Latest Crypto News: 5 Key Updates Impacting Investors and Market Trend

What happened in Crypto Market Today?

Today’s Crypto Fear & Greed Index shows a score of 48 which is signaling a Neutral mood across the market. This marks a slight dip from yesterday’s 51 and last week’s 49.

Source: Alternativeme

The data from Alternativeme suggests that the traders are taking a more cautious approach. Compared to last month’s score of 69, when the market inclined towards Greed sentiment has clearly cooled off.

The neutral zone reflects uncertainty as investors wait for stronger signals before making bold moves. For now, the crypto market remains balanced, showing neither strong fear nor excessive optimism.

Top crypto updates you must know!

Ripple Expands in Spain Through BBVA Partnership

Ripple is strengthening its European presence by partnering with Spain’s major bank, BBVA . The partnership will see BBVA use Ripple Custody to securely trade and store crypto and tokenized assets that is aligning with the EU’s new Markets in Crypto-Assets (MiCA) regulations.

Source: X

This step builds on Ripple’s ongoing partnerships with BBVA in Turkey and Switzerland. BBVA’s Head, Francisco Maroto highlighted the bank’s commitment to innovation and customer access to digital assets. Globally, Ripple continues to expand working with banks in Japan, the US, the Middle East, Africa and Europe to streamline cross-border payments.

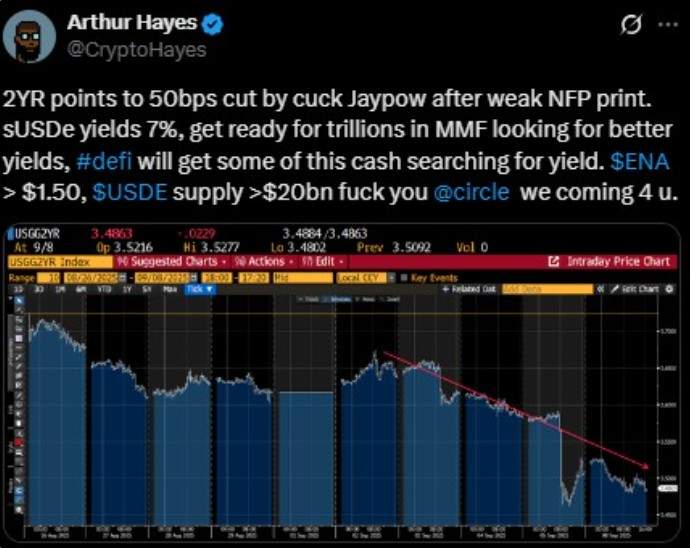

Arthur Hayes Forecasts 50bps Fed Cut, Trillion to Hit DeFi

BitMEX co-founder Arthur Hayes expects a 50 bps Fed rate cut in the September 17, 2025 FOMC meeting citing weak U.S. jobs and two-year Treasury yields.

He believes that trillions from traditional finance could flow into DeFi with stable virtual assets like sUSDe offering 7% yields. Hayes forecasts that ENA could surpass $1.50 and USDE supply may exceed $20 billion, rivaling USDC.

Source: X

While most analysts see a 25 bps cut, the rising probability of a 50 bps move reflects growing confidence. The decentralized markets are bullish with Bitcoin at $111,920 and Ethereum at $4,311 ready for fresh inflows.

Ark Invest Swaps Robinhood for BitMine in Major Crypto Move

Cathie Wood’s ARK Invest has increased its stake in BitMine Immersion Technologies, buying 101,950 shares across ARKK, ARKW, and ARKF ETFs worth about $4.4–$4.5 million at $43.79 per share.

This move highlights BitMine’s growing Ethereum treasury and strategic investments including its tie-up with Eightco and Worldcoin. Simultaneously, ARK sold 43,728 Robinhood shares capitalizing on the stock’s S&P 500 inclusion and $117 price spike.

Source: X

The trades signal ARK’s focus on digital asset-centric companies with ETH exposure, shifting away from retail brokerages toward next-generation financial and digital asset opportunities.

SwissBorg Loses $41M in Solana Hack via Staking Partner Kiln

SwissBorg recently confirmed on September 8, that hackers stole about $41 million worth of Solana (192,600 SOL) by exploiting a flaw in its member Kiln’s system.

The fraud impacted less than 1% of users and 2% of SwissBorg’s assets. CEO Cyrus Fazel said the company will cover all user losses from its SOL treasury while SOL earn redemptions are temporarily paused.

Source: SwissBorg

SwissBorg is collaborating with white-hat hackers, security firms, exchanges and law enforcement to recover funds. Other Earn programs remain unaffected highlighting risks from third-party connections in decentralized platforms.

Gemini’s $2.22B IPO Gets $50M Boost from Nasdaq

According to a Reuters report, Crypto exchange Gemini founded by the Winklevoss twins received a $50 million investment from Nasdaq as it prepares for a $317 million IPO at a $2.22 billion valuation.

The funding makes Nasdaq a strategic investor that is offering the clients access to Gemini’s custody and staking services, while Gemini’s institutional clients gain Nasdaq’s Calypso platform for trading collateral management.

The exchange plans to list on September 12 under the ticker ‘GEMI’ and use IPO proceeds for product development, corporate needs and debt repayment. Gemini will become the third publicly traded U.S. crypto exchange following Coinbase and Bullish.

Conclusion

Today, the crypto market saw a mix of strategic moves, big investments, and security challenges, keeping investors alert. Overall, activity and interest remain strong as both institutions and retail traders navigate opportunities and risks.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。