Key infrastructure should be decentralized, while user-facing applications can be centralized; balance is the optimal solution.

Author: s4mmy

Translated by: Deep Tide TechFlow

The recent launch of the Tempo project by Stripe and Paradigm has reignited discussions about the importance of decentralization. Meanwhile, decentralized artificial intelligence (DeAI) is also affected, as the value proposition of TAO (Decentralized Autonomous Organization) is being questioned in comparison to centralized alternatives like OpenAI.

This article challenges the view that "centralization will dominate" and demonstrates the advantages of decentralization through several successful crypto products.

Table of Contents

Introduction

Understanding Trade-offs

Advantages of Decentralization

Sustainable Ecosystems and Speculative Hype

The Future of Hybrid Models

- Introduction --

It is important to point out that decentralization (in its current form) does face some real challenges:

Scalability limitations

Governance complexity

User experience barriers

However, adopting "strategic decentralization" in key infrastructure can provide better long-term outcomes for innovation, resilience, and the development of autonomous AI agents.

The path forward requires a hybrid model that combines the advantages of decentralization with some centralized features to enhance the performance of crypto products.

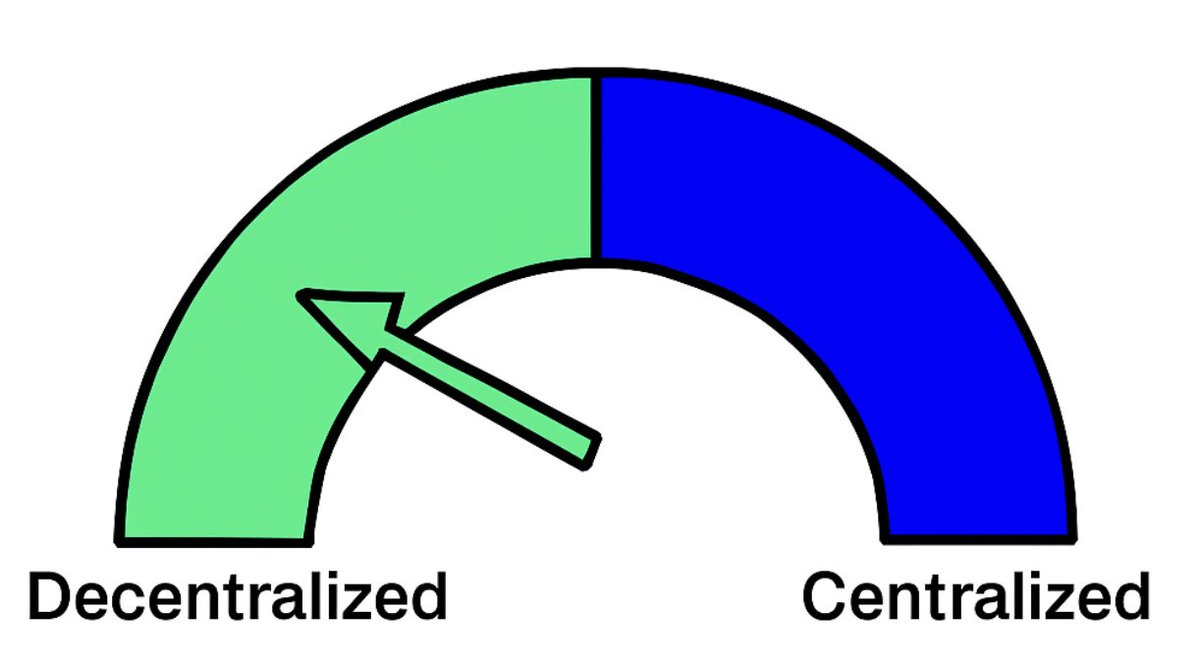

The pendulum between distributed and centralized systems will continue to swing in search of balance; so, what is the optimal level of distribution?

- Understanding Trade-offs ----

Decentralization is not a panacea.

The blockchain trilemma (the trade-off between decentralization, security, and scalability) forces us to make some compromises. For example,

Bitcoin processes 7 transactions per second (TPS), while Visa can handle 65,000 TPS, clearly demonstrating this limitation.

Early DAO governance faced issues of collaborative paralysis and the concentration of tokens in the hands of wealthy holders.

However, these are engineering challenges, not fundamental flaws.

- After Ethereum transitioned to Proof-of-Stake, energy consumption was reduced by 99.95% while maintaining security:

Source: SURF Co-Pilot

Layer-2 solutions inherit Ethereum's decentralization while achieving thousands of TPS processing capacity.

AI agents can provide decision-making efficiencies that can be introduced into DAOs to optimize human shortcomings.

Thus, it is understandable that cyberpunk advocates question Tempo's choice of alternative Layer-1 solutions:

Original tweet link: Click here

But @matthuang also clearly stated that the Ethereum ecosystem (including Layer-2) is not developing quickly enough to address the upcoming on-chain payment surge. Therefore, it is necessary to independently build @tempo.

"From an operational perspective, we feel the need to build for the upcoming demand and reduce dependencies, including reliance on the speed of Ethereum L1 progress."

This sluggishness is indeed a problem, but it does not undermine the areas where decentralization can excel. Both can coexist.

- Advantages of Decentralization -------

a) Resistance to Censorship

In an era where centralized platforms can "ban" users or restrict content due to political pressure, decentralized systems provide an unblockable space for innovation.

Of course, there are downsides, so finding the right balance is crucial. But this is more a matter of human nature than a technical flaw.

For example, AI development on the Bittensor network cannot be shut down by any single authority, thus supporting research in sensitive yet important areas.

b) System Resilience

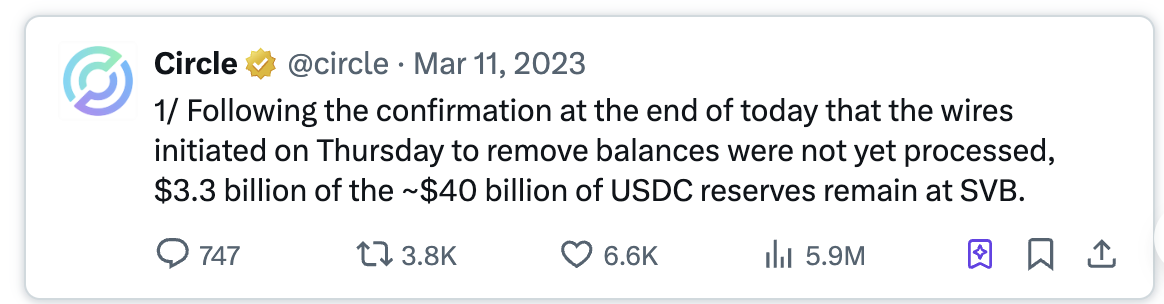

In 2023, USDC became unpegged due to the collapse of Silicon Valley Bank, demonstrating how centralized systems create single points of failure.

Original tweet link: Click here

Decentralized alternatives like Ethena's USDe adopt delta-neutral strategies across multiple venues, thereby reducing counterparty risk.

c) Democratic Resource Access

Centralized cloud service providers have formed oligopolies over critical AI infrastructure.

Networks like @Rendernetwork provide computing power at competitive prices through thousands of nodes, breaking the monopoly of big tech companies over AI development resources.

- Sustainable Ecosystems and Speculative Hype --------------

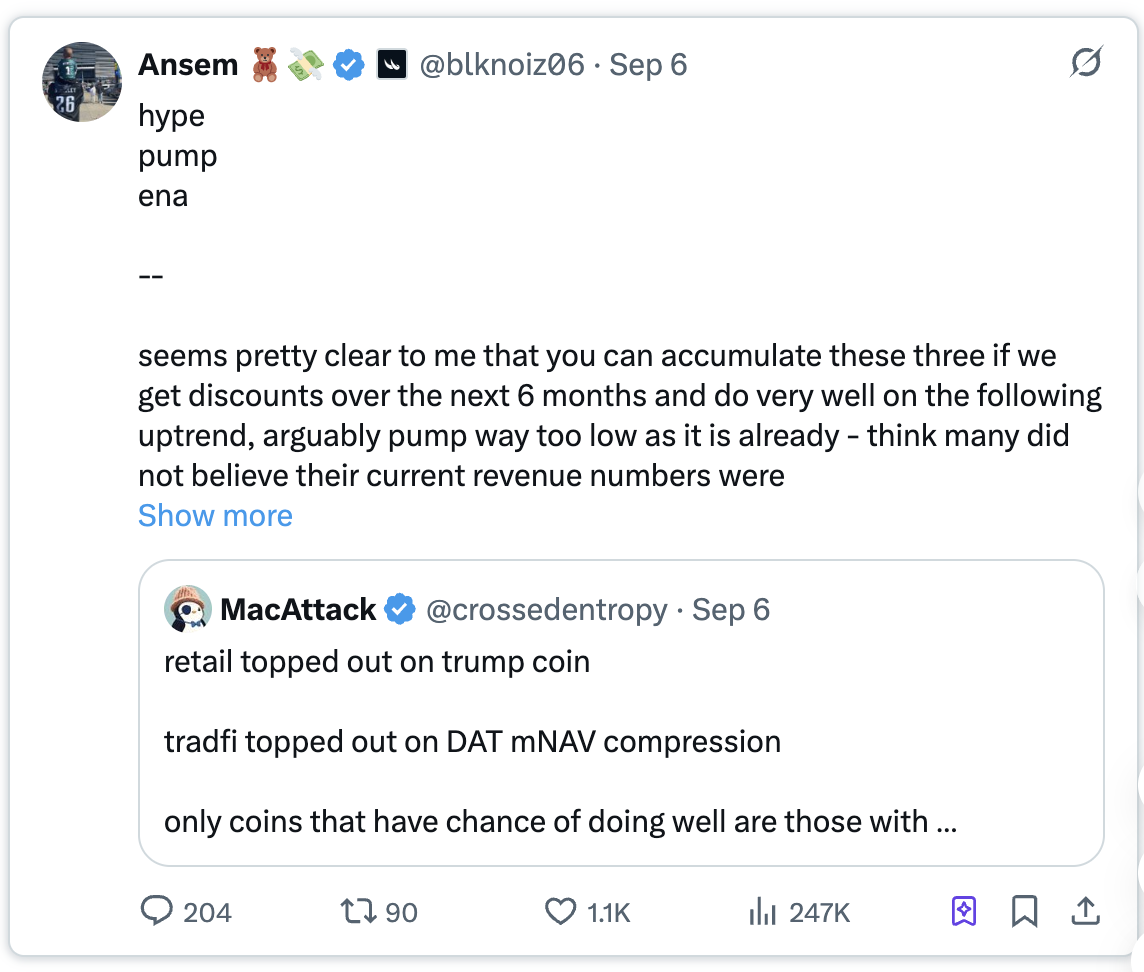

Yes, there are occasional escapees in the trenches, as the instinctual gambling addiction is satisfied by betting on the next "sure thing."

However, the maturity of today's market has led to a greater focus on fundamentals, especially among institutional investors, who tend to rely on what they do best—revenue.

Original tweet link: Click here

Although the intersection of AI and crypto has generated a lot of market hype, true decentralization drives sustainable ecosystems based on actual utility, rather than mere speculation.

I agree that many projects profit from the AI hype but do not provide functional value:

Original tweet link: Click here

But like in any new field, many illusory things without actual value will ultimately be replaced by real value.

For example:

Fetch.ai builds a network of autonomous AI agents to perform tasks

Ocean Protocol creates a marketplace for secure data sharing, which is key for AI training

Bittensor establishes a competitive arena for AI models

@Caesardata, @openservai, and @Surfcopilot provide fine-tuned models for specific domains that outperform centralized generic alternatives.

In these systems, tokens are not just speculative assets; they are used as tools for accessing services, incentivizing contributions, and governing the network, thus creating a robust, self-sustaining economy that transcends short-term market trends.

Assuming the token economic models of these projects can optimize and return value to token holders, here are some specific examples of revenue from crypto AI products:

Original tweet link: Click here

- The Future of Hybrid Models -------

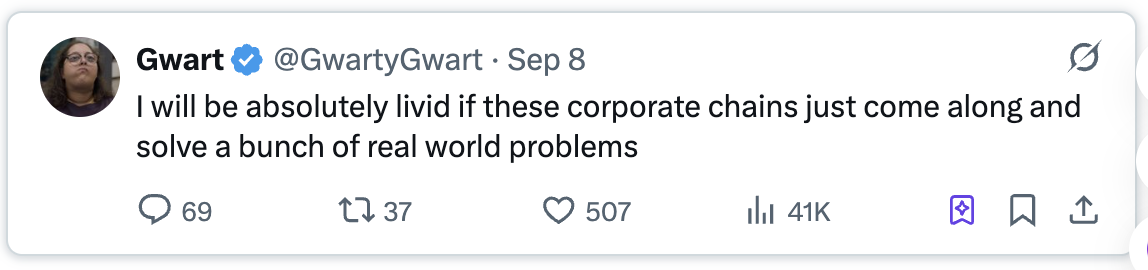

So, what is the optimal balance point?

A purely cyberpunk vision is becoming increasingly challenging, especially as traditional systems begin to adopt crypto technologies.

Original tweet link: Click here

But there is certainly a viewpoint that the best outcomes should lean more towards distributed systems rather than being controlled by a single entity.

The optimal approach is not complete decentralization, but rather strategically achieving decentralization in the most critical areas.

Key infrastructure benefits from a more distributed state:

Financial rails

AI training networks

Data markets

While user-facing applications can maintain a degree of centralization to optimize user experience (UX).

This is precisely the advantage of AI agents—transforming the poor UI/UX of the crypto space through more universally recognized, user-friendly systems.

This is also why I strongly support the intersection of crypto and AI.

AI is empowered by the permissionless nature of crypto, while crypto is promoted to the masses through AI products.

Conclusion

Decentralization does face real challenges, but these issues can be addressed through better technology and governance design.

The core question is not whether to fully decentralize, but in which areas decentralization provides irreplaceable advantages: in foundational layers that drive innovation, resist censorship, and fairly distribute value.

The future belongs to hybrid systems—they strategically achieve decentralization in key infrastructure while optimizing user experience through centralized interfaces. This balanced approach captures the transformative potential of decentralization while pragmatically addressing its limitations.

As for Tempo, will it repeat the fate of Libra, or will it become a "@Paradigm" (a pun) moment for the recognition of crypto rails in the transformation of traditional systems? Time will tell.

Disclaimer:_ The content of this article does not constitute investment or financial advice and is for informational and educational purposes only._

The author holds some of the assets mentioned in the article and has partnerships with some projects.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。