Author: 1912212.eth, Foresight News

Since BTC fell below $108,000, the market has been filled with cries of despair, and the pessimistic sentiment of a bear market has spread among retail investors. However, BTC has not significantly dropped after breaking through this important threshold; instead, it has rebounded above $110,000. On September 8, BTC stood above $110,000. ETH has also been consolidating around $4,300 without showing a clear direction.

With the seasonal curse of September and the upcoming Federal Reserve decision, the market is questioning how far Bitcoin can go. Will there be an altcoin season?

Discrepancies in the Concept of Altcoin Season

In the cryptocurrency market, "altcoin season" refers to a period when the overall performance of altcoins surpasses that of BTC. This concept originates from the rotation of market funds: investors shift from Bitcoin to other cryptocurrencies in search of higher returns, leading to a significant rise in altcoin prices, while Bitcoin's dominance (BTC Dominance, the proportion of Bitcoin in the total cryptocurrency market capitalization) typically declines.

Specifically, altcoin season is often described as a phase of high volatility and high returns, where many altcoins may achieve several times or even tens of times in gains, while Bitcoin remains relatively stable or corrects.

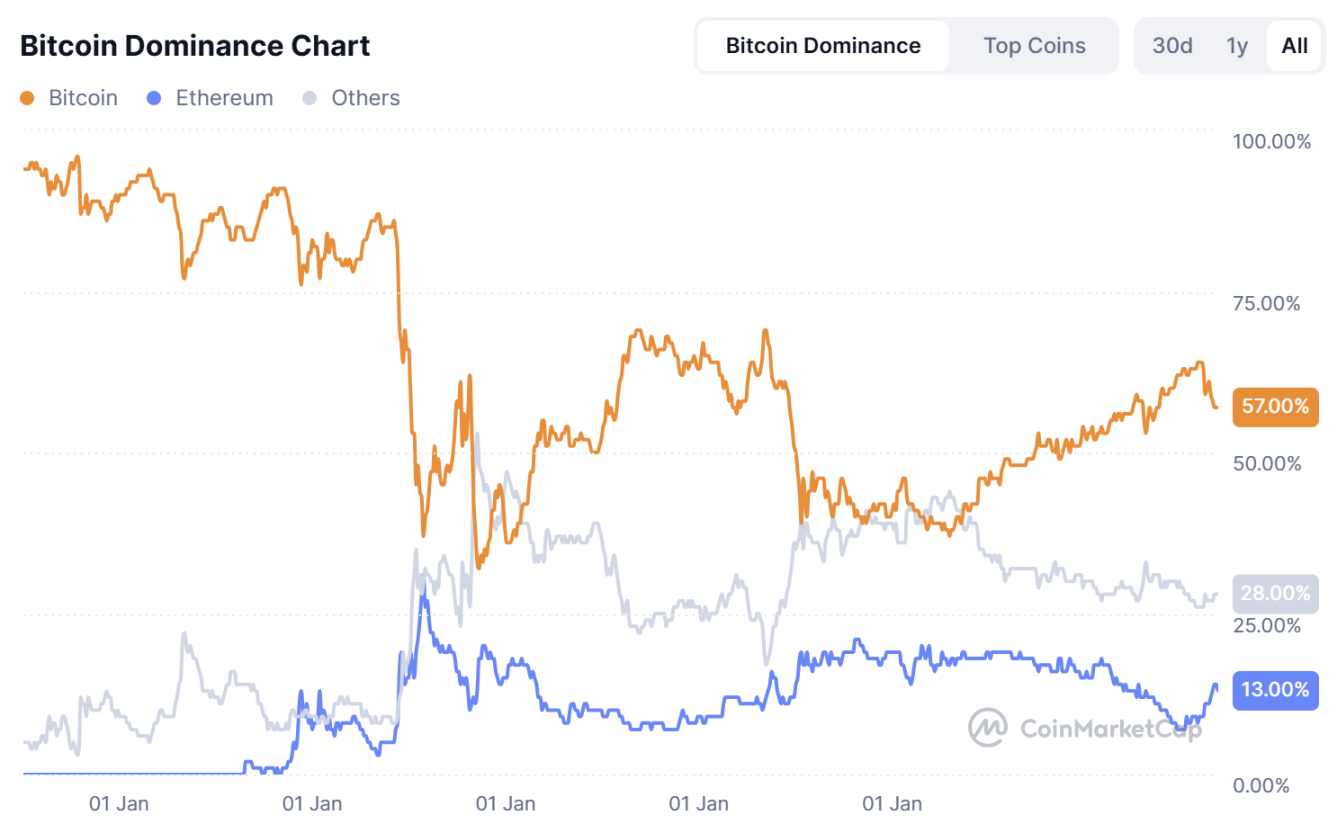

Market participants commonly use several indicators to determine whether an altcoin season is approaching: a decline in Bitcoin's dominance rate: when this ratio significantly falls from a high level (such as above 60%), funds often flow from Bitcoin to altcoins. Currently, BTC's market cap accounts for 57%, yet an altcoin season still seems far off.

This is seen as a precursor to an altcoin season, as it indicates that market attention is shifting towards more speculative assets. Next is the rotation of funds and narrative-driven movements: altcoin seasons often occur in the later stages of a bull market, after Bitcoin first breaks through its historical high, leading retail and institutional funds to shift towards altcoins.

Core characteristics include specific narratives (such as DeFi, NFT, AI, or meme coins) dominating the market, resulting in a "collective explosion" of related cryptocurrencies. Finally, there is the duration and performance: a typical altcoin season lasts 4-6 months or even longer, with the total market cap of altcoins (excluding BTC) potentially doubling or more. Historically, the ICO boom of 2017 and the DeFi/NFT frenzy of 2021 are classic examples.

There are significant discrepancies in the definition and judgment of altcoin seasons in the crypto market.

Discrepancies in precise triggering conditions: Some strictly rely on quantitative indicators, such as the Altcoin Season Index needing to exceed 75. However, others believe this is too mechanical and overlooks market sentiment; they place more importance on a "sharp decline" in Bitcoin's dominance rather than gradual changes. Does an altcoin season have to mean "everything is rising," or is it sufficient for just core narratives and a few altcoins to explode? Many believe the latter is more realistic, as market saturation leads to dispersed funds.

Discrepancies in timing and phases: Some analysts believe altcoin seasons only occur after Bitcoin peaks, when profit-taking funds overflow. In contrast, others think it can start independently of Bitcoin, in specific months (like November to January). In the current cycle (2024-2025), the divergence has intensified: some debate whether we have entered an altcoin season or if it is merely an "illusion," as institutional dominance and oversupply of altcoins may alter traditional patterns. For example, some believe the traditional concept of altcoin season is outdated, influenced by regulatory and macro factors.

Discrepancies in experience and subjectivity: Different groups have very different views on altcoin seasons. Newcomers may see a slight rebound as an altcoin season, while veterans emphasize the need for "life-changing" returns. Pessimists believe market maturation (such as ETF inflows) makes Bitcoin's dominance more enduring, making it difficult for altcoins to fully explode.

How Do Experts View Future Market Trends?

Trader Eugene: Altcoins need BTC to break upward for a rise

Trader Eugene Ng Ah Sio stated in a post on his personal channel that he is currently not participating in market trading, but needs to clarify for his followers that if they hope for substantial volatility in altcoins, it must rely on Bitcoin's upward breakthrough to drive the market; however, Bitcoin's performance has not met the bulls' expectations.

Matrixport: Although Bitcoin is still in a consolidation mode, its long-term outlook remains firmly bullish

Matrixport stated that gold has broken through the $3,400 mark—this key resistance level has suppressed prices for the past four months. Despite the current moderate increase in money supply, this rally has still occurred, with forward-looking investors simultaneously positioning in gold and Bitcoin. Although Bitcoin is still in a consolidation mode, its long-term outlook remains firmly bullish.

Bitfinex Alpha: The market is actually in the later stage of a correction phase, with the $93,000–$95,000 range likely to become a cyclical bottom for BTC

Bitfinex Alpha released a report stating that Bitcoin briefly fell below $110,000, with the pullback from the historical high of $123,640 expanding to over 13%. Historical pullback patterns and seasonal trends indicate that the market is actually in the later stage of a correction phase, with the $93,000–$95,000 range likely to become a cyclical bottom. On-chain data also confirms this: the current realized price for short-term holders is $108,900, which is becoming a key support point. If the price continues to stay below this level, it may further increase downward pressure. Order flow indicators from trading platforms also show that spot market sentiment is trending neutral, reinforcing the view that buyers are choosing to wait for stronger catalysts before acting.

Altcoins are performing more weakly, reflecting a broad risk-averse sentiment in the market. ETH fell 14% after briefly hitting a new historical high, while XRP, ADA, and DOGE all recorded double-digit declines. However, institutional demand remains resilient beneath the surface, with ETH treasuries and corporate buyers continuing to accumulate. Mid-cap tokens like CRO and PUMP performed well in narrative-driven markets, but this rotation is more at the expense of funds withdrawing from weaker coins rather than new capital inflows.

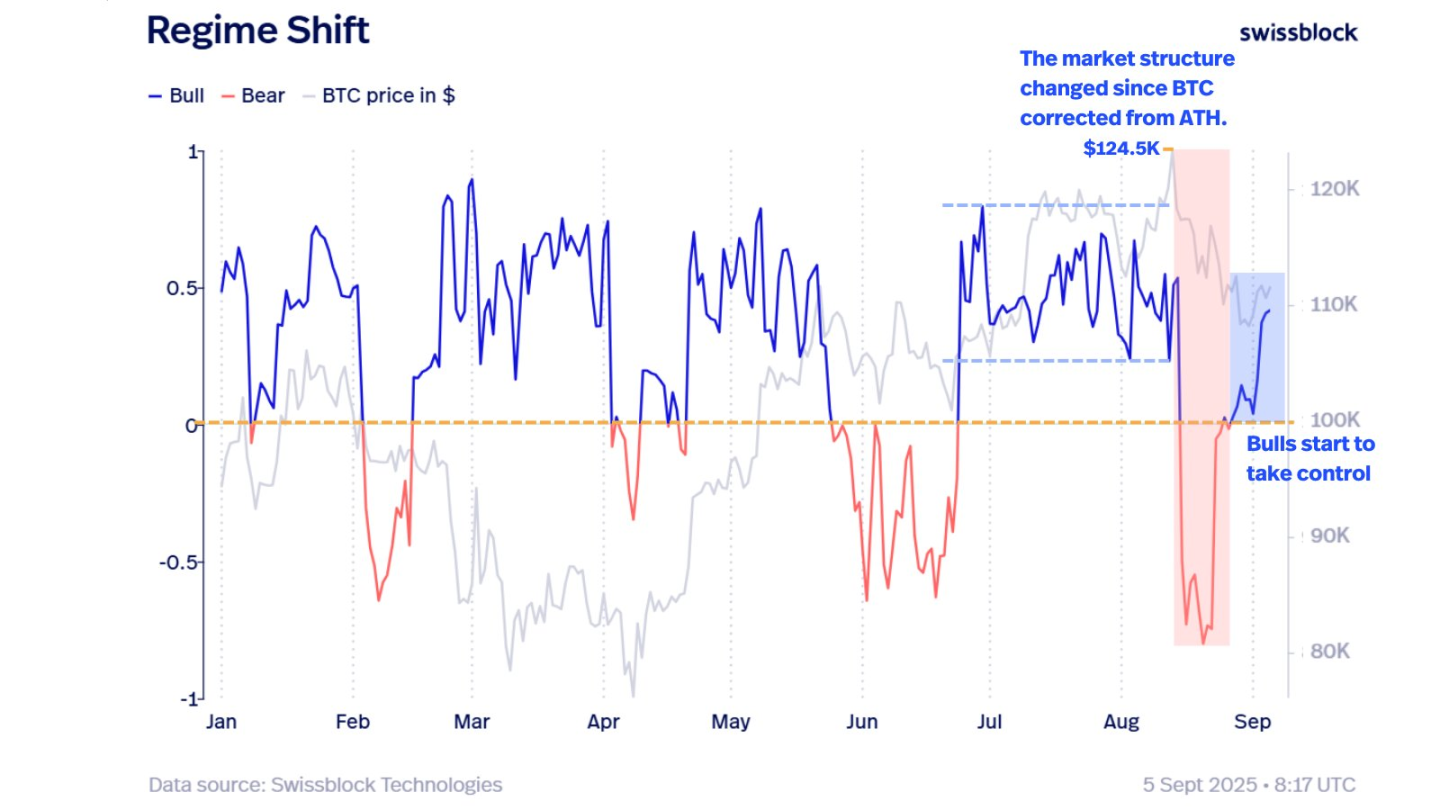

Sweissblock: BTC needs to hold above $110,000 to gain upward momentum

Sweissblock tweeted that Bitcoin's price briefly fell below $110,000 but is now testing the $112,000 range. Is this pullback a trap for short sellers? Bitcoin still maintains a bullish structure. The key is that after market fluctuations, Bitcoin not only needs to hold this structure but also regain upward momentum to drive further increases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。