk assets could see fresh pressure and investors may see a crypto market crash in September 2025.

What Should Investors Do Now?

Analysts suggest caution. History shows that when unemployment rises and spending falls, risk assets face volatility. Investors are advised not to chase quick gains but to watch how Thursday’s inflation numbers shape the Fed’s tone.

Conclusion

The mix of weak jobs, falling construction, and rising long-term unemployment paints a troubling economic picture. With the last inflation data before the Fed meeting due this week , markets remain on edge. For now, investors should stay patient and let policy signals guide their next move.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。