After yesterday's post, many cryptocurrency enthusiasts began to question OKB, wondering why the author only listed the viewpoint of OKB having no upper limit. Today, I am here to clarify, mainly based on the following speculations:

The upgrade nodes are very different, coincidentally encountering the issuance of Hong Kong stablecoin licenses. The upgrade was completed in August, which means that OKB's upgrade has been in progress since at least the beginning of 2025, while the hype around Hong Kong stablecoins began at the end of 2024, which is significant.

Private enterprise stablecoin licenses have mostly been denied, including giants like JD and Alibaba. Currently, it is known that no company has started to access the market for Hong Kong stablecoins. The issues encountered are more likely related to data security; according to past practices, if data is not in one's own hands, it is difficult to access the international market, while OK public chain data is more secure. The rejection of JD and Alibaba is likely due to the Ethereum public chain, where data is unclear, making it impossible to obtain a license.

This upgrade of OKB is evidently different and seems to be paving the way for its future. The TPS has increased to 5,000, sufficient to support high concurrency trading demands, with Gas costs significantly reduced to nearly zero, enhancing user experience. The higher compatibility with the Ethereum mainnet allows developers to seamlessly deploy dApps, strengthening the chain's security and developer-friendliness. With substantial computing power, it can be said that it is currently the top platform token in the cryptocurrency space, possibly to accommodate stablecoins.

The quantity is rare; even if all speculations about stablecoins are denied, it does not mask the scarcity of quantity. It maintains the same total of 21 million as Bitcoin, and the comparison with its platform counterpart BNB shows an advantage, as BNB's circulating supply is between 130 to 160 million. Even as a platform token, OK's brand appeal, while not as strong as BNB's, could still reach half of its value without much issue. Currently, BNB is priced around 900.

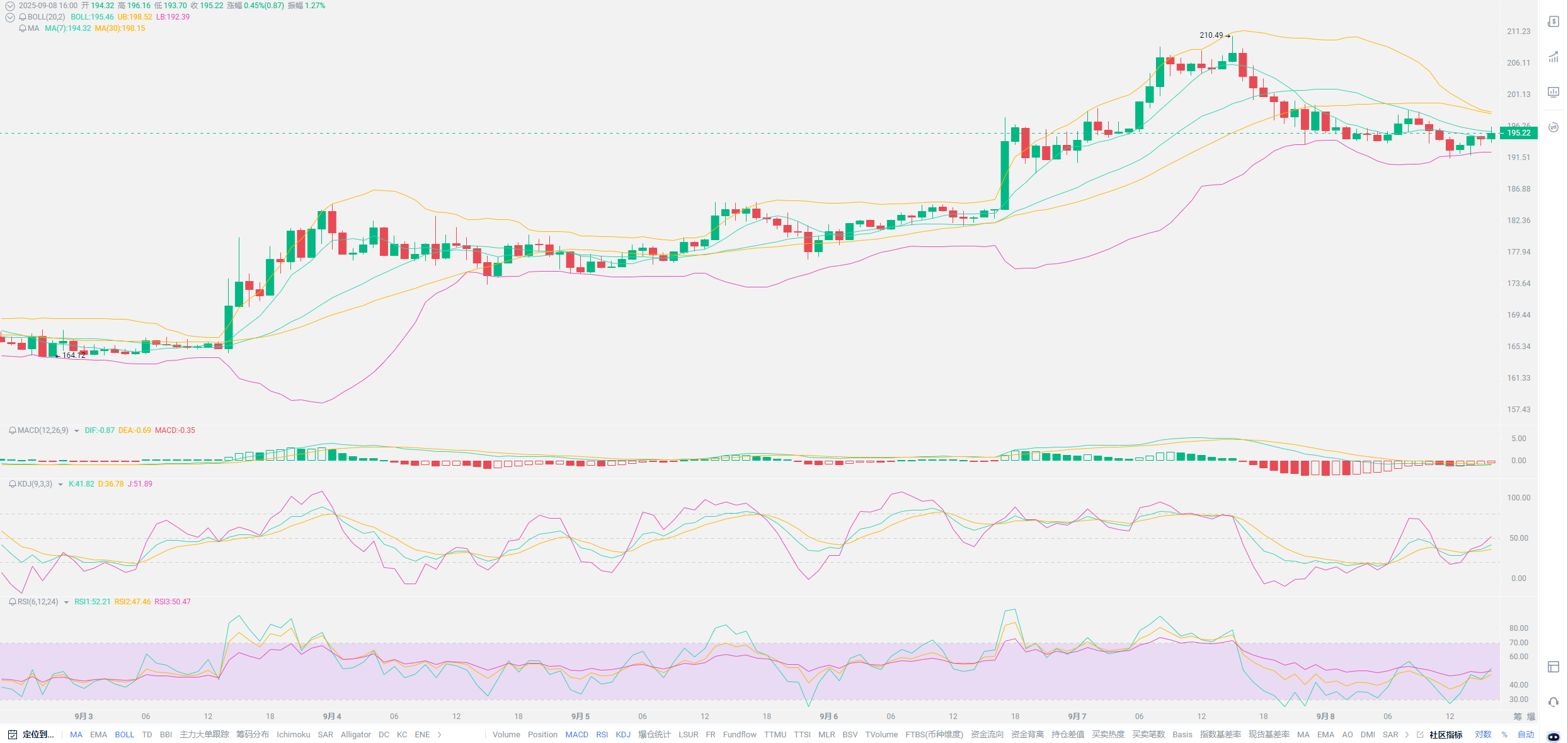

Interest rate cuts are imminent, and OKB may be more favored by domestic capital, as the current market for OK is primarily Chinese. The massive funds released by interest rate cuts will certainly flow into a portion of the market. Recent trends also indicate some issues; despite the significant rise of Bitcoin and Ethereum, OKB has instead declined. This clearly indicates that the two giants are not aligned; OKB is more reliant on domestic capital, and once domestic stablecoins are integrated into the OK public chain, it is very likely that its market value will surpass BNB.

Original creation by WeChat public account: Lao Cui Talks About Coins. For assistance, please contact directly.

Summary: The above five points mostly revolve around speculations about stablecoins. Even if the stablecoin public chain is not primarily based on OK, based on the current upgrade technology, OK is more capable of attracting investments from smaller coins. Its brand appeal is sufficient to support breaking the historical high of 300. Especially with interest rate cuts planned for this year, there will be no shortage of funds. In conclusion, to put it simply, regardless of the impact of stablecoins, this year OKB can rely on itself to break 300. If stablecoins truly utilize the OK channel, the future is limitless; perhaps this year's dark horse will be OKB!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。