Selected News

Falcon Finance's stablecoin USDf supply reaches 1.558 billion, up 24.88% in the past week

Native Markets has secured 71.88% staking support in the USDH bidding

pump.fun has repurchased approximately $85 million worth of PUMP tokens

Trending Topics

Source: Overheard on CT (tg: @overheardonct), Kaito

LINEA: LINEA has become a hot topic after its listing on major exchanges, with its unique token economy and economic design aimed at decentralization drawing significant attention. Initial service interruptions occurred due to high traffic, but the network has since stabilized. The airdrop claiming process faced challenges, but most eligible users have completed their claims. Despite some skepticism regarding valuation and early hiccups, the community remains optimistic about LINEA's potential to drive growth in the Ethereum ecosystem.

PUMP: Today's discussions around PUMP focus on its significant repurchase actions, with PumpFun having repurchased 6.11% of the circulating supply, amounting to approximately $84 million, along with a recent $2.5 million repurchase. The platform's new fee structure has generated $15.5 million in creator fees within just 7 days, indicating strong revenue growth. PUMP's market cap is reported to be $1.88 billion, with over $2 billion in cash reserves to support creator growth. Community sentiment is bullish, often comparing its revenue and market cap to platforms like Twitch, believing it has advantages. Additionally, the diverse token products within the ecosystem and the strategic partnership with Onboard Wallet are seen as positives. Overall expectations are bullish, with a belief that growth and repurchases will continue.

FALCON: The sale of Falcon Finance's $FF token on Buidlpad has sparked discussions, focusing on its innovative "universal collateral" infrastructure and the upcoming community sale. This sale features a two-tier structure corresponding to different fully diluted valuations (FDV), and many investors view it as a significant opportunity given Falcon's rapid growth and institutional backing. While some express concerns about token utility and competition in the stablecoin space, overall sentiment remains positive, with many anticipating substantial returns from this sale.

BNB: BNB has reached an all-time high, surpassing $900, driven by strong market interest and several strategic partnerships. Key discussion points include: BNB's market cap reportedly exceeding that of large companies like BlackRock and Rolls-Royce, with many optimistic about it reaching $1,000; Binance's collaboration with Franklin Templeton to develop digital asset products; and an upcoming airdrop for BNB holders from Holoworld AI (HOLO). The market widely recognizes BNB's strong performance and further growth potential.

AVAX: Today's discussions around AVAX emphasize its significant growth and potential in the crypto market, with AVAX breaking out of a 213-day consolidation range, rising above $28, and expected to continue upward; it has performed strongly in the RWA (real-world assets) sector, with on-chain scale exceeding $400 million. The Avalanche ecosystem's infrastructure is robust, attracting institutional interest and several large financial institutions' tokenization pilots. Meanwhile, momentum in the gaming and DeFi sectors is increasing, with new features and collaborations enhancing overall appeal. Overall sentiment is bullish, with many expecting continued upward momentum.

Featured Articles

Following the previous article "Sun Yuchen's lecture nine years ago went viral on the internet: Why not buy a house, not buy a car, not get married?", after a deep interpretation of Sun Yuchen's "three no's doctrine", we find that behind this set of life choices lies a more grandiose thinking system about money and wealth: his deep reflections on the essence of wealth, changes in the times, and personal positioning in the historical tide. "Not buying a house, not buying a car, not getting married" is just the surface; what is truly worth discussing is: how does Sun Yuchen understand wealth? What insights does he have regarding the challenges of wealth creation and inheritance in Chinese society? Why can't Chinese people become rich, and why do they not stay rich for more than three generations? What are the institutional and cultural roots behind this? In his view, what kind of era transformation are we experiencing? Why did he recognize Trump's election as president nine years ago? The answers to these questions are also hidden in Sun Yuchen's audio course "The Path to Financial Freedom Revolution" from nine years ago, at a life juncture when he had just graduated from Peking University, returned from studying in the United States, and was preparing to make a big impact; Sun Yuchen's reflections explain his personal views on wealth. Over the years, Sun Yuchen has indeed validated his judgments in practice.

While most Perp DEXs are trying to create products that are faster and cheaper than Hyperliquid, Variational has taken a different approach, designing a completely different business model. They did not choose to engage in an arms race on speed and fees but fundamentally rethought the question of "how perpetual contract trading platforms should operate." From CEX to DEX, whether in spot or contract trading, traditional trading platforms have a straightforward way of making money—charging fees. Binance charges 0.1%, Hyperliquid charges 0.025%, which seems to have become an industry norm. However, Variational has achieved true zero fees while still generating substantial revenue. Their OLP achieved over 300% annualized returns between April and July 2025, with cumulative trading volume exceeding $1.2 billion. What are the reasons behind this? While most Perp DEXs are still struggling to attract market makers and figuring out how to balance the interests of traders and liquidity providers, what new solutions has Variational provided? What is the team's background? Rhythm BlockBeats will provide an in-depth introduction to Variational, a project redefining the rules of the perp DEX game, to see how they perfectly combine "technological innovation, business model, and risk engineering" to create a perpetual contract trading platform that achieves zero fees while maintaining high returns.

On-chain Data

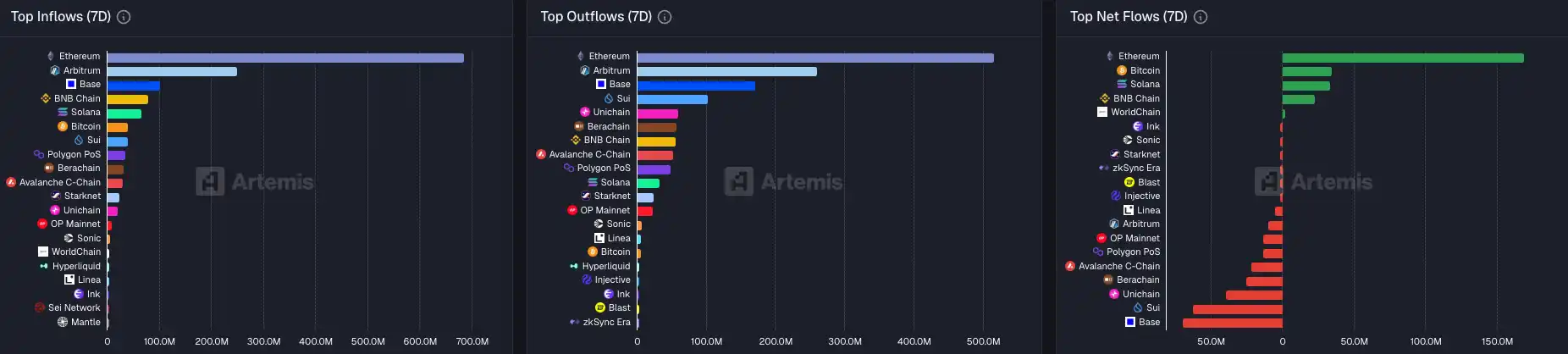

On-chain capital flow situation for the week of September 11

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。