In the past year, Hyperliquid has rapidly attracted users, with trading volumes far exceeding many competitors. Relying on continuous discussions and a strong community ecosystem, its community governance token $HYPE has been on the rise. With Hyperliquid launching the auction and proposal for its stablecoin USDH, it has sparked market discussions again, reaching a new high today, currently priced at $54.7.

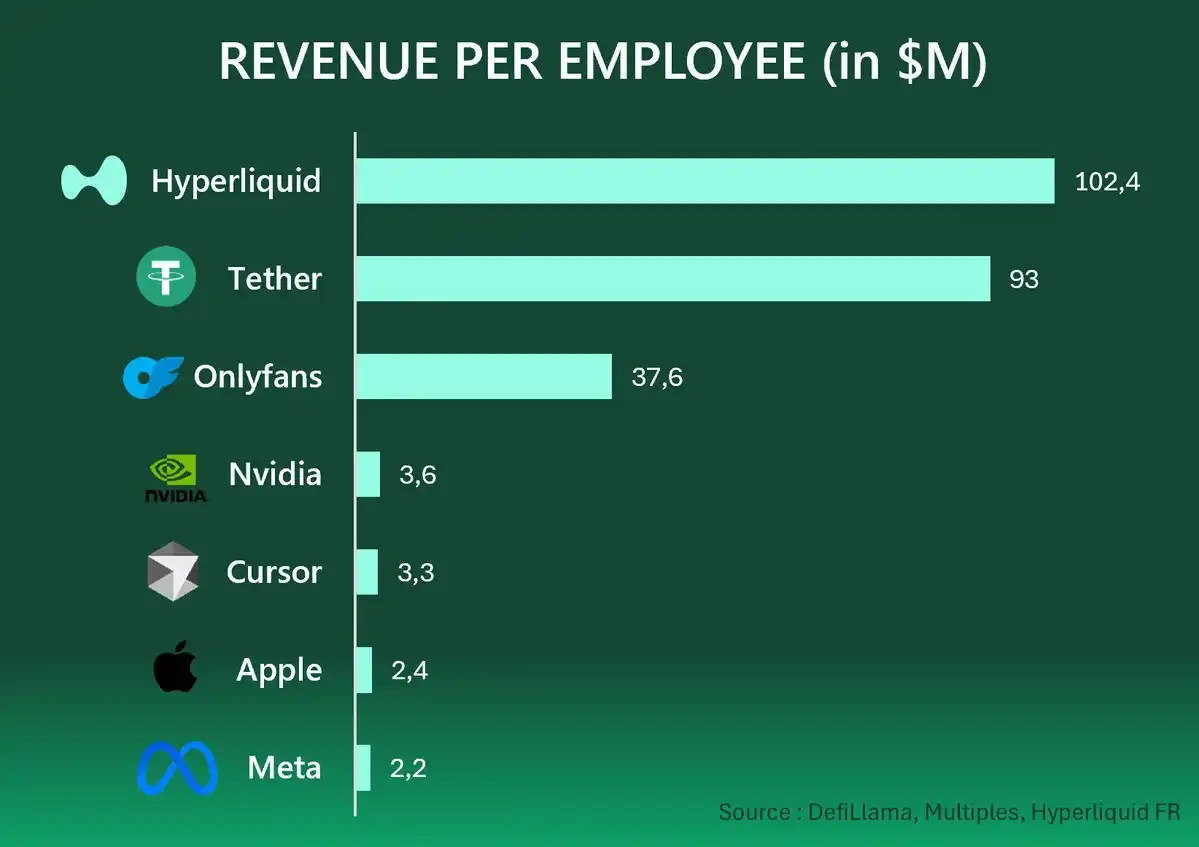

As one of the most successful companies in this crypto cycle, there are two interesting sets of data. The first is protocol revenue; in August, Hyperliquid's protocol fee revenue reached $110 million, with an expected annual revenue exceeding $1.1 billion.

The second is from a valuation perspective. According to Coingecko, Hyperliquid currently has a market capitalization of over $12 billion, ranking 18th in the crypto market. Excluding stablecoins and pegged assets, it actually enters the top ten. It's worth noting that in December last year, its market cap was less than $2 billion.

In the "fat protocol, thin application" world of crypto, the valuation of applications is much lower than that of protocols. However, in this cycle, this narrative is reversing, with Hyperliquid being the most typical representative. Another interesting point is that Hyperliquid's founder, Jeff, revealed in an interview that the company has only 11 people, meaning each team member generates over $100 million in revenue annually, making Hyperliquid one of the highest per capita revenue-generating companies in the world.

So what innovative mechanisms has it implemented? What has the team done right? How will it develop in the future? The latest episode of Web3 101 invited veteran players from the DeFi community, including Teacher Xiaohuanxiong, to discuss. His Xiaohuanxiong Telegram channel is one of the most active and influential communities in the Chinese-speaking world. He is also a deep participant in Hyperliquid and a major holder of HYPE tokens. The following views are all derived from the podcast content (Listen to the podcast: “E61|Challenging Binance, Why Do Whales Love Using Hyperliquid?”)

TL;DR

Xiaohuanxiong's early involvement: He joined Hyperliquid during the Private Beta in August 2023, initially recommended by the community, and later became deeply engaged due to the team's professionalism and liquidity mechanism (HLP). With early participation and long-term investment, he has profited over ten million dollars from the tokens.

Hyperliquid's product advantages: Utilizing a CLOB + active market-making mechanism, it boasts high liquidity efficiency and stability, with an experience close to CEX (90%), maintaining smooth operations even during market volatility. Compared to GMX's GLP physical delivery model, HLP's cash settlement method is closer to CEX, allowing for more trading pairs and liquidity, but the risks are more dependent on the team's risk control.

The development trajectory of Perp DEX: From dYdX (trading mining → volume reliance on token price), GMX (GLP model → stable but lacking scalability), to Hyperliquid (CLOB + HLP → fast, rich trading pairs, thick liquidity), it gradually approaches a centralized experience.

The liquidity flywheel without VC: The founding team has a background in market making, injecting over $100 million in liquidity early on, and using follower pools, Friendtech index, airdrop Purr, and point mechanisms to continuously attract new users and retain them. Through the narrative of "points + airdrops + transparent whale positions," they quickly established community consensus and trading activity.

Reasons why whales prefer Hyperliquid: Beyond low fees and speed, on-chain transparency allows funds to hope to "be followed" to boost returns; at the same time, it protects identity privacy and avoids CEX account suspension risks. Large positions are visible on-chain, becoming a source of platform discussion and traffic.

Formation of consensus among large holders: The team updates quickly (constantly optimizing weekly/monthly), responds to controversies promptly, giving users confidence that "they are getting things done." Early holders of Purr and point airdrops later formed a stable group of large holders, establishing strong consensus.

HyperEVM and HIP-3: Unit (cross-chain asset packaging), Kinetic (largest HYPE staking protocol), Supercell/Inselico (third-party front-end) are core ecosystems. HIP-3 allows for HYPE collateral to launch white-label exchanges, reducing costs for new teams or promoting more asset integration.

Weaknesses and challenges: Poor mobile experience, high fiat deposit and withdrawal fees, insufficient customer service and education systems. The XPL pre-market event also exposed mechanism vulnerabilities and user trust issues. With only 11 team members, if they cannot maintain development pace and ecosystem expansion during a bear market, it may be difficult to compete with Binance in the long term.

Future outlook: Short-term advantages are clear, but long-term competitiveness will rely on team expansion and co-building with ecosystem partners to maintain competitiveness during a bear market. Hyperliquid's true test will be how it crosses the next cycle.

Getting to Know Hyperliquid: Why Can It Attract DeFi OGs?

Xiaohuanxiong: I am Xiaohuanxiong, managing a Telegram community and Twitter account, mainly focusing on DeFi. I have been active in various protocols since 2020. I consider myself one of the first users to participate in Hyperliquid, joining during the private beta. Since then, I have followed the project closely, both in spot and futures trading. After the token launch, I continued to pay attention, and I can say I am one of the most knowledgeable people about Hyperliquid in the Chinese-speaking community. I hope to help everyone better understand this project today.

Liu Feng: Thank you, Xiaohuanxiong. Jack has already mentioned the importance of Hyperliquid. In my view, decentralized contract trading is the crown jewel of Web3, particularly profitable. For example, in August, Hyperliquid's trading volume exceeded $400 billion, double that of Robinhood's monthly trading volume, so it is reasonable that it is making money.

Another topic is the market rumor that your earnings on Hyperliquid tokens exceed $10 million. Is that true?

Xiaohuanxiong: Yes.

Liu Feng: Then we can only envy and be jealous. At the same time, I should clarify that Xiaohuanxiong has a vested interest in Hyperliquid, while Jack and I are not significant holders; I only received a small amount of tokens during the airdrop. Today's program is a knowledge-sharing session and does not constitute investment advice.

JACK: The first question I am most concerned about is, how did you first find Hyperliquid, Teacher Xiaohuanxiong?

Xiaohuanxiong: Initially, it was introduced by some friends in the community, but at that time, friends would post maybe four or five projects a day, and I wouldn't look closely. They mentioned that it was very fast and had good depth, but I didn't pay much attention. Later, a team member DM'd me on Twitter, telling me about their project, and he was also very familiar with our community, knowing that we were previously an active community for GMX.

From my judgment, they had systematically researched their competitors and product-market fit (PMF), so I was confident that the quality wouldn't be too bad since they had done market research beforehand. So I started to look closely at this project, and later I continued to follow it, participating in their Private Beta and some of their updates.

I felt that although this project seemed to be a fair launch, the team behind it was also very mature in the industry, and they had many resources to utilize, so I started spending more and more time on this project.

Liu Feng: About when was that?

Xiaohuanxiong: The Private Beta should have been in August 2023, and it really took off in September, so it wasn't much earlier than others.

JACK: You just mentioned that you initially viewed Hyperliquid as a fair launch project, meaning it is a fair launch that may be more friendly to retail investors and allows for greater participation. At the same time, the team is also very professional. Where did you sense this professionalism?

Xiaohuanxiong: It was initially reflected in the design of HLP (liquidity pool). Unlike GMX/dYdX, which leans towards AMM or passive market-making, Hyperliquid's approach is closer to active market-making at price points in the order book, and it tends to provide liquidity at more central positions in the order book, thus achieving higher capital efficiency.

Later, it wasn't just for technical reasons; they were also very mature in their marketing regarding "GTM" and "point incentive mechanisms and other activities."

They found my community, which is just part of the Chinese-speaking community, but they also found some KOLs or leaders in the English-speaking area who are very mature influencers. Generally speaking, if you don't have enough recognition in this industry, you wouldn't find these people. Their early follower strategy found many individuals who might only have two or three thousand followers, but the composition of those followers was of highly engaged and active users, rather than those with tens of thousands of followers but very few active users. Coupled with the involvement of some project parties and VCs, their marketing was very complete.

And just that isn't enough; their point rhythm is also cleverly designed. For example, they set up a 1.5 quarter incentive between the first and second quarters to reward those native users who continued to trade even without points, reducing the proportion of "airdrop farmers."

This design, along with early community promotion, made their marketing very clever. These two aspects made me feel the professionalism of the team.

Liu Feng: What was your first impression of the product when you saw it?

Xiaohuanxiong: At first glance, there was nothing special; I mainly felt it was smooth and fluid. After using it for a while, I found that its stability was very high. It has fewer issues compared to some competitors and does not withdraw liquidity during significant market fluctuations. The overall experience is close to that of centralized exchanges at 90%, but stability is its true advantage.

A Brief History of Perp DEX Development

JACK: Please outline the evolution of Perp DEX from dYdX to GMX and then to Hyperliquid. You also mentioned that Hyperliquid's market-making mechanism is different from its predecessors, using a Central Limit Order Book (CLOB) and active market-making strategies. Can you provide a brief history for listeners unfamiliar with Perp DEX and name some important products?

Xiaohuanxiong: When talking about on-chain decentralized perpetual contract exchanges, we must first mention dYdX. Before it came out, perpetual contract exchanges were not in the spotlight. dYdX had many airdrops, characterized by moving what centralized exchanges could do on-chain, and it also implemented a "matching-trading mining" mechanism, somewhat like Fcoin, but it was on-chain and settled weekly: the more volume you traded, the more dYdX tokens you received as incentives.

The issue is that the trading volume surged early on: for example, paying $1 million in fees could yield $1.2 million in token rewards, which was definitely profitable and calculable, essentially "officially encouraging volume manipulation." When the token price rose, trading volume increased, and when the token price fell, trading volume would leave all at once. Later, issuing NFTs and launching their own chain did not compensate for the decline in trading mining caused by the token price drop. I believe this is the "cause of death" for dYdX.

After dYdX, there were a bunch of exchanges supported by VCs, such as MCDEX, and many on BSC and Polygon, but none made a significant impact because they wouldn't "lose money to buy data" like dYdX did. Conservative strategies couldn't achieve trading volume.

Then came GMX. GMX initially operated binary options on Ethereum, but when interest waned, it transitioned to BSC to offer perpetual contracts. However, competition on BSC was fierce, and its poor relationship with Binance hindered its growth. After moving to Arbitrum, it developed rapidly, leveraging Arbitrum's incentives to become a leading project on the chain. Its biggest contribution to the industry was "naming and architecture": users providing liquidity were called GLP (which later led to Hyperliquid's LP being called HLP). The characteristic of GLP is physical settlement: for example, if the pool has real BTC, ETH, and USD, when you leverage to go long on BTC, you are using USD from the pool to buy BTC from the pool.

The advantage is that it avoids liquidation; in extreme markets, as long as there is no hacking, the project team can open positions for you, and you can take your profits—this is the most stable model. However, it cannot "leverage" liquidity: how much BTC is in the pool to allow everyone to open leveraged positions? Even in centralized exchanges, open interest (OI) is often greater than actual spot holdings, which is the industry norm. Therefore, GLP often has higher trading fees and funding rates. While stable, it doesn't necessarily attract the 500 "core users" who demand strong decentralization and security.

Later, some cash settlement solutions emerged, and there was a period of silence. Finally, Hyperliquid appeared when people thought this sector was dead, returning to a perspective that is neither fully centralized nor fully decentralized: using a few nodes to match trades on-chain. Unlike dYdX, it places all trades on-chain, but the chain consists of several nodes, resulting in higher speed. It does not use physical delivery but cash settlement, allowing for more tokens to be listed, not limited to BTC and ETH.

This brought extensive coverage of long-tail assets; the active market-making strategy also allowed it to provide thick liquidity at relatively low operational costs. Initially, the liquidity pool was about $200 million, but at launch, it could provide depth comparable to OKX (not reaching Binance but on par with OKX), and now it may be approaching Binance levels. Liquidity and speed are the reasons it later outperformed its earlier competitors.

JACK: So, the entire crypto market's ability to develop Hyperliquid may be attributed to four important factors. One is that the Perp DEX mechanism has been continuously innovating, from the gamified incentives provided by dYdX to the volume manipulation incentives, then to GMX's GLP model, and finally to Hyperliquid, which has improved in various aspects. The second point is the improvement of off-chain to on-chain solutions, which is a core consideration for the Perp DEX product, and Hyperliquid may be one of the best solutions for fully on-chain perpetual contract trading so far. The third point is about its trading speed and trading costs; after all, traders in perpetual contract products place great importance on speed. The last point is about the trading pairs it can offer; the richness of its products and liquidity is also a key reason for Hyperliquid's success.

The Underlying Logic and Differences Between GLP and HLP Mechanisms

JACK: Can you explain the underlying logic of the GLP and HLP models, and what important improvements Hyperliquid's HLP has compared to GMX's GLP?

Xiaohuanxiong: You can compare it to the physical and cash redemption of ETFs: GLP is a liquidity pool with "physical delivery," while HLP is a liquidity pool with "cash delivery."

The "physical" aspect of GLP means that there is real money and tokens in the pool: for example, a scale of $300 million, with $100 million in BTC, $100 million in ETH, and $100 million in USD. When you leverage to go long on BTC, you are using the pool's USD to buy BTC from the pool. The liquidity pool essentially provides the trading. The advantage is that it avoids liquidation; in extreme markets, as long as there is no hacking, the project team can open positions for you, and you can take your profits, which is the most stable model.

However, it cannot leverage liquidity. How much BTC is in the pool to allow everyone to open leveraged positions? In centralized exchanges, OI is usually greater than spot holdings, which is the industry norm. Therefore, GLP often has higher trading fees and funding rates. While stable, the general public may not necessarily pursue this stability, so it cannot break through the 500 "core users."

HLP changes to only holding USD (or stablecoins), with all pairs settled in USD. This way, many trading pairs can be added to any liquidity, allowing for 100 pairs, but all are settled in cash, calculating profits and losses based solely on numbers, without relying on the actual holdings of BTC/ETH/SOL, etc. in the pool. This is closer to the centralized exchange model. It has its drawbacks, but the market currently believes these drawbacks can be overlooked in exchange for higher liquidity, cheaper fees, and profit sharing.

What are the drawbacks? When launching new pairs, issues are more likely to arise because new pairs can be continuously added. For example, with certain tokens (like XPL), if the leverage is set incorrectly, leading to price distortion, HLP holders may incur unreasonable losses. The rise and fall of HLP depend on the quality of the market-making strategy: if done well, returns are higher; if done poorly, returns are lower. GLP does not have this "strategy quality" issue; it merely changes the holding ratios of BTC/ETH/USD, and returns do not suddenly spike or plummet; when none of the three experiences significant fluctuations, there won't be sudden large losses. HLP may incur significant losses if long-tail pairs are manipulated or leverage is set incorrectly.

The design of HLP heavily relies on the team's/risk control's parameter settings: for example, allowing 100x leverage for BTC, 10x for medium-sized pairs, and 2x for small pairs, while also limiting the maximum position size and continuously adjusting. When new tokens are launched, if liquidity is high, leverage can be set higher; if market capitalization declines later, leverage and position limits must be lowered. This requires the team to continuously monitor the liquidity and market capitalization of each token. GLP does not require this because it must "have the underlying asset to allow trading." Even if the GLP team "takes it easy," it won't lead to major issues; HLP must be actively monitored.

Thus, GLP and HLP are actually two different logics. GLP is more "stable," while HLP is more "scalable," but the risks are also higher. This is its improvement, bringing it closer to the CEX model. Of course, it also has its drawbacks, but the current market feels that these drawbacks can be overlooked, so people are willing to accept the HLP model in exchange for higher liquidity, cheaper trading fees, and funding rates.

Where Does Hyperliquid's Liquidity Flywheel Come From Without VC Backing?

JACK: Another interesting point is that Hyperliquid initially did not have VC backing. Many large projects require substantial liquidity or financial support to subsidize users, but it has quickly accumulated a large amount of protocol liquidity in less than a year and a half. It should now be the largest decentralized perpetual contract product in the industry in terms of liquidity, with user numbers far exceeding GMX's 500-600 base users. Why has it been able to quickly accumulate liquidity and early users? Let's first discuss the source of liquidity. How did its "flywheel" get started?

Xiaohuanxiong: Saying "no VC support" does not mean "it succeeded because there were no VCs," but rather that the team itself can play the role of a VC: providing brand endorsement, bringing in market resources, and providing a "base" for liquidity.

Jeff himself has a market-making background and was previously one of the top five market makers at OKX, so he has control over capital and does not need to rely on external funds (whether from VCs or retail investors) to provide basic liquidity. Initially, the HLP team invested over $100 million themselves, which, while not perfect, was enough to support a "tradable" starting point, after which they continuously improved the experience. The team can also directly engage with industry opinion leaders, project parties, and participants who can write on Twitter, without needing to rely on VC connections. So their "lack of VC" means they can already fulfill the role of a VC themselves.

In the early stages, there were two pools: HLP and a liquidation pool. The team provided over $100 million in liquidity across both pools, which is now about $300 million (plus some external funds). There are also external market makers providing liquidity through APIs, but the foundational liquidity is backed by the team, so the starting point is higher than grassroots projects.

Early users mainly came from the "copy trading system" gun pools. Small and medium-sized KOLs could bring volume by opening some copy trading pools, somewhat like Bitget's early growth strategy, bringing in a lot of "directed buying or selling." These types of orders are healthier for market making and LPs, unlike arbitrage, brick-moving, or hedging that only seek to extract 0.1% of unhealthy traffic.

The first wave of growth: Friendtech-related indices (combining the top 50 friend tokens into a product similar to an ETF), benchmarking against AFOUR's product. At that time, there were two factions on Twitter competing for users, and Hyperliquid was more aggressive in its efforts, even though this product might not necessarily be profitable, it garnered significant attention.

The second wave: Airdropping Memecoins Purr (instead of waiting a year and a half to issue governance tokens), which was an unexpected surprise to reward early users. Subsequently, they added a "1.5 quarter" incentive between the first and second quarters: if users remained active traders after the Purr airdrop and did not sell off their airdrop, they would receive additional point airdrops, and this was not announced in advance. This unexpected move deepened the perception that "the team is genuinely rewarding users."

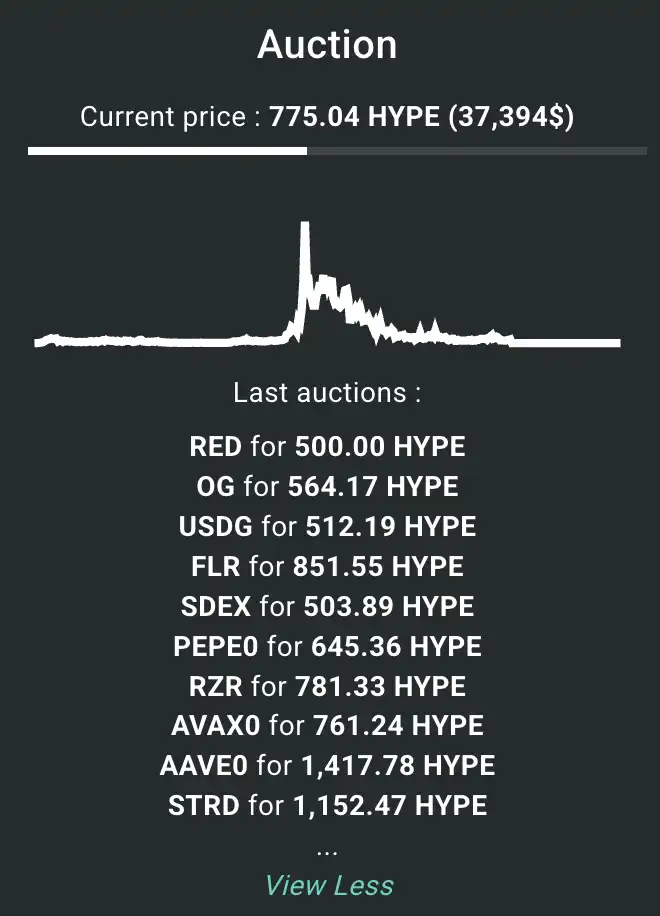

The third wave: Launching the second quarter plan, continuously adjusting the point rules for large coins, small coins, and spot trading (changing weekly and not publicly disclosed), prompting everyone to guess the rules and "try everything," which also boosted spot trading. At that time, there was also a "ticker auction every 48 hours," where the project team would buy tickers and list tokens, which also increased revenue. The first wave attracted attention, the second wave brought in users, and the third wave even increased revenue—although later the spot product faced some failures, and users were less willing to trade spot on Hyperliquid.

At that time, many teams were competing for the "listing fees" for token tickers, marking the first appearance of a term similar to "listing fees" in decentralized protocols. This was the first time that Hyperliquid was associated with centralized exchanges. It also indicated that it already had popularity and traffic, and the project team believed it could bring liquidity, which is why they were willing to pay. The highest ticker fee approached $1 million. However, as the interest in spot trading waned, many project teams had little connection with HYPE, and the HYPE community was also reluctant to buy their tokens, making it difficult to sustain the hype.

Later, they issued the governance token HYPE. Most of the early users who accumulated a large number of points were those who had been actively trading in the first two quarters and had not sold their early Purr airdrop. Therefore, this group received a more substantial HYPE airdrop and was more willing to "hold on." It's like "giving you one candy first, and if you don't eat it, I'll give you five more"—the probability of not eating it is higher. Coupled with market makers maintaining a stable holding community, the token price grew relatively steadily, which also brought greater visibility.

Recently, a wave of attention came from the "transparency of whale positions": compared to centralized exchanges, on-chain transparency allows people to see who is going long and who is going short. The media actively reported on large positions like those of James W or G. T., and people even jokingly referred to it as "insider information," which I don't see that way, but it provides a story to tell. In contrast, centralized exchanges operate as black boxes. This increased media visibility.

At the same time, you will see that they have been "eliminating old lines": currently, HLP's trading volume only accounts for about 10% of the overall volume, with the initial copy trading vault, Purr, and spot trading all being marginalized. They are a rapidly changing team, which has its pros and cons.

The core attraction for users now is still "low fees, an experience that rivals centralized exchanges, and decentralization sounds cooler." It's not about being completely unbanned or never having issues, but rather "cheaper, with the same experience."

For many American users, Hyperliquid has been a good choice, especially since they can't use Binance.

Recently, I was surprised by the excellent liquidity. For example, a Bitcoin whale exchanged nearly $3 billion worth of BTC for ETH in a very short time, likely completed on Hyperliquid. I also heard that he was worried about being banned on Binance.

Why are whales more willing to trade on Hyperliquid?

JACK: The market is most curious about why there are so many whales on Hyperliquid. Why are they willing to open high leverage positions, even up to 50x? Why are they willing to make large cash trades on Hyperliquid? Is it just low fees and decentralized censorship resistance, or are there other reasons?

Xiaohuanxiong: There is a speculation in the community that these funds hope someone will "follow their trades," which can lead to better trading outcomes. This doesn't refer to "gun pools automatically following trades," but rather that if they see someone going long, they also go long, causing the price to rise faster. This can only be realized on a transparent platform like Hyperliquid. On Binance, trades are not visible and cannot be confirmed.

The second factor is "censorship resistance/privacy." It's not that the source of funds is unclear, but they don't want retail investors to know their true identities. People see "a certain ID is very powerful," but they don't know the real name. As long as address separation is done well, real identities and on-chain identities can be separated, better protecting personal safety and privacy. Centralized exchanges have KYC, which does not guarantee that personal data will be properly protected; once leaked, personal safety is at risk.

The third issue is the "account ban" problem. These are the reasons why these funds prefer to use Hyperliquid.

JACK: It sounds like a relatively organic process?

Liu Feng: The term "organic" is quite accurate. The emergence of large traders on decentralized contract exchanges began with GMX. The most famous figure during the GMX era was "Andrew Kang," who would open positions worth hundreds of millions of dollars. People would watch his trades, follow them, or open counter-trades, which greatly boosted platform liquidity. This can only happen on decentralized exchanges because they are transparent and observable. When centralized exchanges say, "I opened a large position," people will question it as "photoshopped."

In the Hyperliquid era, whale trades have become a phenomenon, with many observing whale positions, which has led to more people following or opening counter-trades, thus promoting liquidity.

This is somewhat counterintuitive because we think whales want privacy. However, we need to distinguish between "identity privacy" and "position privacy." It's easier to protect identity privacy on Hyperliquid, but positions are exposed. Some people want their strategies to remain unknown, in which case Hyperliquid may not be suitable; others need "momentum" and don't mind their positions being visible, making Hyperliquid very suitable for them.

JACK: In short, whales are an important keyword for decentralized perpetual contracts, bringing attention and liquidity. Hyperliquid is widely discussed in the industry precisely because of these large whale trades.

Why were large holders able to quickly form a consensus after the issuance of the HYPE token?

JACK: Another phenomenon: many large holders of Hyperliquid around me formed a strong consensus immediately after the token was issued, continuously supporting this protocol, and this was before the "whale trades." The crystallization of whale consensus is difficult for me to understand. As an ecological large holder, why do you think this team was able to gather large holder consensus? How did they achieve this?

Liu Feng: First, let's define "large holders": are we referring to HYPE holders? It sounds like Xiaohuanxiong, who considers anyone with holdings worth over $10 million to be a large holder? Are there really that many at such a scale?

JACK: I think around $1 million could also be considered.

Liu Feng: Then Xiaohuanxiong would be classified as a "super large holder." Tell us about your "large holder life."

Xiaohuanxiong: I know quite a few large holders with several million or tens of millions. They trust the team because they have been following for a long time; many of them don't engage much with new projects, perhaps just two or three larger ones, like WFI, and they don't constantly look for new projects. They have been following this project and have seen the team make rapid changes, communicate promptly, and place great importance on real users.

Customer service is indeed lacking, but on platforms like Twitter, Jeff and team members respond quickly to controversies. Quick responses are the norm for centralized exchanges (Binance, OKX); on-chain projects often go unresponsive for a week. Hyperliquid's response speed is close to that of centralized exchanges, usually responding on Twitter within 24-48 hours.

Project updates are also frequent, with new versions released roughly every month or two. Small updates include UI improvements, especially for mobile, which are continuously optimized; the desktop version also sees more order types and other detailed improvements, with maintenance occurring almost weekly. This gives people the impression that the team is not slacking off, and the development pace is reassuring. Many on-chain projects have V1/V2/V3 versions, with a year or more between V2 and V3, and they don't update weekly or monthly.

This makes everyone feel that "they are doing something," and large holders are more willing to support. One last point: many large holders are those who held onto their airdrops and continued to use the platform. If you took the Purr airdrop and sold it, or if you stopped trading after the first season thinking the airdrop was over, you wouldn't receive as many subsequent airdrops and wouldn't become a "large holder." So, the people who remained are more willing to hold on.

In terms of communication channels, there are some private Telegram/Discord groups that require wallet verification to join, and team members are also in those groups. I am no longer in most groups because I don't use my own wallet, so I'm not sure if they still use these channels.

What projects in the HyperEVM ecosystem are worth paying attention to?

JACK: Many people are looking forward to Hyperliquid's EVM ecosystem, HyperEVM, which allows other teams or applications to directly access Hyperliquid's liquidity pools and develop projects on it. What are some noteworthy projects?

Xiaohuanxiong: Unit is worth paying attention to. They are responsible for "packaging" assets like BTC and ETH into Hyperliquid's spot market, which you can think of as a wrapper that brings spot trading to the Hyperliquid exchange. The potential income is considerable, and they have purchased many mainstream token tickers, which can bring spot trading volume over.

Unit is more like a cross-chain product that brings cross-chain assets to Hyperliquid. It is also decentralized and permissionless. Unlike Thorchain/Rune, it has a closer relationship with Hyperliquid, so when searching on it, you use BTC directly instead of unitBTC. This gives it a sense of "authenticity" in the ticker. Some people jokingly say that the whale who previously exchanged BTC for ETH might consider using Unit to mine for airdrops, but that's obviously a joke. Many people use spot trading, and there may also be considerations for "airdrop hunting." However, I tend to think that if it's useful, just use it; don't use it just for the sake of airdrops, as not receiving the airdrop could affect your mindset.

Kinetiq is a rapidly rising protocol that I also missed out on. It is now basically the largest LST protocol. Previously it was stHYPE, and now everyone is using kHYPE. I see that the underlying asset is ultimately using Kinetiq HYPE, so it holds the most liquidity staking volume. This will be convenient for the upcoming HIP-3, as HIP-3 requires a collateral of 1 million HYPE, and not many people can get that entry ticket. If a large amount of kHYPE can be crowdfunded, it will have an advantage in launching HIP-3.

The kHYPE already staked on Kinetiq has exceeded $2 billion.

Supercexy and Insilico Terminal are third-party front ends that bring volume to Hyperliquid through "builder codes" (similar to referral codes for project teams) and provide third-party front ends. Supercell mainly targets mobile users, while Insilico Terminal caters to professional desktop users, offering more order types. Both currently have relatively high revenue.

They mainly rely on traffic generation, earning commissions from Hyperliquid because their front ends are more user-friendly. The potential stories are limited, similar to the "wallet track"—issuing tokens is also difficult to make big money. You see a bunch of wallets (Magic Eden, Trust Wallet, SafePal, etc.) that are all quite ordinary. The third-party front end track is somewhat like the wallet track; unless they pivot to HIP-3, it will be hard to scale up. If it's useful, just use it.

Interpreting HIP-3 and its impact on Hyperliquid

JACK: Many large holders and active users frequently mention HIP-3. HIP is like Ethereum's EIP, an upgrade proposal for Hyperliquid. We are now at the third generation. My understanding is that HIP-3 allows users who hold a certain amount of HYPE to deploy their own perpetual contract trading pairs on the protocol. This is viewed positively by many HYPE holders and ecosystem observers. What changes will HIP-3 bring to the ecosystem? What do you mean by "transitioning to HIP-3"?

Xiaohuanxiong: HIP-3 allows me to stake 1 million HYPE to launch my own trading pair. The underlying technology uses Hyperliquid's matching engine, while the front end is managed by me, providing a trading experience that is better than the official front end. This is similar to a "white label exchange." Many teams wanted to do this before, like Odon, but they didn't have users, making it difficult to create a white label.

Liu Feng: Staking HYPE tokens grants white label qualifications, allowing you to list the trading pairs you want; this way, more tokens can be staked.

Xiaohuanxiong: However, "more" is also limited. As far as I remember, there is no difference above 1 million (specifics depend on the documentation); it is more like "margin," not "the more, the better."

JACK: Why would someone want to create a white label?

Xiaohuanxiong: Of course, you can now use VC money to create a competitor to Hyperliquid, but you can't rely on VC support in the long term. For example, dYdX is VC-backed, and many exchanges supported by VCs between dYdX and GMX have ultimately disappeared, while GMX, which had no VC backing, has thrived. VCs will not burn money indefinitely in a non-profitable sector; when they realize they can't surpass Hyperliquid, they may prefer to "integrate" rather than "compete."

If you create your own exchange, you must have foundational pairs like BTC/ETH; you need to source liquidity and maintain a thick inventory. If you take money from market makers, you also have to share with them, and if you raise more funds, you have to spend it back, which may not save you money. Building on Hyperliquid allows you to directly use its liquidity for mainstream pairs like BTC/ETH/SOL, while you only need to supplement with the assets you want, such as gold, silver, oil, and other CFD-type assets. Overall, the technical and liquidity costs will be much lower.

What competitors does Hyperliquid have in the market?

JACK: This relates to the next question: besides creating competitors, the applications or front ends of HyperEVM may ultimately become "white labels" for Hyperliquid. So if someone were to create a decentralized perpetual exchange now, how would they differentiate themselves from Hyperliquid? What areas can Hyperliquid still improve? Are there any other noteworthy Perp DEXs?

Xiaohuanxiong: After reviewing, I found that none can achieve even half of what Hyperliquid does. There are some decent products that might reach about 40-50% of its capabilities. I haven't calculated it specifically, but I always feel like something is missing. (Side note: Backpack is currently a centralized exchange but will go on-chain later, transitioning to decentralized.)

Your assumption that "centralized is definitely better than Hyperliquid" does not hold. Hyperliquid is already better than many centralized contract exchanges. Two years ago, this was unimaginable.

I recently tried the popular Lighter. It is the best among the others, although I have quite a few complaints about it. I do have a bias because I hold a lot of $HYPE. It uses ZK for order book matching, which is quite promising.

I have also been looking at Pacific; the product is currently lacking, possibly scoring 1-2 points. But I would prefer to see differentiation based on "different philosophies" rather than "copying Hyperliquid to achieve 70%." Competitors don't necessarily have to be better; they need to be "different." Lighter is too similar to Hyperliquid; I feel like 80% of it is alike. Esta promotes many "grid apps (mobile)," while Pacific focuses on AI, with each name having a "special aspect" that Hyperliquid lacks; whereas Lighter has everything that Hyperliquid already offers.

What weaknesses does Hyperliquid have?

Xiaohuanxiong: There are mainly three areas. First, the mobile experience. There was a previous optimization, but I feel it only improved from 4 to 5 points; it is still "barely acceptable." This is not entirely Hyperliquid's fault, but rather that wallets like MetaMask, Trust Wallet, Coinbase Wallet, OKX/Bybit, etc., do not support complex contract interactions smoothly on mobile. The network and gas design do not provide a good experience on mobile compared to desktop. Currently, it is almost impossible to use Hyperliquid smoothly on mobile without an app. I rarely use the mobile version. However, the mobile experience is a necessity: many office workers cannot trade while sitting at their desks all the time; they still need to rely on their phones. Centralized exchanges (OKX, Binance) have excellent mobile experiences. Hyperliquid's only "solution" at the moment is third-party mobile front ends (like Base or Supercell types). However, whether third parties can compete with the first party is uncertain; if others can move quickly and aggressively, they can compete because the opponent is a "third party" rather than "Hyperliquid official," and small teams cannot spend money like the official team to create an ultimate experience.

Second, deposits and withdrawals. Many people currently "cannot buy," not because they don't know how to deposit or withdraw, but because the fees are too high. You mentioned using MoonPay? The fees are close to 5%, which retail investors won't pay. Even something like "2% credit card deposit" seems high to retail investors, not to mention that the rates for converting many currencies (euros, yen, lira) to USDT are even more discouraging. Hyperliquid has not yet found a balance within 2% between "convenience" and "reasonable pricing." I'm not sure how to tackle this because centralized exchanges have thick fiat deposit and withdrawal inventories, many OTC merchants, and a wide range of integrated products, giving them a significant price advantage.

Third, there is a lack of customer service and user support resources. There are two aspects: one is user documentation. The current documentation is relatively concise and lacks "step-by-step" beginner tutorials, assuming you know how to operate on-chain. Many newcomers have never bought tokens, and you cannot expect them to use Hyperliquid as their first stop. Currently, much relies on KOLs on TikTok and YouTube for recommendations and tutorials. I believe there should be an "official education platform," similar to Binance Academy, that teaches users from scratch, lowering the barrier to entry. It doesn't necessarily have to be on the main site, but it needs official endorsement. The second aspect is "human reassurance and response." For example, if there are occasional withdrawal delays, they may not be resolved immediately, but a real person needs to respond promptly and reassure users. This is a strong point of centralized exchanges. Hyperliquid only has 11 people; no matter how well they communicate on Twitter, they cannot cover broader circles like Facebook, Instagram, Weibo, Xiaohongshu, etc. To expand their reach, relying solely on Twitter/Telegram is insufficient; they need a larger customer service and surrounding team. Ideally, there would be teams within the ecosystem to handle these, generating revenue from it.

These three areas (mobile experience, deposits and withdrawals, customer service) can indeed be addressed through third parties. However, there needs to be reasonable "ecosystem profit-sharing/support." For example, Inselico Terminal publicly complained that they found the income from Hyperliquid lower than from previous platforms, so they had to raise their fees to cover costs. Previously, they charged almost nothing as a third-party front end, but later realized they couldn't survive without increasing fees. This makes it difficult to incentivize everyone to "not start from scratch" but rather "work for Hyperliquid."

My suggestion is for the team to provide more traffic or fee support to "ecosystem partners." It doesn't necessarily have to be direct financial support; it could also include gas discounts on products. If teams working on the ecosystem can make money, they will voluntarily contribute to the ecosystem instead of going out to start new projects. Hyperliquid has already been friendly enough to holders and users; moving forward, they should also be more "magnanimous" towards teams within the ecosystem.

Liu Feng: This also raises the next question: when you communicate with the team, how do you feel they are currently setting priorities? Recently, they announced plans for a support fund and to buy back tokens. Soon, in October/November, there will be a massive unlocking of team tokens.

Xiaohuanxiong: I feel their current priority is to "first fix the mechanism loopholes," such as the recent XPL incident. They want to "not have further issues," stabilize the fundamentals, and then gradually push HIP-3. They are also handling the unlocking issue, emphasizing in public discourse that "they will sell at most 10%," and they have discussed unlocking in some interviews. I think the roadmap is: stabilize first, then push HIP-3. The market may have overly high expectations for the "next round of airdrops."

Liu Feng: You mentioned "fixing the holes" and also brought up the market manipulation controversy surrounding XPL. Can we elaborate on that? Jack, could you provide some background first?

JACK: XPL is the native governance token of the "stablecoin chain" Plasma launched by Tether (the issuer of USDT). Before the token was officially launched, Hyperliquid opened pre-market trading. During the pre-market period, XPL experienced a rapid rise and fall within five minutes, first surging quickly and then plummeting, leading to large-scale liquidations on both long and short positions. The community questioned whether there was manipulation involved.

It later appeared that an address named silent_trader had taken a long position in advance and then used a massive buy order to push up the price of XPL, causing a large number of short positions to be liquidated. The price surged from $0.6 to nearly $2 in a short time, followed by a significant drop, resulting in chaos in the pre-market trading pairs. Could you elaborate on what happened at that time? Who is responsible?

Xiaohuanxiong: In terms of mechanism design, Hyperliquid anticipated that "pre-market would be more volatile" and provided a large banner reminder on the interface. However, many normal hedging users had not encountered such situations before and had higher expectations of Hyperliquid. This reminder did not serve its intended purpose. I believe Hyperliquid should bear about 70% of the responsibility.

I don't think it was "hacked," but there were indeed issues with the mechanism. The biggest problem is that after the event, Hyperliquid used "users didn't read the documentation" as an excuse. I cannot accept that. Because in product design, pre-market and market are placed together, users will default to expecting them to enjoy the same level of "protection." If Hyperliquid is viewed as an "exchange," users expect to "sleep soundly" while trading there. You can say, "this is a competitive arena," but that is not the expectation of most users. You cannot just use "the documentation stated it" as an excuse without specifically addressing user losses, or even blame the users. The amount involved is around $4 million; while it may not be suitable for direct compensation, they could offer some discounts to affected users, such as waiving future fees. Centralized exchanges have handled similar issues multiple times. For example, if a certain exchange cannot trade for two hours after listing, they might give each user a $10 fee waiver. It's not a lot of money, but it greatly improves user sentiment, showing that you "acknowledge the problem and are addressing it," rather than just discussing right and wrong. This is a matter of "attitude."

Especially since the affected users are "real users," different from those who purely speculate to "make a quick profit." The users of this batch of XPL are genuinely using Hyperliquid. For such supporters, I believe there should be more humanistic care, rather than just discussing rules in "black and white."

The impact of this matter on token holders, large investors, and active users is present, but it won't be "fatal." Every exchange has faced similar issues. The key lies in how they handle the aftermath. If they continue to use such handling methods, confidence will gradually erode.

Another impact is on "new coin trading." After the XPL incident, you will see that the trading volume of certain new coins (like WLFI) on Hyperliquid only accounts for a quarter of that on Binance; whereas before XPL, new coins often managed to achieve about half of Binance's volume. This indicates that confidence in the "new coin track" has been weakened. Some users may think: I won't go to Hyperliquid to buy new coins; I'll only go for old coins. This doesn't apply to all users, but it is certain that this mindset is affected. Major coins like Bitcoin and Ethereum are not impacted; the core contract market is still doing well, and the core business remains unaffected.

How long can Hyperliquid's momentum last?

Liu Feng: Looking further ahead, can the advantages of Hyperliquid be sustained? When will it become Binance's "killer"?

Xiaohuanxiong: I think the bottleneck is "only 11 people." Can 11 people really defeat Binance? Relying on a "minority of genius engineers" is quite difficult, and this is something I've always worried about. Binance initially had a small number of staff for offline expansion, but later they invested in many low-cost, high-brand exposure activities, such as sponsoring racing teams and sports clubs. This is a brand exposure issue.

If Hyperliquid relies solely on third-party investments, support from ecosystem teams like Unit/Kinetiq, and the community of token holders, it can be very helpful during a bull market when token prices rise; but in a bear market, there is no community. Even if there is a community in a bear market, they won't spend money to help because everyone is short on funds. Then it will depend on the core team to "hold on."

Defeating Binance is not a one-cycle task; it requires the accumulation of two to three cycles. In the meantime, there will be a phase where the token drops by 75%, and both project teams and retail investors will lose half of their numbers. At that time, can these 11 people "rise again"? This will determine whether they can "complete the entire campaign." I hope they don't necessarily have to expand to two or three hundred people, but at least to 30-40 people, which is better than 11. Because these people are salaried, they can maintain development progress even in a bear market, enduring the phase where "the community has all run away."

As of today, their advantages and momentum are evident. The challenge lies in whether they can effectively expand under the current favorable situation, establish an ecosystem, improve products, and continue to push to the next level. Otherwise, once they enter a bear market, given the current situation, maintaining their advantages may not be easy.

They have not experienced a true bear market. A bear market is irrational. Product data may be excellent, quality may be improving, and user experience may be getting better, but the token price just keeps falling, and both attention and traffic are declining. This is "counterintuitive"; mediocre products can take off in a bull market, while in a bear market, even when doing better, users are still leaving. How to survive a bear market is something they have not experienced. Whether the team's morale can remain stable is worth observing. If they can't withstand a bear market, they won't be able to defeat Binance, because it's impossible to beat it in just one cycle.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。