Selected News

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

HYPERLIQUID: Today's discussion about HYPERLIQUID focuses on the proposal for USDH stablecoin infrastructure, with the core debate revolving around whether to choose established institutions like Paxos for deployment or to have the native team take responsibility. The community is debating the advantages of institutional-grade infrastructure and compliance support versus the strategic focus and directional consistency of the native team. Proposals from Agora, Rain, and LayerZero have garnered attention for promising to return 100% of profits to the Hyperliquid ecosystem. The discussion highlights the importance of ecosystem consistency, scalability, and the potential for USDH to grow into a mainstream stablecoin, with various stakeholders sharing opinions on the best development path.

AVAX: Today's Twitter discussion around AVAX emphasizes its real-world application value beyond cryptocurrency, including in payments, gaming, and supply chains, highlighting its scalability and speed. The recent surge in weekly trading volume on the Avalanche network and its potential for mainstream adoption have also been frequently mentioned. Meanwhile, the community expresses excitement about AVAX's infrastructure capabilities, particularly its horizontal scaling and customizable blockchain features. Overall sentiment is positive, with many users optimistic about AVAX's future.

LINEA: Today's discussion around LINEA focuses on a series of significant developments and events, including the destruction of 1.88 billion LINEA tokens, accounting for 2.615% of the total supply, reducing the total supply to approximately 70 billion. This move has sparked market speculation that its fully diluted valuation (FDV) could reach $5 billion. Additionally, the upcoming token generation event (TGE) on September 10 and the Ignition plan aimed at boosting TVL on platforms like Aave and Etherex are also key discussion points. Sharplink Gaming plans to strategically deploy a $3.6 billion ETH treasury on LINEA to strengthen infrastructure control. These events collectively drive LINEA's visibility and popularity.

DOGE: DOGE has recently sparked heated discussions due to expectations surrounding the first Dogecoin ETF, the Rex-Osprey DOGE ETF (code DOJE), which is expected to launch soon and could bring significant investment to Dogecoin. This development has fueled market speculation about an altcoin season, with many guessing that DOGE could break the $1 mark. Additionally, Elon Musk's affinity for Dogecoin and its connection to ancient monetary systems have further increased the topic's heat. DOGE is likely to lead a new wave of altcoin trends alongside other mainstream cryptocurrencies, making it a focal point of discussion.

Selected Articles

Recently, a captivating battle for stablecoins unfolded on the decentralized derivatives trading platform Hyperliquid. On September 5, Hyperliquid officially announced the upcoming auction for the "USDH" ticker, a native stablecoin serving the Hyperliquid ecosystem. The proposal deadline is September 10 at 10:00 UTC, and as of now, multiple institutions, including Paxos, Ethena, Frax, Agora, and Native Markets, have submitted proposals, competing to become the issuer of the native stablecoin USDH on the Hyperliquid chain.

On September 5, the U.S. Department of Labor released disappointing non-farm employment data for August—only 22,000 new jobs were added, far below the estimated 75,000. This marks the fourth consecutive month of weak non-farm data, pulling the average new jobs added over the past four months down to just 27,000. The weak data has directly prompted a repricing of market expectations for the Federal Reserve's policy path: expectations for consecutive rate cuts in September, October, and December have surged. According to CME data, the probability of a rate cut by the Federal Reserve skyrocketed from 86.4% before the announcement to 100%, with 90% betting on a 25 basis point cut and 10% even betting on a 50 basis point cut. However, the positive policy expectations have not boosted risk appetite, as U.S. stocks slightly declined, indicating that traders are more concerned about the recession risks brought by slowing economic momentum. The "rate cut bullish" sentiment is being overshadowed by "recession trading." Next, Rhythm BlockBeats has compiled traders' views on the upcoming market situation to provide some directional reference for this week's trading.

On-chain Data

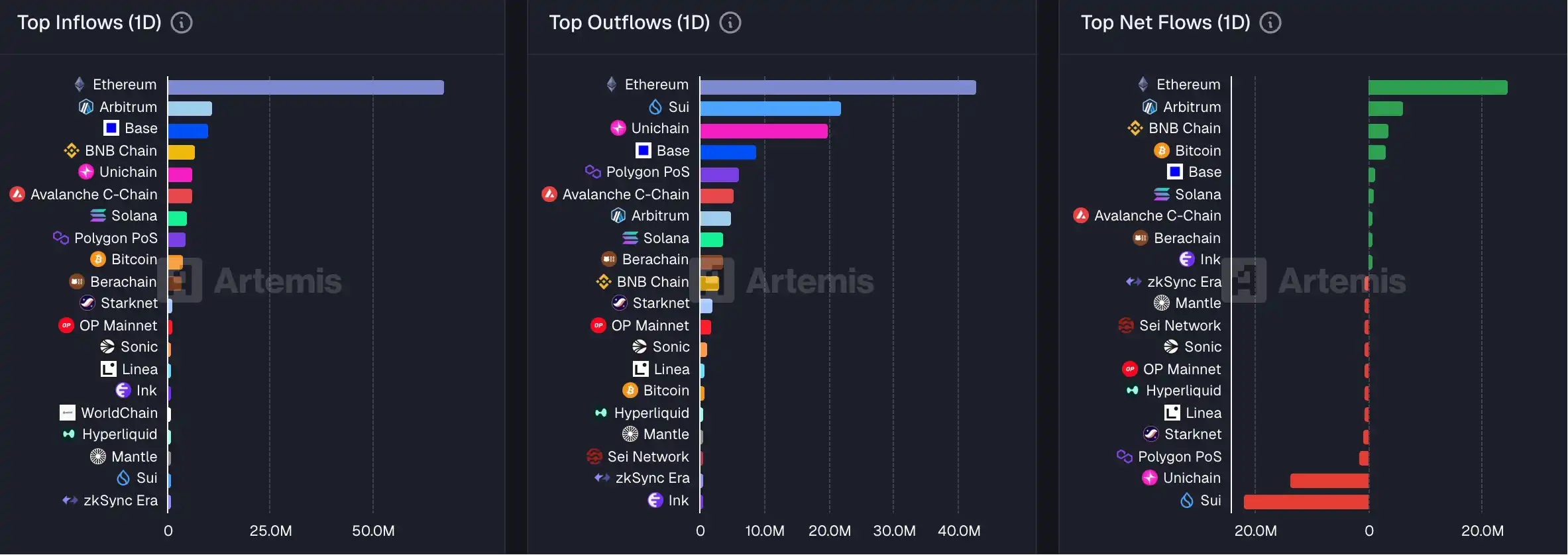

On-chain capital flow situation for the week of September 8

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。