Author: FMGResearch

Hong Kong vs. the United States

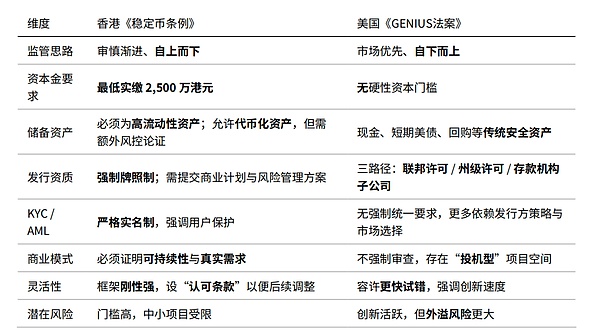

On August 1, 2025, Hong Kong's "Stablecoin Regulation" officially came into effect, establishing the world's first regulatory framework specifically targeting fiat-backed stablecoins, reflecting a "prudent and gradual" regulatory style: high capital requirements, strict reserve requirements, KYC real-name system, and scrutiny of the sustainability of business models. In contrast, the U.S. "GENIUS Act" adopts a "market-first" approach, with no hard capital requirements, diverse issuance paths, and greater reliance on market selection and user choice.

Understanding at a Glance: Core Terms Comparison

Regulatory Portrait: Underlying Logic of Two Paradigms

Hong Kong: A System Built on "Trust"

Goals: Investor protection, systemic stability, cross-border compliance recognition.

Means: High capital requirements, authenticity and liquidity of reserves, strong KYC, sustainability review of business models.

Expected Outcome: Fewer issuances but higher quality, with licenses serving as "trust endorsements."

United States: A Competitive Experiment Prioritizing "Market"

Goals: Encourage competition and diversity, with market selection.

Means: Diverse issuance paths, fewer hard indicators, primarily relying on disclosure and market discipline.

Expected Outcome: A richer array of projects and faster iterations, but risk governance relies more on issuers and the market.

Who is More Suited for Which Model?

Compliance funds / Financial institutions / Large internet companies: Lean towards Hong Kong—high compliance costs but can gain the benefits of institutional trust.

Early-stage startup teams / New mechanism explorations (e.g., RWA + programmable currency): Lean towards the U.S.—larger trial-and-error radius and faster innovation.

Cross-border payments and e-commerce: The Hong Kong route benefits collaboration with banks and licensed payment institutions; the U.S. route favors developer ecosystems and C-end diffusion.

Specific Impacts on the Industry Chain

For Issuers

Hong Kong: Need to prepare funding and auditing in advance; consider compliance justification for tokenized reserves and on-chain disclosure mechanisms.

United States: Focus on liquidity management and transparency disclosure, optimizing compliance costs across different state/federal paths.

For Exchanges/Wallets/Payment Institutions

Hong Kong: Strong KYC and list screening become standard; collaboration with local licensed institutions is more critical.

United States: Multi-asset access, on-chain risk engines, and user education are competitive advantages.

For Reserve Management and Auditing

Hong Kong: Daily reconciliation + regular audits + stress testing.

United States: Disclosure-driven, with audit frequency and scope more determined by issuers and market standards.

Risks and Opportunities Coexist

Threshold vs. Vitality: Hong Kong's high threshold raises the average quality of the industry but may suppress long-tail innovation; the U.S.'s vitality brings higher spillover and compliance uncertainty.

Cross-border mutual recognition: Whoever can first establish compliance recognition with major jurisdictions will gain global settlement network effects.

Trust Engineering: The "product strength" of stablecoins is not only about minting and redemption but also about transparency, auditability, and risk control automation.

Conclusion: Seeking the Optimal Solution Between "Trust" and "Openness"

Hong Kong and the United States showcase two distinctly different regulatory paths: Hong Kong focuses on compliance, safety, and sustainability, emphasizing the stability of licenses and reserves; the U.S. is market-driven and oriented towards competitive experimentation, encouraging diversity and rapid iteration. Each model has its advantages and risks—the former ensures systemic stability but may stifle innovation; the latter stimulates vitality but also comes with spillover and regulatory uncertainty.

Ultimately, the global stablecoin landscape will depend on who can first find the balance: winning the trust of users and institutions while maintaining market openness and vitality. This is not only about the future of financial innovation but will also determine the direction of cross-border payments, digital assets, and global financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。