Key Points

- SZRR Launches with a Bang: The subscription warrant SZRR from Seazen Group officially launched on the XT Innovation Zone on September 10, skyrocketing over 3500% within 24 hours.

- Milestone for RWA Alliance: Marks the second phase of the RWA Global Investment Banking Alliance's strategy to promote high-quality real assets on-chain.

- Strong Institutional Support: XT Labs supports a dual-token project for Hong Kong stock underlying assets for the first time, with controllable risks and significant growth potential.

- Clear Conversion Path: SZRR holders are expected to complete the SZRS conversion around September 27, corresponding to 19,346,101 shares of Seazen Group stock, valued at approximately $22 million.

- Global Stage Focus: TOKEN 2049 and RWA Night will be important exposure points for SZRS, with XT Labs launching a series of events, AMAs, and user education to help investors engage deeply.

September 10, 2025, is destined to be a memorable night for the Web 3 community.

The RWA Global Investment Banking Alliance's X Space was packed with an audience, creating a lively atmosphere. Rockets and thumbs-up emojis filled the screens, enhancing the excitement. The countdown bar for XT Innovation Zone was inching closer to 13:00 UTC, and everyone held their breath, knowing the critical moment was approaching: The subscription warrant SZRR from Seazen Group (Seazen Group) is about to open for trading.

At that moment, the voice of host Laureen rang out, calm yet powerful:

- “Tonight, we are not just discussing RWA, but witnessing history: the SZRR subscription warrant from Seazen Group is officially launching.”

With just a few words, the emotions peaked. The audience erupted in cheers, and the screen was once again flooded with messages.

This was not just a simple launch event, but an important moment marking the second phase of the RWA Global Investment Banking Alliance strategy. Last month, the debut of GSSG caused a sensation, with a peak increase of 80 times, which many still talk about today. Everyone was waiting for the next move from the alliance, and tonight, it finally arrived.

With the scale of global real assets expected to exceed $10 trillion by 2030 and Hong Kong gradually becoming the center for compliant STOs, this night made it clear that the next wave of wealth and innovation is already on its way.

Table of Contents

Detailed Explanation of SZRR: How Seazen Group's Equity Tokenization Works

RWA Global Investment Banking Alliance Vision: Investor Confidence and Future Planning

SZRR Launch Moment: 3500% Surge and Community Celebration

Next Steps for SZRR: SZRS Conversion Timeline and TOKEN 2049 Roadmap

Key Figures Behind the SZRR Launch: Seazen Group, XT Labs, and RWA Global Investment Banking Alliance

Host Laureen (@xinyifengX) warmly and firmly introduced the guests of the night, conveying the significance of this milestone dialogue.

The first speaker was Dr. Robert Lee, Executive Chairman of the RWA Global Investment Banking Alliance (@Robertl 83909710). He pointed out directly that the tokenization of Seazen Group's shares is an important step for the industry:

- “RWA not only serves the real economy but also targets the trillion-dollar market, serving as a key bridge between traditional finance and Web 3.”

Next, Steve, Vice Chairman and Technical Head of the RWA Alliance (@HyperflexLabs), took the microphone and added the technical significance from a builder's perspective:

- “RWA builds a bridge of trust using code and cryptography, making the flow of global assets more transparent and efficient.”

Then Charles (@charleswch 6688), representing Seazen Group (Seazen Group), shared the company's motivation for participating in this initiative. His tone carried a hint of pride:

- “We hope global investors can share in the results of Seazen's transformation and witness the journey of real asset digitization together.”

When discussing future plans, Eva, Operations Head of the RWA Alliance (@RwaAssets), encouraged the audience to look towards a longer-term future:

- “Our vision is to create a multidimensional capital network that allows value to flow freely and securely across borders.”

Finally, Aaron Ji from XT Labs (@labs_xt) provided the platform's perspective and offered insights from an investor's viewpoint:

- “2025 will be the year when RWA fully blossoms, and SZRR is just the first step we bring to XT users.”

The guests' speeches served as a precise warm-up, quickly getting everyone into the mood. As the introductions concluded, the discussion gradually reached a climax, with everyone eager to understand the operational logic of SZRR and the value behind it.

Detailed Explanation of SZRR: How Seazen Group's Equity Tokenization Works

When it was Charles's turn to speak, the atmosphere in the room quieted down, as everyone knew the key points were coming.

- “SZRR is your key to the equity rights of Seazen Group.” Charles spoke steadily, clearly explaining the complex process.

He first explained the core positioning of SZRR: this is a subscription warrant token, trading in the XT Innovation Zone RWA&xStocks** zone from September 10 to September 29 (trading pair: SZRR/USDT). Users holding SZRR will gain priority participation in the upcoming SZRS** stock token, which represents the equity rights of Seazen Group (Seazen Group).

Charles then emphasized the significance of the underlying assets:

- “SZRS corresponds to 19,346,101 shares of Seazen Group Limited (01030.HK), accounting for approximately 0.27% of the company's issued share capital, with an estimated value of about $22 million as of July 31, 2025.”

He informed everyone that this is not a simple experiment, but a transparent, compliant, and traceable design. The shares are held by an independent SPV, and all rights and transfer records are on-chain for verification, with smart contracts also audited to ensure that every step can be publicly verified.

To help the audience understand more intuitively, he presented a clear two-step issuance roadmap:

Step Product Time Investor Benefits

1 SZRR Subscription Warrant September 10–29 Low-cost subscription (0.001 HKD), freely tradable in the secondary market

2 SZRS Stock Token Conversion around September 27 Priority subscription eligibility, long-term exposure to equity rights

As soon as the explanation ended, the comment section lit up. Many listeners pieced together the puzzle for the first time, finally understanding the value of this dual-token mechanism.

- “Through the two-step issuance of the subscription warrant and stock token, we ensure fair participation while guaranteeing a transparent and traceable process.” Charles added.

He also discussed why Seazen Group (Seazen Group) is an ideal first listing target: with over 200 Wuyue Plazas nationwide and an annual foot traffic of over 1 billion, along with thousands of brand partnerships, Seazen is not only a real estate leader but also a thriving business ecosystem with inherent digitalization potential.

- “The massive traffic and partner network of Seazen is the natural soil for RWA products to grow.” Charles concluded, “We hope global investors can share in the transformation dividends of Seazen.”

Image source: Seazen Group Limited (Seazen Group) Official Website

Vision of the RWA Global Investment Banking Alliance: Investor Confidence and Future Planning

After Charles clarified the issuance mechanism of SZRR, the host shifted the topic to other guests. At this moment, the focus of the discussion shifted from "how to do it" to "why to do it" and "what the future holds."

Aaron Ji from XT Labs was the first to speak, bringing the first perspective from the platform and investors. His tone was firm:

- “We do not easily support a project. Our criteria are simple yet strict: risks must be controllable, the ceiling must be high enough, and the team must have vision. Seazen meets all these criteria.”

He added that SZRR is the first dual-token project in the XT Labs portfolio with Hong Kong-listed companies as underlying assets:

- “For us, this is not only an important milestone in the global RWA strategy but also a bridge connecting China's quality assets with international investors.”

As soon as he finished speaking, Dr. Robert Lee, Executive Chairman of the RWA Global Investment Banking Alliance (@Robertl 83909710**) took the microphone and discussed the mission of the alliance. His tone carried a sense of vision:

- “Every successful tokenization project will strengthen the trust foundation of the entire RWA ecosystem. By ensuring compliance, protecting investors, and providing institutional-level transparency, we hope to encourage more listed companies to follow Seazen's lead and bring quality assets on-chain.”

Next, Steve, Vice Chairman and Technical Head of the Alliance (@HyperflexLabs), painted a picture of future possibilities from a technical perspective:

- “Imagine opening a panel to see the real-time rental rates of Wuyue Plazas nationwide, even tracking the latest rental flows. This is the direction we are heading. Tokenization is not just about digitizing shares; it allows for transparent asset operations and enables investors to grasp their holdings in real-time.”

He added that the technical architecture is continuously upgrading:

- “Our next focus is on interoperability and standardized data sources, allowing assets to be monitored, priced, and traded across platforms. This is a key step in building investor confidence and unlocking global liquidity.”

Finally, Eva, Operations Head of the RWA Alliance (@RwaAssets), pushed the discussion towards a broader global vision:

- “Every project we undertake builds a system that brings liquidity, trust, and capital into the real economy. We have established nodes in Hong Kong, Singapore, Dubai, the UK, and the US, and are recruiting global partners to promote more assets on-chain. The goal is to enable global asset holders to easily complete tokenization and provide investors with a consistent, standardized experience across different regions. Upcoming RWA projects are already in preparation, and Seazen is just the beginning.”

This round of speeches allowed the audience to see a larger picture: SZRR (SZRR/USDT trading pair) is not a one-time experiment but an expanding infrastructure that is genuinely connecting quality assets from the real world with global investors.

SZRR Launch Moment: 3500% Surge and Community Celebration

After the discussion concluded, the entire Space fell into a brief silence. Everyone's attention returned to the screen. At 12:59 UTC, the countdown bar had only one minute left, and the atmosphere reached its peak.

Host Laureen's voice came through again, steady yet filled with anticipation:

- “Is everyone ready? Let's count down together.”

The comments on the screen suddenly slowed down, as thousands of listeners seemed to hold their breath simultaneously. The countdown began—Five, four, three…

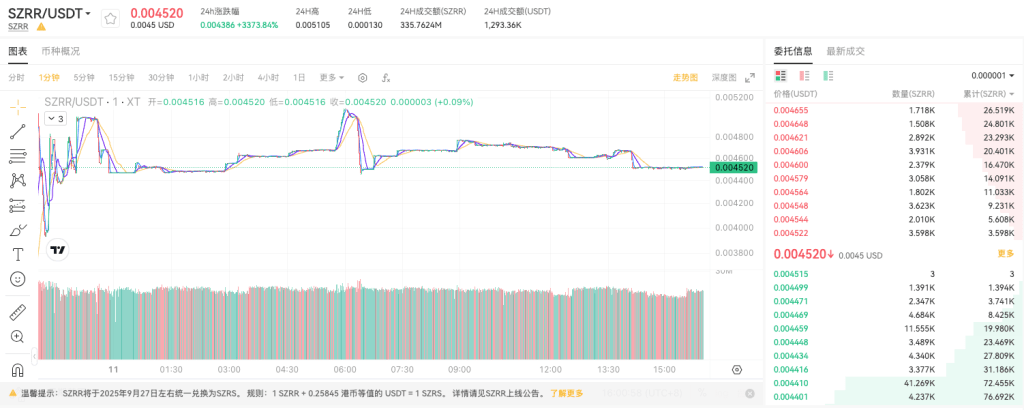

At exactly 13:00 UTC, the SZRR/USDT trading pair officially opened. The first transaction flashed on the screen, instantly igniting the entire venue. Rockets and thumbs-up emojis flooded the screen, with cheers, celebratory messages, and screenshots pouring in. Many users eagerly went to claim their XT red packets, sharing their first transaction prices.

Within just a few hours, SZRR became the most watched trading pair in the XT Innovation Zone. By the end of the day, the price surged over 3500%, and early buyers reaped what could be described as "textbook-level" returns, propelling SZRR to the top of community trending searches.

At that moment, the gap between Web 3 and traditional finance seemed to completely vanish. Thousands witnessed the same historic event: the shares of a Hong Kong-listed company were tokenized and traded in real-time on-chain. The atmosphere was electric, as if everyone was participating in the writing of this history.

Next Steps for SZRR: SZRS Conversion Timeline and TOKEN 2049 Roadmap

As the cheers gradually subsided, the chat room returned to silence. Host Laureen spoke again, her voice steady and clear:

- “Tonight is just the beginning; the real opportunities lie ahead.”

For users who already hold SZRR, she reminded everyone to prepare as soon as possible. Around September 27, SZRR will enter the conversion phase, where each SZRR will need to be paired with 0.25845 HKD worth of USDT to exchange for 1 SZRS. If the account balance is insufficient, the subscription rights will become invalid. After the conversion is completed, SZRS will be directly credited to the account and trading will be opened.

Here are example calculations for different holding amounts (assuming 1 HKD ≈ 0.13 USD):

She reminded everyone that September 30 is another key milestone, as SZRS will officially start trading that day, marking the beginning of a new chapter. Following that, the globally anticipated TOKEN 2049 conference is approaching, where SZRS will make its first international appearance, attracting more attention to the RWA market.

XT Labs has already arranged user education activities, AMA interactions, and offline meetups to help everyone gain a deeper understanding of SZRS and the entire RWA ecosystem.

Aaron Ji from XT Labs extended an invitation at the end:

- “TOKEN 2049 is the first stop for SZRS to go global. We hope users will not just participate in a single trade, but truly integrate RWA products into their portfolios and enjoy long-term growth.”

He also revealed an upcoming major event:

- “The next RWA Night will be even grander, bringing together project parties, investors, and users to share insights and explore more opportunities after SZRS. If tonight made you feel like you witnessed history, RWA Night will truly make you feel like a part of this movement.”

For users who missed tonight's live broadcast, Laureen provided a simple and clear action plan:

- Continue to accumulate SZRR during the issuance period;

- Ensure there is enough USDT in the account to complete the SZRS conversion;

- Follow the official accounts of RWA Global Investment Banking Alliance (@RwaAssets) and XT Labs (@labs_xt) for the latest updates on SZRS listing details, TOKEN 2049 events, and RWA Night.

As the timeline becomes clearer and community enthusiasm continues to rise, everyone can feel that the story of SZRR and SZRS is just beginning.

Frequently Asked Questions

1. What is SZRR?

SZRR is a subscription warrant token that allows holders to have priority in subscribing to SZRS. SZRS is a stock token representing the equity rights of Seazen Group (Seazen Group), launched by the RWA Global Investment Banking Alliance**.

2. What is the role of Seazen Group?

Seazen Group Limited (01030.HK) is the underlying asset provider for this project. SZRS is backed by 19,346,101 shares of Seazen Group stock, allowing investors to gain exposure to equity rights of leading real estate companies in China on-chain.

3. When will SZRS be issued?

The conversion from SZRR to SZRS is expected to be completed around September 27, 2025. Before the conversion, trading and withdrawals of SZRR will be temporarily suspended, and after completion, SZRS will be listed for trading on the XT Innovation Zone.

4. What preparations are needed before the conversion?

Please ensure that there is enough USDT in your account, as each SZRR requires 0.25845 HKD worth of USDT to complete the conversion. Insufficient balance will result in the invalidation of subscription rights.

5. What role does XT Labs play in this project?

XT Labs is the strategic supporter and platform partner for SZRR, marking its first dual-token project with Hong Kong-listed companies as underlying assets, which is of milestone significance.

6. What will happen next?

SZRS will start trading on September 30. The upcoming TOKEN 2049 conference and RWA Night will bring global attention to SZRS, and XT Labs will host more AMAs, events, and educational content to help users engage deeply.

About XT.COM

Founded in 2018, XT.COM currently has over 7.8 million registered users, with over 1 million monthly active users and user traffic exceeding 40 million within the ecosystem. We are a comprehensive trading platform supporting over 1000 quality cryptocurrencies and 1300+ trading pairs. XT.COM cryptocurrency trading platform supports a variety of trading options including spot trading, margin trading, and contract trading. XT.COM also has a secure and reliable NFT trading platform. We are committed to providing users with the safest, most efficient, and most professional digital asset investment services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。