Written by: Glendon, Techub News

Last night, Bitcoin broke through $114,000, reaching a high of $114,313, the highest level since August 25. At the same time, Ethereum once again surpassed $4,400, and even more surprisingly, SOL climbed to $226 after breaking through $220 yesterday, reaching a new high for this cycle and marking a seven-month peak, indicating that the overall market trend remains strong. However, when will this consolidation phase, which has lasted for more than two weeks, come to an end?

Market Condition Analysis

As the saying goes, "a glimpse of the leopard," by analyzing key data from leading cryptocurrencies such as Bitcoin, Ethereum, and Solana, we can gain a clearer understanding of the current market conditions.

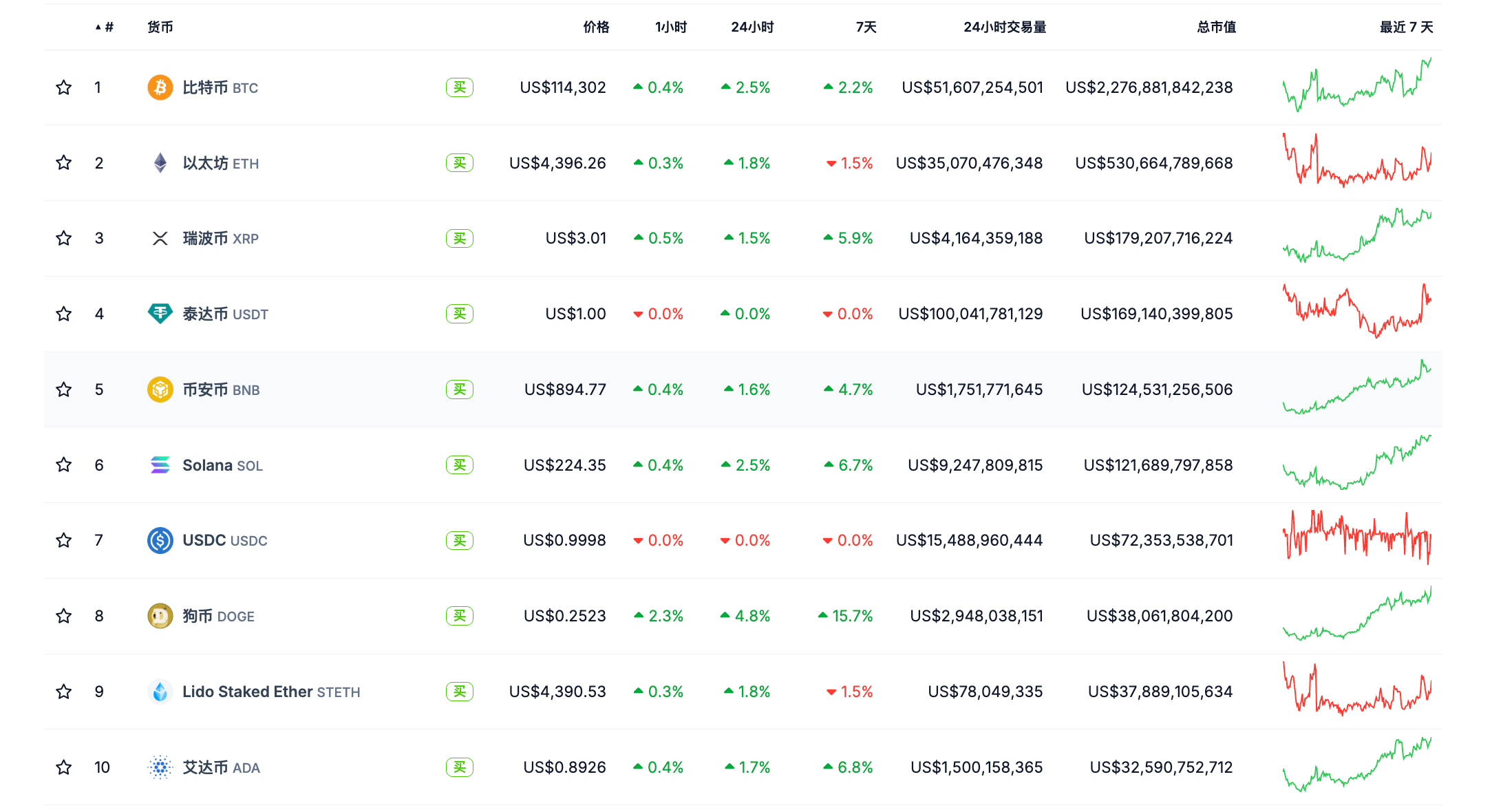

According to Coingecko data, as of the time of writing, the total market capitalization of the global cryptocurrency market is approximately $4.04 trillion, with a 24-hour increase of 2.3% and a trading volume of about $160.6 billion. Among the top 10 cryptocurrencies by market capitalization (excluding stablecoins USDT and USDC), all tokens except Ethereum and stETH have seen varying degrees of increase over the past seven days. Notably, DOGE, SOL, XRP, and ADA have performed particularly well, each rising over 5%, with DOGE leading the market with a remarkable increase of 15.7%.

It is evident that although the cryptocurrency market is generally in a consolidation phase, the overall trend remains robust. Meanwhile, we can observe an optimistic growth trend in altcoins, hinting at the quiet approach of a "altcoin season."

Additionally, data from Glassnode reveals another aspect of the Bitcoin market. As of September 7, the non-liquid supply of Bitcoin reached an all-time high, with the number of non-liquid Bitcoins exceeding 14.3 million as early as late August. Of the 19.9 million Bitcoins currently in circulation, approximately 72% of the total supply is in a non-liquid state, held by long-term holders and cold storage investors. In the past 30 days, the net increase in Bitcoin's non-liquid supply reached 20,000, highlighting a continued accumulation trend even during recent market fluctuations.

CryptoQuant analyst Darkfost expressed a similar viewpoint. He noted that the demand for Bitcoin "accumulation addresses" is surging, with these addresses accumulating over 266,000 Bitcoins as of September 5, also reaching a historical high. (An "accumulation address" is defined as a wallet address that has conducted at least two transactions involving a minimum amount of Bitcoin and has never executed any sell transactions.)

From the above data, it is clear that despite the recent frequent price fluctuations in cryptocurrencies, holders have not been swept away by the waves of short-term adjustments, resulting in large-scale sell-offs.

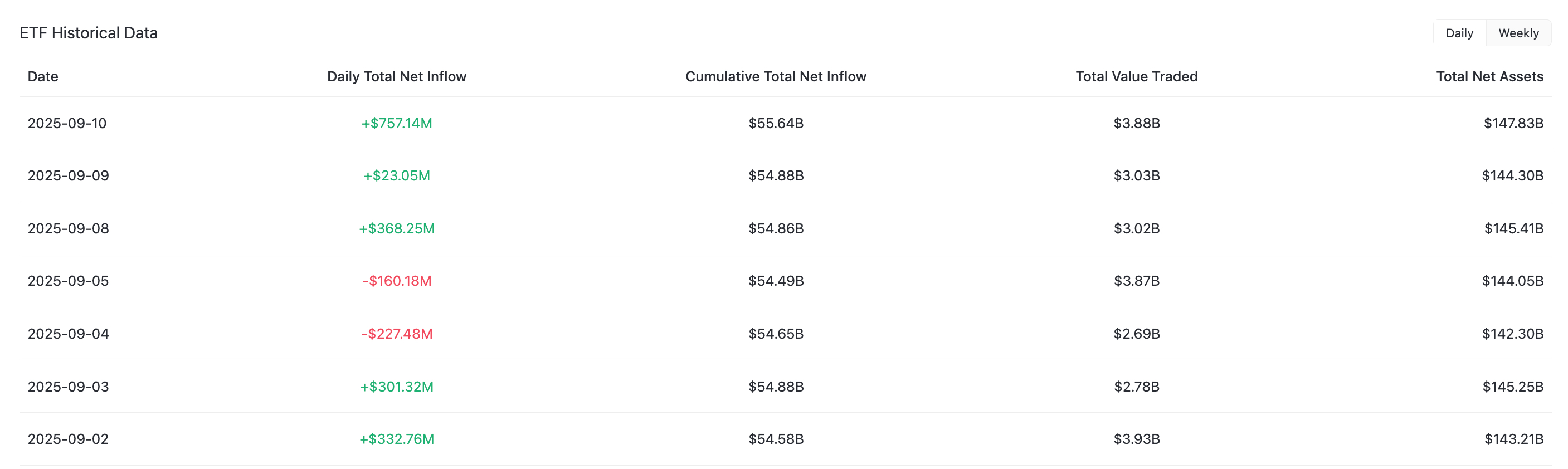

From the ETF market perspective, according to ichaingo data, in the past seven trading days, the total net inflow of U.S. Bitcoin spot ETFs has approached $1.4 billion, with a net inflow of $757 million yesterday, marking three consecutive days of net inflow. In contrast, the total net outflow of U.S. Ethereum spot ETFs has exceeded $650 million, but on September 9, the U.S. Ethereum spot ETF achieved a total net inflow of about $44.2 million. Although this figure is not large compared to ETF liquidity, it ended six consecutive trading days of net outflows for Ethereum, bringing a glimmer of positive signals to the Ethereum ETF market.

Interestingly, BlackRock, the leader in the ETF market, is planning to launch its Bitcoin ETF in the UK. According to Citywire, citing sources, with the new regulations from the UK's Financial Conduct Authority (FCA) set to take effect on October 8, UK retail investors will once again be allowed to purchase cryptocurrency exchange-traded notes (cETNs). Therefore, BlackRock has keenly captured this market opportunity and plans to list its iShares Bitcoin ETP on the London Stock Exchange (LSE) as soon as possible, further expanding its footprint in the global cryptocurrency market.

In addition to the attention on Bitcoin and Ethereum ETFs, Solana ETFs are also becoming a focal point in the market.

Bitwise Chief Investment Officer Matt Hougan expressed strong optimism for Solana in a recent memo sent to clients on Tuesday evening. He pointed out that all factors are in place for Solana to stage an epic rally by the end of the year; Hougan noted that several issuers, including Grayscale, VanEck, Franklin Templeton, Fidelity, Invesco/Galaxy, Canary Capital, and Bitwise itself, have applied for a spot Solana ETF in the U.S.

Hougan expects the U.S. Securities and Exchange Commission to make a decision on the relevant applications by October 10, and multiple Solana ETFs may be launched in the fourth quarter. With the inflow of ETF funds and corporate treasury purchases, "Solana season" may begin, bringing substantial returns to investors.

It is worth mentioning that, according to DefiLlama data, the total value locked (TVL) in DeFi on the Solana chain has surpassed $12 billion, currently reported at $12.313 billion, setting a new historical high.

Speaking of corporate treasury purchases, the narrative of digital asset treasuries (DAT) is currently gaining momentum. Taking Bitcoin as an example, corporate layouts are continuously emerging. On September 9, Hong Kong-listed company Boyaa Interactive announced that approximately 90% of the proceeds from its HKD 440 million placement plan would be used to purchase Bitcoin; shortly after, on September 10, Metaplanet announced it would issue 385 million shares, raising over $1.4 billion to purchase Bitcoin.

In response to this phenomenon, JPMorgan released a report yesterday stating that institutional adoption of cryptocurrencies is still in its early stages, but the momentum is becoming increasingly strong. The bullish IPO of Bullish in August and the passage of the GENIUS Act have further intensified market attention on the industry, and the clarity of regulatory aspects has eliminated one of the biggest obstacles faced by large investors.

Additionally, a report from the Chicago Mercantile Exchange (CME) indicates that the number of open contracts for cryptocurrency derivatives held by institutional investors has reached an all-time high, with institutions currently holding about a quarter of Bitcoin ETPs; a survey by Ernst & Young shows that 85% of companies have allocated or plan to allocate digital assets by 2025, viewing regulatory factors as a key driver.

Recently, the U.S. Congress proposed H.R. 5166, a bill requiring the Treasury to develop custody and management plans for Bitcoin acquired by the federal government (including strategic Bitcoin reserves). Influenced by U.S. policy trends, other countries are also gradually adopting an open attitude toward cryptocurrencies. For example, the Minister of Finance of Kyrgyzstan plans to submit a bill to establish a strategic Bitcoin reserve and hopes for government participation in Bitcoin mining.

From this, we can see that the market is showing a stable upward development trend in multiple aspects. So, we might ask, has the market been consolidating for so long that the bubble has been mostly squeezed out?

The Market is Gaining Momentum, Awaiting a Breakthrough

In this cycle, Bitcoin has entered a prolonged consolidation phase three times. Glassnode analysis indicates that during the consolidation period of Bitcoin's price, supply below $111,100 continues to be absorbed by potential demand. When Bitcoin's price breaks through $114,100, it may test the dense area around $118,000. Glassnode emphasizes that the market is currently in a consolidation phase, waiting for a breakthrough.

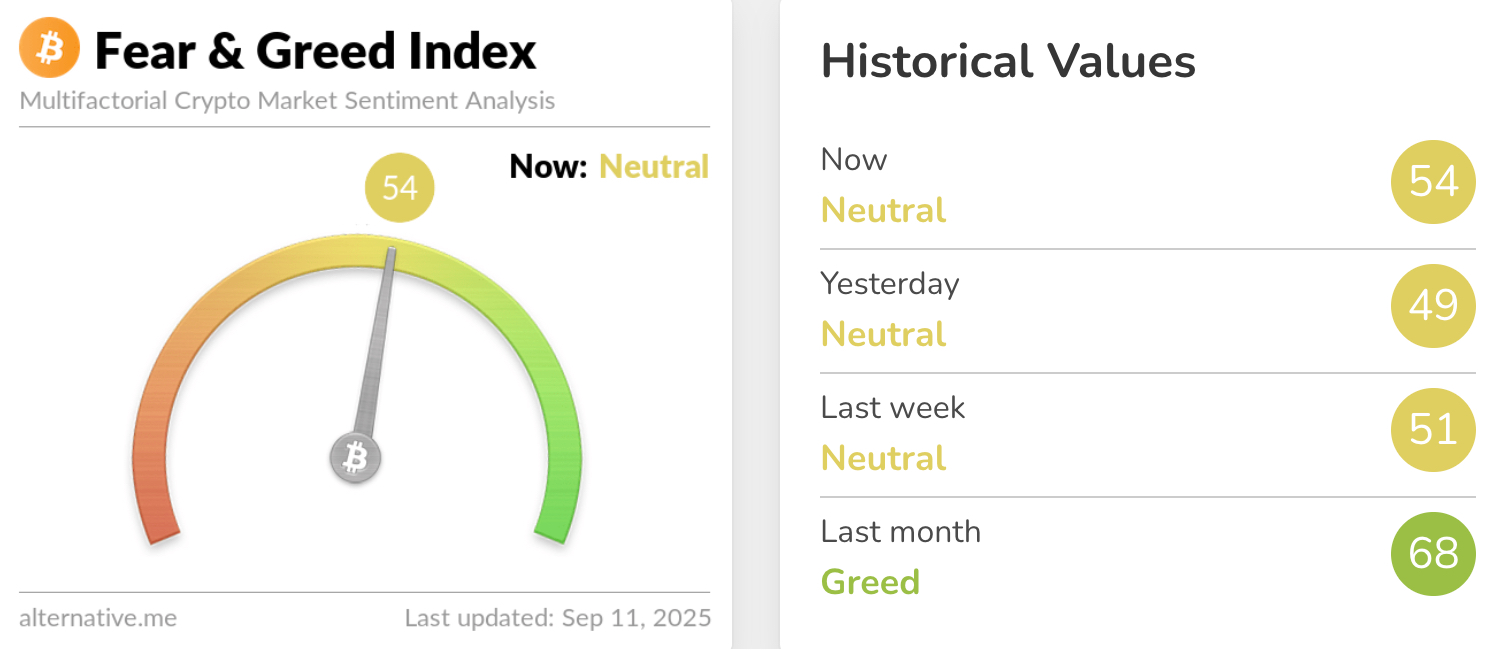

From the perspective of market investor sentiment, according to Alternative.me data, the cryptocurrency fear and greed index has been in a "neutral state" for several days, but interestingly, this index is gradually rising to 54, compared to 49 and 48 yesterday and the day before, respectively. This change clearly indicates that the overall market sentiment is gradually shifting from "neutral" to "greedy."

CryptoQuant analyst Axel Adler Jr. stated that the current market is in a mature bull market phase. He analyzed that Bitcoin's price reached $70,000 in March, showing an extreme value destruction day (VDD) peak, followed by two moderate distribution waves around $98,000 and $117,000, but neither reached the extreme levels of March. This segmented selling behavior of long-term holders (LTH) indicates that, driven by strong institutional demand, the market's redistribution process is more sustainable. Based on this, he predicts that Bitcoin's price peak may occur as early as October to November 2025.

In summary, I believe that the cryptocurrency market's two-week consolidation pattern may soon come to an end, with tokens like SOL, DOGE, and XRP potentially taking over from Bitcoin and Ethereum as the main driving forces behind the recent price increase. However, whether the long-awaited "altcoin season" will truly arrive remains uncertain.

It is worth noting that the U.S. August 2025 unadjusted CPI data will be released tonight, which may trigger market volatility and bring short-term correction risks. However, this may not be a bad thing for the cryptocurrency market. The market needs sufficient time and price fluctuations to squeeze out some bubbles for better and more stable development.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。