While most perp DEXs are trying to create products that are faster and cheaper than Hyperliquid, Variational has taken a different approach by designing a completely different business model. They did not choose to engage in an arms race over speed and fees, but instead fundamentally rethought the question of "how perpetual contract trading platforms should operate."

From CEX to DEX, whether in spot or contracts, traditional trading platforms have a straightforward way of making money—charging fees. Binance charges 0.1%, Hyperliquid charges 0.025%, which seems to have become an industry norm. However, Variational has achieved true zero fees while still generating substantial revenue. Their OLP achieved over 300% annualized returns from April to July 2025, with a cumulative trading volume exceeding $1.2 billion. What is the reason behind this?

While most perp DEXs are still struggling to attract market makers and figuring out how to balance the interests of traders and liquidity providers, what new solution has Variational provided? What is the background of the team?

Next, Rhythm BlockBeats will provide an in-depth introduction to Variational, a project that redefines the rules of the perp DEX game, and see how they perfectly combine "technological innovation, business model, and risk engineering" to create a perpetual contract trading platform that achieves zero fees while maintaining high returns.

The Business Behind Zero Fees

When it comes to zero-fee perp DEXs, most people's first reaction might be lighter. However, lighter's revenue mainly comes from fees charged to large traders and costs associated with early liquidation mechanisms, still leaning towards traditional revenue models.

Variational Omni, on the other hand, has completely changed this model by becoming the sole market maker, profiting by internally absorbing all market-making revenues.

When you place a quote on the platform, their OLP (Omni Liquidity Provider) will provide you with a quote that includes the bid-ask spread. The spread you pay goes into their pocket, rather than being a fee.

Previous DEXs had to pay external market makers to provide liquidity while also charging traders to maintain operations—spending money on both ends. Variational's cleverness lies in acting as its own market maker, keeping all spread revenues in its own pocket, which naturally allows them to offer users zero fees. This is somewhat akin to what Robinhood does in stock trading with "payment for order flow," but it is more transparent and efficient when moved on-chain.

How Does OLP Make Money?

The profit formula for OLP seems straightforward: Net Revenue = User Paid Spread - External Hedging Costs.

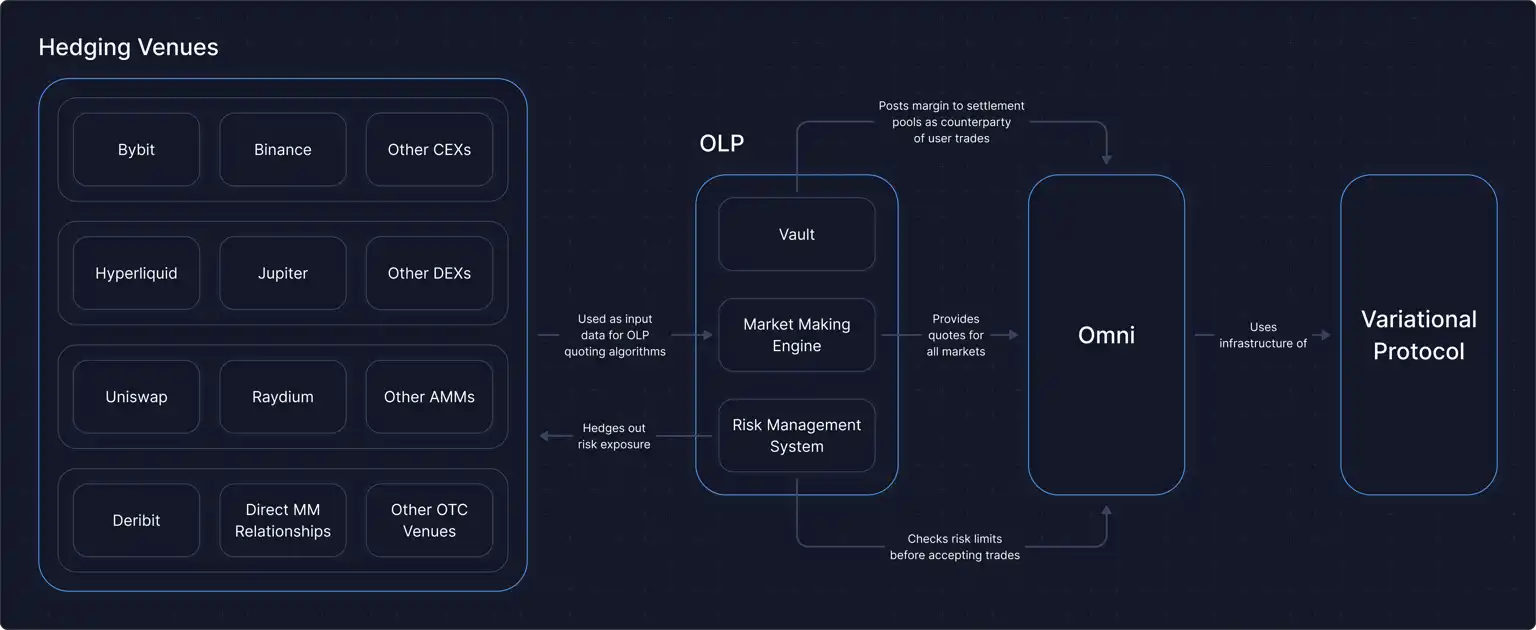

When you open a position on Omni, OLP immediately goes to CEXs like Binance and Bybit or on-chain DEXs like Hyperliquid to trade in the opposite direction to hedge risks.

Due to Variational's team having institutional-level trading volume and VIP rate advantages, their hedging costs are typically only 0-2 basis points, significantly lower than the 4-6 basis points spread charged to users, ensuring a stable profit margin.

According to data released by the platform, OLP achieved over 300% annualized returns from April to July 2025. This astonishing return rate primarily comes from three factors: a relatively small initial treasury size, rapid growth in trading volume, and efficient hedging strategies.

However, whether this level of profit can be sustained is a question. As the treasury size increases, market competition intensifies, or in extreme market conditions, hedging costs may exceed spread income. Therefore, they have implemented a series of risk control mechanisms, such as a "last-look" rejection mechanism, independent settlement pool to isolate risks, and an algorithmic dynamic hedging system.

What Are the Benefits for Users?

Although the treasury is not yet officially open to the public, Variational's product side is already preparing to allow users to deposit USDC into the OLP treasury. 90% of the earnings go to depositors, with the remaining 10% retained for protocol operations. Of course, a failure in OLP's hedging could lead to principal loss, and extreme market volatility could result in liquidity crises, along with the centralization risk of a single market maker model. Therefore, Variational is also considering a loss refund mechanism for the treasury in the future.

Meanwhile, Variational has already launched a mechanism for refunding trading losses. When users close a losing position on the Omni platform, the system automatically triggers a random lottery program, giving users up to a 5% chance of receiving a 100% USDC refund immediately.

These funds come directly from the spread revenues of OLP, with one-sixth of OLP's spread income allocated to a dedicated "Loss Refund Pool" smart contract.

Additionally, the platform offers spread discounts, trading volume rebates, and other incentive measures, which also return part of the market-making profits to active traders. Once the $VAR token is officially issued, the platform plans to use 30% of protocol revenue for token buybacks and burns, creating a complete value capture cycle.

Automated Listing: A Paradise for Long-Tail Assets

Variational's Automated Listing Engine is also one of their key advantages.

Traditional DEXs need to coordinate with external market makers and wait for liquidity providers to market new assets, a process that often takes days or even weeks. Variational eliminates the coordination delays with external market makers through internal market making by OLP, allowing new assets to receive liquidity support immediately after passing automated audits. The system's intelligent security review mechanism significantly reduces the risks of malicious contracts like "honey pot perps" through automatic contract bytecode analysis and distribution analysis, enabling the platform to safely support a large number of long-tail assets.

As of now, Variational supports 515 tradable tokens, making it the perp DEX with the most listed tokens.

Traditional platforms operate on "list and mine," requiring participation from external market makers; Variational operates on "list and have liquidity," with OLP as the sole market maker, able to provide quotes in new markets within seconds.

At the same time, Variational has designed a complete listing-delisting closed-loop mechanism, continuously monitoring asset metrics. When an asset falls below maintenance metrics, it triggers an automatic delisting, closing positions at the EWMA settlement price and delisting to avoid zombie contracts occupying resources for long periods.

The Story of the Core Team

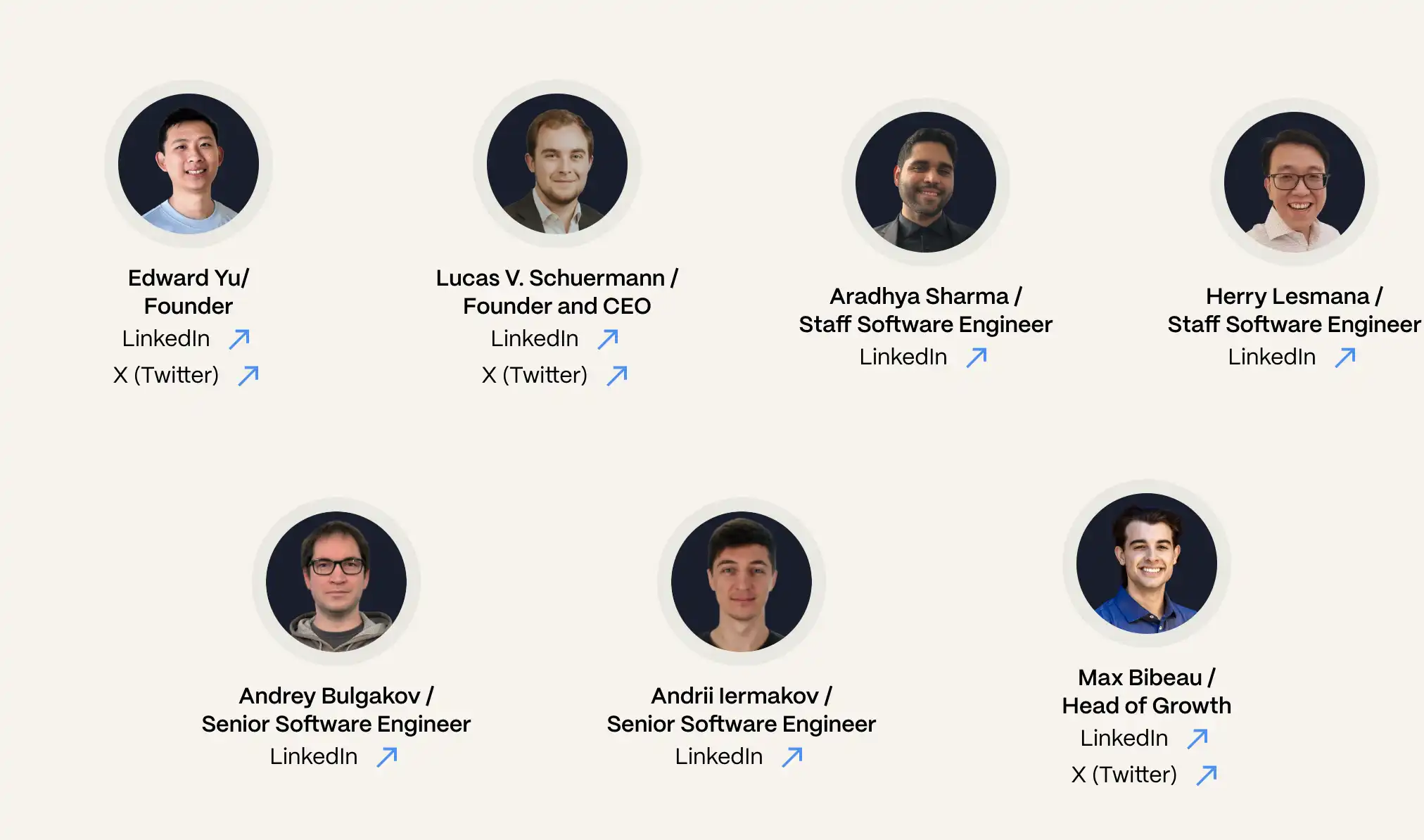

The two core founders of this perp DEX, Lucas Schuermann and Edward Yu, trace their collaboration back to their time at Columbia University.

Founder and head of technology Lucas studied at Columbia University's School of Engineering, graduating in 2019 as an Egleston Scholar (an honor typically awarded to the top 1% of students in the entire school), while simultaneously majoring in computer science and mathematics during his undergraduate studies.

Quantitative research head Edward also hails from Columbia University, majoring in applied mathematics, with an academic focus on Bayesian statistics, gradually shifting his research focus to quantitative trading.

In 2017, after meeting at Columbia, they co-founded Qu Capital, a small quantitative investment and research firm registered in New York, specializing in uncovering inefficiencies in the digital asset market, with a technical route of "self-developed high-speed trading infrastructure": more stable exchange connections, smarter smart order routing, and more refined execution tools.

This "small but specialized" boutique team was acquired by Genesis Trading on September 19, 2019 (this was Genesis's first external acquisition, with the valuation undisclosed). Among the three co-founders of Qu Capital, Lucas and Edward subsequently joined Genesis in core technology and quantitative roles. To understand why they chose to rewrite the perp DEX with RFQ + OLP (Order-Level Protection) + isolated settlement pools, we must further look at Genesis Trading.

Genesis Trading was established in 2013 and is part of Barry Silbert's Digital Currency Group (DCG). It is one of the earliest Bitcoin OTC market makers serving institutional clients. For example, in 2019, a particularly stable year, its Q2 lending business had a loan issuance of $746 million, with cumulative loans reaching $2.3 billion; it has long provided liquidity to large institutions like Circle and Gemini, serving as a crucial channel for "traditional finance entering crypto," and is regarded as a leader in OTC liquidity.

However, after the FTX collapse, Genesis took a sharp downturn. In 2022, Genesis's massive exposure to Three Arrows Capital (3AC) and FTX triggered a liquidity crisis, leading its lending department to file for bankruptcy protection on January 19, 2023. In May 2024, the court approved a liquidation plan, expecting to return about $3 billion to customers.

The combination of concentrated exposure and settlement risks can amplify into systemic shocks during extreme market conditions. For Lucas and Edward, who experienced all of this firsthand, it was a problem that needed solving and the source of Variational's design philosophy.

Thus, after leaving Genesis in 2021, Lucas and Edward co-founded Variational, continuously iterating on machine learning, quantitative market making, and decentralized derivatives design. In 2024, Variational was officially established and completed a $10.3 million seed round of financing, led by Bain Capital Crypto and Peak XV Partners, with participation from Coinbase Ventures and Dragonfly Capital.

In July 2025, Edward appeared on the "Flirting with Models" podcast, systematically explaining "how OTC derivatives can go on-chain" and Variational's design philosophy—this was a public discussion where he integrated Bayesian frameworks, market-making games, and on-chain mechanisms; his personal website quant.am also regularly updates research related to this topic. Lucas's personal website (lucasschuermann.com) features similar content.

Summary

Variational has moved elements validated in institutional settings onto the blockchain, but not by simply "putting matching into smart contracts." Instead, they have redesigned the structure of perpetual contracts from the first principles of business models and risk engineering.

This allows them to avoid Genesis-style concentration risks at the mechanism level, managing each risk channel through separate accounts, pools, and limits—making it easier to implement targeted stop-losses and auditable provisions even in extreme situations.

Beyond the technical path, the more important aspect is the business loop: Variational vertically integrates the role of market makers, merging the two revenue streams of traditional exchanges—"fees + spreads"—into a "spread-only" revenue model. By relying on institutional-level hedging capabilities, they cover system costs and extreme tail risks, turning "zero-fee trading" into a positive cash flow rather than a subsidy game.

This model binds system design, market microstructure, and risk budgeting into a flywheel, achieving "faster/more stable/more scalable" on the engineering level, and "more sustainable" on the business level.

Returning to the "human" aspect, Lucas's engineering obsession and Edward's Bayesian thinking are the most stable foundations behind this architecture: the former emphasizes making latency, jitter, and throughput into "measurable, regressable, and gradable" engineering assets from the perspective of distributed systems and scalable software architecture; the latter emphasizes making risk limits, hedging paths, and strategy drawdowns into "explainable, auditable, and self-governing" governance assets from the perspective of statistical decision-making and market-making games.

The two switch back and forth between "small workshop-style optimization" at Qu Capital, "industrial-grade assembly lines" at Genesis, and "mechanism-level redesign" at Variational, gradually forming the underlying character of today's perp DEX, which is also one of their most difficult-to-replicate moats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。