Original Author: Luke, Mars Finance

Introduction: The New Battlefield - A War Composed of Dollars and Code

Circle CEO Jeremy Allaire's recent comments on the competitive advantages of USDC in emerging ecosystems (such as the decentralized exchange Hyperliquid) and his grand vision of exporting the "digital dollar" as a tool for technological and geopolitical competition provide a timely entry point for examining the stablecoin market. Allaire defines stablecoins as "technological weapons" that compete with markets like China and consolidate the global dominance of the dollar, elevating the topic from a mere crypto trading tool to the heights of global financial strategy.

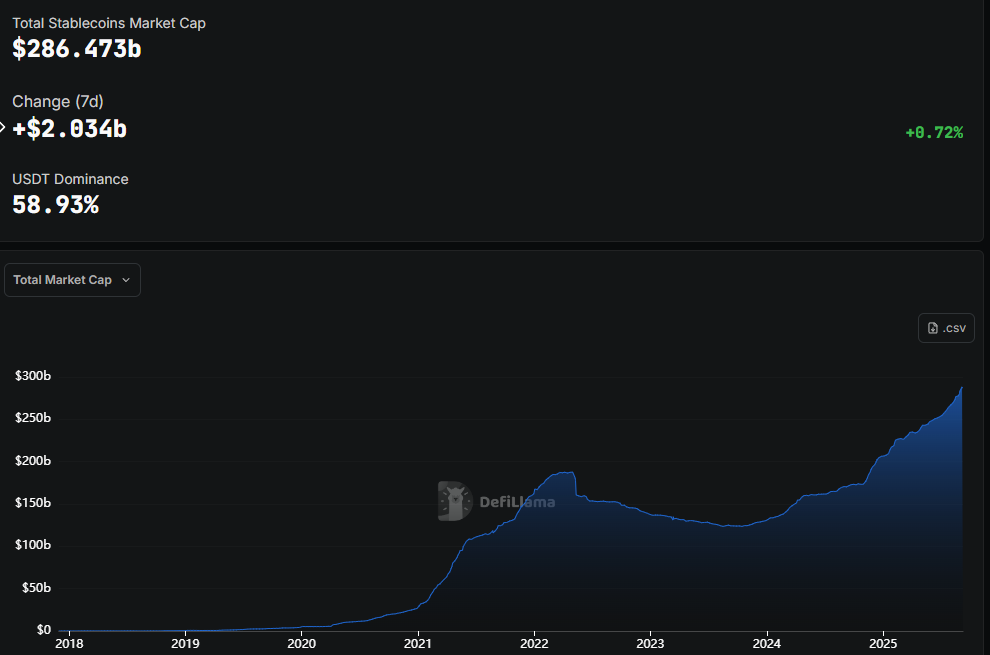

The current state of the stablecoin market—a multi-front battlefield with a total market capitalization exceeding $283 billion—did not come about overnight. It is an epic tale written over the past decade, marked by outstanding innovation, arrogant failures, regulatory games, and ideological conflicts surrounding the nature of money. This report will deconstruct this history, revealing the forces that shaped today's giants and the ghosts of fallen empires. We will chronologically explore the evolution of stablecoins from their initially flawed genesis, to the rise of Tether's opaque empire, to the compliance-driven challenges posed by USDC, the apocalyptic downfall of the Terra algorithmic experiment, the regulatory withdrawal of BUSD, PayPal's mainstream foray, and the opening of new frontiers in decentralized and synthetic design.

To provide readers with a clear framework, the table below outlines several core stablecoin models that this article will delve into. This table will serve as a key reference to help understand the technological evolution and design philosophy that runs throughout the history of stablecoins.

Overview of Core Stablecoin Models

Chapter 1: Genesis - Early Explorations and Failures in the Search for Stability (2014-2017)

The birth of stablecoins stems from a fundamental problem: the extreme volatility of early cryptocurrencies like Bitcoin makes them unreliable as a medium of exchange or stable unit of account. For traders who wish to "park" funds during market turmoil without fully retreating to the traditional financial system, this volatility is unacceptable. It is against this backdrop of demand that the exploration of the first generation of stablecoins began.

Initial Experiment: BitUSD (2014)

On July 21, 2014, the world's first stablecoin, BitUSD, was launched on the BitShares blockchain, marking the dawn of the stablecoin era. The project was backed by future industry giants, including Charles Hoskinson, founder of Cardano, and Dan Larimer, founder of EOS, which provided it with a strong intellectual pedigree.

BitUSD adopted a collateralized model using crypto assets, supported by BitShares' native token BTS. Its stability relied on a "seigniorage arbitrage" mechanism—a mechanism that was later nearly replicated and amplified by Terra/UST. Theoretically, when the price of BTS fell, users could buy cheaper BTS with BitUSD, thereby supporting the price of BTS. However, this mechanism had a fatal flaw. While it designed a protocol to respond to the price drop of the collateral (BTS), it lacked an effective mechanism to address the decline in the value of BitUSD itself and could not handle the extreme volatility of BTS prices. The root of its failure lay in the low liquidity and high volatility of the collateral itself. Ultimately, BitUSD decoupled from its dollar peg in 2018 and never recovered.

Second Attempt: NuBits (2014)

Also launched in 2014, NuBits attempted to improve upon the BitUSD model by choosing a more mature and liquid crypto asset—Bitcoin—as collateral. However, this did not fundamentally solve the problem. Although Bitcoin had deeper market depth than BTS, its price volatility remained too high to provide reliable value support for the stablecoin. The collapse of NuBits was dramatic: in 2016, as the Bitcoin market entered a bull run, many NuBits holders concentrated their sell-offs to chase Bitcoin's gains, leading to a break in its peg.

These early failures revealed a profound lesson that runs throughout the history of stablecoins: unstable assets cannot support stable assets. Relying on a single, highly volatile crypto asset as collateral, even with a clever arbitrage mechanism, is inherently fragile in design.

However, the significance of this history goes beyond mere failure. The arbitrage mechanisms of BitUSD and NuBits were not just failed experiments; they were the genetic ancestors of later algorithmic stablecoin models. The idea of maintaining a peg through economic incentives guiding market arbitrage behavior, rather than relying on a 1:1 reserve of real assets, was born here. The "seigniorage arbitrage" model of BitUSD is strikingly similar to the "burn and mint equilibrium" mechanism of Terra/UST. BitUSD failed due to the "extreme volatility" of its collateral, which directly foreshadowed the "death spiral" experienced by UST when LUNA's price collapsed under extreme sell pressure. Therefore, the collapse of Terra was not a "black swan" event born from a brand-new idea, but rather an inevitable outcome of a decade-old, known fragile model amplified to catastrophic scale by unsustainable yields and market frenzy. The entire industry seems to have failed to fully absorb the lessons of 2014.

Chapter 2: Dominance - The Controversy and Hegemony of Tether (2014 - Present)

In the ruins of BitUSD, a project called Tether learned from the lessons and chose a completely different path. It abandoned complex algorithms and volatile crypto collateral, proposing a simple and straightforward solution: for every USDT issued, one dollar is deposited in a bank account. This model directly addresses the core issue of "unstable support."

Origins and Early Development

Tether was initially named "Realcoin," founded in July 2014 by Brock Pierce, Reeve Collins, and Craig Sellars, and built on the Mastercoin protocol (later renamed Omni) of the Bitcoin network. In November 2014, the project was renamed Tether. In January 2015, USDT was first listed for trading on the Bitfinex exchange, a relationship that later became central to its story and controversy. Tether Limited and Bitfinex are both owned by iFinex, and this close connection facilitated its early development while also sowing the seeds of conflict of interest.

Bull Market Engine and King of Global Liquidity

The explosive growth of USDT stemmed from its role as a key "bridge" connecting the fiat world and the crypto world. In the early days, many cryptocurrency exchanges lacked stable banking partnerships, and fiat deposit and withdrawal channels were limited. USDT perfectly filled this gap, becoming the de facto "on-chain dollar," providing crucial liquidity to the global crypto market and supporting the vast majority of trading volume. Its application scenarios quickly expanded beyond trading to include cross-border remittances and value storage. In many countries with unstable fiat currencies, USDT became an attractive alternative due to its lower fees and faster settlement speeds compared to traditional banking systems.

Persistent Clouds of Doubt: Reserve Issues

However, alongside its hegemonic status came ongoing controversy, primarily targeting the authenticity of its 1:1 dollar reserves. Although Tether has always claimed that its tokens are fully backed by reserves, it has never provided a complete independent audit report from a top accounting firm.

In 2021, the U.S. Commodity Futures Trading Commission (CFTC) fined Tether $41 million, finding that between 2016 and 2018, Tether only held sufficient fiat reserves 27.6% of the time, confirming long-standing market suspicions—that its "100% backed" claims were often false. Subsequently, Tether's reserve composition evolved from its initial claim of pure cash to a mix of "cash equivalents," commercial paper, and other assets, further increasing the opacity of its reserves. However, in recent years, Tether's reserve strategy has undergone a significant shift, with a large allocation to U.S. Treasury bonds, making it one of the largest holders of U.S. Treasuries, which has somewhat enhanced the quality of its assets and market confidence.

Resilience and Dominance Amid Controversy

Despite being mired in controversy, USDT not only survived but became the undisputed market leader. By the end of 2024, its market capitalization had approached $120 billion, with over 350 million users, and it further grew to over $159 billion by July 2025. It has demonstrated remarkable resilience during various market crises, even briefly decoupling during the panic sell-off triggered by the collapse of Terra, but quickly regained stability.

Tether's success is not accidental; it profoundly reflects the "original sin" characteristics of the early crypto industry. Its dominance is not built on transparency and compliance; rather, it is founded on regulatory ambiguity and operational opacity. In the wild west of cryptocurrency, exchanges generally faced difficulties in obtaining banking services, struggling to handle fiat inflows and outflows. USDT provided a perfect solution: a digital dollar that could flow freely between these exchanges operating in regulatory gray areas, avoiding the hassles of touching the traditional banking system for every transaction. Its relatively lax KYC/AML requirements and registration in jurisdictions like the British Virgin Islands made it the path of least resistance for a global, often pseudonymous user base to conduct transactions. Therefore, Tether's success can be seen as a direct product of the early semi-"lawless" nature of the crypto market. It thrived in a regulatory vacuum. The rise of a competitor embracing regulation, such as USDC, is an inevitable response as the industry matures and seeks legitimacy.

Chapter 3: The Challenger's Grand Strategy - USDC and the Path to Compliance (2018 - Present)

In 2018, the stablecoin market welcomed a distinctly different challenger. The Centre Consortium, co-founded by Circle (led by Jeremy Allaire) and Coinbase, launched USD Coin (USDC). From its inception, USDC's strategy was in stark contrast to Tether: it chose a path of embracing regulation, pursuing transparency, and focusing on gaining institutional trust.

The "Compliant" Stablecoin

USDC's core competitive advantage lies in its "compliance" label. Circle actively collaborates with regulators to obtain money transmission licenses in various U.S. states and implements strict anti-money laundering (AML) and know your customer (KYC) protocols. In sharp contrast to Tether's opacity, USDC promises the highest level of transparency. It regularly publishes attestation reports from top accounting firms (initially Grant Thornton, later Deloitte) to publicly verify that its reserves consist of 100% cash and short-term U.S. Treasury bonds. This not only directly challenges Tether's model but also paves the way for institutional investors seeking a safe and reliable on-chain dollar.

Growth Engine: DeFi and Institutional Adoption

If Tether is the lifeblood of centralized exchanges, then USDC has found its "product-market fit" in the thriving decentralized finance (DeFi) space. Due to its high transparency and credibility, USDC quickly became the most popular collateral asset and trading pair in mainstream DeFi protocols like Aave and Uniswap. This regulatory-first strategy made it the preferred stablecoin for institutions, corporate treasury, and fintech companies entering the crypto space, helping them effectively avoid the reputational risks associated with USDT.

Crucible of Fire: The Collapse of Silicon Valley Bank (SVB) (March 2023)

USDC's development has not been smooth sailing, with its most severe test occurring in March 2023. Following the collapse of Silicon Valley Bank (SVB), Circle disclosed that approximately $3.3 billion of its cash reserves were held at the bank, a significant portion of its total reserves. This news instantly triggered market panic, shattering USDC's image as the "safest" stablecoin, with its price temporarily decoupling and dropping to around $0.87.

This crisis served as an extreme stress test for the USDC model. Market panic and large-scale redemption requests tested Circle's liquidity management capabilities. Ultimately, the resolution of the crisis relied on external forces: the U.S. government announced it would guarantee deposits for all SVB depositors, allowing Circle to fully recover its funds and quickly restore USDC's 1:1 peg to the dollar.

What seemed like a severe blow from this decoupling paradoxically reinforced the rationale behind the USDC model. It revealed a profound reality: while deep integration into the regulated traditional financial system introduces new risks (such as bank failures), it also means access to the ultimate safety net of that system. The risk in this crisis stemmed from traditional finance (the bank failure), and the solution also came from traditional finance (government guarantees). A purely crypto-native or offshore entity like Tether, if its partnered Bahamian bank were to collapse, would likely face permanent loss of funds without the prospect of similar government rescue.

This event forced the market to reassess risks. The risks of Tether—reserve opacity, offshore status, and lack of audits—versus the risks of USDC—transparent reserves but held in potentially failing U.S. banks that are also subject to government intervention—what weighs heavier? For institutional participants, the answer is clear: the risks associated with a regulated U.S. banking system are known and manageable, far superior to the unknown counterparty risks of an offshore, unregulated entity. Thus, this crisis not only failed to destroy USDC but, in the long run, validated Circle's core strategy of betting on regulatory integration from the outset.

Chapter 4: The Great Collapse - The Algorithmic Hell of Terra/UST (2022)

In the landscape of stablecoins, Terra and its founder Do Kwon were once hailed as pioneers of "true decentralization," promising to create a stablecoin free from the shackles of fiat collateral. Its core mechanism was the "burn and mint equilibrium" of UST-LUNA: 1 UST could always be exchanged for 1 dollar's worth of LUNA, and vice versa. This design maintained the peg of UST to the dollar through arbitrage incentives.

Growth Flywheel: The Allure of the Anchor Protocol

However, relying solely on the arbitrage mechanism was insufficient to drive mass adoption. The true catalyst of the Terra ecosystem was the Anchor protocol, a lending platform that offered nearly 20% annual percentage yield (APY) on UST deposits. This unsustainable high yield, far exceeding market levels, created enormous artificial demand for UST.

The logic of its growth flywheel was as follows: users were attracted by the high yield, purchased LUNA, then burned LUNA to mint UST, and subsequently deposited UST into Anchor. This process reduced the circulating supply of LUNA, driving up its price. The rising price of LUNA further enhanced the perceived value and stability of the entire ecosystem, attracting more users to join. This was a classic positive feedback loop. At its peak, out of a total supply of $18 billion UST, as much as $16 billion was locked in the Anchor protocol, highlighting its core driving role in the entire system.

Collapse: The Death Spiral Timeline (May 2022)

In May 2022, this seemingly perfect system came crashing down. The crisis was ignited by large UST withdrawals from the Anchor protocol and the decentralized exchange Curve Finance between May 7 and 9, which first caused UST's price to drop below $1.

Once the decoupling occurred, the arbitrage mechanism began to operate in reverse and quickly evolved into a disaster. Arbitrageurs bought UST at prices below $1, then exchanged it for LUNA worth $1 through the protocol, immediately selling LUNA on the market for profit. This process led to an astonishingly rapid increase in the supply of LUNA, putting immense downward pressure on its price. As the price of LUNA plummeted, the amount of LUNA needed to mint each UST grew exponentially, further exacerbating the selling pressure on LUNA—this is known as the "death spiral."

To salvage the situation, Terra's non-profit organization Luna Foundation Guard (LFG) deployed its billions of dollars in Bitcoin reserves to defend the peg, but this effort was akin to a drop in the bucket in the face of massive market sell pressure, further intensifying panic across the entire crypto market. Within a week, over $45 billion in market capitalization evaporated from the Terra ecosystem.

Aftermath: Market Contagion and Regulatory Alarm Bells

The collapse of Terra triggered a chain reaction throughout the crypto industry, leading to the bankruptcies of well-known institutions like Celsius and Three Arrows Capital, dragging the entire market into a prolonged "crypto winter." This event also brought algorithmic stablecoins into the spotlight of global regulators, brutally demonstrating the inherent fragility of such models and the systemic risks they could pose. The lessons of BitUSD in 2014 were forgotten, and this time, the cost was a disaster for the entire industry.

On a deeper analysis, the Terra ecosystem was essentially a financial perpetual motion machine, its fate doomed to failure from the start. The 20% yield offered by the Anchor protocol did not come from any sustainable economic activity but was subsidized by Terra's reserves and the inflation of LUNA tokens. The entire system was a closed loop, entirely reliant on the continuous inflow of new capital and the sustained rise in LUNA's price to pay interest to existing depositors. Despite being executed automatically through smart contracts, it functionally resembled a Ponzi scheme.

A stable system cannot continuously pay a 20% yield in an environment where risk-free rates are close to zero. This yield must have a source. When Anchor's lending income was insufficient to cover interest, the shortfall was filled by Terra's reserves. The entire system's value was built on the price of LUNA, which was driven by the demand for UST, and the demand for UST was driven by Anchor's high yield. This was a completely self-referential, internally cyclical system. It required continuous growth to maintain its operation. Once demand for UST wavered (as in the case of large withdrawals), the growth flywheel would reverse, and the system's inherent logic would force it to self-destruct. The "death spiral" was not a flaw in the system but rather the inevitable outcome of its core design under pressure.

Chapter 5: The Fork in Destiny - The Hammer of Regulation and Embrace of Traditional Finance (2023)

2023 marked a watershed year for the stablecoin market. In this year, two landmark events—the forced delisting of BUSD and the high-profile debut of PYUSD—clearly delineated two distinctly different paths for the future of stablecoins, heralding the arrival of a new era.

Part One: The Fall of BUSD

Binance USD (BUSD) is a stablecoin issued by the New York-regulated trust company Paxos, but it is branded and primarily used by the world's largest cryptocurrency exchange, Binance. This partnership model allowed it to rise rapidly, becoming the third-largest stablecoin in the market.

However, in February 2023, the regulatory hammer fell. The New York Department of Financial Services (NYDFS) ordered Paxos to stop minting new BUSD. The reason given by regulators was that Paxos failed to conduct adequate due diligence on its partner Binance, which was found to have systemic anti-money laundering compliance issues and handled a large volume of illegal transactions. Paxos was subsequently fined $26.5 million. This regulatory action effectively sentenced BUSD to death.

After the ban was issued, Binance began to gradually withdraw support for BUSD and encouraged users to switch to other stablecoins, such as the newly launched FDUSD, leading to a rapid shrinkage in BUSD's market capitalization.

Part Two: The Rise of PYUSD

In stark contrast to the quiet exit of BUSD, payment giant PayPal launched its stablecoin PayPal USD (PYUSD) in August 2023, with Paxos as the issuer. This event is significant: a mainstream, publicly traded, and strictly regulated U.S. fintech giant has officially entered the stablecoin space. This marks the beginning of a new phase for stablecoins, one dominated by traditional finance (TradFi) and fintech, aimed at achieving large-scale mainstream adoption.

PayPal's strategy is clear and powerful: leveraging its vast user base (over 426 million active accounts) and merchant network to promote the use of PYUSD in everyday payments, cross-border remittances, and in-app scenarios, aiming to bypass traditional card networks to reduce transaction costs and improve efficiency.

The drastically different fates of BUSD and PYUSD in the same year profoundly reveal the "great divergence" in the stablecoin market. BUSD's model relied on a massive, but regulatory gray-area global crypto exchange channel. Regulators (NYDFS) demonstrated their ability to stifle this model by cracking down on its regulated issuer in the U.S. (Paxos), regardless of the size of the exchange behind it. In contrast, PYUSD's model relies on a large, but strictly regulated global payment company channel.

This shift indicates that for stablecoins to achieve large-scale success in the future, the key will no longer be the network effects of the crypto-native world, but the ability to access mainstream distribution channels within a regulatory framework. Power is shifting from offshore cryptocurrency exchanges to onshore, regulated financial institutions. This is precisely the future that Jeremy Allaire and Circle have long bet on.

Chapter 6: The Cutting Edge of Innovation - Decentralized and Synthetic Asset Alternatives

While fiat-collateralized stablecoins dominate, another parallel path of innovation has been exploring alternatives to centralized dependency. From the earliest decentralized stablecoins to the latest synthetic dollars, competition on this front is equally fierce, filled with profound reflections on risk, efficiency, and the spirit of decentralization.

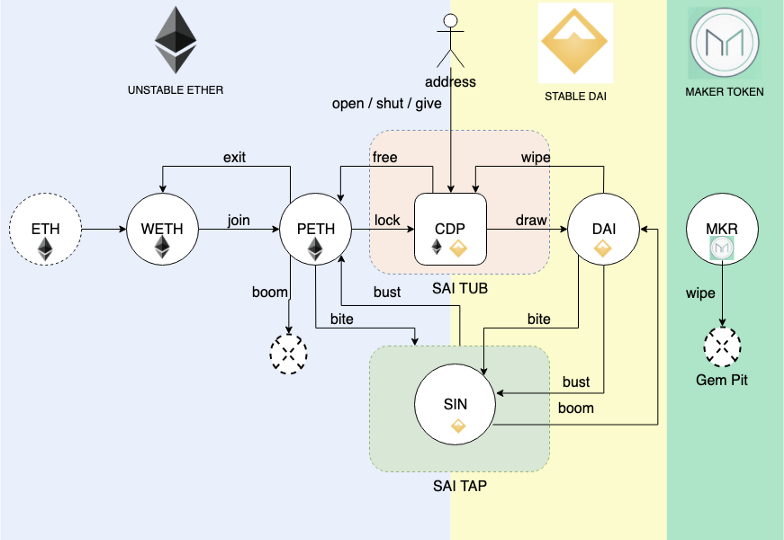

Resilient Decentralized Option: MakerDAO (DAI)

Launched in 2017, DAI is the oldest and most successful decentralized stablecoin. It employs an over-collateralization model with crypto assets: users lock volatile crypto assets like Ethereum (ETH) in a smart contract (referred to as a "vault" or CDP) and borrow DAI against it. To buffer against the risk of collateral price declines, the value of the collateral must far exceed the value of the borrowed DAI (for example, the collateralization ratio typically requires over 150%).

DAI's governance is managed by a decentralized autonomous organization, MakerDAO, whose governance token MKR holders can vote on the system's risk parameters, such as stability fees (interest), collateral types, and more. DAI's development has also undergone a significant evolution: from initially accepting only ETH as a single collateral type to accepting various crypto assets as collateral. More controversially, to enhance stability and scale, MakerDAO later began accepting centralized stablecoins (like USDC) and real-world assets (RWA) as collateral. While this move improved DAI's robustness, it sparked intense debate within the community about whether it sacrificed decentralization purity.

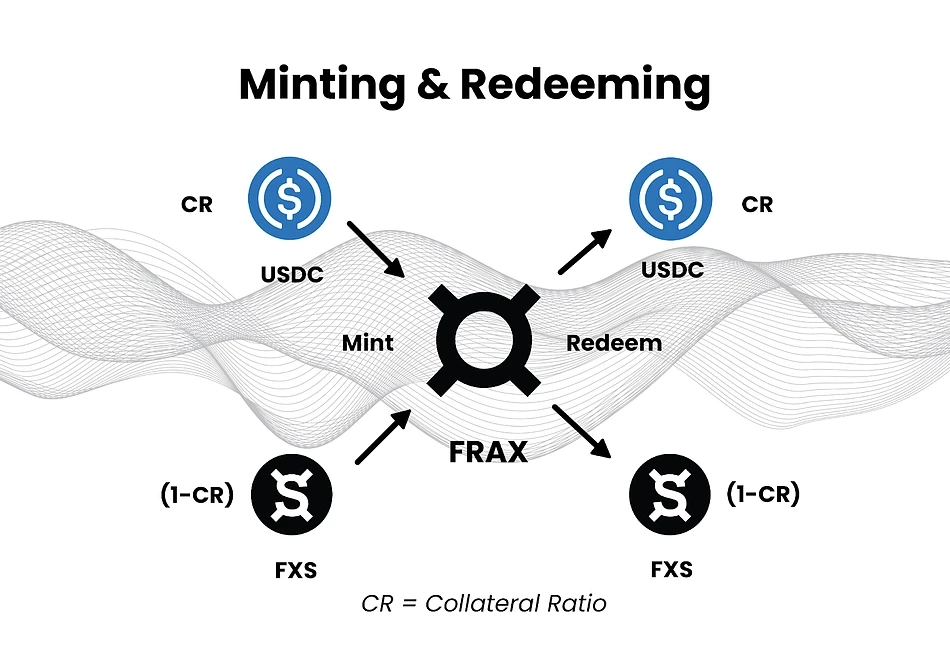

Hybrid Experiment: Frax Finance (FRAX)

Frax, as the first "partially algorithmic" stablecoin, attempts to find a balance between capital efficiency and security. The anchoring mechanism of FRAX is a unique hybrid model: it is partially backed by real collateral (such as USDC) and partially stabilized by its governance token Frax Shares (FXS) through algorithms.

At its core is a dynamic collateral ratio (CR). When market confidence in FRAX increases, the protocol can lower the collateral ratio, making it more algorithmically stable, thus improving capital efficiency. When users mint FRAX, the algorithmic portion requires the destruction of an equivalent value of FXS tokens. Although Frax's model is more complex and robust than pure algorithmic stablecoins, avoiding the fate of Terra, its long-term stability under extreme market pressure remains an open question.

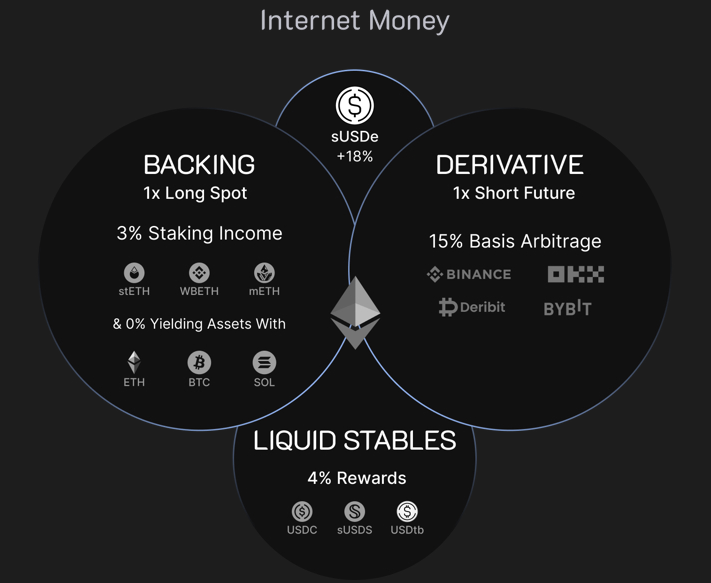

New Paradigm: Ethena's Synthetic Dollar (USDe)

Ethena's USDe represents a more radical innovation; it is not a traditional stablecoin but a "synthetic dollar." USDe is not directly backed by dollars but aims to synthetically replicate and mirror the value of the dollar through financial engineering.

Its core mechanism is a "Delta-neutral" hedging strategy: for every dollar of collateral received (for example, staked Ethereum stETH), Ethena opens an equivalent perpetual contract short position on a derivatives exchange. This way, regardless of whether the price of the collateral ETH rises or falls, the gains and losses of the spot position will be offset by the gains and losses of the futures position, keeping the total position's dollar value stable.

The high yield of USDe primarily comes from the funding rates in the perpetual contract market. In a bull market, with high bullish sentiment, long traders typically need to pay funding fees to short traders, and Ethena, as the holder of the short position, can continuously collect these fees and distribute them as returns to users staking USDe.

From USDT to DAI, and then to Frax and USDe, the evolution of stablecoin design is, in fact, a history of risk transfer and reshaping. The emergence of each new model does not simply eliminate risk but transforms one type of risk into an entirely new one.

USDT/USDC eliminated the collateral volatility risk of BitUSD but introduced significant centralization and counterparty risk (Is Tether's reserve real? Will SVB collapse?).

DAI addressed the centralization risk of USDT/USDC through on-chain collateral and decentralized governance, but it reintroduced collateral volatility risk (managed through over-collateralization) and added smart contract and oracle risks, while its capital efficiency is extremely low.

Frax attempts to solve DAI's capital efficiency problem through its partially algorithmic model, but this introduces reflexivity and algorithmic risk, a milder version of the risk that destroyed Terra.

Ethena (USDe) addresses both DAI's capital efficiency issue and direct collateral volatility risk through Delta-neutral hedging. However, it introduces a series of entirely new, potentially more systemic risks: funding rate risk (what if funding rates are negative for an extended period?), exchange counterparty risk (what if derivatives exchanges like Binance collapse?), and custodial risk from its off-chain settlement partners. The risks have not disappeared; they have merely shifted from the asset's negative balance sheet to the derivatives market.

The Current State and Future Battle of Stablecoins

Looking back over the past decade, stablecoins have evolved from the fragile early experiments of 2014 to a multi-hundred-billion-dollar industry with significant political and economic implications today. The market landscape, after a brutal elimination process, is highly concentrated in fiat-collateralized models, with USDT and USDC accounting for nearly 90% of the market share, while the specter of algorithmic stablecoins serves as a perpetual warning for the industry.

Current Market Landscape

By the end of 2025, the total market capitalization of stablecoins has surpassed $283 billion, growing 128% since the beginning of the year. The following chart clearly illustrates the historical market share evolution of major stablecoins, vividly narrating this power game.

The Future Battlefield

The first decade of the stablecoin war was about finding product-market fit within the crypto ecosystem. The next decade will be about breaking through this boundary to become the underlying rails of a new, internet-native global financial system. This war will unfold across several key battlegrounds:

Regulatory Moat: With the implementation of regulatory frameworks such as the U.S. GENIUS Act and the EU MiCA Act, compliance is no longer optional but a ticket for any stablecoin hoping for large-scale adoption. This provides a significant first-mover advantage for participants like Circle and PayPal that have already established compliance advantages.

Trillion-Dollar Payment Market: The industry's focus is shifting from crypto trading to real-world applications, especially in cross-border payments and remittances. In this vast market, stablecoins have overwhelming advantages in speed and cost compared to traditional systems. This is precisely PayPal's main focus.

The Soul Struggle of DeFi: Although centralized stablecoins currently dominate, the demand for a truly decentralized, censorship-resistant store of value remains a core ideal of the crypto world. The competition among different models like DAI, Frax, and Ethena will determine who can become the native currency of a decentralized internet.

The Blockchain Platform War: Competition exists not only among stablecoins but also among the Layer 1 and Layer 2 networks that host them. Currently, most stablecoins circulate on Ethereum and Tron networks, but as new public chains and layer two solutions emerge, the battle over who can become the preferred settlement layer is intensifying.

The epic saga of stablecoins is far from over. With the entry of traditional financial giants and sovereign nations, future competition will be fiercer, and the stakes higher than ever. The outcome of this war will not only determine which tokens will become the reserve currency of the digital world but could also reshape the global financial landscape for decades to come.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。