Recently, a captivating battle for stablecoins unfolded on the decentralized derivatives trading platform Hyperliquid. On September 5, Hyperliquid officially announced the upcoming auction for the Ticker of "USDH," a native stablecoin serving the Hyperliquid ecosystem. The proposal submission deadline is set for September 10 at 10:00 UTC, and as of now, several institutions, including Paxos, Ethena, Frax, Agora, and Native Markets, have submitted proposals, competing to become the issuer of the native stablecoin USDH on the Hyperliquid chain.

Participants in this competition include not only established compliant institutions and emerging DeFi projects but also teams backed by well-known investment firms. The high-profile competition is driven by Hyperliquid's rapid rise as a new decentralized trading platform, with its perpetual contract monthly trading volume nearing $400 billion and August's single-month fee revenue reaching $106 million, capturing about 70% of the decentralized perpetual market.

Currently, the dollar liquidity on the Hyperliquid chain primarily relies on external stablecoins like USDC, with a circulating scale that once reached approximately $5.7 billion, accounting for about 7.8% of USDC's total issuance. The Hyperliquid team's approach means that annual interest income could potentially reach hundreds of millions of dollars, directly benefiting the community.

Thus, obtaining the issuance rights for USDH not only signifies a substantial market share but also relates to the dominance over this massive potential revenue. The presence of multiple heavyweight players competing from the outset has made this bidding war charged with tension, and the on-chain voting for the ownership of the stablecoin issuance will be decided within one hour on September 14 from 10:00 to 11:00 (UTC).

Hyperliquid-first, Hyperliquid-aligned

Behind this stablecoin bidding war is a significant shift in the platform's stablecoin strategy. Earlier this year, the Hyperliquid team considered issuing a native dollar stablecoin themselves, reserving the ticker "USDH" and temporarily prohibiting others from registering this code through the on-chain domain auction mechanism.

Hyperliquid's unique Ticker auction system allows anyone to bid for the registration of new asset symbols, but USDH, as a potential platform-exclusive stablecoin, was initially reserved by the official team. The community once believed that the official team would directly launch the USDH stablecoin. However, after careful consideration, the team chose to "devolve" the issuance rights of USDH to the ecosystem, introducing multiple bidding proposals and allowing the community to vote on the ownership. Previous events had led the community to question Hyperliquid's centralization, and this decision is seen as an important signal of Hyperliquid's governance moving towards community openness and mutual benefit. The official team has given up the opportunity to monopolize stablecoin issuance revenue, instead opting to let the bidding process allocate this piece of the pie to the bidder that can best benefit the community. The operation of multiple stablecoins will also provide Hyperliquid with broader expansion channels.

This shift is motivated by clear reasoning and background. On one hand, changes in the interest rate environment have made stablecoin reserve interest a significant source of revenue. Based on the current risk-free interest rate of about 4%-5%, the nearly $6 billion in stablecoin deposits on Hyperliquid could generate over $200 million in annual interest income. Previously, most of these earnings flowed to centralized issuers like USDC, and the Hyperliquid ecosystem did not directly benefit. As the platform grows, this situation of "making clothes for others" has become increasingly hard to ignore.

On the other hand, excessive reliance on USDC also brings centralization and compliance risks. Hyperliquid aims to introduce a platform-native stablecoin to enhance autonomy, incorporating interest income and minting tax revenue into its chain system, thereby strengthening the value support for the HYPE token and the ecosystem's self-sustaining capabilities.

Therefore, when the team decided to open the USDH bidding, they also set a clear value orientation: "Hyperliquid-first, Hyperliquid-aligned," prioritizing proposals that can return most of the revenue to the community and enhance the value of the Hyperliquid token. Notably, the Hyperliquid Foundation currently holds a significant amount of HYPE equity, and the official team has committed not to use this portion of voting rights, ultimately adhering to the community's voting results.

However, the influence of the team's founder, Jeff Yan, as a core figure, cannot be overlooked. The community generally believes that the official team is inclined to choose proposals that prioritize community profits. This special decision-making mechanism ensures that the bidding results align with Hyperliquid's long-term interests and sets an implicit standard for bidders: the more they can transfer benefits to the Hyperliquid ecosystem, the greater their chances of success.

What strategies are various institutions employing in the bidding?

The contenders for the USDH issuance rights are showcasing their unique strategies, each offering incentives to attract the Hyperliquid community. Paxos, Frax, Agora, and Native Markets have submitted detailed proposals, while projects like Ethena are eager to participate. Despite their different backgrounds, these proposals all emphasize a common theme: binding interests and ecosystem benefits.

Paxos (Compliance Advantages and Buyback Model)

Established compliant stablecoin institution Paxos (which previously issued USDP and PayPal USD) was the first to submit a proposal. Paxos promises to create USDH as a compliant dollar stablecoin "launched first on Hyperliquid," fully compliant with the U.S. "Stablecoin Innovation Act (GENIUS)" and EU MiCA regulatory standards. Technically, USDH will be operated by the Paxos Labs division and natively issued on Hyperliquid's two chains (HyperEVM and HyperCore).

In terms of profit distribution, Paxos has made an impressive commitment to allocate 95% of the interest generated from USDH reserves for the buyback of HYPE tokens in the secondary market, returning the buyback proceeds to ecosystem projects, validators, and users.

According to estimates, if USDH fully replaces the existing approximately $5.7 billion USDC supply on Hyperliquid, this mechanism could bring nearly $190 million in annual buyback demand for HYPE.

Additionally, Paxos will leverage its extensive traditional financial network resources: promoting the integration of HYPE assets among dozens of financial institutions it serves, including PayPal, Venmo, MercadoLibre, Nubank, and Interactive Brokers, enhancing Hyperliquid's mainstream reach. Paxos also promises to provide a free one-click conversion channel between USDC and USDH, smoothing the user migration experience.

Overall, Paxos's proposal is based on compliance and trustworthiness, supplemented by substantial buybacks and extensive channel resources, and is regarded as "very sincere," addressing both legal compliance and initial liquidity access while directly empowering HYPE, even opening up collaboration space with fiat and traditional finance.

Frax (Full Revenue Payment and DeFi Orientation)

The decentralized dollar stablecoin protocol Frax Finance quickly followed suit with its proposal. Frax's proposal focuses on "extreme benefits" and on-chain governance, promising to return 100% of USDH's underlying revenue to the Hyperliquid community.

Specifically, USDH will be pegged 1:1 to Frax's existing stablecoin frxUSD as the reserve asset, with frxUSD backed by high-quality bond assets such as those from BlackRock's BUIDL fund, generating revenue. Frax proposes to use all interest earned from these bonds to reward HYPE holders. Additionally, Frax supports users in freely exchanging USDH between USDT, USDC, frxUSD, and fiat currencies, providing convenience comparable to centralized institutions.

Notably, the Frax proposal emphasizes that HYPE will govern the liquidity and distribution of USDH, rather than Frax itself, thereby avoiding conflicts of interest. Compared to Paxos, Frax offers more enticing conditions, choosing not to take a cut, not to request tokens or revenue sharing, and will distribute 100% of the underlying treasury bond revenue to Hyperliquid users in a programmatic manner through the FraxNet account layer. With the current $5.5 billion in stablecoin deposits and a 4% annual treasury bond yield, this means that $220 million in revenue will flow back into Hyperliquid each year.

However, a drawback is that Frax is somewhat lacking in traditional credibility in reserve management, compliance licenses, and financial institution networks. In other words, Frax embodies an aggressive DeFi orientation, maximizing benefits for the community but lacking the strong regulatory backing and traditional industry support that Paxos has.

Agora (Neutral Alliance and Full Revenue Sharing)

Emerging stablecoin infrastructure company Agora (founded by Nick van Eck, who has a Wall Street asset management background) has also joined the fray. Agora recently completed a $50 million financing round led by Paradigm in July, with its first stablecoin AUSD having a market cap of approximately $130 million.

Its proposal features the introduction of the concept of a "stablecoin issuance alliance," with Agora providing on-chain issuance technology, Rain Company offering compliant fiat deposit and withdrawal solutions, and the cross-chain communication protocol LayerZero ensuring USDH's multi-chain interoperability.

The president of Moonpay also announced a few hours ago that he would join the alliance, perhaps in response to community leader mlm's tweet regarding Dragonfly partner Rob's somewhat "FOMO" comments about Agora. He specifically announced that he would request Paradigm co-founder Matt Huang to abstain from this vote (Paradigm is also an investor in Stripe, Tempo, MoonPay, and Agora Finance).

In terms of profit distribution, Agora promises to share 100% of the USDH reserve interest income with the Hyperliquid ecosystem, which can take various forms such as HYPE buybacks or contributions to a community assistance fund.

At the same time, Agora emphasizes its "neutral" position, focusing on serving Hyperliquid and will not use USDH to access other payment networks, brokerage services, or cross-chain issuance, avoiding any actions that would compete with or create conflicts of interest with the Hyperliquid ecosystem. This is seen as a response to Paxos, implicitly suggesting that large issuers like Paxos, with their multi-chain and multi-institution layouts, may have issues with pure profit distribution.

However, community comments suggest that while Agora's philosophy aligns closely with Hyperliquid's interests, the transparency of details regarding interest redistribution and ecosystem collaboration in its proposal is not as strong as the first two, and the external incremental resources it can bring are relatively limited. In short, Agora offers a concept of a "Hyperliquid-led custom stablecoin," but it currently lacks the scale and resources to have the same influence as Paxos.

Native Markets (Differentiated Approach from Local Teams)

The proposal from Native Markets was put forward by Max, a community leader who previously led the listing of Hyperliquid DAT company Hyperion, and he has sparked the most discussion among community members regarding all proposals.

The team is led by former Uniswap Labs president and COO Mary-Catherine Lader and builder Anish Agnihotri. Native Markets also promises that USDH will comply with U.S. GENIUS regulatory standards and inherit the global compliance qualifications and fiat channel capabilities of the team's issuer, Bridge.

Bridge was acquired by payment giant Stripe last year, and Native plans to leverage Bridge to complete the fiat channel integration for the stablecoin. However, this also brings potential conflicts, as Stripe has recently partnered with Paradigm to develop its own stablecoin chain, Tempo, and Bridge's involvement may indicate a conflict of interest, which has also been criticized by the Agora alliance.

In terms of profit sharing, Native states that it will inject reserve interest profits into Hyperliquid's community assistance fund, similar to Agora's focus on ecosystem returns. Overall, as the least well-known bidder, Native Markets' advantage lies in its deep understanding of the Hyperliquid chain and local ecosystem, but both its brand appeal and the external collaboration opportunities it can bring to Hyperliquid are relatively limited.

Ethena Labs

Additionally, projects like Ethena Labs have been rumored to potentially participate in the bidding. Ethena is a newcomer in decentralized derivative stablecoins, and its founding team claims to have submitted a USDH proposal to Hyperliquid as early as the fall, but has yet to receive a response.

After the bidding news was announced, Ethena's official Twitter account even posted a meme-style tweet using Eminem's "STAN" to "call out" Hyperliquid founder Jeff, complaining that their submitted proposal seemed to have vanished into thin air (the gist of the song is that a fan of Eminem, after not receiving a response from his idol for a long time, ultimately chooses to take his wife and child’s lives).

This little episode reflects that Hyperliquid initially had reservations about the selection of bidders, and it has made the community curious about what different path Ethena, as a platform utilizing LSD and perpetual hedging to build a non-dollar reserve stablecoin, would propose if it were to join.

When institutions "serve" the community, the era of stablecoin 2.0 is about to arrive

Faced with several attractive proposals, the Hyperliquid community has recently engaged in lively discussions, with overall public opinion leaning towards supporting proposals that offer high profit-sharing and enhance HYPE's value. Many token holders have responded positively to the proposals from Paxos and Frax, believing that both align with the direction of "the majority of profits going to the community."

Among them, Paxos has garnered support from another faction due to its compliance reputation and vast resources. Although it only promises a 95% profit-sharing, its indirect empowerment through HYPE buybacks may bring more sustained token demand support, and Paxos's channels are expected to introduce traditional financial incremental users to Hyperliquid. However, some have pointed out that the execution details of redistributing buyback profits to ecosystem partners in the Paxos proposal are uncertain, raising concerns that the actual benefits reaching the community may be discounted.

On the other hand, Frax's approach of directly returning all profits to users is seen as an extreme example of "decentralization and zero fees," distributing profits transparently and efficiently through HYPE governance on-chain. In contrast, under the Frax model, profits are directly distributed to HYPE stakers by the contract, leaving less operational space, which further builds trust within the crypto-native community. Many prefer Frax's model, which can directly allocate profits to users on-chain.

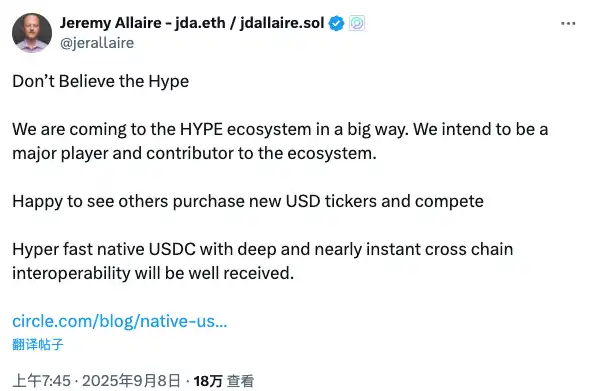

This bidding war has also prompted a broader range of industry participants to express their views. Jeremy Allaire, CEO of USDC issuer Circle, was among the first to speak out on the X platform, welcoming competition and stating, "Don't be fooled by hype; Circle will also make a significant entry into the HYPE ecosystem."

The entity most affected by this USDH auction may be Circle, which has compelled Circle to begin implementing some favorable proposals for Hyperliquid. Their first proposed plan is to directly issue native USDC on the Hyperliquid chain (previously mostly cross-chain).

Some analysts believe that if a new issuer for USDH successfully rises, USDC's monopoly position on Hyperliquid will be broken, which would undoubtedly worsen the situation for USDC, which is already experiencing a decline in market share. However, for the Hyperliquid community, the greater concern is whether the final proposal can fulfill its promises to HYPE holders and whether the platform can thus break free from excessive reliance on centralized stablecoins, achieving a true internal value circulation.

As the voting approaches, the ownership of USDH issuance rights will soon be revealed. This competition is not just a game among a few institutions; it serves as a litmus test for the evolution of stablecoin models in the current crypto market. Regardless of who ultimately wins, it is certain that stablecoin issuance is moving from a situation dominated by a few players to a new phase where various trading platforms and ecosystems compete fiercely.

Recently, new projects including Circle's new chain Arc, Stripe and Paradigm's Tempo chain, decentralized stablecoins like Ethena's Converge, and Metamask's mUSD have emerged, highlighting an unprecedented level of interest in the stablecoin sector, with innovative models continuously surfacing.

In the case of Hyperliquid, we see stablecoin issuers willing to relinquish almost all profits in exchange for scene distribution, which was unimaginable in the past. It is foreseeable that once USDH successfully launches and validates the positive cycle of "returning profits to the community and value reinvesting in the ecosystem," other trading platforms or public chains may follow suit, sparking significant changes in industry stablecoin strategies. Perhaps the "stablecoin 2.0 era" is about to begin.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。