Crypto exchanges remain the engine room of digital markets. They are the places where liquidity meets speculation, where prices form, and where the success or failure of new assets is ultimately decided. In the early 2010s, Mt. Gox introduced the first centralized liquidity hub; however, by 2025, the landscape has completely changed.

No single platform controls discovery. Instead, a mixed world has emerged, where giants dominate majors while specialized challengers capture new narratives. At the same time, competition between centralized and decentralized exchanges has become fierce. Hyperliquid, with its deep on-chain liquidity and CEX-like trading efficiency, has emerged as a direct threat to traditional order books. This rise has blurred the lines between CEX and DEX, forcing incumbents to innovate or risk irrelevance.

The competition for assets within CEXs themselves is equally intense. The WLFI wave of listings in early 2025 showed how frenzied the race has become: within hours of token creation, multiple exchanges scrambled to secure first-mover advantage, while investors rushed to capture early price action. In this new environment, discovery is not simply a function of market share; it is a contest of speed, curation, and the ability to channel liquidity into emerging assets.

The stakes in 2025 could not be higher. Institutions anchor liquidity in bitcoin and ethereum, retail traders flood into meme coins and small caps in search of asymmetric returns, and regulators are reshaping the rules that govern listings. Market discovery in 2025 is no longer guaranteed by size alone, but by agility, adaptability, and the capacity to capture narratives at the precise moment they emerge.

Amid this volatility, one exchange has quietly built a reputation as the boutique hub of discovery: LBank. Recognized as a 100x Gems Hub, LBank is positioning itself as the exchange where hidden gems emerge and retail capital meets curated opportunity.

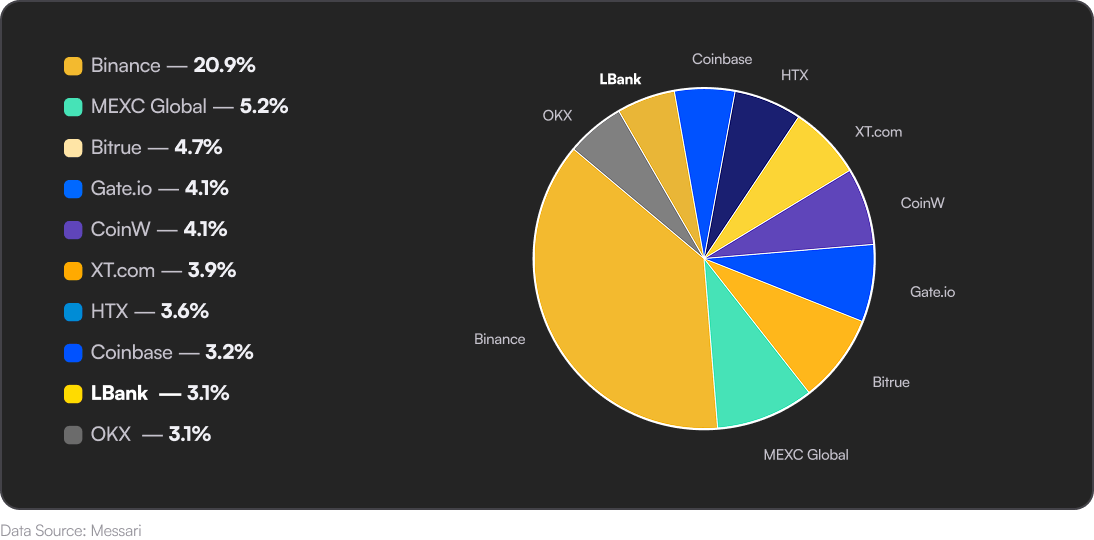

Price discovery has always been the lifeblood of crypto, and in 2025, it has become the key battleground for exchange competition. Liquidity depth and spreads determine the credibility of a market. When an order book is thin and spreads are wide, traders hesitate, and price signals lose their authority. Binance and OKX remain the primary venues for bitcoin and ethereum, but for altcoins and meme tokens, exchanges such as LBank and MEXC have taken the lead. Their order books, particularly in the first hours of a new listing, provide the reference prices around which the wider market forms.

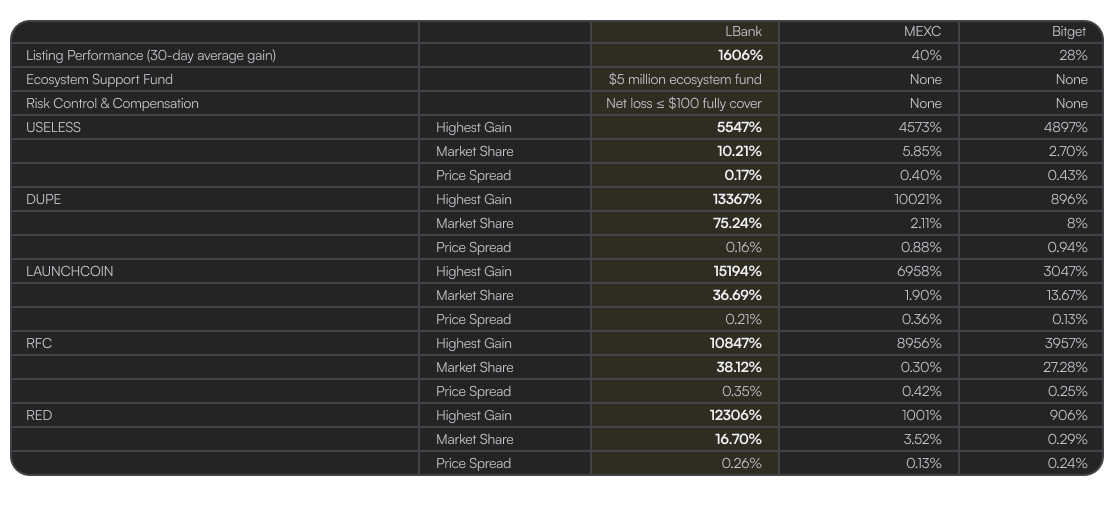

The success of the new coin following its debut is the most crucial factor for investors in meme coins. There are notable variations in the performance of the recently released meme coins on three main platforms: LBank, MEXC, and Bitget, based on the data comparison of the previous 30 days. The information contrasts LBank, MEXC, and Bitget’s main performance metrics in the spot and contract markets for meme coins, such as average growth, support for ecological funds, risk compensation, and the greatest growth, market share, and price differential of a number of common meme projects.

Source: Coinmarketcap

LBank shows itself as a leading player in the current sample with respect to the 30-day average growth. The LBANK EDGE sector has produced approximately 1,606% in returns, which is far greater than Bitget’s 28% and MEXC’s 40%.

Transparency also plays a defining role. Centralized exchanges are criticized for opaque order books, yet this very opacity allows them to curate listings, stage liquidity, and filter out some of the noise from the on-chain flood. Decentralized exchanges, by contrast, offer radical transparency but suffer from fractured liquidity and extreme volatility. For most new tokens, discovery begins on-chain, but survival requires migration to a centralized venue where liquidity can concentrate.

New models are emerging as well. Automated market makers continue to evolve, while intent-based trading and AI-driven flow optimization are becoming increasingly common. Bitget, for example, has launched GetAgent, an AI trading assistant that optimizes order execution, while Binance is experimenting with predictive matching. At the same time, oracles such as Chainlink and Pyth are bridging data across DeFi and CeFi, helping stabilize price feeds. Yet despite these innovations, the defining reality is simple: in the world of small-cap and meme assets, it is specialized exchanges that set the tone, and here LBank has carved out a distinct edge.

Unearthing Hidden Gems: Where Market Discovery is Evolving

The most striking development of 2025 is the shift of discovery away from giants and toward specialized mid-tier exchanges. LBank, MEXC, and Bitget have emerged as the three most important players in this segment, each with a distinct strategy. LBank has adopted a curated approach. Its EDGE sector lists only a handful of carefully screened projects, yet those that pass through deliver staggering results. Across early 2025, the average return of EDGE listings reached 1,606%, with standout tokens such as DUPE and RED climbing more than one hundred-fold. This selective process raises the average dramatically, though it means users may miss the very earliest 0-to-10x stage that occurs on-chain.

MEXC has taken the opposite path. It embraces a model of scale and breadth, listing hundreds of meme coins each month and even aggregating liquidity from decentralized pools through its DEX+ product. This flood of tokens dilutes returns, bringing the average 30-day gain to just 40 percent. Yet hidden within the noise are gems: the top ten new coins in April 2025 averaged gains of over 800%. MEXC, therefore, appeals to traders who prefer raw access to everything and are willing to filter manually.

Bitget, by contrast, has pursued conservatism. Its listings generally occur after the initial hype subsides, positioning it as a safer but slower venue. Average 30-day returns are lower, at just 28 percent, but its users benefit from stability and mature liquidity. This approach is less about chasing meme mania and more about building a disciplined marketplace supported by tools such as social trading, derivatives protection, and AI-driven strategies.

Despite the meme coin explosion, BTC and ETH remain the anchor assets of the crypto economy. Bitcoin continues to serve as the volatility benchmark, the collateral base for derivatives, and the reference asset for institutional inflows through CME futures and spot ETFs. Ethereum maintains its central role in DeFi, providing the primary liquidity pools for lending, yield farming, and NFT trading. Every meme or altcoin pair is ultimately benchmarked against BTC or USDT, with Ethereum anchoring liquidity across Layer 2 ecosystems. Even on exchanges like LBank, where meme trading dominates, the structural reliance on BTC and ETH remains absolute. Without their stability, price discovery in small caps would collapse.

The drivers of discovery vary widely across user groups. Retail traders remain the most visible, chasing early altcoin opportunities with the hope of outsized returns. For them, Solana’s zero-threshold meme coin boom has become a casino of experimentation, where thousands of coins are minted weekly but only a handful survive. Centralized exchanges, particularly LBank, act as the survival filter, providing secondary markets where the winners consolidate liquidity.

Institutions and proprietary trading firms play a different role. Their capital anchors liquidity in majors, while they arbitrage spreads between exchanges and hedge across derivatives. These players rarely chase memes directly, but their presence in the system ensures depth in BTC and ETH, which indirectly stabilizes the altcoin market. DAOs and DeFi-native protocols also contribute, using centralized venues to hedge treasuries or bridge liquidity between on-chain and off-chain markets.

Finally, regional communities have become increasingly important. In countries like Nigeria, Vietnam, Turkey, and Pakistan, retail traders are entering crypto through fiat ramps that connect directly to mid-tier exchanges. LBank’s presence in over 160 countries and regions, with support in 18 languages and 50-plus fiat currencies, has given it reach that few competitors can match. For many of these users, LBank is not a secondary platform but the primary gateway into crypto discovery.

The way exchanges handle risk and liquidity has become a key differentiator. LBank frequently dominates trading share in hot memes, at times capturing over seventy percent of a coin’s total volume. Spreads are remarkably tight, often between 0.1 and 0.3 percent, which keeps slippage minimal. This makes LBank the venue of choice for traders who want both depth and efficiency.

MEXC, by contrast, struggles with dilution. It’s thousands of listings thin out liquidity, leading to spreads as wide as 0.9 percent on long-tail tokens. Its DEX+ integration provides access to external pools, but at the cost of reliability. Bitget holds its ground on mainstream memes and specific projects it supports, with competitive spreads on large caps but limited depth in smaller coins.

Where LBank stands apart is in its risk protection mechanisms and regular liquidity surveillance activities. The EDGE zone compensates traders for up to 100 USDT in losses, while a $5 million ecosystem fund supports meme projects, and a $100 million futures risk fund safeguards against abnormal liquidations. The exchange has even contributed to broader industry rescue efforts, donating to the SLERF recovery pool and supporting DEXX compensation. This level of capital commitment reinforces its brand as a safe yet speculative hub. MEXC relies more on promotions such as zero-fee campaigns and frequent airdrops, while Bitget emphasizes derivatives insurance and adds value through social trading and AI quant strategies.

By 2025, the global crypto regulatory environment is best described as harmonized advancement layered over persistent regional divergence.

In the European Union, MiCA establishes a single rulebook for issuance and trading access, disclosure, and market conduct, thereby elevating admission and compliance thresholds for token issuance and delivering more systematic investor safeguards; the attendant authorization and technical due diligence requirements, however, lengthen listing lead times and slow iteration.

In the United States, beginning in 2025, the policy stance is pivoting from an enforcement-led approach toward clearer, rules-based authorization pathways, modestly reducing incentives for user outflow. Across Asia, Hong Kong (HKMA/SFC), Singapore (MAS), and Dubai’s DIFC (DFSA) are deploying regulatory sandboxes to run controlled pilots, reinforcing Asia’s position as an innovation hub.

Collectively, Europe’s regulatory clarity, the United States’ policy recalibration, and Asia’s active piloting are coalescing into regional centers of gravity. LBank continues to operate across multiple regions, backed by its compliance framework and licenses in various jurisdictions.

The future of discovery is likely to be shaped by several converging forces. Artificial intelligence will play a growing role in predictive liquidity flows, automated screening of scams, and personalized execution strategies. Tokenized real-world assets are beginning to enter the discovery cycle, expanding exchanges beyond crypto-native projects. Cross-chain interoperability is improving, allowing exchanges such as LBank, with overall liquidity performance below industry average, to position themselves as hubs for hybrid liquidity. In this environment, niche exchanges are not a sideshow but a central force, able to dominate narratives that the giants cannot move on quickly enough.

For LBank, its position as a discovery hub has never been clearer. The exchange has survived a decade without a security breach, built a user base of over 15 million across 160 countries and regions, and grown into a top-10 global platform. Its listing speed, often within one hour from on-chain to listing, is unmatched. Its curation strategy has delivered the highest average meme coin returns among major exchanges. And its risk protections, including loss compensation and multi-million-dollar ecosystem funds, have created a trust layer that is rare in a market still haunted by exchange collapses.

In an industry where size once dictated power, LBank has demonstrated that agility, focus, and curation now define success. Market discovery in 2025 is no longer monopolized by giants but distributed across specialized platforms that connect retail demand with emerging narratives. For meme coins and altcoins, LBank has become the definitive proving ground. Its model suggests a discovery rule: it is not about grabbing the next coin before anyone else, but about choosing the right exchange, one that balances opportunity with protection, and speculation with structure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。